You’ve probably seen the lists. Every year, financial magazines drop a new ranking of the "wealthiest" places on Earth. Usually, there’s a predictable rotation of flags: the blue and white of Luxembourg, the green of Ireland, or the crescent moon of Singapore.

But honestly? Finding out what is the richest country in the world is a bit like asking who the "best" athlete is. Do you mean the one who can lift the most total weight, or the one with the highest power-to-weight ratio?

If you look at the United States, it’s an absolute titan. By the end of 2026, the US GDP is projected to push past $31.8 trillion. That is a number so large it’s hard to wrap your head around. It makes up more than a quarter of the entire global economy. If "rich" means having the biggest bank account and the most influential markets, the US wins by a landslide.

But walk into a cafe in Luxembourg City and then one in a rural town in the American Midwest. The "wealth" feels different. That’s because the US has over 340 million people. When you divide that massive $31 trillion pile of cash by every citizen, the US actually drops out of the top ten in many "rich" rankings.

The Numbers Game: GDP vs. PPP

To figure out who’s actually winning, economists use a couple of different "rulers."

First, there’s Nominal GDP. This is the raw market value of everything a country produces. It’s great for measuring geopolitical muscle, but it sucks for measuring how the average person lives.

Then, there’s GDP per capita (PPP). This is the "Gold Standard" for these lists. PPP stands for Purchasing Power Parity. Basically, it adjusts the numbers for the cost of living. If a burger costs $10 in New York but $2 in a smaller economy, your dollar goes five times further in the second place.

📖 Related: Kimberly Clark Stock Dividend: What Most People Get Wrong

Why Luxembourg Always Wins

If we’re going by the "wealth per person" metric, Luxembourg is almost always the answer to what is the richest country in the world. As of early 2026, its GDP per capita (PPP) is hovering around a staggering $146,000.

Why is this tiny nation, tucked between Belgium, France, and Germany, so ridiculously wealthy? It’s not just luck.

- The Commuter Effect: This is the "secret sauce" that skews Luxembourg’s numbers. About 200,000 people drive across the border every single day from neighboring countries to work in Luxembourg. They produce wealth (which goes into the GDP numerator), but they don’t live there (so they aren't in the population denominator). It makes the country look twice as rich as it actually is on paper.

- Banking Powerhouse: It’s the second-largest investment fund center in the world, trailing only the US. Nearly 40% of its GDP comes from the financial sector.

- A "Niche" Economy: Because it's small, Luxembourg is nimble. They moved from steel to finance, and now they’re even investing heavily in space mining and green finance.

The Ireland "Leprechaun Economics" Problem

If you look at the 2026 IMF data, Ireland often shows up as the runner-up, or even the winner, with a GDP per capita well over $135,000.

But there’s a catch.

Economists sometimes call this "Leprechaun Economics." Ireland has a very low corporate tax rate (around 15%), which has led massive tech giants like Apple, Google, and Meta to headquarter their European operations in Dublin.

These companies book billions of dollars in profits through their Irish offices. On paper, it looks like Ireland is exploding with wealth. In reality, a lot of that money belongs to shareholders in California, not the local baker in Cork. To get an honest look at Irish wealth, you have to look at *GNI (Modified Gross National Income)**, which strips away those "phantom" corporate assets. When you do that, Ireland looks more like a standard, wealthy European nation rather than a hyper-wealthy outlier.

👉 See also: Online Associate's Degree in Business: What Most People Get Wrong

The Real Wealth: Singapore and Switzerland

If you want to see wealth that you can actually feel on the street, look at Singapore.

Singapore is a fascinating case because it has almost zero natural resources. It’s a rock in the ocean. Yet, its GDP per capita (PPP) is consistently in the top three, projected at roughly $157,000 for 2026.

The difference here is the Sovereign Wealth Funds. Through GIC and Temasek, the Singaporean government owns massive stakes in global companies. They’ve reinvested their trade profits back into the island's infrastructure. When you see the futuristic skyline or the world-class Changi Airport, you’re looking at "tangible" national wealth that actually stays within the borders.

Then there’s Switzerland. It’s the "stable" choice. While other countries' rankings fluctuate with tax laws or oil prices, Switzerland just stays rich. It has a diversified mix of high-end manufacturing (think Rolex and precision medical tools) and a legendary banking sector.

The Top 5 Richest Countries (2026 Projections)

| Rank | Country | GDP per Capita (PPP) | Primary Wealth Driver |

|---|---|---|---|

| 1 | Luxembourg | ~$146,800 | Financial services & Cross-border labor |

| 2 | Singapore | ~$157,000 | Global trade & Sovereign wealth funds |

| 3 | Ireland | ~$133,000 | Multinational corporate hubs (Tax strategy) |

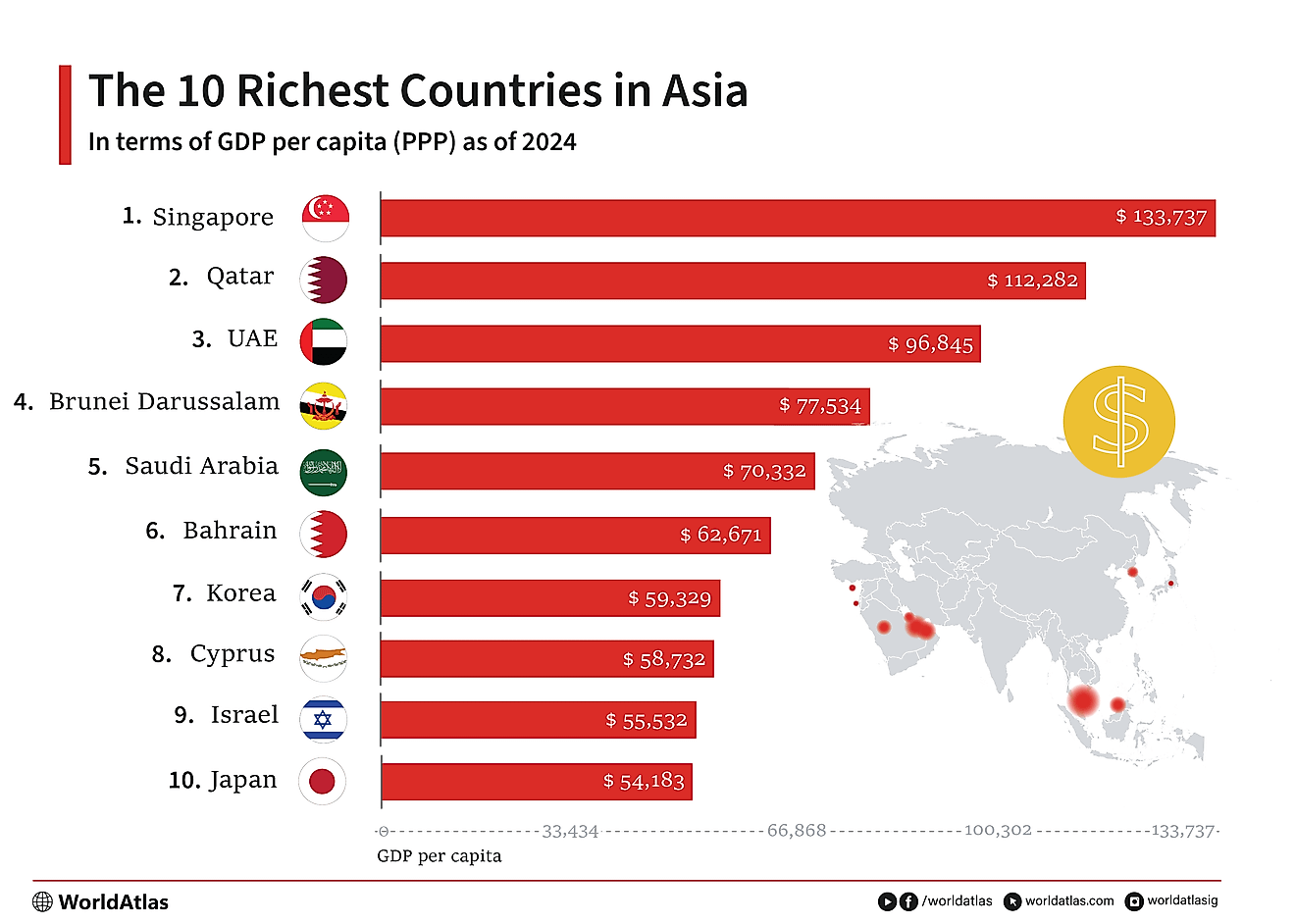

| 4 | Qatar | ~$122,000 | Natural gas & Energy exports |

| 5 | Switzerland | ~$111,000 | Banking & Precision manufacturing |

What Most People Get Wrong About "Rich" Countries

Honestly, being the "richest" country doesn't always mean having the "richest" life.

Take Monaco. It’s arguably the wealthiest place on the planet, with a nominal GDP per capita exceeding $250,000. But it’s also a place where a tiny one-bedroom apartment can cost you $3 million. If you have to spend 80% of your massive income just to keep a roof over your head, are you actually "rich"?

✨ Don't miss: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Similarly, oil-rich nations like Qatar or the UAE have astronomical per capita numbers, but that wealth is often concentrated in a small percentage of the population or the royal families.

The Cost of Living Trap

In 2026, the cost of living has become the great equalizer. High-income countries like Norway and Iceland have incredible GDP numbers, but they also have some of the highest prices for basic goods in the world. A gallon of milk or a simple restaurant meal can cost double what it does in the US or Germany.

Actionable Insights: What This Means for You

If you’re looking at these rankings because you’re considering moving, investing, or just curious about where the world is heading, here is the "real-world" takeaway:

- Don't follow the "Phantom" Money: If a country’s wealth is driven by corporate tax loopholes (like Ireland), it might be a great place for a tech job, but it might also have a massive housing crisis because the local infrastructure hasn't kept up with the "paper" wealth.

- Look for Diversification: Countries like Switzerland and the Netherlands are "safer" bets for long-term stability because their wealth comes from multiple industries, not just one (like oil) or one tax law.

- PPP is the Only Metric that Matters for Quality of Life: If you are a digital nomad or looking to relocate, always check the PPP-adjusted figures. They give you a much better idea of how your salary will actually "feel" when you're paying rent and buying groceries.

- The Small State Advantage: Notice that almost all the richest countries are tiny. It’s easier to manage a massive pile of money when you only have a few hundred thousand people to take care of. This is why the United States being at #8 or #9 is actually more impressive than Luxembourg being at #1.

The title of "richest country" is always going to be a bit of a shell game. But whether it's Luxembourg's bankers, Singapore's traders, or Qatar's gas fields, the real winners are the nations that figure out how to turn those abstract numbers into a high quality of life for the people actually living there.

To get a true sense of global wealth distribution, you should now compare these per-capita rankings against the Human Development Index (HDI), which factors in life expectancy and education alongside the money.