Trading is basically a game of clocks. People think it’s all about the charts or the latest earnings report from Nvidia, but if you don't understand the stock market time table, you're essentially walking into a casino after the house has already changed the rules for the night. You've probably heard that the market opens at 9:30 AM ET. That’s true. But it's also a massive oversimplification that gets beginners slaughtered in the first twenty minutes of the day.

The real action doesn't start when the bell rings. It starts hours before most people have even poured their first cup of coffee.

The Morning Chaos and the 9:30 Trap

Pre-market trading is a wild west. Starting as early as 4:00 AM ET, institutional players and high-frequency algorithms are already tossing shares back and forth. By the time the "official" stock market time table hits the opening bell at 9:30 AM, the price of a stock might have already moved 10% on news that broke while you were asleep. This is where the "Opening Range Breakout" happens. It’s chaotic. It’s loud, metaphorically speaking. Volume spikes to insane levels. Honestly, for most retail traders, the first 30 minutes of the day are a "no-fly zone" because the volatility is just too high to manage risk effectively.

Professional traders like Art Cashin, the legendary floor trader at the NYSE, have often talked about the "margin of error" in those early minutes. You’re not just trading against humans; you’re trading against server farms in New Jersey that can execute orders in microseconds. If you aren't prepared for the 9:30 AM to 10:00 AM rush, you're the liquidity.

The Mid-Day Slump is Real

Around 11:30 AM ET, something weird happens. The volume just... disappears. This is the "lunch hour" on Wall Street, and while it sounds like a cliché from an 80s movie, it’s a factual part of the stock market time table. Large institutional desks often step back. Algorithms take over the heavy lifting. This is often the most dangerous time for a casual trader to enter a position. Why? Because low volume means high slippage.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

If you try to buy a large block of shares at 12:45 PM, you might move the price against yourself because there aren't enough sellers on the other side. It’s boring. The market often "drifts" sideways. You'll see professional traders on Twitter (or X, whatever we're calling it this week) posting pictures of their golf simulators or lunch because they know the "meat" of the move usually happens in the first and last 90 minutes of the day.

The Power Hour and the Closing Cross

Then comes 3:00 PM ET. This is the "Power Hour." This is when the big boys come back to play. Fund managers look at their portfolios and realize they need to adjust their positions before the day ends. They have "mandates." If a mutual fund needs to be 95% invested in tech by the closing bell, they start buying or selling aggressively in this final window.

The stock market time table hits its most critical point at 4:00 PM ET. This isn't just the end of the day; it's the "Closing Cross." This is a specialized process where the exchange (like the Nasdaq or NYSE) matches buy and sell orders to determine the official closing price. This price is vital. It’s what every index fund, every ETF, and every retirement account uses to value their holdings.

- Pre-Market: 4:00 AM – 9:30 AM ET (High risk, low liquidity)

- The Open: 9:30 AM – 10:30 AM ET (Peak volatility)

- The Lull: 11:30 AM – 1:30 PM ET (The "Danger Zone" for slippage)

- Power Hour: 3:00 PM – 4:00 PM ET (Institutional repositioning)

- After-Hours: 4:00 PM – 8:00 PM ET (Earnings reports and late-day reactions)

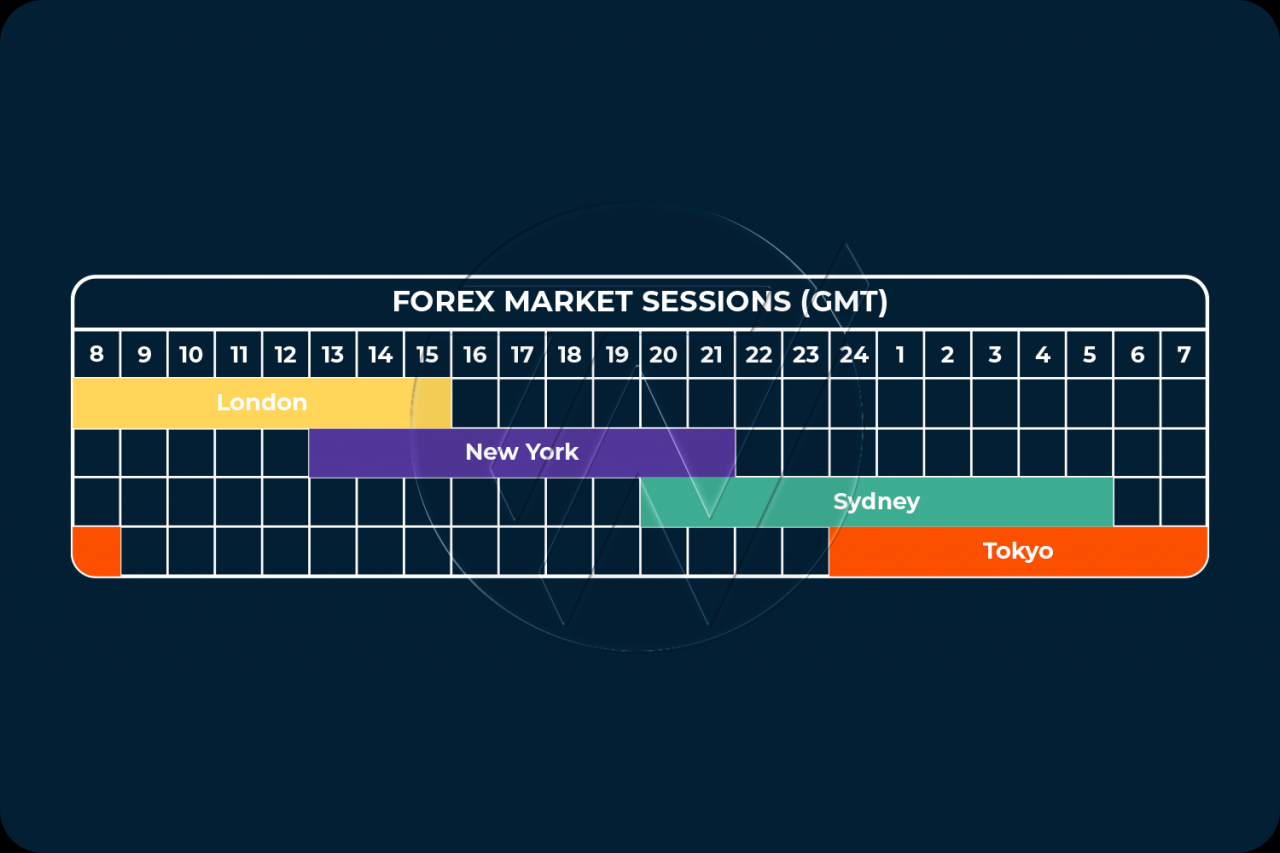

Why Time Zones are Your Best Friend (or Worst Enemy)

If you’re trading from London, you’re hitting the US open in the middle of your afternoon. If you’re in Tokyo, you’re basically a vampire. The global stock market time table is a 24-hour cycle, even if the NYSE isn't open. When the US market is closed, the futures market (ES for S&P 500, NQ for Nasdaq) is still ticking.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Watch the European markets. Often, the Dax (Germany) or the FTSE (UK) will provide a "lead-in" for what the US markets will do. If Europe is bleeding out at 8:00 AM ET, don't expect a sunny opening in New York. Markets are interconnected in a way that makes the "official hours" feel a bit like a suggestion rather than a rule.

The After-Hours Earnings Gamble

At exactly 4:01 PM ET, the world changes again. This is when the big tech giants—Apple, Microsoft, Google—release their earnings. The after-hours market is a ghost town compared to the regular session, but the moves are massive. A stock can drop 15% in four minutes on a bad earnings call.

Because the liquidity is so thin, the "spread" (the difference between what a buyer will pay and what a seller wants) gets huge. You might see a bid at $150 and an ask at $155. If you market-sell there, you’re getting ripped off. This is part of the stock market time table that most people should probably just watch from the sidelines. It’s for the gamblers and the pros with specialized software.

Don't Forget the Bond Market and the Fed

The stock market doesn't live in a vacuum. The bond market usually closes at 3:00 PM ET or 4:00 PM ET depending on the day, and it often dictates what stocks do. When the Federal Reserve releases its "FOMC Minutes" or interest rate decisions, it’s almost always at 2:00 PM ET on a Wednesday.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

The market usually goes haywire for ten minutes, goes completely quiet while Chairman Jerome Powell starts speaking at 2:30 PM, and then picks a direction for the rest of the week. If you’re trading at 1:55 PM on a Fed day, you’re basically betting on a coin flip.

Actionable Steps for Your Trading Schedule

Understanding the clock is about survival. Stop trying to trade every minute of the day. It’s exhausting and statistically a losing strategy for most individuals.

- Map your local time to Eastern Time. Everything revolves around New York. If you don't have a clock on your desk set to ET, get one.

- Wait for the "Washout." Let the first 15-30 minutes of the day pass. Let the "weak hands" get shaken out before you put your money at risk.

- Respect the Lunch Lull. If you aren't in a position by 11:30 AM, consider waiting until 2:00 PM to find a new entry. The price action during mid-day is often "noise."

- Check the Economic Calendar. Every Sunday night, look up the scheduled releases for the week (CPI, Jobs Report, Fed meetings). These events temporarily override the standard stock market time table.

- Use Limit Orders. Especially in the pre-market and after-hours sessions. Never use "Market Orders" when the volume is low, or you’ll pay a "tax" to the market makers in the form of terrible fill prices.

The market is a machine that runs on a schedule. You don't need to be the fastest player in the game; you just need to know when the machine is most likely to break—and when it's most likely to pay out.