Money feels solid. You hold a twenty-dollar bill, and it’s there—paper, ink, and a little bit of history. But when you start asking exactly how many us dollars are in circulation, the answer gets slippery. It’s not just about the stacks of Benjamins sitting in a vault at the Federal Reserve or the crumpled ones at the bottom of your backpack.

Most people think of "circulation" as physical cash. In reality, the Federal Reserve tracks this stuff using different buckets, and those buckets are getting weirdly huge. As of the latest data heading into 2026, there is roughly $2.3 trillion in physical Federal Reserve notes floating around the globe. That sounds like a lot. It is. But that’s just the physical stuff. If you start counting the digital entries in bank ledgers—the money that exists only as 1s and 0s—the number rockets up to over $21 trillion.

Wealth is mostly invisible.

The Physical Stack: Where are the Actual Bills?

Let’s talk about the green stuff first. The Federal Reserve Board (the Fed) is the gatekeeper here. They don't actually print the money—that's the Bureau of Engraving and Printing—but the Fed decides how much goes out into the world.

How many US dollars are in circulation in physical form? About $2.35 trillion. Interestingly, more than half of that isn't even in the United States.

It’s abroad.

People in countries with unstable currencies or high inflation—think Argentina or parts of the Middle East—trust the dollar more than their own money. They stash $100 bills under mattresses. They use them for large transactions. According to the Federal Reserve Bank of Chicago, the $100 bill is now the most common note in circulation, surpassing the $1 bill years ago. It’s basically the world's favorite "store of value."

The Life Cycle of a Bill

Physical money dies. Fast. A $1 bill lasts about 6.6 years on average before it's too shredded or dirty to use. A $100 bill? That survives about 23 years because people don't pass it around at the grocery store every day.

👉 See also: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

Every year, the Fed orders billions of new notes to replace the ones they shred. For the 2024–2025 fiscal year, the print order ranged between 5.3 billion to 8.2 billion notes. Most of that isn't "new" money in the sense of increasing the money supply; it's just refreshing the deck.

M1, M2, and the Digital Ghost Money

This is where it gets crunchy. If you ask an economist about how many us dollars are in circulation, they’ll ask you, "Which M are you talking about?"

- M0 (The Monetary Base): This is the narrowest definition. It’s just physical coins, paper money, and the reserves banks keep at the Fed.

- M1: This includes everything in M0 plus demand deposits. Basically, your checking account. Things you can spend right now.

- M2: This is the big daddy. It’s M1 plus "near money"—savings accounts, money market securities, and time deposits.

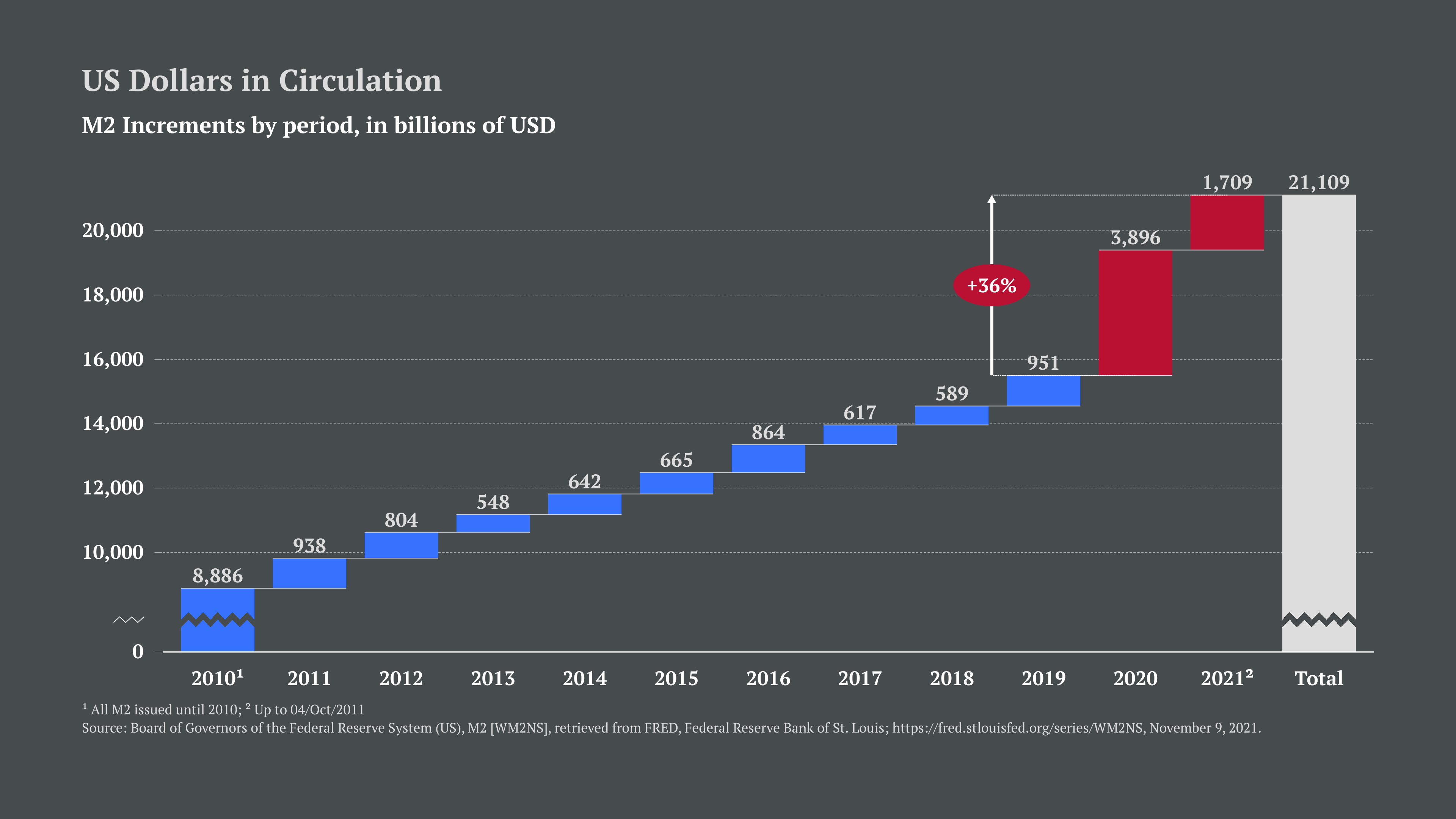

Currently, the M2 money supply sits around $21.1 trillion.

Why does this matter? Because most of the money you think you "have" doesn't actually exist as paper. When you get a paycheck via direct deposit, no one is moving a briefcase of cash. A bank just changes a number in a database. In a way, the vast majority of US dollars in circulation are just digital promises.

Honestly, it's a bit of a miracle it all works. If everyone went to the bank at once to withdraw their M2 balance in physical cash, the system would collapse instantly. There literally aren't enough $100 bills in existence to cover even 15% of the digital balances.

The COVID Spike and the "Printing" Myth

You've probably heard the phrase "the Fed printed 40% of all dollars in existence in two years." People love saying that on Twitter. It's partially true but mostly a misunderstanding of accounting.

Back in 2020, the Fed changed how they defined M1. They started including savings accounts in the M1 calculation because the rules changed on how often you could move money out of savings. This made the "money supply" look like it exploded overnight.

✨ Don't miss: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

However, the money supply did increase significantly. Through a process called Quantitative Easing (QE), the Fed bought trillions in government bonds. They paid for these bonds by creating "bank reserves" out of thin air. This injected massive liquidity into the system to keep the economy from freezing up during lockdowns.

The result? The amount of US dollars in circulation (digital and physical) went from roughly $15 trillion in early 2020 to over $21 trillion by 2022. That’s a massive jump.

What Happens to the Value?

Basic supply and demand applies to money too. If you have ten apples and ten dollars, an apple costs a buck. If I suddenly create another ten dollars but there are still only ten apples, those apples are going to start costing $2.

That’s inflation.

When people ask how many US dollars are in circulation, they’re usually worried about their purchasing power. When the supply grows faster than the economy produces goods and services, your money buys less. We saw this peak in 2022 with 9.1% inflation. The Fed has spent the last few years trying to "drain the swamp" by raising interest rates and doing Quantitative Tightening (QT)—essentially deleting some of that digital money to bring the total down.

The Secret World of Foreign Exchange

The US dollar is the "Reserve Currency" of the world. This is a huge deal.

Central banks in China, Japan, and Europe hold trillions in US dollar-denominated assets. Why? Because the US dollar is the "petrodollar." Most oil is priced in USD. Most international debt is settled in USD.

🔗 Read more: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

This creates a massive "demand" for dollars outside our borders. This demand actually allows the US to have more dollars in circulation than it otherwise could without causing hyperinflation. If the world suddenly stopped wanting dollars—a process called de-dollarization—all those trillions of offshore dollars would "come home," flooding the domestic market and potentially tanking the currency's value.

So far, that hasn't happened. The "Eurodollar" market (US dollars held in banks outside the US) remains massive, estimated by some researchers at McKinsey and the BIS to be worth upwards of $13 trillion, though it's incredibly hard to track because it’s not regulated by the Fed.

Myths vs. Reality

People get weird about the dollar. Let's clear some stuff up.

- "The Dollar is backed by gold." Nope. Not since 1971. It’s "fiat" currency. It’s backed by the "full faith and credit" of the US government. Basically, it’s valuable because we all agree it is and the government accepts it for taxes.

- "The Fed is a private company." Kinda, but no. It’s an independent agency with private and public components. It doesn't have "owners" in the traditional sense, and it returns its profits to the Treasury.

- "Physical cash is going away." Not yet. While digital payments are skyrocketing, the amount of physical currency in circulation actually increases most years. People like the privacy of cash.

How to Track This Yourself

If you’re a nerd for data, you don't have to take my word for it. The Federal Reserve Bank of St. Louis maintains a database called FRED (Federal Reserve Economic Data).

You can look up "M2SL" (the M2 Money Supply) and see the chart in real-time. You’ll see the massive vertical line from 2020 and the slight dip in 2023–2024 as the Fed tried to cool things down.

Actionable Takeaways for Your Wallet

Knowing how many US dollars are in circulation isn't just trivia; it’s a way to understand your own net worth.

- Hedge against supply increases: Since the money supply generally trends upward over decades, keeping all your wealth in "cash" is a losing game. Assets like stocks, real estate, or even certain commodities tend to hold value better because they can't be "printed."

- Watch the Fed: Their "dot plot" and monthly meetings tell you if they are going to increase or decrease the money supply. When they decrease it (tightening), cash becomes "harder" and more valuable (interest rates go up).

- Diversify: If you're worried about the dollar's role as the global reserve currency, look into international equities or assets that aren't purely tied to the USD.

The dollar isn't going anywhere tomorrow, but it is changing. It’s becoming more digital, more global, and—paradoxically—more plentiful even as its individual buying power fluctuates. Understanding the sheer scale of the trillions in play helps you realize that the $20 in your pocket is just one tiny drop in a very deep, very complex ocean.

To keep a pulse on the actual purchasing power of those dollars, your next step should be checking the monthly Consumer Price Index (CPI) releases from the Bureau of Labor Statistics. This shows you not just how much money is out there, but how much that money is actually worth in the real world. You can also monitor the "Currency in Circulation" (H.4.1) release from the Federal Reserve, which is updated every Thursday and gives the exact breakdown of physical notes by denomination.