When people ask when was the stock market crash of 1929, they usually expect a single date. They want the one "big bang" moment where the money vanished. Honestly, history is a bit messier than a calendar square. It wasn't like a lightning strike. It was more like a slow-motion car wreck that started with a few sparks in September and ended in a total fireball by late October.

The crash wasn't just one bad afternoon on Wall Street.

If you're looking for the technical "start," many historians point to Black Thursday, October 24, 1929. That’s when the panic really went viral. But the market had been wobbling since early September. Steel production was down. Car sales were sagging. People were deeply in debt because they’d been buying stocks on margin—basically gambling with money they didn't actually have.

The Timeline: When Was the Stock Market Crash of 1929?

You’ve probably heard of Black Tuesday. It’s the most famous part of the disaster. But the collapse was actually a series of terrifying drops over several weeks.

On Thursday, October 24, the market opened and immediately fell off a cliff. There was a weird moment of hope around noon when Richard Whitney, Vice President of the New York Stock Exchange, walked onto the floor. He started buying shares of U.S. Steel at prices way above the current market. It was a bluff. He was trying to show confidence. It worked for a couple of days, and the market steadied.

Then came the weekend.

📖 Related: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Imagine sitting at home in 1929, reading the Sunday paper, and realizing your entire life savings might be gone by Monday morning. The anxiety cooked over. When the opening bell rang on Black Monday, October 28, the selling was relentless. The Dow dropped 13%.

Then came the real nightmare. Black Tuesday, October 29.

This is the day everyone remembers. Over 16 million shares were traded. The ticker tape machines—the things that printed stock prices—couldn't keep up. They were hours behind. Investors were selling stocks without even knowing what the current price was. They just wanted out. By the end of that day, the market had lost billions of dollars.

It Wasn't Just One Week

A common misconception is that the crash ended on October 29. It didn't. Not even close. The market kept bleeding. It bumped up and down for months, but the true "bottom" didn't happen until July 1932. By then, the Dow Jones Industrial Average had lost about 89% of its value. Think about that. If you had $100 in the market in September 1929, you were looking at roughly $11 by the summer of '32.

The Red Flags We All Ignored

Why did it happen then? Why 1929?

👉 See also: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

The 1920s were a party. The "Roaring Twenties" felt like a permanent boom. Everyone was a genius. You could put down 10% of a stock's price and borrow the other 90% from your broker. This is "buying on margin," and it's basically gasoline for a financial fire. When stock prices started to dip in the fall of '29, brokers issued margin calls. They told investors: "Give us more cash right now or we’re selling your stock."

Since nobody had the cash, the stocks were sold. This forced prices lower, which triggered more margin calls, which forced more sales. It was a death spiral.

Economists like John Kenneth Galbraith, who wrote the definitive book The Great Crash, 1929, argued that the economy was fundamentally hollow. Wealth was concentrated in too few hands. Wages were stagnant while productivity skyrocketed. People couldn't afford to buy the stuff factories were making.

The Federal Reserve's Role

The Fed usually gets a lot of blame here, too. They saw the "irrational exuberance" (a term Alan Greenspan would use decades later) and tried to cool things down by raising interest rates. But they did it too late and maybe a bit too aggressively. By the time they acted, the bubble was already popping.

What Really Happened on the Floor?

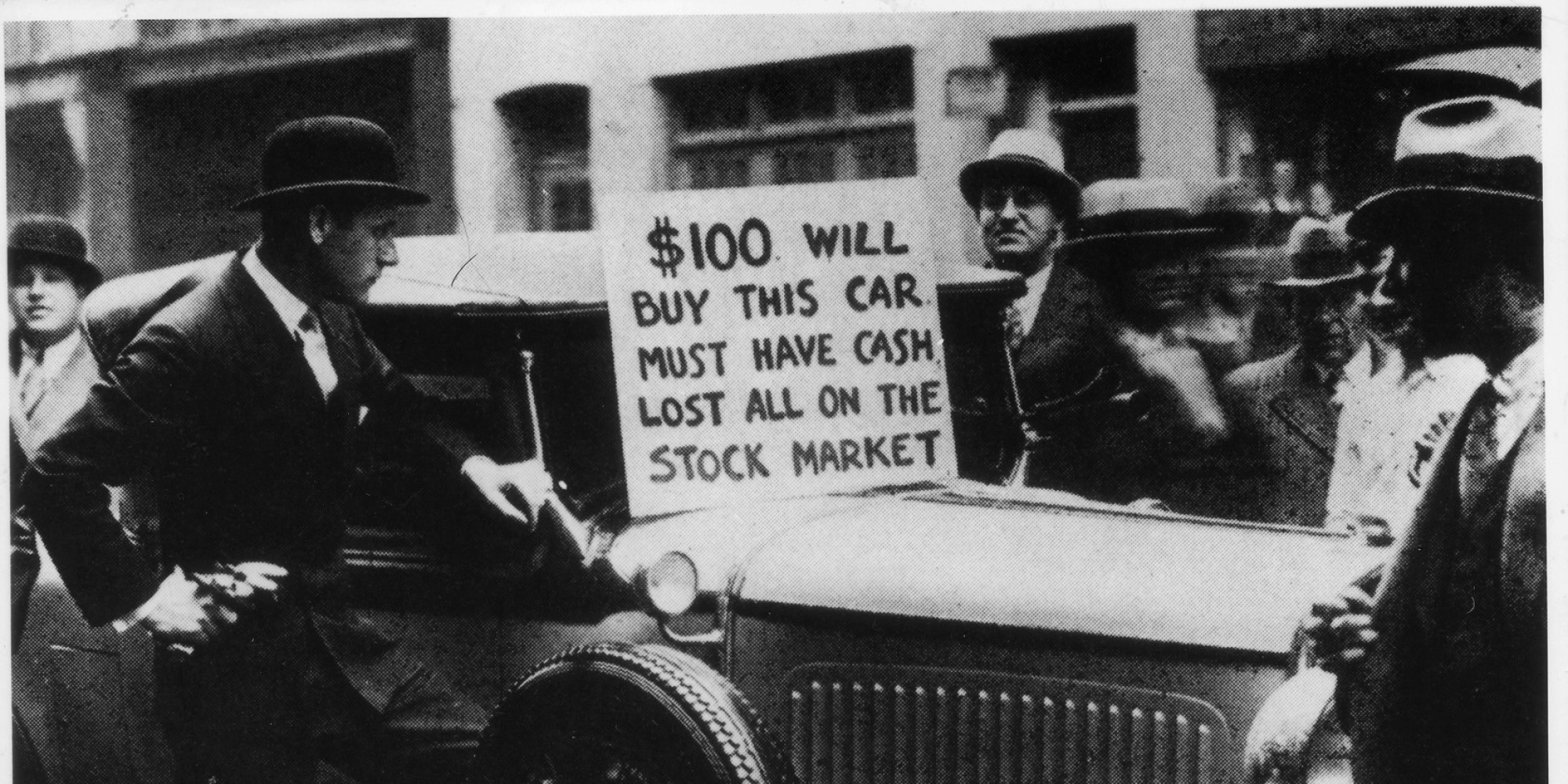

There are all these myths about bankers jumping out of windows. While there were some high-profile suicides, the "mass jumping" thing is mostly a legend. The real tragedy was quieter. It was the sound of silence in bank lobbies where people realized their life savings were just... gone. Because back then, there was no FDIC insurance. If your bank went bust because they’d invested your deposits in the market, you were broke. Period.

✨ Don't miss: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Why Does 1929 Still Matter Today?

You see shadows of 1929 in every modern crisis. The 2008 housing bubble? Same vibes. The 2021 meme stock craze? Definitely some similarities. The big difference is that we have "circuit breakers" now. If the market drops too fast today, the New York Stock Exchange literally hits a pause button to let everyone breathe. In 1929, there was no pause button. There was only gravity.

The crash didn't technically cause the Great Depression by itself, but it was the catalyst. It destroyed consumer confidence. People stopped buying cars, stopped building houses, and stopped dreaming about the future for a while. It took a World War to truly kick the economy back into high gear.

Actionable Takeaways from 1929

History isn't just for textbooks. It's a warning label. If you're looking at your own portfolio today, here is what 1929 teaches us about surviving the next one.

- Margin is a Double-Edged Sword: Leverage makes you look like a genius when things go up and a bankrupt when they go down. Avoid excessive debt in your investment strategy.

- Watch the Fundamentals: The 1929 crash happened because the "real" economy (manufacturing and wages) was diverging from the "paper" economy (stock prices). If the two don't match, be careful.

- Liquidity is King: The people who survived the crash were the ones who had "dry powder"—actual cash on hand to buy when everything was on sale.

- Diversification Actually Works: While everything fell in '29, those who weren't 100% in speculative "glamour stocks" (the tech stocks of the 20s) tended to lose less than those who were chasing the latest trend.

- Don't Panic Sell, But Have a Plan: The worst losses happened to people who didn't have an exit strategy and were forced to sell at the absolute bottom.

The stock market crash of 1929 wasn't a single event on a single day. It was a month-long collapse that fundamentally changed how the world thinks about money, debt, and government intervention. We live in the house that 1929 built.

Next Steps for Investors:

- Review your leverage levels: Ensure you aren't over-exposed to margin or high-interest debt that could force a sale during a downturn.

- Verify your emergency fund: The 1929 crisis showed that market volatility can last for years, not just weeks. Keep 6–12 months of expenses in a high-yield savings account.

- Audit your asset allocation: Check if you are too heavily weighted in "growth" or speculative assets that historically drop the hardest during a systemic crash.

- Study modern "Circuit Breakers": Familiarize yourself with the SEC's current trading halt rules so you don't panic when the market briefly freezes during high volatility.