Money doesn't have a political party. That’s the hard truth most people ignore when they pull up a Dow Jones chart by president. You’ve probably seen the viral memes or the cherry-picked data points on social media. One side screams that the market only goes up when a Republican is in the White House because of tax cuts. The other side points to the historical fact that, since the 1920s, the S&P 500 and the Dow have actually seen higher average annual returns under Democratic administrations. Both are kinda right, and both are mostly wrong.

The market isn't a scoreboard for a four-year term. It’s a massive, vibrating machine of global expectations, interest rates, and corporate earnings. If you look at the Dow Jones Industrial Average (DJIA) through the lens of whoever is sitting in the Oval Office, you’re basically looking at a rearview mirror while trying to drive a car at 70 miles per hour. It’s dangerous.

Why We Obsess Over the Dow Jones Chart by President

Humans love patterns. We want to believe that the guy at the top controls the price of Apple stock or the cost of a gallon of milk. When you look at a Dow Jones chart by president, you see these distinct blocks of time. You see the Reagan era’s massive bull run. You see the Clinton years where the tech boom sent everything to the moon. You see the 2008 crash under Bush and the subsequent recovery under Obama.

But here is the thing: Presidents often get credit for things they didn't do and blame for things they couldn't stop.

Take Herbert Hoover. People associate him with the Great Depression. The Dow fell about 80% during his time. Was it all his fault? Probably not. The seeds of the crash were sown years earlier. On the flip side, look at Gerald Ford. His term was short, and the market didn't do much, but he was dealing with the brutal aftermath of the 1970s stagflation. The "president" variable is just one piece of a much larger, uglier puzzle.

The Numbers That Actually Matter

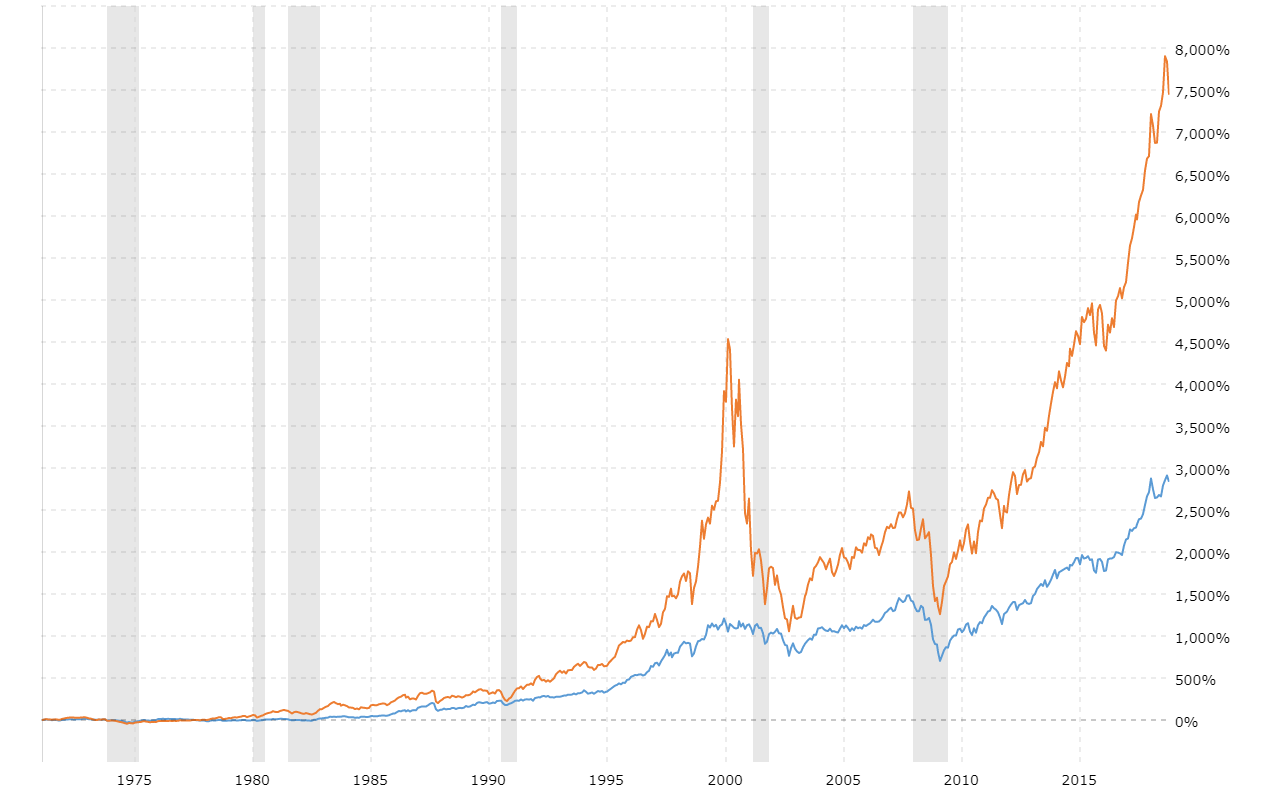

If we look at the raw data provided by sources like the Schwab Center for Financial Research or CFRA Research, the long-term trend of the Dow is upward. Period.

Since 1945, the S&P 500 (which tracks closely with the Dow) has averaged an annual return of about 11% under Democrats and about 7% under Republicans. Does that mean you should only invest when a Democrat is in office? Absolutely not. If you sat out the Trump years because you didn't like his tweets, you missed a roughly 56% gain in the Dow. If you sat out the Reagan years because you feared "Reaganomics," you missed one of the greatest wealth-building periods in American history.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

The Illusion of Policy Impact

We talk about "Presidential Cycles." There is this theory that the third year of a presidency is the strongest for the stock market. Why? Because the theory suggests the incumbent starts pumping the economy to get re-elected. It sounds plausible. It even happens sometimes. But then 2007 happens. Or 2020 happens.

Exogenous shocks—things like global pandemics, oil embargos, or the invention of the internet—dwarf whatever tax policy or executive order comes out of Washington. The Dow Jones chart by president often hides the reality of the Federal Reserve.

Honestly, the person running the Fed probably has more influence over your 401(k) than the person in the White House. When Paul Volcker hiked interest rates to 20% in the early 80s to kill inflation, the market hated it. It didn't matter that Reagan was in office. When the Fed kept rates at near-zero for a decade, the market loved it. That was a tailwind for both Obama and Trump.

Historical Heavyweights and the Dow

Let's get specific.

Bill Clinton’s presidency saw the Dow rise by over 200%. Was it his "Bridge to the 21st Century"? Or was it the fact that every household in America was suddenly buying a PC and getting on AOL?

Compare that to George W. Bush. He left office with the Dow lower than when he started. That looks terrible on a chart. But he started his term right as the Dot-com bubble burst and ended it during the Global Financial Crisis. He was the "bookend" president for two of the worst market events in a century.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Then you have Calvin Coolidge. The "Silent Cal" years were a riot for the Dow. It went up nearly 250%. He barely did anything. He believed in staying out of the way. Was his inaction the cause, or was he just lucky to be there during the "Roaring Twenties" when everyone was buying radios and cars on credit?

The Problem with "Market Timing" Based on Elections

If you look at a Dow Jones chart by president and decide to move your money to cash because "your person" lost, you are statistically likely to lose money.

The market hates uncertainty. This is why you often see a dip right before an election. Investors are nervous. They don't know what the tax code will look like in January. But once the election is over—regardless of who wins—the market usually rallies. Why? Because the uncertainty is gone. The "rules of the game" are set for the next four years, and Wall Street is great at playing by whatever rules are on the table.

Sectors vs. The Whole Market

Instead of looking at the total Dow, smart money looks at sectors.

- Energy: Usually does better when people expect deregulation (often Republican).

- Healthcare: Moves wildly based on talk of "Medicare for All" or drug price caps (often Democratic).

- Defense: Usually gets a bump when "hawks" are in power.

But even these aren't sure bets. Energy stocks actually performed quite well during parts of the Biden administration, despite the green energy push, simply because global oil supply was tight.

The "January Effect" and New Administrations

There is a weird phenomenon where the first year of a new presidency is often a bit rocky. The market is feeling out the new administration. They want to see the first budget. They want to see the cabinet picks.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

If you look at the Dow Jones chart by president for the first 100 days, you’ll see a lot of noise. It’s mostly meaningless. Real wealth is built in the years 5 through 20 of an investment plan, not the first 100 days of a political term.

Don't Let Your Politics Go Broke

I’ve seen people liquidate their entire portfolios because they were convinced the country was "going to hell" under a specific leader. It’s a tragic mistake.

The U.S. economy is a $27 trillion beast. It is powered by millions of people going to work, companies innovating, and consumers buying stuff. That momentum is hard to stop. Whether the guy in the White House is someone you love or someone you can't stand, the CEO of Microsoft is still trying to sell software. The CEO of Exxon is still trying to sell oil.

Actionable Insights for Investors

If you're staring at a Dow Jones chart by president and trying to decide what to do next, stop. Here is what actually works:

- Ignore the "Party" Variable: Historical data shows the market has gone up under 13 of the last 15 presidents. The trend is the friend, not the party.

- Watch the Fed, Not the Oval Office: Interest rates and inflation are the real drivers of stock prices. If the Fed is cutting rates, the market usually has a tailwind.

- Stay Invested During Transitions: The volatility around elections is usually a buying opportunity, not a reason to sell.

- Diversify Beyond Policy: No president can control the global supply chain or the price of microchips in Taiwan. Build a portfolio that doesn't rely on a single legislative outcome.

- Look at "Earnings, Not Oratory": At the end of the day, stock prices follow earnings. If corporate profits are growing, the Dow will eventually follow, regardless of who is giving the State of the Union address.

The most successful investors I know are the ones who can't remember who was president in 1994 or 2004 without Googling it. They just stayed in the market. They let compounding do the heavy lifting while everyone else was arguing about tax brackets.

Don't let a colorful chart convince you that politics is the primary driver of your financial future. It’s a distraction. Focus on the underlying companies, keep your costs low, and stay the course. The market has survived wars, depressions, and every kind of politician imaginable. It will likely survive the next one, too.