You’re probably staring at a pile of 1099s and W-2s wondering if you should just get it over with or wait until the literal last second on April 15. It’s a valid question. Honestly, figuring out when to file tax return forms feels like a game of chicken with the IRS, but the stakes are your own bank account.

Most people think there's just one deadline. That's wrong.

Actually, the tax season is a series of windows. If you jump too early, you might miss a corrected form that forces you to file an amendment later—which is a total nightmare. If you wait too long, you’re basically giving the government an interest-free loan while risking identity thieves filing a fake return in your name first. It’s a mess.

The Mid-January Starting Gun

The IRS usually opens its "Electronic Filing" gates in late January. For the 2025 tax year (the ones you're filing in early 2026), that date typically lands between January 20th and January 27th. You can submit your info to software like TurboTax or H&R Block before then, but they just sit in a "pending" queue.

Don't rush it.

Seriously. Employers have until January 31 to mail out your W-2. If you work in the gig economy or have brokerage accounts at Vanguard or Fidelity, those 1099-NECs and 1099-DIVs often arrive even later. Imagine filing on January 25, feeling like a productivity god, and then getting a "Corrected 1099" in the mail on February 12. Now you have to file Form 1040-X. It’s more paperwork, more fees, and more stress.

Wait for the mail. Just wait.

Why Early Birds Actually Win (Most of the Time)

If you have all your documents by early February, stop stalling. There is a massive, underrated benefit to knowing exactly when to file tax return paperwork early: identity protection.

💡 You might also like: Why Big Into Energy Stockx is Shaking Up the Secondary Market

Tax identity theft is a quiet plague. Scammers get your SSN from a data breach, file a dummy return with fake numbers, and snatch a "refund" before you even wake up. When you finally go to file in April, the IRS rejects your return because "you've already filed." Resolving that can take months of phone calls and physical mail. If you file first, the scammer gets rejected. It's the simplest defense you have.

Plus, there's the refund factor. If the IRS owes you money, why let them keep it? Direct deposit refunds usually hit accounts within 21 days. If you file in February, you've got that cash for spring break or your IRA contribution. If you wait until the April rush, the system slows down. It's basic physics, really.

The Mid-March Danger Zone for Business Owners

If you're an S-Corp owner or part of a partnership, your world is different. Your deadline isn't April; it's March 15.

I've seen so many small business owners forget this and get hit with "per-partner" monthly late fees that scale incredibly fast. These entities file "informational" returns, but the penalties for missing that window are some of the most aggressive in the tax code. If you’re waiting for a K-1 from a partnership you invested in, you might not even be able to file your personal return until late March or April anyway.

The Psychology of the April 15 Deadline

Most of the country waits until the final 72 hours. It's human nature. But here’s something most people get wrong about when to file tax return extensions: An extension to file is not an extension to pay.

If you owe $5,000 and file an extension on April 15, you still need to send a check for that $5,000 on April 15. If you don't, the IRS starts ticking the interest clock immediately. Currently, those interest rates aren't exactly low. You’re looking at a failure-to-pay penalty of 0.5% per month, plus the actual interest rate which fluctuates quarterly.

👉 See also: Littleton & Rue Springfield OH: What Most People Get Wrong

Surprising Details About "Free File"

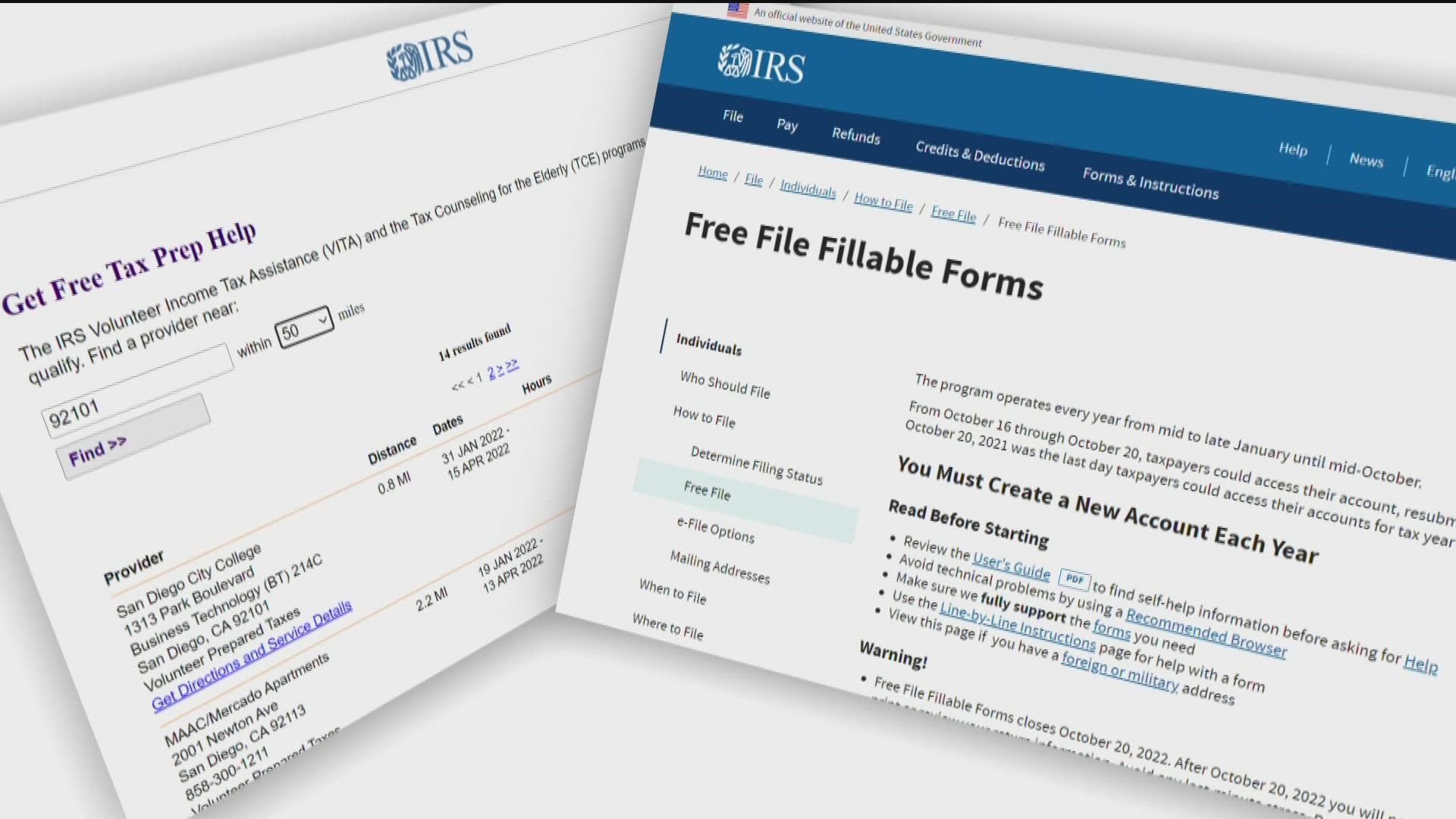

If your Adjusted Gross Income (AGI) is $79,000 or less, you shouldn't be paying to file. The IRS Free File program is a partnership with big-name software companies, but they hide it. They really do. They want you to click the "Premium" button.

You have to go directly through the IRS.gov website to get the truly free version. If you go to the software site first, they’ll often "upsell" you halfway through the process. It's frustrating.

Real Talk: When Should YOU Specifically File?

It depends on your life.

- The Simple Filer: You have one W-2 and no kids. File the second that W-2 hits your inbox. There's no reason to wait.

- The Family with EITC or ACTC: If you claim the Earned Income Tax Credit or the Additional Child Tax Credit, the IRS is legally required to hold your refund until mid-February. Filing on January 1st won't get you money faster than filing on February 1st.

- The Investor: Wait until at least late February. 1099-B forms (for stocks and crypto) are notorious for being corrected.

- The Ower: If you know you owe a fortune, file as late as possible—but calculate it early. You want to know the number so you can save up, but you don't have to part with the cash until April 15.

Nuance in the Law: The "Emancipation" of Documents

Back in the day, you waited for the mailman. Now, most documents are digital. But don't trust the "Estimated" dates on your brokerage portal. They change.

👉 See also: Beauty Kingdom USA Corporation: Why This Wholesaler is Quietly Winning the Beauty Supply Game

I remember a client who filed based on a "preliminary" tax document from an app. The final version changed his capital gains by $4,000. He ended up with an underpayment penalty that cost him more than his actual tax bill. Just because you can download a PDF on January 15 doesn't mean it's the final word from the financial institution.

Breaking Down the Extension Myth

People think filing an extension is a "red flag" for an audit. That’s a myth. The IRS computers don't care. In fact, some CPAs argue that filing an extension might actually lower audit risk because you aren't part of the initial April frenzy when the IRS is setting its enforcement quotas.

Whether that's true or not is debated, but one thing is certain: a clean, accurate return filed in October is a thousand times better than a rushed, error-filled return filed on April 15.

Practical Next Steps

- Gather the "Master List": Create a folder (digital or physical). Don't touch it until you have every document from last year. Look at your 2024 return to see what forms you’re missing.

- Check for "Sneaky" Forms: Did you sell $600 worth of stuff on eBay? Did you get a 1099-K? The rules for these change constantly, and the IRS gets a copy of those forms too.

- Confirm Your Bank Info: If you're expecting a refund, double-check your routing number. A single typo turns a 10-day refund into a 3-month nightmare of "lost check" tracers.

- Set a "Soft" Deadline: Aim for March 15. This gives you a one-month buffer for any missing documents before the actual April 15 chaos begins.

- Look into IRS Direct File: If you live in a participating state and have a relatively simple tax situation, you can now file directly with the IRS for free, bypassing the big software companies entirely.

Deciding when to file tax return paperwork isn't just about the calendar; it's about your specific financial ecosystem. Get your documents in order, wait for the late-arriving 1099s, and hit "submit" once you're certain the data is frozen. Accuracy beats speed every single time in the eyes of the IRS.