If you’ve checked the news lately, you’ve probably seen some pretty staggering numbers. It feels like every time we look at a screen, the U.S. national debt has jumped by another trillion dollars. Honestly, it’s getting hard to keep track.

So, what is the national debt right now?

As of mid-January 2026, the total gross national debt has officially cleared $38.43 trillion. Just let that sink in for a second. That's about $112,966 for every single person in the country. If you break it down by household, we’re looking at over $285,000 in debt per family.

Understanding the $38 Trillion Pile

Most of us can't even visualize a billion, let alone 38 trillion. To put it in perspective, the debt is currently growing at a rate of roughly $8.03 billion per day. That’s about $92,000 every single second. While you were reading that last sentence, the government borrowed enough to buy a nice luxury SUV.

🔗 Read more: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Basically, the national debt is the accumulation of every yearly deficit the federal government has run. We spend more than we take in. We’ve been doing it for a long time.

There are two main buckets this money falls into:

- Debt Held by the Public: This is the big one—about $30.8 trillion. This is the money the government owes to outside investors. Think individual people with savings bonds, big banks, and foreign countries like Japan and China.

- Intragovernmental Holdings: This is around $7.6 trillion. It’s basically the government borrowing from itself. For instance, when the Social Security trust fund has a surplus, the Treasury "borrows" that money and replaces it with an IOU.

Why is it growing so fast in 2026?

You might wonder why the needle is moving so much faster lately. It’s a mix of old habits and new realities. We’re still dealing with the long-term hangover of pandemic-era spending, but the real "engine" of the debt right now is interest.

💡 You might also like: Kimberly Clark Stock Dividend: What Most People Get Wrong

Because interest rates have stayed elevated, the cost of just holding this debt has skyrocketed. In fiscal year 2025, the U.S. spent over $1 trillion just on interest payments. That’s more than we spend on the entire defense budget. It’s like having a credit card where the monthly interest is so high you can’t even start paying off the actual shoes you bought three years ago.

Recent policy changes haven't exactly slowed things down. The "One Big Beautiful Bill" (OBBBA) passed in July 2025 added roughly $5 trillion to the debt limit to keep things running through early 2026. While the administration points to new revenue from increased tariffs and savings from the Department of Government Efficiency (DOGE), those numbers—while significant—are still small compared to the total $38 trillion mountain. For example, DOGE reported about $202 billion in savings, which is great, but it’s a drop in the bucket when the debt is growing by $2 trillion a year.

What Most People Get Wrong

There's a common myth that China "owns" us. In reality, the largest owners of U.S. debt are actually American citizens and institutions—pension funds, the Federal Reserve, and everyday investors. Foreign ownership is significant (around 29%), with Japan being the top holder, but we mostly owe the money to ourselves.

📖 Related: Online Associate's Degree in Business: What Most People Get Wrong

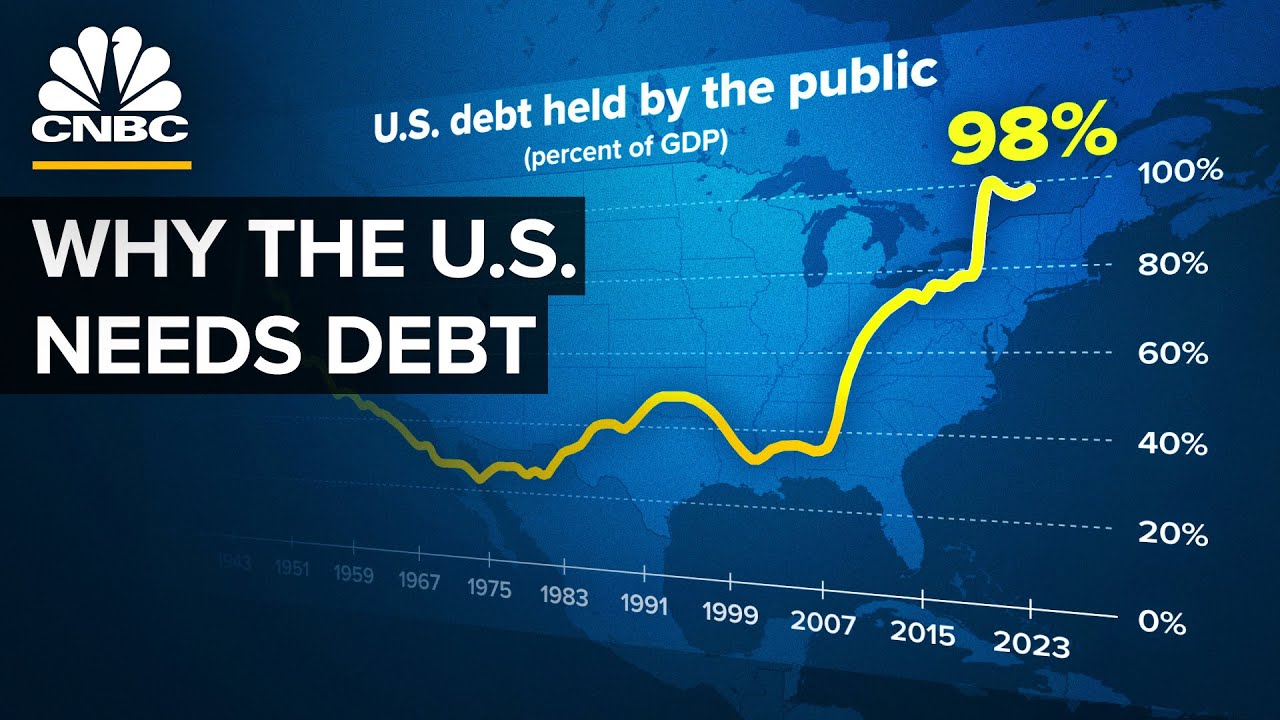

Another misconception? That we have to pay it off to zero. Most economists agree we don't need a zero balance. What matters is the debt-to-GDP ratio. Basically, can our economy grow fast enough to make the debt manageable? Right now, that ratio is sitting at roughly 123%. That’s high—the highest since World War II—and it’s why people are starting to get nervous.

Is there a "Red Line"?

Nobody knows exactly when the debt becomes a "crisis." Some experts, like Maya MacGuineas from the Committee for a Responsible Federal Budget, argue we are already in the danger zone because interest is eating up 13% to 14% of all federal outlays. When interest payments crowd out spending on roads, schools, and research, the economy starts to feel the squeeze.

Others argue that as long as the U.S. dollar remains the world's reserve currency, we can keep this going. But with gold prices hitting record highs and some foreign central banks diversifying away from Treasuries, that "reserve currency" status isn't a guaranteed shield anymore.

Actionable Steps: What This Means for You

The national debt feels like a "big government" problem, but it has real-world effects on your wallet.

- Watch Interest Rates: If the government has to compete for investors to buy its debt, it has to offer higher interest rates. This can keep mortgage and car loan rates higher for longer.

- Diversify Your Assets: With the dollar under pressure and debt levels rising, many financial advisors suggest looking at a mix of assets—equities, international stocks, or even "hard assets" like gold or real estate—to hedge against potential inflation or currency devaluation.

- Audit Your Future Taxes: Higher debt often leads to higher taxes down the road. If you're planning for retirement, consider tax-advantaged accounts like a Roth IRA where you pay the tax now rather than later.

- Stay Informed on the Budget: The next big deadline is January 30, 2026. This is when the current funding runs out. Watching how Congress handles these "fiscal cliffs" will give you a good idea of how much more borrowing is on the horizon.

The $38.43 trillion figure is a milestone we weren't supposed to hit for years. It’s a wake-up call that the "new normal" of trillion-dollar jumps is here to stay, at least for the foreseeable future.