Agriculture is a gamble. You've got the weather, the water rights, and the global markets all playing against you at once. For years, Sran Family Orchards was the gold standard of California almond and walnut production. They weren't just some small farm; they were a massive vertical operation, handling everything from the soil to the shipping container. But recently, the news of the Sran Family Orchards Chapter 11 filing sent shockwaves through the Central Valley. It wasn't just a business failing—it was a signal that even the giants are feeling the squeeze of a brutal economy.

Honestly, the scale of this is hard to wrap your head around. We are talking about thousands of acres and millions in debt.

Why the Sran Family Orchards Chapter 11 filing matters to California

When a name like Sran hits the bankruptcy courts, people notice. This isn't just about one family. It's about the entire infrastructure of the nut industry. The Sran family, led by Lakhmir Sran and his sons, built an empire in Kerman, California. They grew, processed, and marketed organic and conventional nuts. They were the ones who proved you could scale organic almonds to a global level.

So, what happened?

Basically, a "perfect storm" is the only way to describe it. In the court documents filed in the Eastern District of California, the company pointed to a few major culprits. Interest rates spiked. If you're carrying a lot of debt to fund your equipment and land, those rate hikes are a slow-motion car crash for your cash flow. Then you have the almond prices. A few years ago, almonds were the "white gold" of the valley. Now? Overproduction and shipping logistics issues have tanked the price per pound.

💡 You might also like: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

The filing wasn't just for Sran Family Orchards, Inc. It included several related entities, including Sran Family Land, LLC. This is common in these big ag cases. You have to wrap the land-owning side and the operating side into one big legal bundle to keep the creditors from picking the bones clean before a reorganization plan is set.

The debt mountain and the creditors

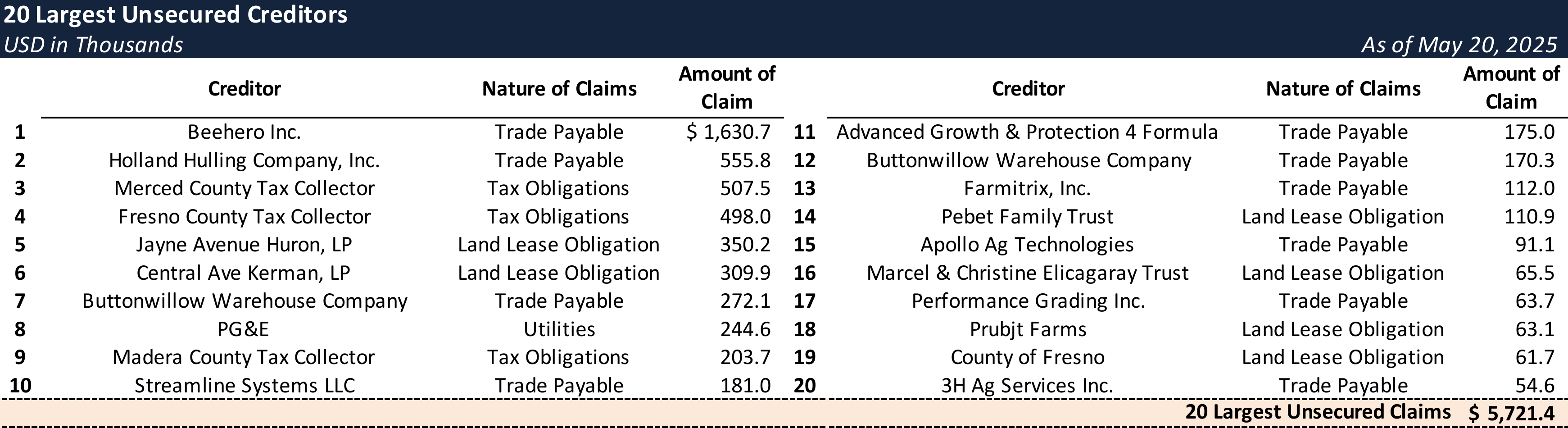

When you look at the bankruptcy schedules, the numbers are staggering. We are looking at liabilities that stretch into the hundreds of millions.

- Principal Lenders: Large institutional banks like Farm Credit West (now AgCountry) hold the bulk of the secured debt.

- Unsecured Creditors: This is where it gets messy. This list includes local vendors, trucking companies, and smaller farm service providers who might not see a dime for a long time.

- The Assets: While the debt is high, the assets are also massive. We're talking about prime San Joaquin Valley acreage and state-of-the-art processing facilities.

Bankruptcy isn't always the end, though. That’s a common misconception. Chapter 11 is specifically for reorganization. The goal here is to keep the tractors moving. If the Sran family can restructure their payments and maybe sell off some non-core assets, there is a path where the business survives in a leaner form. But man, it’s a steep hill to climb.

Is the almond boom officially over?

People keep asking if this is the "canary in the coal mine." Maybe. The California almond industry has been through cycles before, but this one feels different. Input costs—fertilizer, diesel, labor—have all stayed high while the payout at the processor has dropped.

📖 Related: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Water is the other invisible hand here. With the Sustainable Groundwater Management Act (SGMA) kicking in, the "wild west" days of pumping as much water as you want are over. Land values are being reassessed based on water security, not just soil quality. If your orchard is in a district with "white area" (unmanaged) groundwater, your land value might have just cratered.

The human element of the Sran bankruptcy

It's easy to look at spreadsheets and court filings and forget that there are hundreds of employees involved. The Sran family has been a major employer in the Kerman and San Joaquin area for decades. When a Chapter 11 hits, the first thing people worry about is payroll.

In the initial days of the filing, the company sought "first day motions" to ensure they could continue paying workers and keep the lights on. Without that, the crop dies in the field. And in ag, if the crop dies, there's no money to pay the banks back. It’s a delicate ecosystem.

The Sran family has deep roots. They are part of the tight-knit Punjabi farming community that has transformed the Central Valley over the last fifty years. This isn't just a corporate failure; it's a blow to the community's pride. Many other farmers are looking at the Sran Family Orchards Chapter 11 and wondering, "If they couldn't make it work with all that scale, how can I?"

👉 See also: USD to UZS Rate Today: What Most People Get Wrong

What happens to the land?

One of the most likely outcomes of a Chapter 11 like this is a "363 sale." This is a section of the bankruptcy code that allows a company to sell assets free and clear of liens. Don't be surprised if we see massive blocks of Sran acreage hitting the market soon. Institutional investors—think pension funds and insurance companies—are often the ones waiting in the wings to buy this land. They have the "patient capital" to wait out a five-year market slump that a family-owned operation just can't survive.

Actionable insights for those following the case

If you are a vendor, a neighboring farmer, or an investor, you need to be proactive. Waiting for the mail to arrive isn't a strategy.

- Check your UCC filings. If you provided equipment or supplies to Sran, ensure your liens are properly perfected. In a Chapter 11, the order of who gets paid is everything.

- Monitor the "Claims Bar Date." This is the hard deadline set by the court. If you don't file your proof of claim by this date, you are legally out of luck.

- Watch the almond market trends. This bankruptcy is a supply-side signal. If one of the biggest organic producers is restructuring, it could eventually lead to a tightening of supply, which might (fingers crossed) help stabilize prices for everyone else.

- Diversify your water risk. If you're an ag investor, use the Sran case as a lesson. Look at the water district data for every parcel. If the SGMA impact hasn't been priced into the land yet, you're looking at a future liability.

The Sran Family Orchards Chapter 11 is a complicated, evolving story. It’s a mix of bad luck, aggressive expansion, and a global market that turned sour at the worst possible time. While the legal proceedings will likely drag on for months—if not years—the impact on the Central Valley landscape is already being felt. The industry is watching to see if the Srans can pull off a miracle reorganization or if this is the beginning of a massive consolidation in the California nut industry.

Keep an eye on the court's monthly operating reports. They are public record and provide the most honest look at whether the "reorganization" is actually working or if a liquidation is inevitable. For now, the irrigation lines are still pressurized, and the trees are still growing, but the future of this almond empire remains entirely in the hands of a bankruptcy judge.