If you’ve ever found yourself staring at a brightly colored bill with a portrait of a man in a traditional cap, you’ve likely held the Nigerian Naira. It is the heartbeat of Africa’s largest economy. But what is the money of Nigeria exactly? It’s not just paper. It’s a mix of history, intense economic shifts, and a new digital frontier that most people are still trying to wrap their heads around.

Nigeria's currency is the Naira (symbol: ₦; code: NGN). It’s divided into 100 kobo.

Honestly, finding a kobo coin on the street today is like finding a four-leaf clover. They technically exist, but inflation has made them practically invisible in daily trade. You won't be buying a loaf of bread with a handful of 50 kobo coins anymore.

What Is the Money of Nigeria Today?

Right now, the Naira is in a bit of a transition phase. As of early 2026, the currency is navigating the aftermath of major reforms that began a few years back. The Central Bank of Nigeria (CBN), led by Governor Olayemi Cardoso, has been working overtime to stabilize the exchange rate.

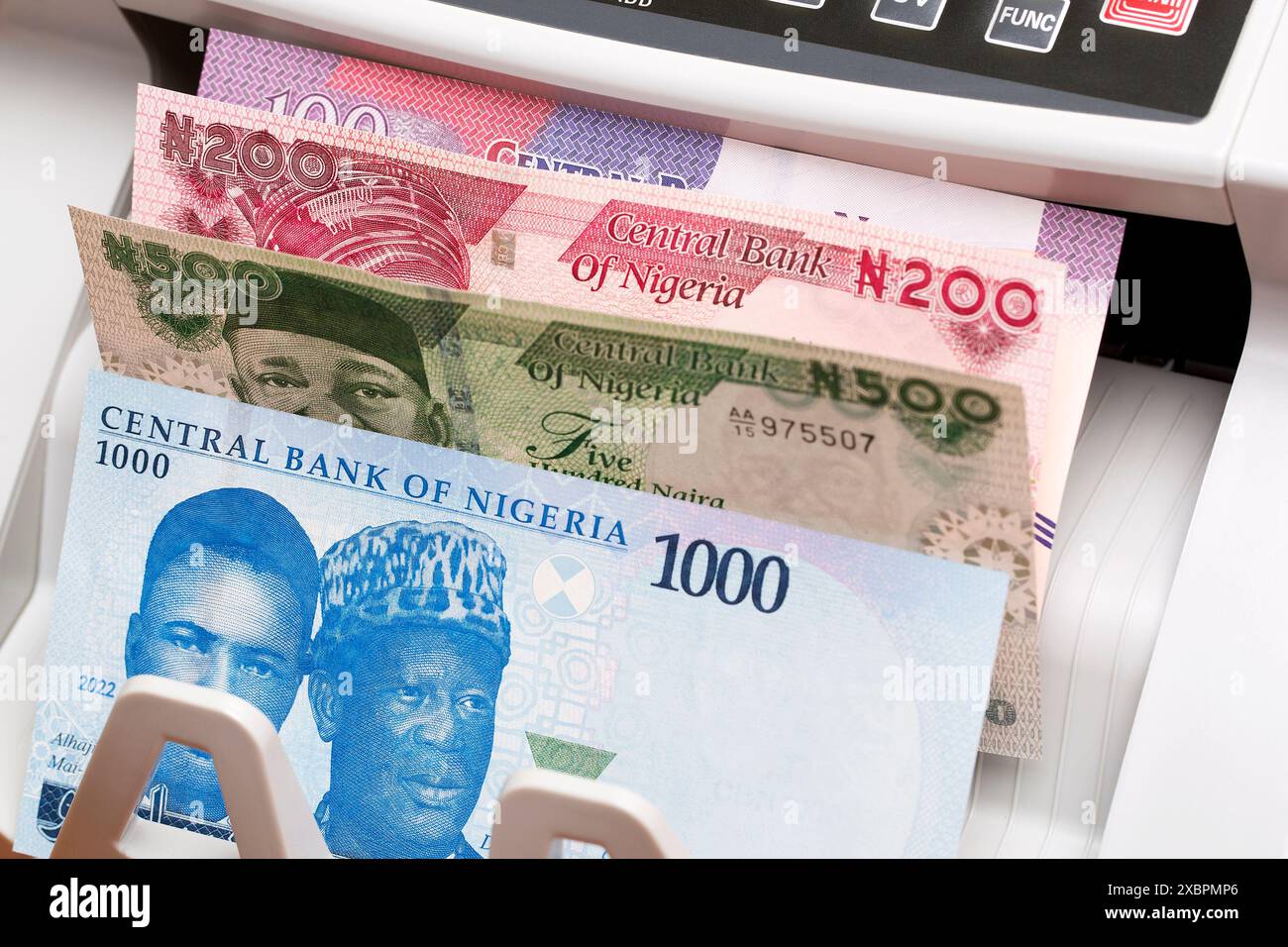

If you are traveling to Lagos or Abuja today, you’ll see the "New Naira" notes. These were rolled out in late 2022 and early 2023. The ₦200, ₦500, and ₦1,000 notes got a facelift—mostly a change in color palette. They look a bit more vibrant, though some locals jokingly say they look like they were "washed with a blue shirt."

The current exchange rate is a moving target. In mid-January 2026, the official rate has been hovering around ₦1,420 to ₦1,470 per US Dollar. This is a huge leap from where it was just a few years ago when it sat comfortably under ₦500. It’s been a wild ride for the local wallet.

💡 You might also like: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

The Breakdown of Banknotes

You’ll mostly handle paper (and polymer) money. Here is what is in your pocket:

- The Small Stuff (Polymer): ₦5, ₦10, ₦20, and ₦50 notes. These are made of a plastic-like material because they change hands the most. They’re durable. You can accidentally leave them in your pocket during laundry, and they’ll survive.

- The Big Bills (Paper): ₦100, ₦200, ₦500, and ₦1,000. These are the heavy hitters. The ₦1,000 note features Alhaji Aliyu Mai-Bornu and Dr. Clement Isong—two legendary central bankers.

The eNaira: Nigeria’s Digital Gamble

In 2021, Nigeria did something pretty bold. They launched the eNaira. It’s a Central Bank Digital Currency (CBDC).

Think of it as the digital version of the cash in your wallet. It’s not Bitcoin. It’s not "crypto" in the sense that its value fluctuates based on hype. One eNaira will always equal one physical Naira.

Why bother? Basically, the government wanted to bring the "unbanked" into the system. Millions of Nigerians don't have traditional bank accounts. With a smartphone and a digital wallet, they can theoretically participate in the economy. Adoption has been a bit slow—only about 700,000 downloads in the first year—but by 2026, it has become a more common sight for government transfers and cross-border trade.

How to Spot a Fake Naira

Counterfeiting is a headache everywhere, but it's something you've gotta watch for in Nigeria. Real Naira notes have specific "tells."

📖 Related: Getting a music business degree online: What most people get wrong about the industry

First, do the Touch Test. Real notes have raised print. If the portrait of the person on the bill feels flat and smooth like a photocopier print, give it back. It's likely a fake.

Second, use the Ribbon Test. Look at the metallic security thread. On a real note, it looks like a broken line when lying flat, but when you hold it up to the light, it becomes a solid, continuous dark line. You should also see "CBN" printed in tiny letters on that thread.

Finally, check the Gold Foil. On the ₦1,000 note, there’s a gold foil patch. On a real bill, you cannot scratch this off with your fingernail. On a fake, the "gold" will peel away like a cheap lottery ticket.

A Quick Trip Down Memory Lane

Before 1973, Nigeria didn't even use the Naira. They used the Nigerian Pound.

The country decided to break away from the British colonial currency system and decimalize. They introduced the Naira at a rate of 2 Naira for every 1 Pound. Back then, the Naira was incredibly strong. There was a time when one Naira was worth more than a US Dollar.

👉 See also: We Are Legal Revolution: Why the Status Quo is Finally Breaking

Things changed. Oil price shocks, political instability, and shifting economic policies took their toll. The currency has been devalued several times over the decades to help boost exports and manage debt.

Actionable Tips for Handling Nigerian Money

If you're dealing with the money of Nigeria for business or travel, don't just wing it.

- Use Official Channels: While "parallel market" (black market) mallams on the street might offer a slightly better rate, it’s risky. Use the banks or licensed Bureau De Change (BDC) operators.

- Download a Converter: Use apps like Wise or XE to track the daily fluctuations. The Naira can move 2% or 3% in a single day.

- Carry Small Denominations: If you're taking a "Danfo" (yellow bus) or buying "Suya" on the street, don't pull out a ₦1,000 note. Change is often scarce. Keep ₦100 and ₦200 notes handy.

- Inspect Every Note: Especially at night. If someone hands you a ₦1,000 bill in a dark taxi, use your phone light to check the watermark.

The story of Nigeria's money is the story of the country itself: resilient, slightly chaotic, and always evolving. Whether it's the polymer notes in a market stall or an eNaira transfer on a flashy smartphone, the currency remains the ultimate symbol of the Giant of Africa.

To stay ahead of currency shifts, monitor the Central Bank of Nigeria's official website for the latest circulars on exchange rate policies and ensure you are using the redesigned notes, as older versions of certain denominations are no longer legal tender.