It started with a whisper, then a roar, and then a deafening silence. People usually think the stock market collapse 1929 was just one bad afternoon in October where everyone lost their shirts and jumped out of windows. That's a bit of a myth, actually. It was much slower, more agonizing, and honestly, way more complicated than the history books usually let on.

Imagine a world where everyone thinks they’re a genius. In the late 1920s, your barber was giving you stock tips. Your grandmother was probably looking at ticker tapes. The "Roaring Twenties" felt like a party that would never end, fueled by easy credit and a brand-new invention called "buying on margin." You could put down just 10% of a stock's price and borrow the rest. It’s basically like gambling with the bank’s money while only having a few dollars in your pocket.

Then came Black Thursday. Then Black Monday. Then the soul-crushing Black Tuesday.

By the time the dust settled on October 29, 1929, the market had essentially vomited up years of gains. But the real pain? That took years to bottom out.

The Lead-Up: A Bubble Built on Borrowed Time

The stock market collapse 1929 didn't happen in a vacuum. You've gotta look at the years leading up to it. Between 1921 and September 1929, the Dow Jones Industrial Average skyrocketed from roughly 63 points to a peak of 381. That is insane growth.

Production was up. Cars, radios, and washing machines were flooding American homes. But there was a catch. Wages weren't keeping pace with how much stuff was being made. Eventually, people stopped buying because they simply couldn't afford it anymore.

Agricultural prices were also cratering. Farmers were already in a depression long before the bankers on Wall Street felt a thing. When the industrial sector started to slow down in the summer of 1929, the smart money started headed for the exits. The "smart money" is usually the first to leave, leaving the regular folks—the ones who bought at the top—holding the bag.

Buying on Margin was the Real Killer

If there's one thing to blame, it’s margin. It’s leverage. If you buy $1,000 worth of stock with only $100 of your own cash, and that stock drops 10%, you’ve lost your entire investment. If it drops more, you owe the broker money you don't have.

When the market wobbled, brokers panicked. They issued "margin calls." They basically called up investors and said, "Give us more cash right now or we sell your stocks to cover the loan." When thousands of people are forced to sell at the same time, the price doesn't just dip. It vanishes. It’s a feedback loop of pure terror.

👉 See also: Disney Stock: What the Numbers Really Mean for Your Portfolio

What Actually Happened on Black Tuesday?

October 29, 1929. The day the music died.

The volume of trading was so high that the ticker tapes—the machines that printed stock prices—couldn't keep up. They were hours behind. Investors were selling stocks without even knowing what the current price was. They just wanted out.

Over 16 million shares changed hands. That was a record that stood for nearly 40 years.

Billions of dollars evaporated. To put that in perspective, the total cost of World War I was roughly $32 billion for the U.S. In a single week of the stock market collapse 1929, the market lost $30 billion. It was like a giant eraser just swiped across the country's balance sheet.

The Myth of the Jumping Bankers

We’ve all heard the stories of suicidal investors leaping from skyscrapers. While there were some tragic high-profile suicides, like the Vice President of the County Trust Co. or J.J. Riordan, the "suicide wave" is largely an exaggeration popularized by comedians like Will Rogers.

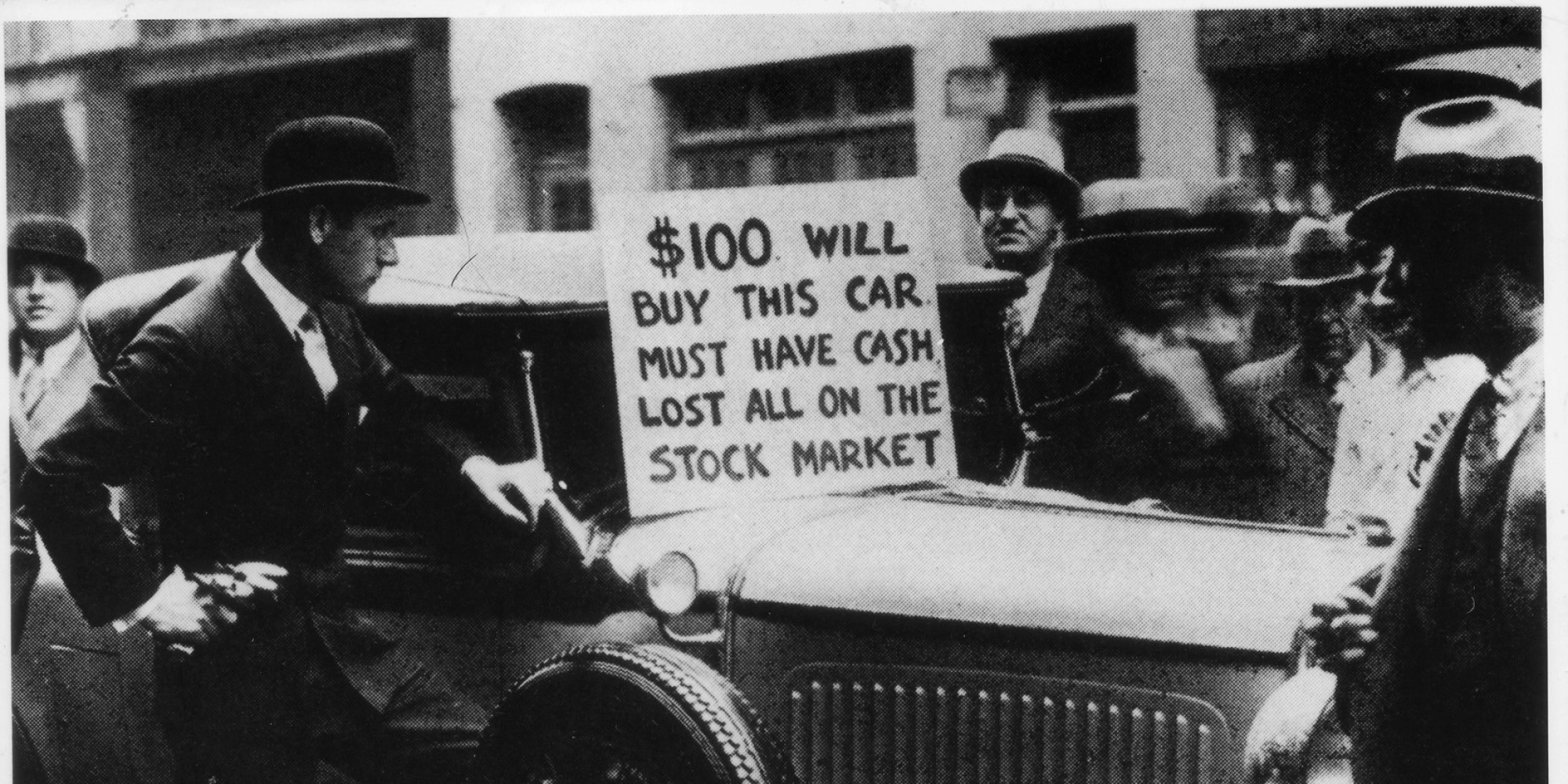

Actually, the suicide rate in New York didn't spike nearly as much as the legends suggest. The real tragedy was more quiet. It was the millions of middle-class families who saw their life savings disappear in forty-eight hours.

Why the Federal Reserve Failed

You’d think the "lender of last resort" would step in, right?

Well, the Fed back then was... let's say "cautious" to a fault. They were worried about inflation and "speculative excesses." Instead of pumping money into the system to keep banks afloat, they actually raised interest rates.

✨ Don't miss: 1 US Dollar to 1 Canadian: Why Parity is a Rare Beast in the Currency Markets

They tightened the money supply when the economy was already gasping for air. This is one of the biggest lessons modern economists like Ben Bernanke and Janet Yellen have obsessed over. They realized that in a crisis, you don't let the money supply shrink. The Fed in 1929 did the exact opposite, turning a bad market crash into a decade-long Great Depression.

The Aftermath: From Crash to Catastrophe

The stock market collapse 1929 was just the opening act. The real bottom didn't happen until July 1932.

By that point, the Dow had lost nearly 90% of its value from the 1929 peak. Think about that. If you had $10,000, you now had $1,000.

Unemployment hit 25%. Banks failed by the thousands because they had used depositors' money to play the stock market. When people went to the bank to get their cash, the vault was empty. This led to "bank runs," where lines of terrified people stretched around city blocks, hoping to get their money out before the doors were locked forever.

The Birth of Regulation

Out of this mess, we got the SEC (Securities and Exchange Commission). Before 1929, the stock market was basically the Wild West. No rules. No transparency. No protection.

The Glass-Steagall Act was passed to make sure banks couldn't gamble with your savings account anymore. It separated "boring" commercial banking from "risky" investment banking. We also got the FDIC, which ensures that even if your bank fails, your money is safe. These are the guardrails that keep our current system from turning into a 1929-style freefall every time there’s a recession.

How the 1929 Collapse Compares to Today

People love to compare 1929 to the 2008 housing bubble or the 2020 COVID dip.

There are similarities, sure. Over-leverage. Asset bubbles. Blind optimism.

🔗 Read more: Will the US ever pay off its debt? The blunt reality of a 34 trillion dollar problem

But today, we have circuit breakers. If the market drops too fast, the New York Stock Exchange literally hits a "pause" button to let everyone breathe and stop the panic selling. We didn't have that in 1929. Back then, the slide just kept going until there were no buyers left at any price.

Also, the "Gold Standard" played a huge role in 1929. Countries couldn't just print money to stimulate the economy because their currency had to be backed by physical gold. This restricted how the government could react. Today, we have "fiat" currency, which gives central banks a lot more tools (for better or worse) to stop a total systemic meltdown.

Key Takeaways and Actionable Insights

Looking back at the stock market collapse 1929, it’s easy to feel like it’s ancient history. It isn't. The psychology of greed and fear hasn't changed a bit in a hundred years.

If you want to protect yourself from the "Next 1929," there are a few brutal truths you need to accept:

- Leverage is a double-edged sword. Margin can make you rich when things are going up, but it will absolutely destroy you in a downturn. Avoid excessive debt in your investment portfolio.

- Diversification isn't just a buzzword. In 1929, people were heavily concentrated in "glamour stocks" like RCA and Montgomery Ward. When those fell, everything fell. Spread your risk across different asset classes—stocks, bonds, real estate, and cash.

- Keep an "Emergency Fund" separate from the market. The people who survived the 1929 crash were the ones who didn't have to sell their stocks at the bottom just to buy groceries. If you have 6–12 months of cash in a boring savings account, you can afford to wait for a recovery.

- Watch the "Shoeshine Boy" indicator. This is a famous story about Joe Kennedy (JFK's dad). He allegedly exited the market just before the crash because a shoeshine boy started giving him stock tips. When the most "uninformed" people are bragging about easy money, the bubble is usually about to pop.

- Understand "Systemic Risk." Sometimes the problem isn't the stock you own; it's the plumbing of the financial system itself. Pay attention to bank health and Federal Reserve policy. They move the markets more than any single company's earnings report.

The 1929 crash taught us that the market isn't a machine; it's a reflection of human emotion. It can stay irrational longer than you can stay solvent. By studying what went wrong then—the over-reliance on credit, the lack of regulation, and the failed government response—you can better navigate the volatility of the modern financial world.

History doesn't always repeat, but it definitely rhymes. Stay liquid, stay diversified, and never invest money you can't afford to lose in a week.

Next Steps for Your Portfolio

- Audit your debt levels. Check if you are using margin or high-interest loans to fund investments and create a plan to reduce that exposure.

- Verify your FDIC coverage. Ensure your cash savings are held in institutions that are federally insured up to the current limits.

- Review your asset allocation. If you find yourself too heavy in a single sector (like tech or AI), rebalance to include more "defensive" assets like consumer staples or treasury bonds.