It happened fast. One minute Contemporary Amperex Technology Co., Limited—better known to the world as CATL—is the undisputed king of the battery world, and the next, they're playing defense against a wave of geopolitical pressure that would make any CEO sweat. You've probably seen the headlines floating around about forced labor allegations or "entity lists," but the actual CATL statement on supply chain concerns tells a much more nuanced story than a simple soundbite. It isn’t just corporate PR. It’s a massive company trying to navigate a world where where you get your lithium is just as important as how much energy your cells can hold.

Honestly? The battery industry is messy.

CATL controls roughly a third of the global EV battery market. If they sneeze, Ford, Tesla, and BMW catch a cold. So, when members of the U.S. House of Representatives started pointing fingers at their supply chain, specifically citing ties to the Xinjiang region, the market didn't just notice—it shook. The company had to respond. They didn't really have a choice. Their rebuttal wasn't just a "we didn't do it"; it was a detailed breakdown of their internal auditing processes and a firm denial of the specific allegations linking them to Gotion High-Tech or various "forced labor" lists.

Why the CATL Statement on Supply Chain Concerns Matters Right Now

Politics and chemistry are colliding.

When CATL issued their formal response, they were addressing very specific letters from U.S. lawmakers like Marco Rubio and John Moolenaar. These guys aren't just asking questions; they are pushing for CATL to be added to the U.S. Department of Homeland Security’s Entity List under the Uyghur Forced Labor Prevention Act (UFLPA). If that actually happens, it’s a game-changer. It would essentially ban their products from entering the United States. Think about that for a second. No CATL batteries means a massive chunk of the American EV transition just stops dead in its tracks.

💡 You might also like: State by State Corporate Tax Rates Explained (Simply)

The CATL statement on supply chain concerns was clear: they claim the accusations are "groundless and completely false." They argued that some of their suppliers are being targeted based on outdated information or "speculative" links that don't reflect current business realities. For example, the company pointed out that they exited certain partnerships or divested from specific entities long before the controversy reached this boiling point. It’s a game of "trace the mineral," and CATL is trying to prove they have the best map in the business.

Breaking Down the Xinjiang Connection

You’ve got to look at the geography here. Xinjiang is a hub for raw materials, but it's also the epicenter of global human rights scrutiny. CATL’s defense rests on the idea of "strict supplier vetting." They use third-party audits. They use internal tracking software. They basically told the U.S. government, "We know exactly where our stuff comes from, and it’s not where you think it is."

But here is the kicker: transparency in China is tough. Even for a giant like CATL.

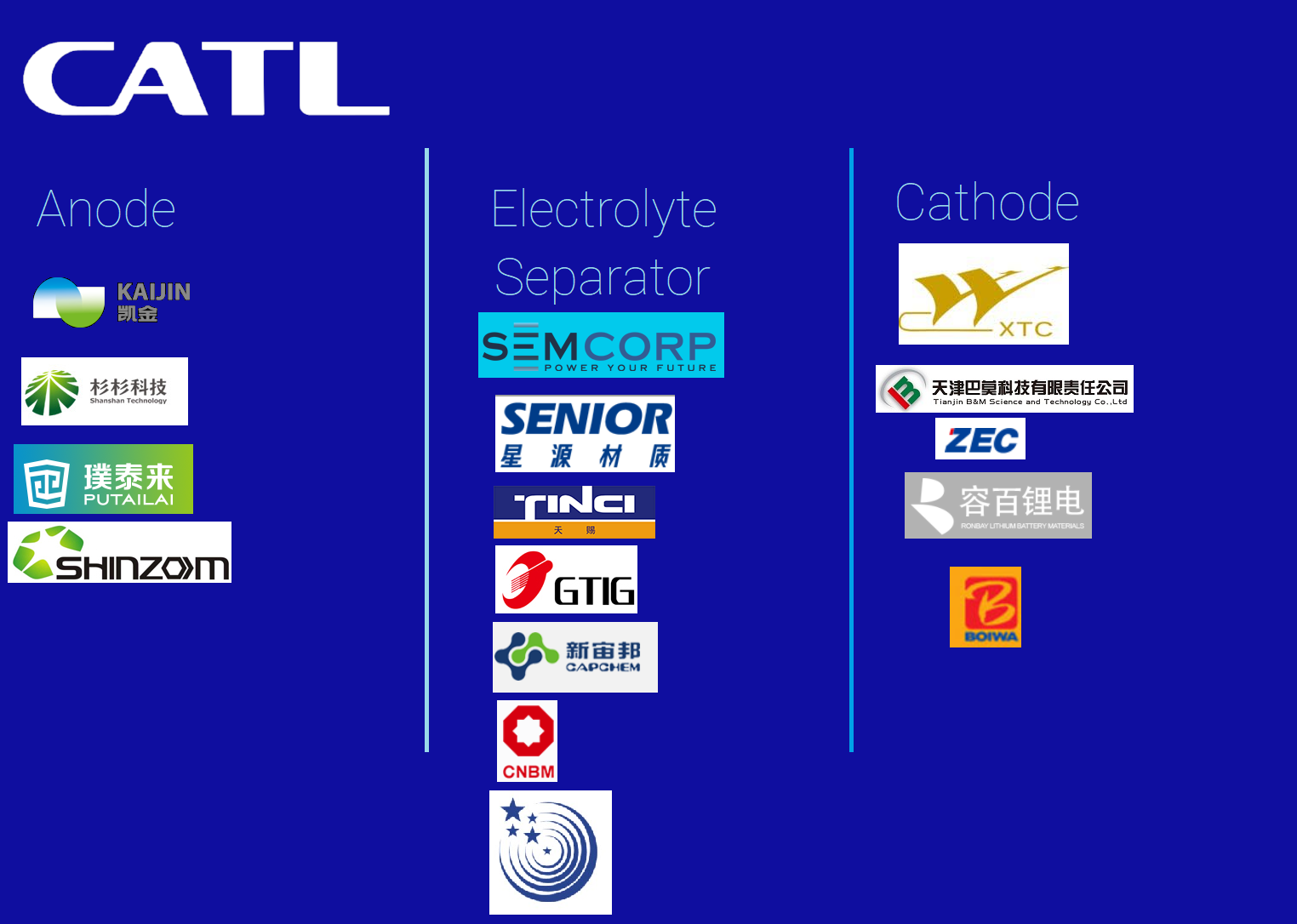

While the company insists its supply chain is clean, the sheer complexity of battery manufacturing makes it hard to be 100% certain every single day. You have tier-one suppliers, tier-two, tier-three. It goes deep. CATL’s statement emphasizes that they have established a "comprehensive procurement management system." This isn't just a spreadsheet; it's a massive technological undertaking designed to flag any supplier that might even sniff a "restricted" list.

The Economic Stakes for Tesla and Ford

Let's talk about the money. Specifically, American money.

Ford is currently building a massive battery plant in Michigan using CATL technology. They aren't "partners" in the traditional sense; Ford owns the plant, but CATL provides the "know-how." This loophole was supposed to satisfy the Inflation Reduction Act (IRA) requirements while still getting the best tech on the planet into American trucks. But the CATL statement on supply chain concerns shows how fragile this bridge really is. If the U.S. government decides CATL is a "persona non grata," Ford’s multibillion-dollar investment becomes a very expensive paperweight.

Tesla is in a similar boat. Elon Musk has relied heavily on CATL’s lithium iron phosphate (LFP) cells because they are cheap and they don't catch fire easily. If CATL is sidelined, the cost of a Model 3 goes up. Period. There is no other supplier on earth right now that can match CATL’s scale and price point. That is the leverage CATL holds, and you can see it between the lines of their official statements. They know they are indispensable, even if they have to be polite about it.

The Problem With "Decoupling"

Everyone loves to talk about "decoupling" from China. It sounds great in a campaign speech. In reality? It’s a nightmare.

The battery supply chain is a web. You might mine lithium in Australia, ship it to China for processing, turn it into a cathode in a CATL factory, and then put it in a car in Germany. Trying to pull one thread out without destroying the whole tapestry is nearly impossible. CATL’s statements often remind stakeholders that they are a global company with global investors—including big names from the West. They are trying to frame themselves not as a "Chinese company," but as a "global energy technology leader."

What the Audits Actually Say

One thing people get wrong is thinking these statements are just fluff. CATL actually points to specific audits. They've engaged with firms like RCS Global, which is a big deal in the world of responsible sourcing.

These audits look at:

- Working hours and conditions.

- Environmental impact of mining.

- Child labor risks in cobalt mines (especially in the DRC).

- Adherence to the OECD Due Diligence Guidance.

According to the CATL statement on supply chain concerns, they have passed these checks. But critics argue that audits in certain regions are "staged" or that auditors don't have full access. It's a "he-said, she-said" at a multi-billion dollar scale. CATL’s response to this is basically to double down on data. They are moving toward "battery passports"—digital twins of every battery that track every gram of material from the ground to the car.

The Future of LFP Technology and Sovereignty

LFP (Lithium Iron Phosphate) is the "boring" battery tech that's suddenly the hottest thing in the industry. It doesn't use nickel or cobalt, which are the most "problematic" minerals from a human rights and cost perspective. CATL is the king of LFP.

By leaning into LFP, CATL is actually trying to solve some of the supply chain concerns before they even start. If you don't need cobalt from a questionable mine in the Congo, you have one less headache. Their statement highlights their innovation in this space as a way to "stabilize the global supply chain." It's a smart move. They are positioning their tech as the solution to the very problems they are being accused of causing.

However, the U.S. is terrified of being "addicted" to Chinese tech. This is where the CATL statement on supply chain concerns hits a wall. No matter how clean their mines are, the fact that the intellectual property sits in Ningde, China, is a problem for some D.C. lawmakers.

What Happens If the US Bans CATL?

If the worst-case scenario happens and CATL gets blacklisted, expect a massive delay in EV adoption.

- Prices skyrocket: Other suppliers like LG Energy Solution or SK On would have zero competition on price.

- Shortages: There isn't enough non-CATL capacity to meet 2030 climate goals.

- Tech Stagnation: CATL’s new "Shenxing" battery can charge 400km in 10 minutes. Losing access to that tech hurts the consumer.

CATL knows this. Their communication strategy is designed to remind the world—and specifically the U.S. Treasury—that they are the engine under the hood of the green revolution.

Actionable Insights for Investors and EV Owners

If you're watching this play out, don't just look at the stock price. Look at the "Rules of Origin" changes in the coming months.

- For Investors: Watch for CATL's "North America Strategy" updates. They are increasingly looking to license tech rather than own factories. This "asset-light" model is their way around the supply chain heat.

- For Car Buyers: Don't panic. If you own a Tesla or a Ford with CATL cells, your car isn't going anywhere. But if you're looking to buy, check the VIN and the battery source if you care about the tax credit. The credit is what's really at risk here.

- For Policy Watchers: Pay attention to the "FEOC" (Foreign Entity of Concern) definitions. This is the legal jargon that will decide CATL’s fate in the U.S. market.

The CATL statement on supply chain concerns is a masterpiece of corporate survival. It balances "we are innocent" with "you need us." In the high-stakes game of global energy, it turns out that being right is only half the battle; being essential is what actually keeps the lights on.

Moving Forward

Keep an eye on the upcoming U.S. Department of State reports on supply chain transparency. These will likely be the "rebuttal" to CATL's claims. If you're a business leader, the lesson here is clear: transparency isn't a "nice to have" anymore. It's the only way to protect your market access in an increasingly fractured world.

Watch the lithium prices and the G7's "Critical Minerals Club" developments. Those will tell you more about the future of CATL than any single press release ever could. The battery war is just getting started, and the supply chain is the primary battlefield.