Everything was screaming. Not just the people on the floor of the New York Stock Exchange, but the machines themselves. The tickers couldn't keep up. They were lagging by hours, spitting out prices that were already obsolete by the time the ink hit the paper. Imagine trying to drive a car while looking through a rearview mirror that’s twenty minutes behind reality. That was Tuesday, October 29, 1929.

People talk about the stock market crash of 1929 like it was a single bad afternoon, a lightning strike out of a clear blue sky. It wasn't. It was more like a slow-motion train wreck that started months earlier and took years to stop burning.

If you look at the charts from that era, the peak actually happened in September. The market had been "frothy," as analysts say today, but back then, they just called it the "Great Bull Market." Everyone was in. Your barber was giving you tips on RCA. Your grandmother was probably looking at margin requirements. It felt like a perpetual motion machine of wealth. Then the friction started.

Why the stock market crash of 1929 actually happened (It wasn't just panic)

Panic is the symptom, not the disease. To understand why the floor fell out, you have to look at how people were buying. They were using "margin."

Basically, you could put down 10% of a stock's price and borrow the other 90% from your broker. It’s a genius move when stocks go up. If you have $100 and buy $1,000 worth of stock, and that stock goes up 10%, you’ve doubled your money. Easy. But if the stock drops 10%? You’ve lost everything. Your broker calls you up—the dreaded "margin call"—and demands the cash you don't have. If you can't pay, they sell your shares immediately to cover their own tails.

This created a mechanical domino effect.

Once the prices dipped in late October, brokers started selling off their clients' shares to protect themselves. This mass selling drove prices lower. Which triggered more margin calls. Which triggered more selling. It was an automated nightmare before computers even existed. Economists like John Kenneth Galbraith, who wrote the definitive post-mortem on this, pointed out that the structure of the market was fundamentally fragile. It was a house of cards built on debt, and someone left the window open.

📖 Related: Kimberly Clark Stock Dividend: What Most People Get Wrong

Black Thursday, Black Monday, and Black Tuesday

Most folks get the days mixed up.

Black Thursday (October 24) was the first real "oh crap" moment. Volume hit nearly 13 million shares. To give you some perspective, a "heavy" day back then was maybe 4 million. A group of bankers, led by Richard Whitney—acting for J.P. Morgan—tried to save the day. They walked onto the floor and started buying huge blocks of U.S. Steel above market price. It was a flex. A show of confidence. And it actually worked... for about forty-eight hours.

Then came Monday. The fever didn't break.

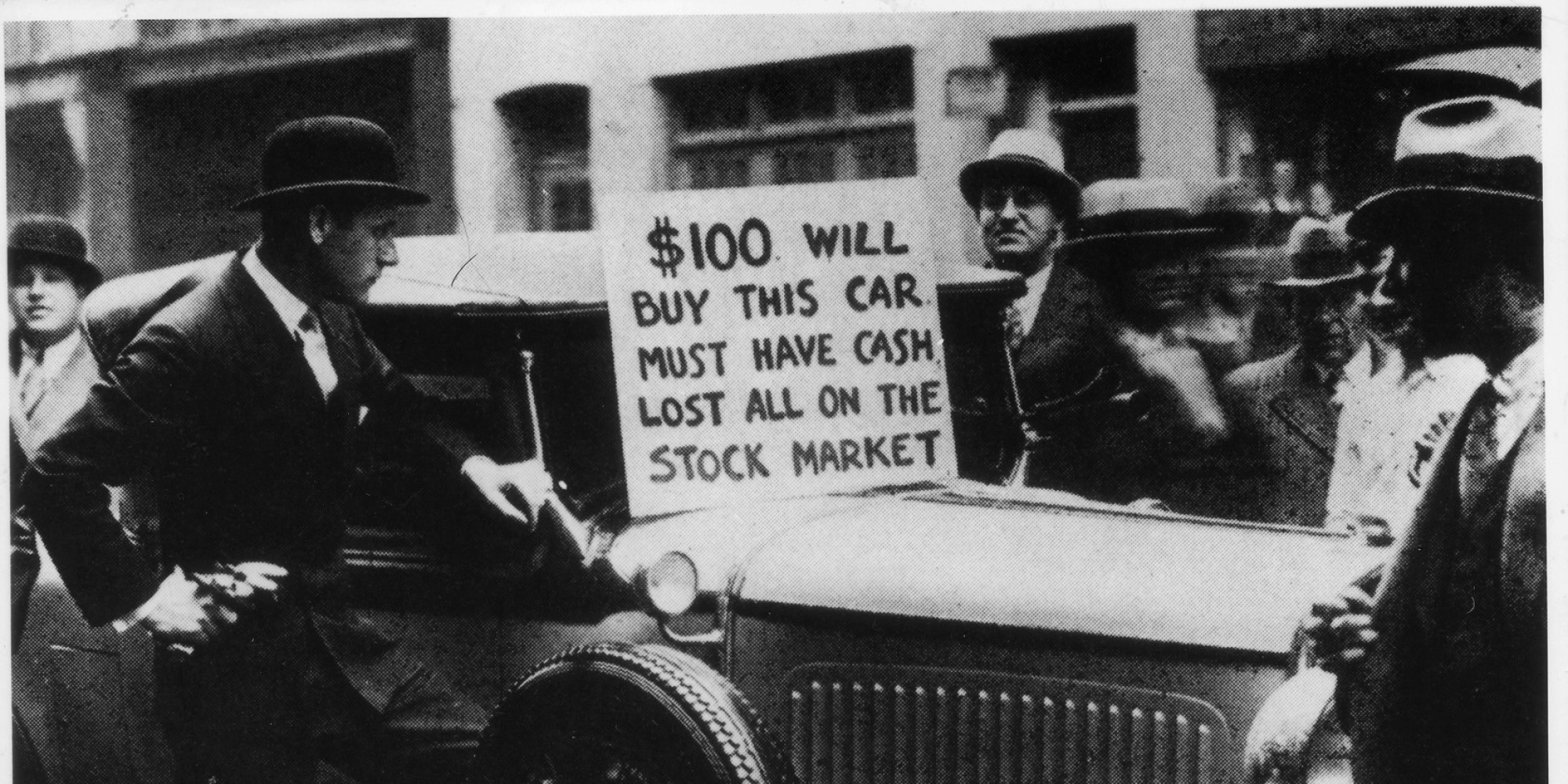

By Black Tuesday, the 29th, the bankers gave up. They couldn't plug a dam that was bursting in a thousand places. Over 16 million shares changed hands. Some stocks had no buyers at all—just a sea of people screaming to sell at any price.

The Myth of the Jumpers

You’ve heard the stories. Bankers leaping from high-rise windows in Wall Street, raincoats flapping in the wind. Honestly? It's mostly a myth. While there were some high-profile suicides, like the head of County Trust Co., the suicide rate in New York didn't actually spike that week. The "leaping banker" became a cultural trope because it captured the visceral feeling of total ruin, but the reality was a lot grimmer and slower. It was middle-class families losing their life savings in forty-eight hours. It was the "New Era" ending in a cold sweat.

The Role of the Federal Reserve (The "Oops" Moment)

We love to blame "greedy speculators," and yeah, they played their part. But the Federal Reserve gets a lot of the heat from modern historians and economists like Milton Friedman.

👉 See also: Online Associate's Degree in Business: What Most People Get Wrong

In the lead-up to the stock market crash of 1929, the Fed was worried about the "speculative bubble." They wanted to pop it gently. So, they raised interest rates. The problem is that by the time they did, the economy was already cooling off. Auto sales were down. Steel production was slowing. By tightening the money supply, they didn't just pop the bubble—they suffocated the entire room.

Even after the crash, the Fed stayed tight. They were worried about the gold standard. They let banks fail by the thousands because they didn't want to encourage "moral hazard." It was a catastrophic policy error that turned a market correction into the Great Depression.

Misconceptions that still linger

One of the biggest misunderstandings is that the crash caused the Great Depression. It’s more accurate to say the crash was the starting gun.

- The market didn't hit bottom in 1929. Not even close. The Dow Jones Industrial Average kept sliding until July 1932. By then, it had lost nearly 90% of its value.

- The economy was already sick. Agriculture had been in a depression for years before the crash. Farmers were drowning in debt and overproduction.

- It wasn't just a U.S. problem. Thanks to the aftermath of WWI and the web of international debt, when Wall Street caught a cold, Europe got pneumonia.

The crash was the moment the psychology changed. Before October 1929, the vibe was "prosperity is permanent." Afterward, the vibe was "hide your money in a mattress." When people stop spending, businesses stop hiring. When businesses stop hiring, people have no money to spend. It’s a vicious circle that the stock market crash of 1929 kicked into high gear.

The Aftermath: Laws Written in Blood

If you trade stocks today, you’re playing in a sandbox designed specifically because of 1929. The Securities Act of 1933 and the Securities Exchange Act of 1934 weren't just boring paperwork. They were a middle finger to the "buyer beware" culture of the 20s.

Before these laws, companies didn't really have to tell you the truth about their earnings. You could just lie. You could form "pools" where a bunch of rich guys bought a stock back and forth to inflate the price, then dumped it on unsuspecting retail investors. This was called "painting the tape."

✨ Don't miss: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

The SEC was created to stop that. They made "insider trading" a crime (mostly). They forced companies to publish audited financials. They regulated margin so you couldn't just bet your house on 10% down. Basically, the government tried to build a cage around the animal spirits of Wall Street.

What this means for you in 2026

History doesn't repeat, but it sure does rhyme. You see bits of 1929 everywhere if you look close enough. The rise of "meme stocks" and high-leverage trading apps feels a lot like the margin accounts of the Roaring Twenties. The same psychological pressure to "not miss out" is still there.

But there are differences. We have "circuit breakers" now. If the market drops too fast, the NYSE literally pulls the plug and pauses trading for fifteen minutes or even the rest of the day. This is designed to prevent the mechanical "panic-selling" feedback loop that destroyed 1929.

Actionable Insights for the Modern Investor:

- Audit your leverage. If you are trading on margin, ask yourself: "Can I survive a 20% drop tomorrow?" If the answer is no, you are over-leveraged. The 1929 crash proved that the market can stay irrational longer than you can stay solvent.

- Diversification isn't just a buzzword. In 1929, everyone was heavy in "New Era" tech like radio and automobiles. When those sectors died, everything died. Make sure your eggs are in different baskets—real estate, bonds, international markets, and cash.

- Watch the Fed. The biggest lesson of the crash is that liquidity is king. When the Federal Reserve starts raising rates aggressively, the "froth" is the first thing to evaporate. Pay attention to the macro, not just the ticker.

- Keep an "Opal" fund. That’s just a fancy way of saying have cash on the sidelines. The people who got rich after the stock market crash of 1929 were the ones who had the liquidity to buy when blood was in the streets in 1932.

The stock market crash of 1929 wasn't just a financial event; it was a cultural trauma. It changed the way an entire generation viewed money, risk, and the government. While we have more safety nets today, the fundamental human emotions—fear and greed—haven't changed one bit since the ticker tape stopped running on Black Tuesday. Don't get caught thinking "this time is different." It rarely is.