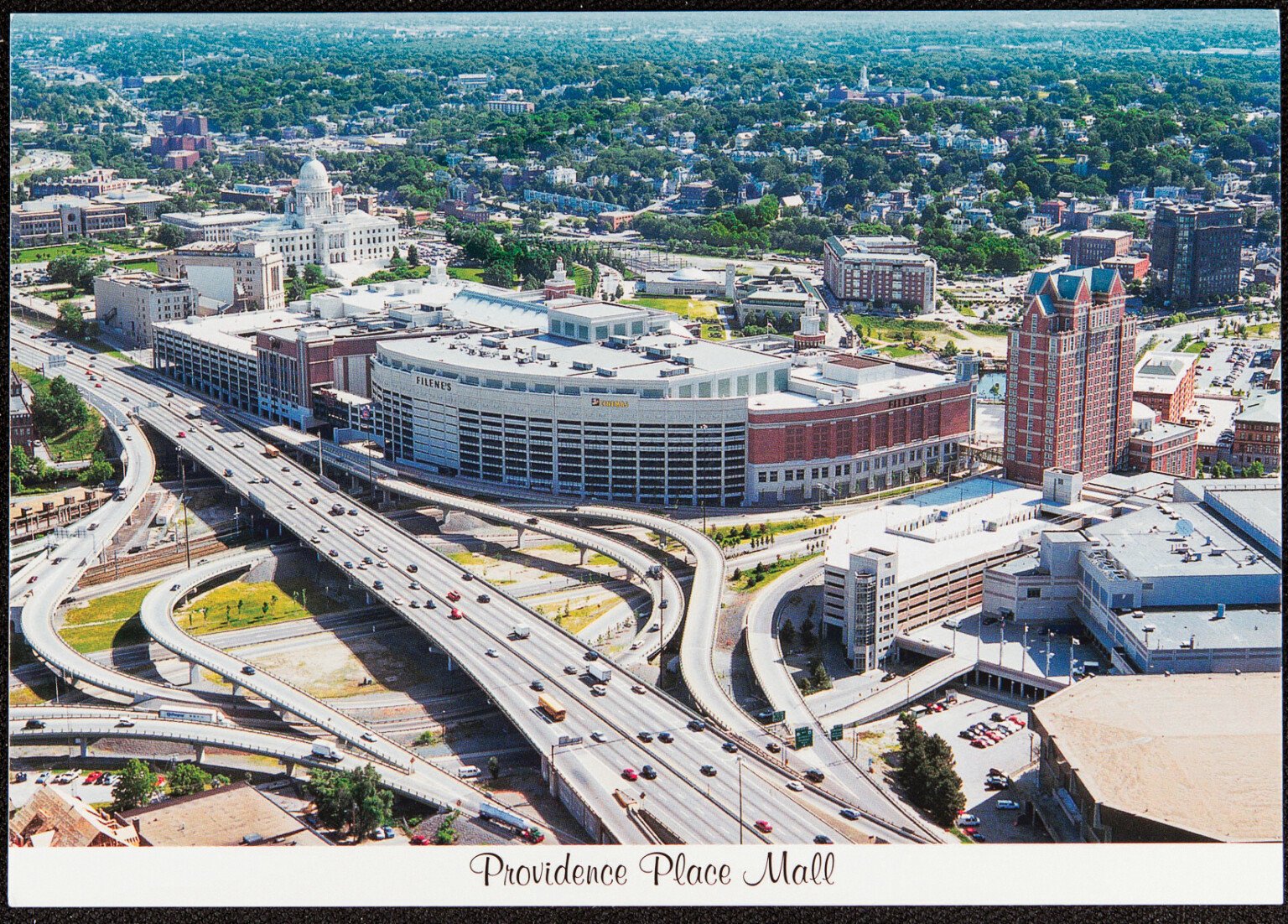

So, the big white building that looms over I-95 is finally officially on the block. For months, the rumors were swirling around downtown like a Nor'easter, but now it’s real: there is a Providence Place mall sale in motion. If you’ve walked through the food court lately or tried to find a parking spot that wasn’t confusing, you’ve probably felt the shift. It’s not just about a change in ownership; it’s about a massive, complicated financial "divorce" between a global real estate giant and the banks that are tired of waiting for their money.

Honestly, the headlines make it sound like a disaster movie. "Bankruptcy," "Default," "Receivership." But if you peel back the layers of corporate jargon, the situation is way more nuanced than just "malls are dying."

What Really Triggered the Providence Place Mall Sale?

The story starts with Brookfield Properties, the previous owner. They aren’t broke—far from it. They’re a multi-billion dollar entity based in Bermuda. But back in 2011, they took out a massive $305 million loan on the property. When that loan came due in May 2024, Brookfield basically looked at the bill and decided not to pay the remaining $259 million.

Why? Because the math changed.

In the world of high-stakes real estate, if the interest rates are high and the property value isn't skyrocketing, sometimes the "titans" just walk away. They didn't "fail" in the traditional sense; they made a calculated business decision to let the mall go into receivership.

✨ Don't miss: Online Associate's Degree in Business: What Most People Get Wrong

Think of receivership as a controlled, state-level version of bankruptcy. A judge in Rhode Island Superior Court, Brian Stern, appointed two local attorneys—Mark Russo and John Dorsey—to take the wheel. Their job isn't to shut the place down. It’s to clean up the books, fix the broken escalators, and find a buyer who actually wants to invest in the future of Providence.

The 2026 Reality: Is the Mall Actually Empty?

You’d think a mall in "foreclosure" would be a ghost town. It’s actually the opposite.

Despite the drama, the occupancy rate has stayed surprisingly high, hovering around 88% to 90%. People are still buying Apple Watches and eating Dave & Buster’s wings. But there are big holes to fill. The most glaring one? The Showcase Cinemas closure.

National Amusements, the parent company, decided not to renew their lease, which officially expires on January 31, 2026. This was a blow to the "date night" vibe of the top floor. However, the receivers are already hunting for a replacement. They even went to court to get permission to keep the projectors and seats in the building so a new operator—rumored to potentially be Apple Cinemas or another boutique chain—could move in without a massive construction delay.

🔗 Read more: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

The Anchor Problem (and the Boscov’s Surprise)

- Macy’s: They are the wildcard. Macy’s is closing 150 stores nationwide through 2026. While the Providence location has been "at risk" on several analysts' lists, it remains a massive footprint that the new owners will desperately need to keep or reinvent.

- Boscov’s: Since taking over the old Nordstrom spot in 2019, they’ve been a steadying force. It’s a "classic" department store vibe that still draws a crowd that doesn't just shop on Amazon.

- Level99: This is the future. It’s not a store; it’s an "experience." This massive interactive gaming venue replaced the old JCPenney space and represents exactly what a new buyer will be looking for: reasons for people to leave their house that don't involve buying a pair of jeans.

The "Tax Cliff" No One Is Talking About

Here is the part where things get dicey for the City of Providence. The mall has been living under a Tax Stabilization Agreement (TSA) for decades. Basically, they’ve been paying a fraction of what they should in property taxes—only about $500,000 a year.

That deal expires in 2028.

If a new buyer steps in, they are looking at a potential tax bill of $25 million annually once that agreement ends. That is a massive jump. Mayor Brett Smiley and the city council are going to have to play a high-stakes game of poker with whoever buys the mall. If the city insists on the full tax amount, the mall might not be profitable. If they extend the tax break, the taxpayers get grumpy. It’s a mess.

What’s the Next Move for Investors?

Jones Lang LaSalle (JLL) is the firm handling the listing. They aren't just selling a shopping center; they are selling 15.8 acres of prime downtown real estate. Here’s what the smart money is looking at:

💡 You might also like: Modern Office Furniture Design: What Most People Get Wrong About Productivity

- Residential Conversion: Don't expect the whole mall to become apartments (plumbing and windows make that a nightmare), but the parking garages and the "dead zones" are perfect for luxury condos or student housing.

- Medical and Educational Hubs: We’ve seen this in other states. Part of the mall could easily become a satellite campus for URI or a specialized clinic for Lifespan.

- The "Omni" Connection: The skybridge to the Omni Hotel makes this a "hospitality" play as much as a retail one.

Actionable Steps for the Community and Businesses

If you’re a local business owner or just someone who shops there, the Providence Place mall sale isn't a signal to panic. It's a signal to adapt.

For Current Tenants: Check your lease "co-tenancy" clauses. If Macy’s or another major anchor leaves, you might have the right to renegotiate your rent. The receivers are currently very motivated to keep the lights on, so now is actually the best time to ask for maintenance fixes or better terms.

For Shoppers: Support the "experiential" spots. If we want the mall to survive, we have to use the parts of it that the internet can’t replace—the cinema (once it reopens), the restaurants, and the entertainment venues like Level99.

For the City: Expect public hearings in 2026. The sale has to be approved by Judge Stern, and that will be a public process. If you have opinions on whether the mall should become housing or stay a retail hub, that is your window to speak up.

The era of the "Mega Mall" as we knew it in 1999 is dead. But the Providence Place mall sale is the first step toward whatever is next—and honestly, a local owner with a fresh vision is probably exactly what that giant glass building needs.

Keep an eye on the court filings through the end of the year. The "bid process" is a closed-door affair for now, but the final result will define the Providence skyline for the next thirty years.