You’re sitting there, coffee in hand, staring at a flickering screen. It’s 9:29 AM Eastern Time. You think the race is about to start. But here’s the thing: by the time the bell actually rings at the New York Stock Exchange, the biggest players have already been running for hours.

The official time of market open is a bit of a polite fiction. Sure, for the average person using a basic brokerage app, the doors swing open at 9:30 AM sharp. That’s when the "Opening Cross" happens and the liquidity floods in. But if you’re only looking at that specific window, you’re basically showing up to a marathon at mile ten.

Market mechanics are messy. They aren't just a light switch that someone flips. It’s more like a heavy engine that starts coughing at 4:00 AM and doesn't hit full speed until much later.

What the Time of Market Open Actually Looks Like

Most people think of the stock market like a grocery store. It’s closed, then it’s open. In reality, the U.S. markets operate on a tiered system that starts way before your alarm goes off.

At 4:00 AM ET, the "Early Pre-Market" session begins. This isn't where your grandma trades her 10 shares of Coca-Cola. It’s thin. It’s volatile. Spreads—the gap between what a buyer wants to pay and what a seller wants to get—are wide enough to drive a truck through. If a company drops an earnings report at 4:15 AM, the price can jump 10% on tiny volume. This is the wild west.

Then you have the "Standard Pre-Market" from 8:00 AM to 9:30 AM. This is when the heat really turns up. Institutional desks are manned. European markets are already mid-day. The time of market open at 9:30 AM is actually just the climax of all this pent-up energy.

The Opening Cross and Why It Matters

When 9:30 AM hits, the NYSE and Nasdaq don't just start matching random orders. They use something called an auction.

The Nasdaq Opening Cross, for example, is a sophisticated process that centralizes all the orders that piled up overnight. It calculates a single price that will clear the most shares. It’s designed to prevent the price from gapping so hard that it breaks the system. If you've ever wondered why your stock price "jumps" the second the market opens, that's the auction at work.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Global Time Zones: The Sun Never Sets on Volatility

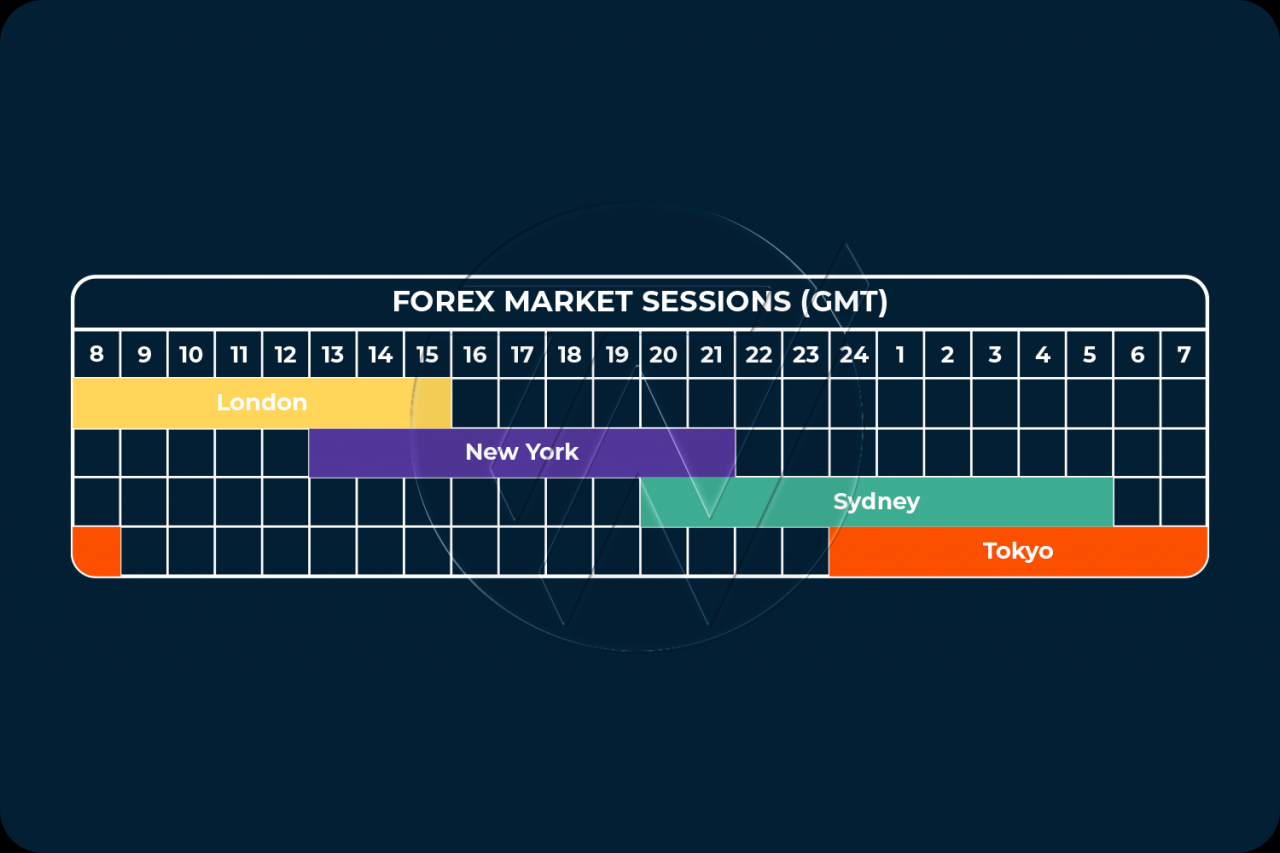

If you’re trading from London, Tokyo, or Los Angeles, the time of market open is a moving target. It’s easy to get confused.

Let's look at the big ones:

- London (LSE): Opens at 8:00 AM GMT. If you're on the East Coast of the US, that's 3:00 AM.

- Tokyo (TSE): Opens at 9:00 AM JST.

- Hong Kong (HKEX): Opens at 9:30 AM HKT.

The overlap is where the magic (and the danger) happens. Between 8:00 AM and 11:30 AM ET, both the US and European markets are open at the same time. This is peak liquidity. This is when the big boys move their money because they can do it without moving the price too much. If you’re a retail trader, this is often the best—and scariest—time to be active.

Honestly, trading the open is a bit like jumping into a blender. You have "dumb money" (retail traders hitting market orders) colliding with "smart money" (algorithms executing complex strategies). Within the first 15 to 30 minutes after the time of market open, the market is trying to find its "true" price for the day. This is why many professional day traders, like Linda Raschke or the late Mark Douglas, often suggested waiting. They'd tell you to let the "opening range" establish itself before putting real skin in the game.

The 9:30 AM Myth

We talk about 9:30 AM like it’s a sacred moment. But have you ever looked at the volume bars?

The volume usually looks like a "U" shape. Huge spike at the time of market open, a long, boring lull during "lunchtime" in New York (usually 12:00 PM to 2:00 PM), and then another massive spike right before the 4:00 PM close.

If you trade at 10:30 AM, you’re in a completely different world than 9:31 AM. By 10:30, the "noise" has settled. The initial panic—people reacting to news that broke at 2:00 AM—has been digested. The market has "voted" on what that news is worth.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Why Do Markets Even Close?

In the age of crypto, where trading happens 24/7/365, the idea of a time of market open feels almost quaint. Why do we still do it?

Humanity, basically.

Even in 2026, we haven't fully handed the keys to the AI. Human beings still oversee these systems. Closing the market provides a "cooling-off" period. It prevents flash crashes from spiraling out of control overnight when nobody is watching the monitors. It also allows for a centralized moment of liquidity. If everyone is forced to trade at the same time, it’s easier to find a buyer or a seller.

Crypto markets have shown us what happens when you don't have an opening bell. You get 3:00 AM liquidations that move the price 20% while everyone is asleep. The traditional time of market open acts as a stabilizer. It's a social contract.

Common Mistakes Beginners Make at the Open

I've seen it a thousand times. A trader sees a stock up 5% in the pre-market. They get FOMO (fear of missing out). They put in a "Market Order" for the time of market open.

Bad idea.

When you use a market order at 9:30 AM, you are saying, "I will take whatever price you give me." Because the opening is so volatile, you might end up buying at the absolute peak of the morning spike, only to see the stock crater five minutes later.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Experts use "Limit Orders." This tells the broker, "I only want to buy if the price is X or lower." It protects you from the slippage that happens when thousands of orders hit the exchange at the exact same millisecond.

The "After-Hours" Ghost Market

Just as there is a pre-market, there is an "After-Hours" session from 4:00 PM to 8:00 PM ET. This is often where the real drama happens. Most companies release their earnings reports after the market closes.

Why? To give people time to read the report before the next time of market open.

If Apple drops a bomb of an earnings report at 4:05 PM, the stock might move 5% in seconds. But again, the volume is low. You can't always trust these moves. Often, a stock will soar in the after-hours, only to give it all back by the time the 9:30 AM bell rings the next day. This is called a "fade."

How to Prepare for the Opening Bell

If you want to handle the time of market open like a professional, you need a routine. You can't just roll out of bed and click "buy."

- Check the Futures: Before 9:30 AM, look at the S&P 500 and Nasdaq 100 futures (often listed as /ES and /NQ). This tells you the general "mood" of the market. If futures are down 1%, almost every stock is going to open lower, regardless of its individual strength.

- Identify the "Gap": Is the stock opening significantly higher or lower than it closed yesterday? Gaps usually get "filled," meaning the price eventually returns to where it was. Trading against a gap at the open is a high-risk move.

- Watch the Economic Calendar: Is the Fed speaking at 10:00 AM? If so, the 9:30 AM time of market open is just a head-fake. Everyone will be waiting for the news at 10:00.

The Psychology of the Open

There’s a reason traders call the first half-hour "Amateur Hour." It’s driven by emotion. It’s people panicking because they lost money overnight, or people getting greedy because they think they found the next Nvidia.

Institutional traders—the guys at Goldman Sachs or BlackRock—often use the open to offload large positions into the retail "buy" orders. They need that opening liquidity to sell 500,000 shares without tanking the price. You don't want to be the person buying the shares they are trying to get rid of.

Actionable Steps for Navigating the Market Open

Stop treating 9:30 AM like a race. Start treating it like a data point.

- Use the 15-Minute Rule: If you are a beginner, do absolutely nothing for the first 15 minutes. Watch the price action. Look at where the "high" and "low" of that first 15-minute candle is. This often sets the tone for the entire morning.

- Switch to Limit Orders: Never use market orders during the first or last 30 minutes of the day. The spread is too unpredictable.

- Verify the News: If a stock is gapping at the time of market open, find out why. Was it an analyst upgrade? An earnings beat? Or just a random rumor on Twitter? If you don't know the "why," don't trade the "what."

- Check the Volume: A price move at the open means nothing if the volume is low. You want to see "conviction." If the price is moving up on massive volume, it’s a sign that the big institutions are actually buying.

The time of market open is a tool, not a deadline. By understanding the machinery behind the bell—the auctions, the pre-market layers, and the institutional strategies—you move from being a gambler to being a participant. The market doesn't care about your coffee or your 9:30 AM excitement. It only cares about liquidity and price discovery. Respect the process, wait for the noise to clear, and you'll find much better entries.