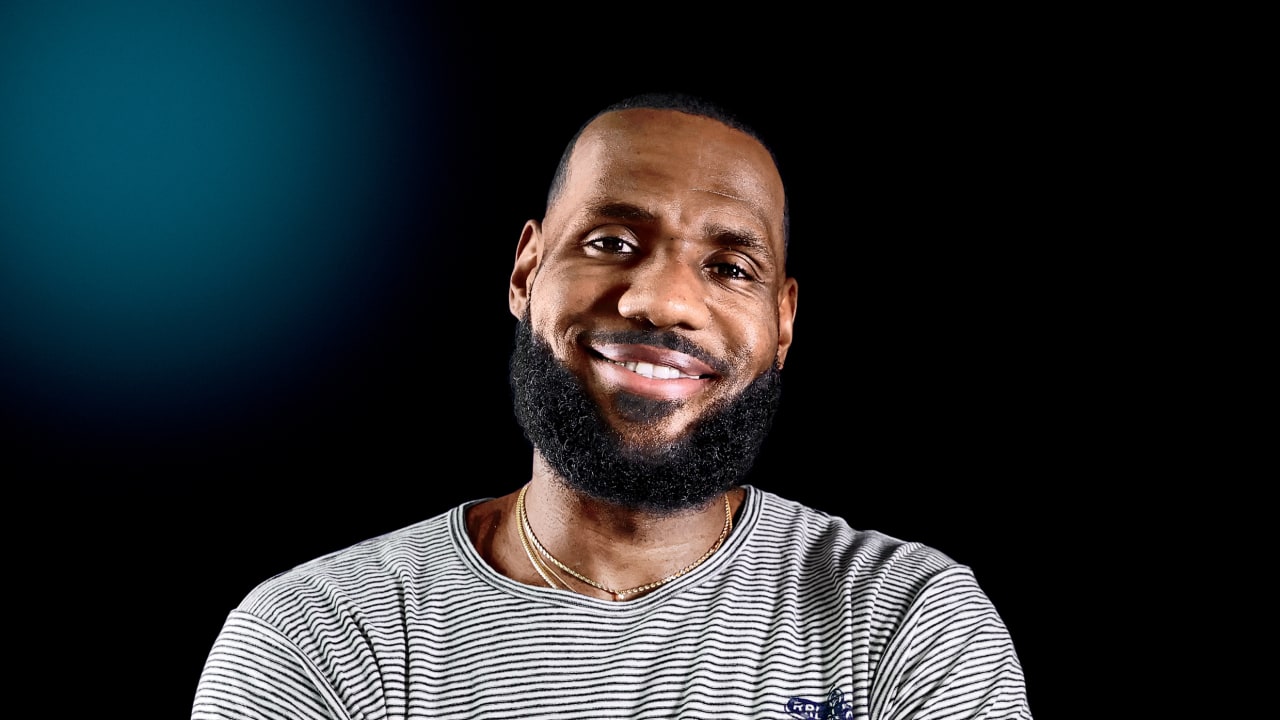

Making money in Hollywood is hard. Making money as a celebrity-backed "content engine" is apparently even harder. Honestly, you'd think that having the greatest basketball player of a generation as your co-founder would be a literal cheat code for business success. But for The SpringHill Company, the reality has been a bit of a cold shower lately.

Despite the glitz of projects like Space Jam: A New Legacy and the ubiquitous The Shop, the ledger hasn't looked great.

The Numbers That Raised Eyebrows

Let's look at the actual damage. According to financial documents that surfaced late in 2024 via Bloomberg, The SpringHill Company financial losses hit a staggering $28 million in 2023. This wasn't just a one-off bad year. It followed a $17 million loss in 2022.

Think about that for a second.

The company pulled in $104 million in revenue in 2023—a healthy number for many—but it still managed to bleed nearly $30 million. Basically, for every dollar they earned, they were spending way more to keep the lights on and the cameras rolling.

It’s a classic "burn rate" problem.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

SpringHill isn't alone here. The whole industry has been getting punched in the gut. But when you’ve been valued at $725 million by heavy hitters like RedBird Capital and Nike, people expect you to find the "profit" button eventually.

Why the SpringHill Company Financial Losses Kept Growing

You can't blame just one thing. It's a mess of bad timing and shifting goalposts.

- The Streaming Correction: Remember when Netflix and Apple TV+ were just handing out checks to anyone with a famous name? Those days are dead. Streamers are now obsessed with "efficiency" and "profitability." They’re buying less, paying less, and taking longer to say "yes."

- The Strike Hangover: The 2023 writers’ and actors’ strikes didn't just stop production; they blew up schedules. For a mid-sized studio like SpringHill, which doesn't have the infinite bank account of Disney, those delays were expensive.

- High Overhead: Running a "cultural consultancy" like The Robot Company alongside a production arm and an athlete platform (Uninterrupted) takes a lot of expensive talent.

Maverick Carter, the CEO and LeBron’s longtime partner, hasn't tried to hide the struggle. He’s been pretty open about "recalibrating." In business-speak, that usually means "we spent too much and need to fix it." They’ve had to write off projects that just weren't going anywhere, which is a painful but necessary part of the game.

The Big Pivot: The Fulwell 73 Merger

By late 2024, it became clear that staying the course wasn't an option. You can't just lose $2 million a month forever.

So, they made a move. SpringHill merged with Fulwell 73, the British powerhouse behind The Kardashians and Carpool Karaoke.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

This wasn't just a "let's be friends" deal. It was a survival strategy.

The merger brought in $40 million in fresh cash from the existing investor group. It also allowed for "synergies"—which is just a fancy way of saying they laid people off to lower costs. The goal is to get the combined workforce down to about 250 people.

They’re aiming to finally hit profitability by the end of 2025. It’s a tall order, but having the Kardashian-producing machine in your corner probably helps the bottom line more than a high-concept documentary might.

What Most People Get Wrong About LeBron's Involvement

There’s this idea that LeBron James is sitting in a corner office picking scripts. He’s not.

Carter has famously said, "We built this business with LeBron, not around him."

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Sure, his name gets them into the room with Nike or Epic Games. But LeBron is still, you know, playing professional basketball at an elite level. He’s the chairman, but the day-to-day grind—the stuff that actually results in $28 million losses—falls on the management team.

The real test comes when he retires. Will he become the "closer" for deals, or will the brand lose its luster when he’s not on the court every night? Honestly, it could go either way. Some think the company needs him more active; others think the brand is now big enough to stand on its own.

Lessons from the SpringHill Struggle

If you're looking at this from a business perspective, there are a few blunt truths to take away.

- Star power is a door-opener, not a business model. You can have the most famous person on earth as your founder, but if your production costs exceed your licensing fees, you’re in trouble.

- Scale matters. In the current media landscape, being "mid-sized" is the most dangerous place to be. You don't have the nimble nature of a boutique shop, and you don't have the leverage of a major studio.

- The "Pivot to Profit" is real. The era of "growth at all costs" is over. Every media startup is now being forced to prove they can actually make a cent, or the funding dries up.

Practical Steps for Following the Turnaround

If you’re tracking the health of celebrity-led media or just want to see if LeBron can pull off this fourth-quarter comeback, keep an eye on these specific markers throughout 2026:

- Project Volume vs. Quality: Watch if they move away from prestige "passion projects" toward more "unscripted" (reality) content, which is significantly cheaper to produce and easier to sell.

- Investor Appetite: Watch for any news of "Series D" or additional debt rounds. If they need more cash before 2025 ends, the Fulwell merger might not have been enough.

- International Expansion: The Fulwell 73 deal was a play for the European market. If SpringHill starts announcing major UK or EU-based productions, it’s a sign the strategy is working.

The story isn't over. A $28 million loss is a big hole, but in the world of high-stakes media, it's a hole you can climb out of if you've got the right ladder. For SpringHill, that ladder is now made of British reality TV and a much leaner staff.