Imagine waking up and realizing your entire life savings just evaporated because of a ticker tape delay. That’s not a horror movie plot. It was Tuesday, October 29, 1929. People call it Black Tuesday, but the truth is the stock market crash of 1929 wasn't a one-day fluke. It was a slow-motion train wreck that started months earlier and took years to stop bleeding.

Most people think everyone just jumped out of windows the second the Dow dropped. They didn't. That's a myth, mostly. While the carnage was real, the actual mechanics of how the market collapsed are way more interesting—and terrifyingly relevant to how we trade today.

The Roaring Twenties Were Basically a Giant Leveraged Bet

The 1920s were wild. For the first time, regular people—barbers, cooks, chauffeurs—thought they could get rich without working. The "Coolidge Prosperity" felt permanent. By 1929, the stock market had gone up roughly 400% in less than a decade. Everyone was "buying on margin."

Think of margin like this: You want to buy $1,000 worth of Radio Corporation of America (RCA) stock, but you only have $100. Your broker lends you the other $900. It's great when the stock goes up. If RCA hits $1,100, you doubled your money! But if it drops to $800? Your broker freaks out. They demand the "margin call." You have to pay up immediately or they sell your stock at a loss.

By the summer of 1929, the entire American economy was built on these IOUs. Experts like Roger Babson were screaming that a crash was coming. People ignored him. They called him the "Prophet of Doom." Then, in September, the market started getting twitchy. It wasn't a plunge yet, just a series of "shivers" that signaled the fever was about to break.

What Actually Happened on Black Thursday and Black Tuesday

The stock market crash of 1929 really kicked off in earnest on October 24, known as Black Thursday. The opening bell rang and the floor just fell out. Volume was so high that the ticker tape—the machine that printed stock prices—couldn't keep up. It was running hours behind. Imagine trying to trade stocks today if your banking app only showed you prices from three hours ago. You’d be flying blind.

Panic hit.

💡 You might also like: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

A group of powerful bankers, led by Thomas W. Lamont of J.P. Morgan, tried to save the day. They met at 23 Wall Street and decided to pool their money to buy stocks above market value to show confidence. Richard Whitney, the Vice President of the Exchange, walked onto the floor and placed a massive order for U.S. Steel. It worked. Briefly.

The market stabilized Friday and Saturday. People breathed. They thought the "big boys" had it under control. They were wrong.

Over the weekend, the panic curdled. When Monday hit, the selling started again, but this time the bankers didn't step in. They were tapped out or realized the tide was too strong. Tuesday, October 29, was the absolute abyss. 16 million shares changed hands. That sounds small now, but back then, it was an astronomical, system-breaking volume. The Dow Jones Industrial Average plummeted 12%. By the time the dust settled in mid-November, the market had lost $30 billion. To put that in perspective, that was more than the U.S. spent on World War I.

The Myth of the Jumping Bankers

We’ve all seen the cartoons of guys in top hats diving off skyscrapers. It’s mostly nonsense. While there were a few high-profile suicides—like the tragic death of J.J. Riordan, president of the County Trust Co.—the suicide rate in New York actually didn't spike significantly during the week of the crash.

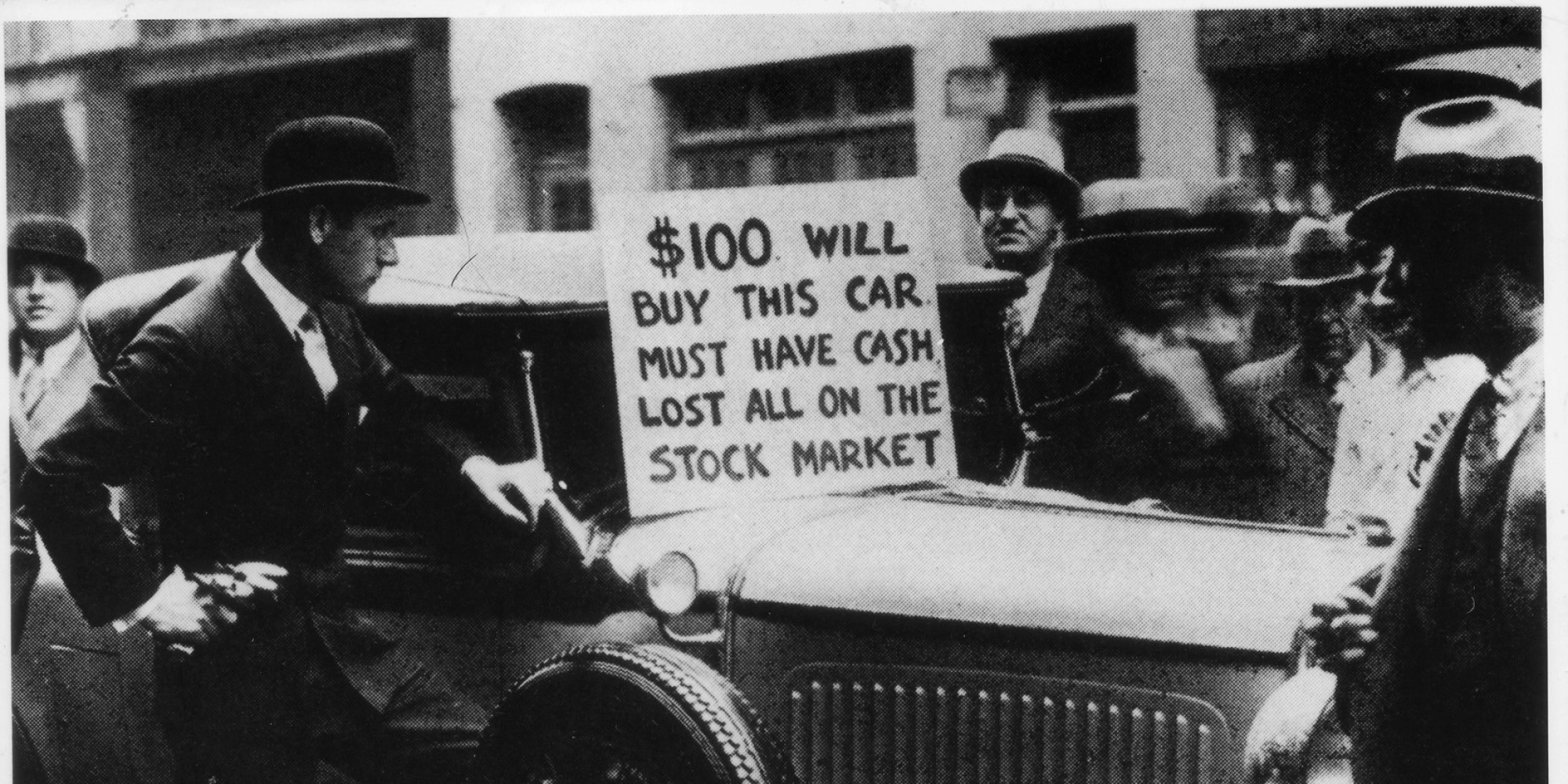

The real pain was quieter. It was the guy who lost his house because he used it as collateral for a margin account. It was the grandmother whose "safe" bank investments vanished because the bank had been gambling with her deposits in the market. That's the part that really hurts to think about. There was no FDIC then. If your bank went bust because they lost money in the stock market crash of 1929, your money was just... gone. Forever.

Why Did It Happen? It Wasn't Just Greed

Economists like Milton Friedman and Ben Bernanke have spent decades arguing about why the crash turned into the Great Depression. It wasn't just the stock prices. The "real" economy was already slowing down.

📖 Related: Modern Office Furniture Design: What Most People Get Wrong About Productivity

- Overproduction: Factories were making more cars and radios than people could afford to buy.

- Agricultural Distress: Farmers were already in a depression throughout the 1920s because of falling crop prices.

- Bad Banking Laws: There were way too many small, weak banks that didn't have enough cash on hand.

- The Fed: The Federal Reserve actually raised interest rates right when they should have been lowering them. They were trying to stop "speculation," but they ended up starving the economy of cash.

Basically, the stock market was the thermometer, and the crash showed that the patient (the U.S. economy) had a lethal fever.

Life After the Bottom

The market didn't hit its true bottom until July 1932. By then, the Dow had lost nearly 90% of its value from the 1929 peak. 90 percent! If you had $100,000 in 1929, you had $10,000 three years later.

This period changed everything about how the U.S. government works. We got the Securities and Exchange Commission (SEC) to stop brokers from lying. We got the Glass-Steagall Act (which was eventually repealed, but that’s another story) to separate "gambling" investment banks from "safe" commercial banks.

Most importantly, it changed the American psyche. My grandfather used to hide cash under his mattress well into the 1990s. He never trusted a bank again after 1929. That kind of trauma doesn't just go away. It sticks in the DNA of a country.

How to Protect Yourself from a Modern 1929

History doesn't repeat, but it sure does rhyme. We still see bubbles. We still see people trading on massive leverage using apps on their phones. The stock market crash of 1929 teaches us that liquidity—having actual cash when you need it—is the only thing that matters when the panic starts.

If you want to avoid the mistakes of 1929, you've gotta be smarter than the crowd. Here is how you actually protect your neck:

👉 See also: US Stock Futures Now: Why the Market is Ignoring the Noise

Audit your leverage immediately. Are you trading on margin? Do you have "buy now, pay later" debt tied to volatile assets? If the market drops 20% tomorrow, will you be forced to sell? If the answer is yes, you are over-leveraged. Reduce your debt until a market "shiver" doesn't give you a heart attack.

Diversify outside of the "Hot" sectors. In 1929, it was radio and steel. Recently, it's been AI and tech. It's fine to own those, but make sure you have "boring" stuff too. Utilities, consumer staples, and even some boring government bonds. They won't make you a millionaire overnight, but they'll keep you from being a pauper during a crash.

Check your bank’s health. While we have the FDIC now, bank runs still happen (look at Silicon Valley Bank). Ensure your total deposits are within the insured limits—$250,000 per depositor, per insured bank. If you have more than that, spread it around.

Keep a "Dry Powder" fund. The people who got rich after 1929 weren't the ones who stayed in the market the whole way down. They were the ones who had cash ready to buy when stocks were trading for pennies on the dollar in 1932. Keep 10% of your portfolio in high-yield cash or money market funds. It’s your insurance policy—and your lottery ticket for the next recovery.

Verify your sources. In 1929, people listened to "tipsters." Today, it's TikTok "finfluencers." Before you make a trade, look at the actual earnings reports on the SEC's EDGAR database. If you can't explain how the company makes money in two sentences, don't buy the stock.

The goal isn't just to survive a crash. It's to be the person standing with cash in hand when everyone else is running for the exits.