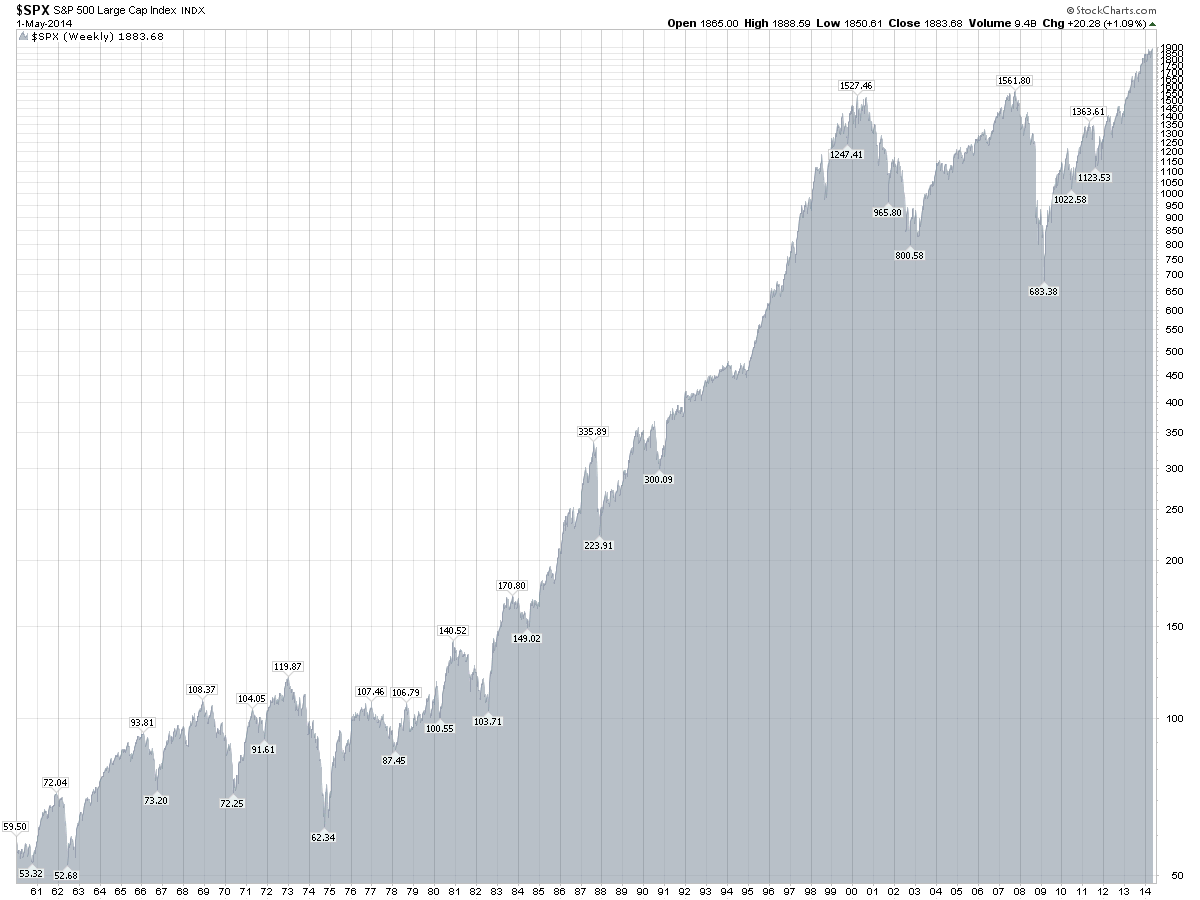

Money makes people weird. When you look at an s and p 500 historical chart, most folks see a jagged line that eventually goes up and to the right. But honestly? That line is a graveyard of panics, a monument to human greed, and a pretty decent roadmap for why you aren't as rich as you should be yet. It’s not just a bunch of data points. It’s a record of every time the world thought it was ending and then, somehow, didn't.

If you’ve been staring at the charts lately, you’ve probably noticed the S&P 500—which tracks roughly 500 of the biggest companies in the U.S.—has a habit of making people look like geniuses one year and total idiots the next. It’s the benchmark. If you’re an investor, this is the yardstick you're measured against. You either beat it, or more likely, you get beaten by it.

Why the S and P 500 historical chart looks so different depending on your zoom

Context is everything. If you zoom in on the last six months, the chart looks like a mountain range designed by a caffeinated toddler. Highs, lows, sharp drops. It’s stressful. But when you pull back to a 50-year or 100-year view, those massive "catastrophes" like the 1987 Black Monday crash or the 2008 Great Recession start to look like tiny blips.

Take 1929. The Great Depression. On a long-term s and p 500 historical chart, that era is a deep, dark valley. It took nearly 25 years for the market to fully recover its pre-crash peak in nominal terms. That’s a lifetime. Most people don't have 25 years to wait for "even." But then you look at the post-WWII boom. From the late 1940s through the 1960s, the index went on a tear that redefined the American middle class.

The chart doesn't move in a straight line because humans don't think in straight lines. We overreact. When things are good, we buy until valuations make no sense—think the Dot-com bubble in 2000. When things are bad, we sell until stocks are practically being given away.

The 7% to 10% myth

You’ve heard it. Everyone says the S&P 500 returns about 10% annually on average. That’s true, mathematically. But basically no one ever actually gets a 10% return in a single year. In reality, the market is usually up 30% or down 15%. "Average" is just the middle point of two extremes.

If you look at the s and p 500 historical chart over the last century, you'll see "Lost Decades." From 2000 to 2010, the S&P 500 basically went nowhere. It was flat. If you started investing in the year 2000, you spent ten years watching your money evaporate and reappear without any real growth. Then, from 2010 to 2020, we had one of the most aggressive bull markets in history. If you only saw the second half of that, you’d think investing was easy. It isn't.

👉 See also: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

The big crashes that define the chart

You can't talk about the history of this index without talking about the carnage. These are the moments that shake people out of the market.

- The 1970s Stagflation: This is a part of the chart most people ignore. It wasn't one big crash; it was a slow, painful grind. High inflation and stagnant growth meant that even though the chart looked "flatish," your actual purchasing power was getting wrecked.

- 1987 Black Monday: The S&P 500 dropped over 20% in a single day. One day. Imagine waking up and a fifth of your net worth is just... gone. The chart shows a vertical cliff. But interestingly, the market ended that year in the green.

- The 2008 Global Financial Crisis: This was the big one for the modern era. The index halved. It fell about 50% from its peak. If you look at the s and p 500 historical chart for this period, it’s a terrifying slide that didn't bottom out until March 2009.

- The 2020 Covid Flash Crash: This was the fastest 30% drop in history. It also resulted in one of the fastest recoveries, fueled by massive government stimulus.

It’s a survivor’s club

Here is something most people forget: the S&P 500 is curated. It’s not a stagnant list of the same companies. It’s a "living" index. Companies that fail or shrink get kicked out. New, massive winners like Nvidia or Tesla get added.

This means the s and p 500 historical chart has a built-in "quality" bias. It’s always reflecting the winners of the current economy. In the 1950s, it was all about industrials and railroads. Today, it’s dominated by tech giants—the "Magnificent Seven." If the chart only tracked the original companies from 1957, it would look a lot bleaker.

This is why "buying the index" works. You’re essentially betting on the survival and evolution of the American economy rather than any single company’s ability to stay on top forever.

Does the chart mean we're in a bubble?

Everyone wants to know if the current peak is a "top." Honestly, no one knows. Experts like Jeremy Grantham have been calling for a massive reversion to the mean for years. Meanwhile, others point to the fact that corporate earnings—the actual profits these companies make—have largely kept pace with price increases.

When you look at a historical chart, pay attention to the P/E ratio (Price-to-Earnings). Historically, the average P/E for the S&P 500 is around 16. Sometimes it's higher, like during the 2000 tech bubble when it cleared 30. When the price line on the chart gets too far ahead of the earnings line, things usually get messy.

✨ Don't miss: Are There Tariffs on China: What Most People Get Wrong Right Now

How to use this data without losing your mind

Most people use the s and p 500 historical chart the wrong way. They use it to try and time the market. They see a peak and think, "I'll wait for the dip."

The problem? The "dip" might happen 20% higher than where we are now. Peter Lynch, the legendary manager of the Fidelity Magellan Fund, famously said that more money has been lost by investors preparing for corrections than has been lost in the corrections themselves.

Look at the chart again. Notice how many "peaks" turned out to be just mid-points on the way to much higher levels. If you sold in 2013 because the market hit an all-time high, you missed out on one of the greatest runs in history.

Inflation adjustment changes everything

If you want the real truth, you have to look at an inflation-adjusted s and p 500 historical chart. Nominal gains are great, but if the price of a loaf of bread triples while your stocks double, you're actually poorer.

When adjusted for inflation, the "break-even" periods for the S&P 500 are often longer than they look on a standard Yahoo Finance chart. This is the nuance that "perma-bulls" often ignore. Growth is real, but it’s not always as explosive as the raw numbers suggest.

Actionable insights for your portfolio

Don't just stare at the lines. Do something with the information. The history of the S&P 500 proves a few things beyond a shadow of a doubt.

🔗 Read more: Adani Ports SEZ Share Price: Why the Market is kida Obsessed Right Now

Stop trying to be a hero. Unless you are a professional trader with a Bloomberg terminal and no soul, you probably won't beat the index consistently. The chart shows that "time in the market" beats "timing the market" almost every single time.

Expect the 10% correction. On average, the S&P 500 sees a 10% drop once a year. It's normal. It's the "price of admission" for the long-term gains. If you can't handle a 10% red dip on your screen without panicking, you shouldn't be in equities.

Rebalance when things feel too good. When the s and p 500 historical chart looks vertical, your portfolio might become "top-heavy" with stocks. If you started with 60% stocks and 40% bonds, a big market run might push you to 80% stocks. That means you're taking more risk than you intended right when the market is most expensive. Sell some winners. Buy some boring stuff.

Watch the yield curve. Historically, when short-term interest rates become higher than long-term rates (an inverted yield curve), a recession and a subsequent dip in the S&P 500 chart usually follow within 12 to 18 months. It's not a perfect crystal ball, but it's one of the few indicators that has a scary-accurate track record.

Keep a "crash fund." The best way to handle the inevitable drops on the chart is to have cash ready to buy. When everyone else is screaming on Twitter about the end of the world, that’s when the s and p 500 historical chart offers the best entry points.

At the end of the day, the chart is just a mirror of us. It’s a record of innovation, labor, and the weird, collective belief that tomorrow will be slightly more productive than today. As long as that belief holds true, the chart's long-term direction is likely to stay the same. Just be prepared for a few stomach-churning drops along the way.