October 1929 didn’t start with a scream. It started with a whisper of doubt. For years, the Roaring Twenties had felt like a party that would never end, fueled by cheap credit and the brand-new thrill of "buying on margin." People were literally betting their life savings on radio stocks and automotive startups, convinced that prices could only go up. But they were wrong.

The stock market crash of 1929 wasn't just one bad day. It was a slow-motion train wreck that lasted weeks, eventually wiping out billions of dollars and signaling the start of the Great Depression. Honestly, if you look at the charts from that era, the volatility is terrifying. Imagine waking up and seeing 10% of your net worth vanish before lunch. Then imagine it happening again the next day. And the day after that.

The Lead-Up: A Bubble Built on Borrowed Time

Before the stock market crash of 1929, the U.S. economy looked invincible. We’re talking about a 400% increase in the Dow Jones Industrial Average between 1924 and 1929. Everyone wanted in. Your barber was giving you stock tips. Your grandmother was asking about RCA dividends. It was mania.

The real poison, though, was margin. Back then, you could buy stock by putting down only 10% of the price. The other 90% was a loan from the broker. This works great when the market rises. If the stock goes up 10%, you’ve doubled your money. But if the stock drops even a little? The broker calls you up. "Give me more cash, or I sell your shares now." This is the dreaded margin call. By mid-1929, the entire system was a house of cards held together by these precarious loans.

Economists like Roger Babson actually warned people. In September 1929, he famously said, "Sooner or later, a crash is coming." The market didn't like that. It dipped, then recovered, then started to wobble. The "Babson Break" was the first real crack in the glass. People started to realize that the industrial production numbers didn't actually support the sky-high stock prices. Steel production was down. Car sales were flagging. The vibes were off.

Black Thursday and the Illusion of Safety

October 24, 1929. Black Thursday. This was the first day of true panic.

The volume of trading was so high that the stock tickers—the machines that printed the prices on paper tape—couldn't keep up. They were running hours behind. Imagine trying to trade stocks today if your screen only showed prices from three hours ago. You’d be flying blind. That’s exactly what happened. Panicked investors began selling simply because they didn't know how low the price had already dropped.

👉 See also: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

Around noon, a group of powerful bankers met at the offices of J.P. Morgan & Co. They decided to play hero. Richard Whitney, vice president of the Exchange, walked onto the floor and placed a massive bid for U.S. Steel at a price well above the current market. He was trying to signal confidence. It worked, mostly. The market stabilized for the afternoon, and everyone took a deep breath over the weekend. They thought the worst was over.

They were wrong.

Black Tuesday: When the Bottom Fell Out

If Black Thursday was a warning, Tuesday, October 29, was the execution. This is the date most people associate with the stock market crash of 1929. The opening bell wasn't even a bell; it was a starter's pistol for a stampede.

Over 16 million shares changed hands that day. That record wouldn't be broken for nearly 40 years. Prices didn't just slide; they plummeted in vertical lines. Big names like General Electric and AT&T were getting hammered. The bankers who tried to save the day on Thursday were nowhere to be found. They were busy trying to save their own skins.

Why the Panic Spread So Fast

There’s a psychological component to the stock market crash of 1929 that people often overlook. It wasn't just about the math. It was about the loss of faith.

- The Ticker Delay: Because the ticker was slow, people assumed the worst.

- The Margin Spiral: As prices fell, brokers automatically sold off customers' stocks to cover loans, which pushed prices even lower, triggering more automatic sales.

- Bank Runs: People saw the market collapsing and ran to the bank to withdraw their cash. But the banks had invested their depositors' money in... you guessed it... the stock market.

By the end of the day, the ticker tape was running 7 hours and 46 minutes late. The "official" closing numbers were meaningless because nobody actually knew where the prices landed until well into the night.

✨ Don't miss: Is The Housing Market About To Crash? What Most People Get Wrong

The Long Road Down: It Didn't End in 1929

One of the biggest misconceptions about the stock market crash of 1929 is that it hit bottom on Black Tuesday and then everyone was poor. That's not what happened. There were actually several "dead cat bounces" where the market regained ground.

In fact, by early 1930, the market had recovered a significant chunk of its losses. Some people thought the storm had passed. But the structural damage to the global economy was too deep. The crash had destroyed consumer confidence. People stopped buying cars. They stopped buying radios. This led to layoffs. Layoffs led to less spending. It was a vicious cycle that the Federal Reserve, quite frankly, fumbled. Instead of loosening the money supply to help banks, they tightened it.

The actual bottom of the market didn't happen until July 1932. By that point, the Dow had lost nearly 90% of its value from the 1929 peak. It wouldn't return to those 1929 highs until 1954. Think about that. Twenty-five years to just get back to even.

Comparing 1929 to Modern Crashes

You often hear people compare 1929 to the 2008 financial crisis or the 2020 COVID-19 dip. There are similarities, sure. Speculative bubbles always look the same in hindsight. But the 1929 crash was unique because we had almost no "guardrails" back then.

There was no Securities and Exchange Commission (SEC). There was no FDIC to insure your bank deposits. If your bank went bust, your money was just... gone. Today, we have "circuit breakers" that shut down trading if the market drops too fast. In 1929, the only circuit breaker was the end of the day.

The Human Cost: Beyond the Numbers

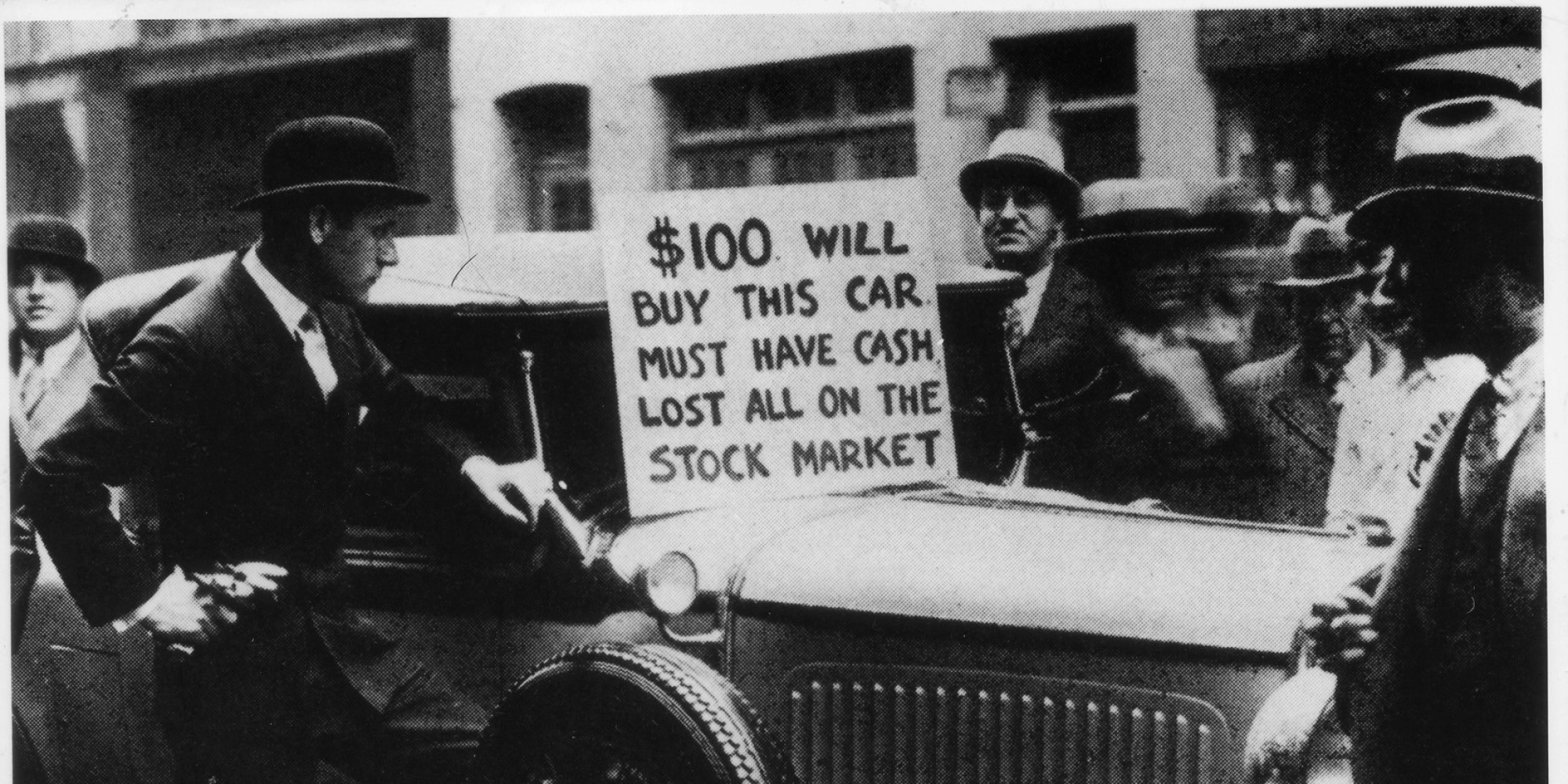

We talk about percentages and Dow points, but the stock market crash of 1929 was a human tragedy. You've heard the stories of brokers jumping out of windows. While some of that is sensationalized—suicide rates didn't actually spike as much as the legends suggest—the financial ruin was very real.

🔗 Read more: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

Middle-class families who had done "the right thing" by investing for the future saw their entire lives erased in a week. This led to a massive shift in the American psyche. The generation that lived through the crash became famously frugal. They hid cash under mattresses because they never trusted a bank or a stockbroker ever again. This event literally reshaped how humans interact with money for the next century.

Lessons We Still Haven't Quite Learned

History doesn't repeat, but it often rhymes. The stock market crash of 1929 taught us about the dangers of excessive leverage. When you're playing with borrowed money, you aren't just an investor; you're a gambler with a ticking clock.

Today, we see similar patterns in crypto, high-growth tech stocks, and real estate. The names change, but the "irrational exuberance"—a term coined by Alan Greenspan much later but perfectly applicable to 1929—remains the same. People start believing that "this time it's different." It's never different.

Actionable Insights for Investors

If you want to protect yourself from a 1929-style event, you need a plan that doesn't rely on "the vibes."

- De-leverage your life. Avoid using margin to buy stocks. If you can't afford the asset with cash, you can't afford the risk of it dropping to zero while you still owe a bank.

- Diversify beyond the hype. In 1929, everyone was heavy in "New Era" stocks like radio and aviation. Today, don't put everything into AI or a single sector.

- Keep an emergency fund in a boring place. High-yield savings accounts aren't sexy, but they don't vanish when the NYSE has a meltdown.

- Study market history. Read The Great Crash, 1929 by John Kenneth Galbraith. It’s the gold standard for understanding the psychology of the era.

- Watch the "Buffett Indicator." This is the ratio of total market cap to GDP. When it gets way out of whack, like it did in 1929 and 2000, it's a signal that the party might be winding down.

The stock market crash of 1929 serves as a permanent reminder that markets are driven by human emotion—fear and greed—not just spreadsheets. Understanding what happened on those frantic days in October isn't just a history lesson; it's a survival manual for anyone with a brokerage account today.

Check your current portfolio allocation. If a 30% drop would force you to sell because you need the cash, you are over-leveraged. Rebalancing now, when things are calm, is the only way to ensure you don't end up as a cautionary tale in the next history book.

Look at your debt-to-equity ratio. Reduce any high-interest debt that could squeeze your cash flow during a market downturn. Build a "dry powder" fund—cash set aside specifically to buy assets when everyone else is panicking. History shows that those who survived the crash with cash on hand were the ones who built generational wealth in the decades that followed.