Ever looked at your bank account after a trip to Oslo or a payout from a Norwegian client and thought, "Wait, that's it?" It’s a common sting. Converting Norwegian Krone to US Dollars isn't just a matter of checking a ticker on Google; it is a wild ride influenced by global oil prices, the Federal Reserve’s mood swings, and the sheer liquidity of a "minor" currency.

Money is weird.

One day you feel like a king with a pocket full of 100-krone notes, and the next, the exchange rate shifts and your purchasing power evaporates. If you are dealing with a nok to usd conversion today, you aren't just swapping paper. You are participating in a massive, interconnected web of energy exports and interest rate differentials.

Most people assume the exchange rate is a static number. It's not. It is a live negotiation happening every millisecond between banks in London, New York, and Oslo.

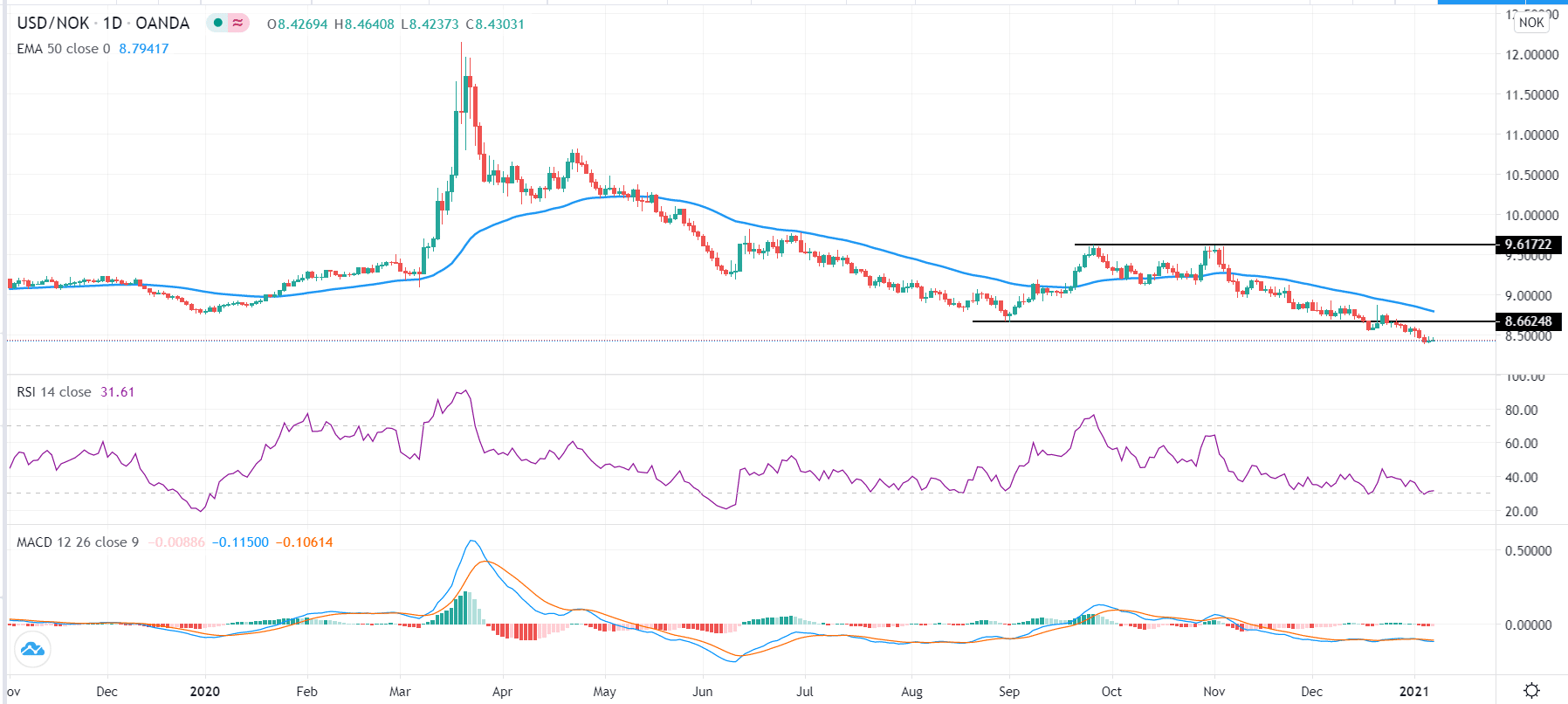

Why the NOK to USD Conversion is a Rollercoaster

The Norwegian Krone is what traders call a "proxy for oil." Basically, when Brent Crude prices climb, the Krone usually follows. Norway is one of the world's largest exporters of oil and gas, so the health of their currency is intrinsically tied to the energy market. If the world is worried about supply chains or geopolitical tension in the Middle East, the Krone might spike. If there is a global shift toward renewables that scares investors, the Krone often takes a hit.

The US Dollar, on the other hand, is the "safe haven."

When the world gets scary, everyone runs to the Greenback. This creates a fascinating tug-of-war. You might have a situation where Norway’s economy is actually doing great—low unemployment, high surplus—but the nok to usd conversion rate still drops because the US Federal Reserve raised interest rates, making the dollar more attractive to big investors.

It’s frustrating. You’re doing everything right, but the macro-economics of a country 4,000 miles away just made your vacation 5% more expensive.

The "Petro-currency" Trap

Let's look at the numbers without getting too bogged down. Historically, the Krone was much stronger. There were times in the mid-2000s and early 2010s where 6 NOK would get you 1 USD. Those days feel like a fever dream now. Lately, we've seen rates hovering much higher, sometimes touching 10 or 11 NOK per dollar.

Why the slide?

It’s partly because the Norges Bank (Norway's central bank) has to walk a very fine line. If they raise interest rates too high to support the Krone, they risk stifling domestic growth. If they keep them too low, the currency weakens, and suddenly every iPhone or Tesla imported into Norway costs a fortune.

💡 You might also like: 111 W 44th St: The Real Story Behind This Midtown Power Address

Then there is the "Equity Fund" factor. Norway’s Government Pension Fund Global—the world’s largest sovereign wealth fund—is massive. It owns about 1.5% of all publicly traded companies globally. When the fund rebalances or buys foreign assets, it actually involves selling Krone. It’s the ultimate irony: Norway is so rich that its own success sometimes puts downward pressure on its currency value.

Where Most People Lose Money During Conversion

Honestly, the biggest mistake is using your local bank’s default "traveler" rate.

If you go to a physical bank branch and ask for a nok to usd conversion, they aren't giving you the "mid-market" rate. That’s the rate you see on XE or Reuters. Instead, they charge you a "spread." This is a hidden fee tucked into the exchange rate.

Let's say the real rate is 10.50. The bank might sell you dollars at 10.90. That 0.40 difference? That is their profit. On a $1,000 transaction, you might be losing $40 or $50 just for the privilege of the service.

- Airport Kiosks: Total trap. Avoid them like the plague. Their spreads can be as high as 10-15%.

- Credit Card "Dynamic Currency Conversion": You know when a card reader in a foreign country asks if you want to pay in USD or NOK? Always choose NOK. If you choose USD, the merchant’s bank chooses the rate, and it is almost always terrible.

- Neobanks: Companies like Revolut or Wise use the mid-market rate. They are usually the gold standard for getting the most out of your money.

The Role of Inflation and "Real" Value

Inflation in the US has been a headline-grabber for years. But Norway has had its own struggles. When you are looking at a nok to usd conversion, you have to consider what that money actually buys.

Norway is notoriously expensive. A beer in Oslo might cost 110 NOK. At an exchange rate of 10.50, that’s about $10.50. If the Krone strengthens to 9.00, that same beer is suddenly $12.20.

✨ Don't miss: What Really Happened With Crystal Pepsi: Why It Actually Vanished

For a business owner importing goods from the US to Norway, a weak Krone is a nightmare. They have to pay more NOK to get the same amount of USD-priced inventory. They eventually pass those costs to the consumer. This is why you see prices in Norway fluctuate so much based on global currency markets.

Is the Krone Undervalued?

Many analysts at firms like Goldman Sachs or Nordea have argued for years that the Krone is fundamentally undervalued. Based on Purchasing Power Parity (PPP)—the idea that a basket of goods should cost roughly the same everywhere—the Krone should be stronger.

But "should" doesn't pay the bills.

The market is currently obsessed with "liquidity." The Krone is a small currency. In times of uncertainty, traders prefer the Euro or the Dollar because they are easier to sell quickly. The Krone is "expensive" to trade in large volumes, which keeps it depressed even when Norway’s economy is rock solid.

Tactical Advice for Your Next Move

If you have a large amount of money to move, do not do it all at once.

Market timing is a fool's game, but "laddering" is smart. If you need to convert 100,000 NOK to USD, do 25,000 this week, 25,000 next week, and so on. This averages out your exchange rate and protects you from a sudden, disastrous dip in the market.

Also, keep an eye on the Norges Bank calendar. They meet roughly eight times a year to discuss interest rates. The days following these meetings are usually volatile. If they signal a "hawkish" stance (meaning they might raise rates), the Krone usually jumps. If they seem "dovish" (keeping rates low), expect the Krone to slide.

Next Steps for Better Conversion:

💡 You might also like: Why C as in Charlie Photos Still Dominate Professional Communication

- Verify the Mid-Market Rate: Before you commit to any transfer, check the current interbank rate on a neutral site like Reuters or Bloomberg. This is your "zero" point.

- Compare the Spread: Look at what your provider is offering. If the difference between their rate and the mid-market rate is more than 1%, keep looking.

- Use Specialist Services: For amounts over $5,000, use a dedicated currency broker. They can often provide "forward contracts," which let you lock in today’s rate for a transfer you plan to make in the future.

- Check Your Credit Card Terms: Ensure your card has "No Foreign Transaction Fees." Some cards charge 3% just for the "convenience" of spending money abroad, on top of a poor exchange rate.

- Monitor Brent Crude: If you see oil prices tanking, expect your nok to usd conversion to get worse. If oil is rallying, it might be worth waiting a few days to see if the Krone catches up.

Understanding the mechanics behind the curtain makes the process less of a gamble. You can't control the global economy, but you can control where you choose to click "convert."