Money talks. Usually, it whispers, but lately, the tipo de cambio peso mexicano a dólar estadounidense has been screaming. If you’ve looked at a chart recently, you know things are weird. For a long time, we got used to the "Super Peso," that era where the Mexican currency seemed invincible, defying every prediction by staying comfortably below 17 or 18 pesos per dollar. It felt like a glitch in the matrix.

But things changed. Fast.

Tracking the tipo de cambio peso mexicano a dólar estadounidense isn't just for Wall Street guys in suits anymore. It matters if you're buying a laptop on Amazon, planning a trip to Puerto Vallarta, or sending money back home to family in Michoacán. Honestly, the exchange rate is basically the heartbeat of the North American economy. When it spikes, people panic. When it drops, exporters sweat.

Why the Tipo de Cambio Peso Mexicano a Dólar Estadounidense is All Over the Place

Markets hate uncertainty. They loathe it.

Right now, the Mexican Peso is caught in a tug-of-war between local politics and global jitters. We saw a massive shift after the 2024 elections in Mexico. Investors got nervous about constitutional reforms, specifically the judicial overhaul. They started asking: is my money safe? When big institutional investors ask that, they sell. When they sell, the peso drops.

It's not just Mexico's "fault," though. The US Federal Reserve plays a massive role.

Think of it like this. If the Fed keeps interest rates high in the US, investors would rather keep their money in dollars because it's "safe" and pays well. But if the Banco de México (Banxico) keeps its rates even higher, the "carry trade" becomes the star of the show. Investors borrow dollars at low rates to buy pesos and pocket the difference. For a while, this carry trade was the secret sauce keeping the peso strong. But that trade is unwinding. It’s messy.

💡 You might also like: Big Lots in Potsdam NY: What Really Happened to Our Store

The Bank of Japan even threw a wrench in the gears recently. By raising their rates, they forced a global shuffle of assets that hit emerging markets like Mexico particularly hard. It’s all connected. A butterfly flaps its wings in Tokyo, and suddenly you’re paying more for your dollar at a casa de cambio in Mexico City.

The Nearshoring Myth vs. Reality

You've heard the word "nearshoring" a thousand times. It’s the idea that companies are fleeing China to build factories in Monterrey and Querétaro.

It’s real, but it’s slow.

Tesla’s pauses and shifts in its Gigafactory plans are a perfect example of why we shouldn't count our chickens before they hatch. While the promise of nearshoring supports the tipo de cambio peso mexicano a dólar estadounidense in the long run, the immediate reality is that infrastructure, water shortages, and electricity reliability are massive bottlenecks. Investors are realizing that moving a supply chain isn't as easy as flipping a switch.

Understanding the Volatility

Volatility isn't just a buzzword. It's the reason you see the rate at 19.30 in the morning and 19.85 by lunch.

Mexico has one of the most liquid currencies in the world. Because the peso is traded 24/7 and is easy to buy and sell, it often gets used as a "proxy" for all emerging markets. If a fund manager is worried about Brazil or Turkey but can't easily exit those positions, they might sell Mexican pesos instead to hedge their risk. It’s unfair, sure, but that’s how the plumbing of global finance works.

📖 Related: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

What the Experts are Watching

Keep an eye on the inflation data from the INEGI. If inflation stays sticky in Mexico, Banxico has to keep interest rates high. High rates usually mean a stronger peso. However, if the Mexican economy starts to slow down too much—which some data suggests is happening—the central bank will be forced to cut rates to stimulate growth.

When those rates fall, the "Super Peso" loses its cape.

- Remittances: This is the invisible pillar. Billions of dollars flow from workers in the US back to Mexico every year. This constant supply of dollars helps keep the peso from crashing completely, even when the news looks bad.

- Oil Prices: Mexico isn't the oil powerhouse it used to be, but Pemex’s health still matters. If oil prices tank, or if Pemex's debt becomes unmanageable, the peso feels the heat.

- US Elections: Nothing moves the tipo de cambio peso mexicano a dólar estadounidense like rhetoric from Washington. Trade deals, tariffs, and border talk are all "priced in" the second a candidate opens their mouth.

Real-World Impact: What This Means for Your Pocket

Let’s get practical.

If you are a digital nomad living in Mexico City, a weaker peso is a pay raise. Your dollars go further. You can afford that nicer apartment in Roma Norte or eat out more often. But for the local Mexican family, a weaker peso means the price of imported goods—electronics, certain grains, and gasoline—goes up.

It’s a double-edged sword.

Exporters love a weaker peso. If you're selling avocados or auto parts to the US, your products become cheaper and more competitive. But if you’re a Mexican company that took out debt in dollars? You're hurting. Suddenly, that $1 million loan costs a lot more pesos to service than it did six months ago.

👉 See also: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

How to Manage the Risk

Don't try to "time" the market. You'll lose. Even the best hedge fund managers get the tipo de cambio peso mexicano a dólar estadounidense wrong constantly.

Instead, look at the "average" over time. If you need to exchange a large amount of money, do it in tranches. Move 25% now, 25% next week, and so on. This "dollar-cost averaging" for currency is the only way to sleep at night when the markets are swinging by 2% or 3% in a single day.

The Road Ahead

The days of the 16-something peso are likely behind us for now. We are entering a period of "normalization."

Most analysts from banks like BBVA or Banorte are looking at a range between 18.50 and 20.50 for the foreseeable future. Of course, a black swan event—another global pandemic, a sudden trade war, or a massive geopolitical shift—could blow those estimates out of the water.

The relationship between these two currencies is more than just numbers on a screen. It’s a reflection of how two neighbors are getting along. Right now, the relationship is complicated. There’s deep integration, but there’s also friction.

Steps You Should Take Now

If you have expenses in dollars but earn in pesos, it's time to hedge. Buy some dollars now to cover your future obligations. If you earn in dollars, don't get complacent. The "Super Peso" showed us that the exchange rate can stay "irrationally" strong for much longer than anyone expects.

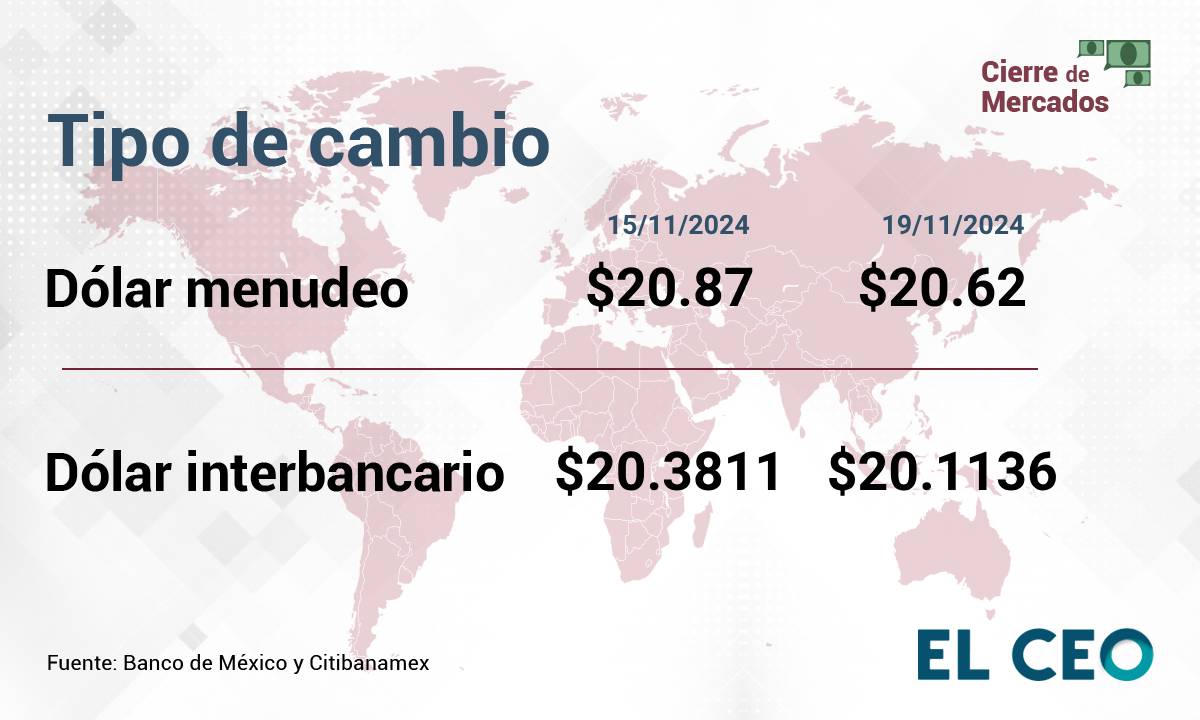

- Check the spread: Don't just look at the "interbank" rate you see on Google. That's not what you get at the airport or the bank. Use apps like Wise or XE to see the real rate you'll actually receive.

- Monitor Banxico's Calendar: Pay attention to their interest rate announcements. They usually happen every few weeks on a Thursday. These are the moments of highest volatility.

- Diversify: If all your savings are in one currency, you’re gambling. Keep a mix. It’s the only way to stay sane in this economy.

The tipo de cambio peso mexicano a dólar estadounidense will continue to be a rollercoaster. It's driven by sentiment as much as it is by math. Understanding that the peso is often used as a "safety valve" for global markets helps explain why it moves so violently even when things in Mexico seem relatively calm. Stay informed, stay flexible, and don't panic when the red candles start appearing on the charts.

Adjust your budget to reflect a "worst-case" scenario of 21 pesos per dollar. If it stays lower, you have a surplus. If it hits that mark, you're prepared. This proactive approach is the only way to handle a currency pair that is famous for its unpredictability. Observe the trends, but don't let them dictate your financial peace of mind.