Money is messy. When you look at a presidents and national debt chart, your first instinct is probably to point a finger at the person sitting in the Oval Office when the line starts spiking toward the moon. It’s natural. We want a hero or a villain. But if you actually sit down and dig into the Treasury’s historical data, you realize the "who" is often less important than the "what." What was happening in the world? Was there a global pandemic? A housing bubble that went pop? A world war?

The debt doesn't care about political parties.

Since the early 1900s, the U.S. national debt has basically acted like a runaway freight train. We haven't had a surplus—meaning we made more than we spent—since the late 1990s. Even then, it was a brief blip. Today, we are looking at a total gross debt north of $34 trillion. That number is so large it feels fake. It’s hard to wrap your head around a trillion of anything, let alone 34 of them. To understand how we got here, you have to look past the campaign slogans and look at the actual math behind the presidents and national debt chart.

Why the Raw Numbers in a Presidents and National Debt Chart Are Lying to You

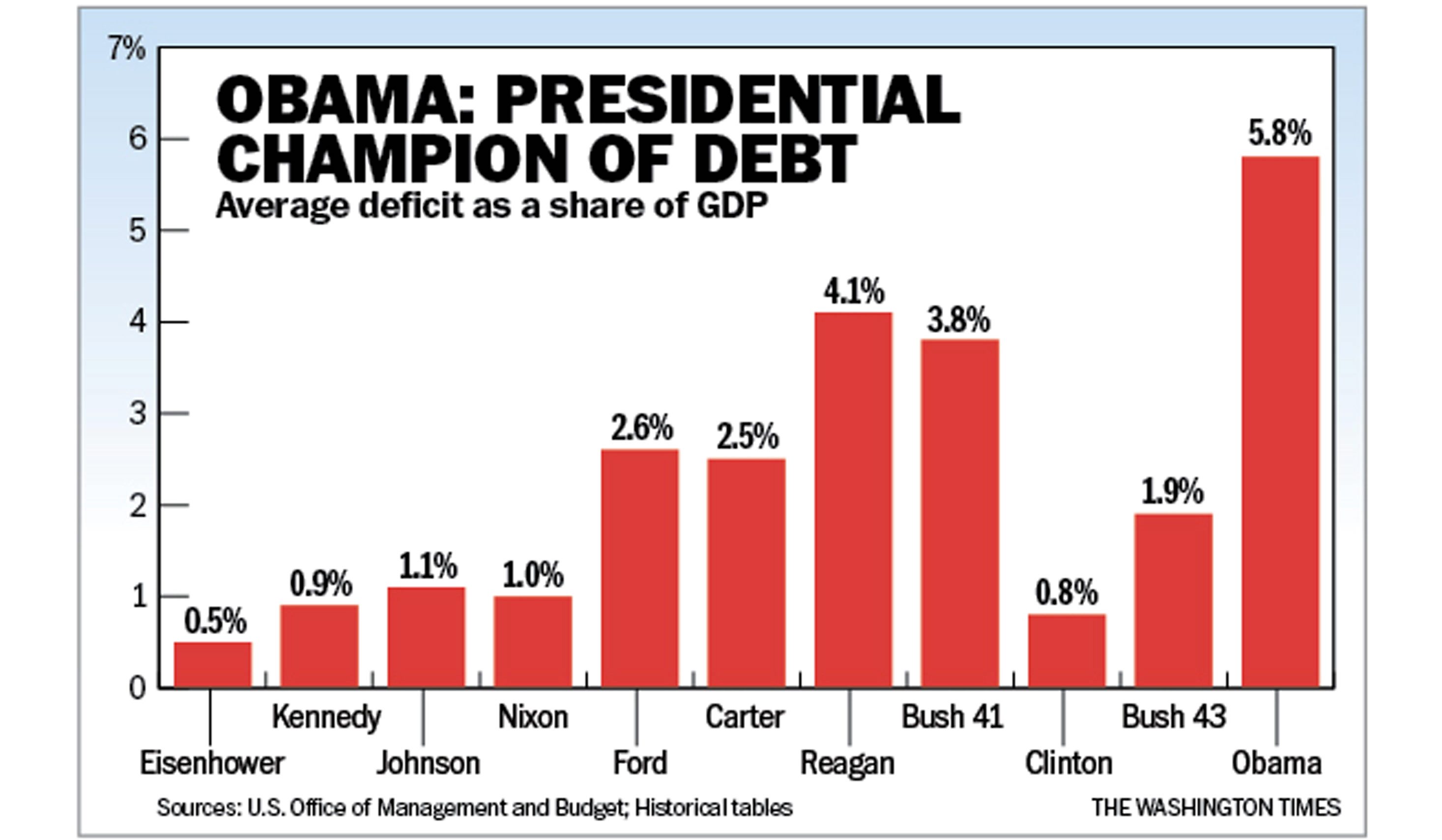

Context is everything. If I tell you that President George W. Bush added about $6 trillion to the debt and President Barack Obama added about $8 trillion, you might think Obama was the bigger spender. But wait. You have to look at the percentage increase. Or better yet, look at the Debt-to-GDP ratio. GDP is the "Gross Domestic Product," basically the total value of everything the U.S. produces. It's like comparing a person with a $1,000 credit card debt who makes $20,000 a year to someone with $5,000 debt who makes $200,000. The second person is actually in a "healthier" financial spot relative to their income.

Most charts you see on social media are cherry-picked. They start at a specific year to make one party look like fiscal geniuses and the other like reckless gamblers. Honestly, it’s exhausting.

The World War II Spike

Let’s go back. Franklin D. Roosevelt (FDR) saw the largest percentage increase in the national debt of any president. Was he just throwing money away? No. He was fighting the Great Depression and then, you know, a literal World War. The debt-to-GDP ratio soared to 106% by 1946. We were spending money we didn't have to keep the world from falling apart.

📖 Related: Who Bought TikTok After the Ban: What Really Happened

After the war, the debt didn't actually go away. We just grew the economy so fast that the debt became "smaller" by comparison. From the late 1940s through the 1970s, the line on your presidents and national debt chart actually looks relatively flat or even trends downward when measured against the size of the economy. This is what economists call "inflating your way out of debt" combined with massive post-war productivity.

The Modern Era of "Permanent" Deficits

Everything shifted in the 1980s. Under Ronald Reagan, the philosophy changed. The idea was that cutting taxes would stimulate so much growth that the debt wouldn't matter. It didn't quite work out that way. Tax cuts plus increased military spending led to the debt nearly tripling during his tenure. This was the birth of the modern era where we just sort of accepted that the debt would always go up, regardless of whether we were at peace or at war.

Then came the 2000s.

If you look at a presidents and national debt chart from 2000 to 2024, the angle of the line changes. It gets steeper. A lot steeper. You have the 2001 tax cuts, the wars in Iraq and Afghanistan, and then the 2008 financial crisis. When the housing market collapsed, the government stepped in with massive stimulus packages. This wasn't a "Democrat" or "Republican" thing in the way people argue about it—Bush started the bailouts (TARP) and Obama continued and expanded the recovery efforts.

The COVID-19 Vertical Line

If you want to see a jump that looks like a mistake on the page, look at 2020. Under Donald Trump, the debt jumped by trillions in a single year. Again, context matters. The world shut down. Businesses stopped. To prevent a total economic evaporation, the government pumped trillions into the system through the CARES Act. Then, under Joe Biden, more spending followed with the American Rescue Plan and the Inflation Reduction Act.

👉 See also: What People Usually Miss About 1285 6th Avenue NYC

By the time we hit 2024, the debt was growing by about $1 trillion every 100 days. That is a staggering pace.

Who Is Actually Responsible? (The Answer Is Boring)

You want a name. I get it. But the truth is that the President doesn't actually hold the purse strings. Congress does. The "Power of the Purse" belongs to the Legislative Branch. A president can propose a budget, but Congress is the one that actually passes the bills and decides how much to borrow.

Also, a huge chunk of our spending is "mandatory."

- Social Security

- Medicare

- Interest on the debt

These three things alone eat up the majority of the federal budget. No president can just "flip a switch" and stop the debt from growing because they don't have the legal authority to stop paying Social Security benefits or interest to bondholders. If the U.S. stopped paying interest on its debt, the global economy would basically implode overnight. We are locked into a cycle where we borrow money to pay the interest on the money we already borrowed.

It's a treadmill that keeps getting faster.

✨ Don't miss: What is the S\&P 500 Doing Today? Why the Record Highs Feel Different

Breaking Down the Chart: The 100-Year View

| Era | Primary Debt Driver | Impact on Chart |

|---|---|---|

| 1940s | World War II | Massive spike, peak ratio |

| 1950s-1970s | Post-war growth | Debt-to-GDP falls |

| 1980s | Supply-side economics / Defense | Steady climb starts |

| 1990s | Tech boom / Spending caps | Brief flattening (Surplus) |

| 2000s | Wars / Tax cuts / Great Recession | The curve steepens |

| 2020s | Pandemic / High interest rates | The vertical leap |

When you look at the data provided by the St. Louis Fed (FRED), you see that the "Total Public Debt" line looks like an exponential curve. But if you toggle the view to "Debt as a Percentage of GDP," the story changes. It shows that we are currently at levels we haven't seen since the end of WWII. The difference? In 1946, the war was over and we could stop spending. Today, our spending is tied to an aging population and rising healthcare costs. Those don't just "end."

Why This Matters to Your Wallet

You might think, "Why should I care about a presidents and national debt chart? It doesn't affect my grocery bill."

Actually, it does. Or it might soon.

When the government borrows a lot of money, it has to pay interest. As interest rates rise (which they have, significantly, to fight inflation), the government has to spend more of its tax revenue just to keep the lights on. This is called "crowding out." Every dollar spent on interest is a dollar not spent on roads, schools, or tax cuts. Eventually, if the debt gets too high, investors might demand even higher interest rates to lend the U.S. money, because they see it as a higher risk. That can lead to a spiral.

Actionable Insights: How to Read the Debt Data Like an Expert

Stop looking at the raw dollar amounts. They are scary but mostly meaningless without context. If you want to actually understand the fiscal health of the country, follow these steps:

- Look at Debt-to-GDP Ratio: This tells you if the economy is growing fast enough to support the borrowing. If the ratio is rising, we're in trouble. If it's falling, we're "growing out of it."

- Check the Net Interest Costs: Watch how much of the federal budget goes strictly to paying interest. When interest payments exceed the defense budget, that’s a major red flag for the economy.

- Distinguish Between "Debt Held by the Public" and "Intragovernmental Debt": A lot of the debt we "owe" is actually money the government owes to itself (like the Social Security Trust Fund). The "Debt Held by the Public" is the one that really affects market interest rates.

- Acknowledge the Lag: A president’s first year of "debt" is almost always the result of the previous president's final budget. Budget years (Fiscal Years) run from October to September, so the lines on the chart are always a bit blurred.

The presidents and national debt chart is a reflection of our national priorities. It shows that for the last 40 years, we have consistently voted for more services and lower taxes. You can't have both forever. Whether you lean left or right, the math eventually catches up. The chart isn't just a political scorecard; it's a map of every crisis and policy shift of the last century.

To stay truly informed, monitor the Monthly Treasury Statement released by the Bureau of the Fiscal Service. It provides the most granular view of where the money is going in real-time. Understanding the nuances of these figures allows you to bypass the partisan noise and see the actual structural challenges facing the U.S. economy.