You’ve probably seen the ads with the pink branding and the promise of "insurance for the 21st century." It sounds great. But when you actually sign up, there’s a specific piece of tech that enters the chat. Most people call it the lemonade car insurance device, though it’s technically a blend of a physical plug-in and the app on your phone. It’s the gatekeeper. It’s the thing that decides if you’re actually a "good driver" or just someone who thinks they are.

Insurance used to be a guessing game based on your zip code and your credit score. Lemonade is trying to flip that. They want to know how you actually handle a curve at 2 a.m.

What is the Lemonade car insurance device anyway?

Let’s get the hardware out of the way. When you join Lemonade Car, they don’t just take your word for it that you rarely drive. They often require a small telematics device that plugs into your car’s OBD-II port. This port is usually hiding under your dashboard, the same place a mechanic sticks their scanner to figure out why your check engine light is screaming.

It’s small. It’s unobtrusive. But it’s loud in terms of the data it spits out.

Honestly, the "device" is part of a duo. It works in tandem with the Lemonade app on your smartphone. The hardware tracks the car’s movement, while the phone provides the GPS and helps the company understand if you’re texting while driving or if you’re actually focused on the road. If you’re the type of person who hates being watched, this might feel a bit like Big Brother is riding shotgun. But if you’re a safe driver who stays off the road during "witching hours" (basically 11 p.m. to 4 a.m.), it’s essentially a way to prove you deserve a lower rate.

🔗 Read more: Davis Royster Henderson NC: The Legacy of a Local Institution

The telematics trap: What it tracks and what it doesn't

People get weird about privacy. I get it.

The lemonade car insurance device focuses on specific behaviors. It isn’t listening to your conversations or checking your Spotify playlist. It cares about "critical events." We’re talking about hard braking. That sudden jerk when someone cuts you off in traffic? The device feels that. If you do it once, no big deal. If you do it every three blocks, Lemonade’s algorithms start flagged you as a tailgater or an aggressive driver.

Speeding is the big one. But it’s not just about doing 70 in a 65. It’s about "excessive speeding." They look for patterns.

Then there’s mileage. Lemonade loves low-mileage drivers. Because, logically, if your car is sitting in a driveway, it’s not getting into a fender bender. The device verifies your odometer without you having to snap a blurry photo of your dashboard every month. It’s seamless.

Why the "Time of Day" factor matters

This is where it gets nuanced. Driving at 2 p.m. on a Tuesday is statistically safer than driving at 2 a.m. on a Sunday. Why? Drunk drivers. Fatigue. Poor visibility.

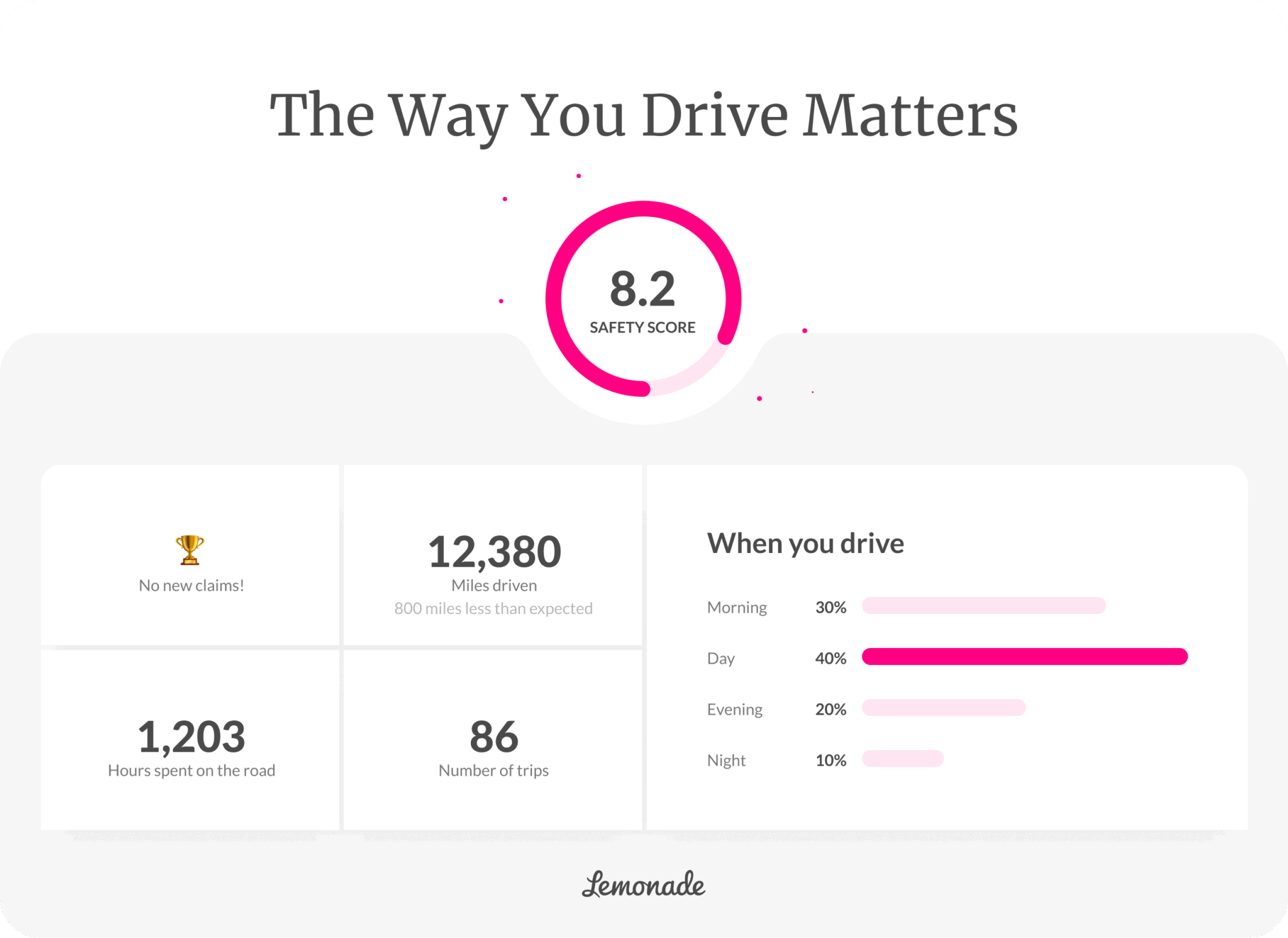

The Lemonade system tracks when you are on the road. If your job requires you to work the graveyard shift, you might actually find that your "driver score" takes a hit even if you’re the most cautious person on earth. It’s a bit of a systemic bias in telematics. The math says late-night driving is risky. The device doesn’t care that you’re a responsible nurse heading to a shift; it just sees a car moving during high-risk hours.

Setting it up without losing your mind

You get the box in the mail. You open it. There’s a little plastic thingy.

- Find your OBD-II port. (Usually under the steering wheel).

- Plug it in.

- Open the Lemonade app.

- Enable "Always On" location services.

That last step is where people usually trip up. If you set your location permissions to "Only while using the app," the whole thing breaks. The lemonade car insurance device needs to know when you start a trip without you manually opening the app every time you go to Target. If the app can't see the device, you don't get the "safe driver" credit. It’s that simple.

The financial reality: Does it actually save you money?

Insurance companies aren't charities. They give discounts because data-driven drivers are cheaper to insure.

Lemonade claims you can save significantly, sometimes up to 40%, but that’s the "best-case scenario" stuff you see in fine print. For most people, the savings are more modest. However, the real value comes from the "Per-Mile" model if you’re a remote worker. If you only put 3,000 miles a year on your car, the device proves it. You stop paying for the "risk" of a commuter who does 15,000 miles.

But there’s a flip side. If the device records you taking corners like a Formula 1 driver, your rates aren't going down. In fact, while Lemonade says they want to reward good drivers, the industry trend is moving toward using this data to accurately price "bad" drivers too. You’re essentially inviting an auditor into your car.

The tech behind the "Crash Detection"

One feature that actually justifies the device's existence is the crash detection.

The sensors in the lemonade car insurance device can detect the specific G-force signature of an impact. If it senses a wreck, the app can trigger an emergency call. They’ll literally check in on you. If you don’t respond, they can send emergency services to your GPS coordinates. In a world where we worry about data privacy, this is the one "pro-privacy" trade-off that actually saves lives. It turns your 2012 Honda Civic into a "smart car" with safety features it wasn't born with.

Comparisons: Lemonade vs. Progressive Snapshot vs. Tesla Insurance

Lemonade isn't the only player here. Progressive has Snapshot. State Farm has Drive Safe & Save.

Progressive’s device is famous for beeping at you. It’s annoying. You hit the brakes a little too hard, and beep—there goes your discount. Lemonade is quieter. It’s more "background tech."

Tesla Insurance is perhaps the closest competitor in terms of "purity" of data. Tesla uses the car’s built-in sensors to calculate a Real-Time Safety Score. Lemonade is basically trying to bring that "Tesla experience" to every other car brand. They want to use the same granular data (following distance, aggressive turning) to price insurance for a Ford F-150 or a Toyota Prius.

Environmental impact and the "Green" angle

Lemonade pushes a heavy environmental narrative. They mention planting trees to offset the carbon emissions tracked by your device.

Is it a gimmick? Sort of. But it’s a gimmick with a paper trail. By tracking your exact mileage via the lemonade car insurance device, they calculate your carbon footprint and donate a portion of their "leftover" premium (the part they don't take as profit) to environmental causes through the Lemonade Giveback program. It makes the act of driving feel slightly less guilty, I guess.

What happens if you unplug it?

Don't.

If you unplug the device or disable your Bluetooth/GPS for an extended period, Lemonade will send you a series of increasingly firm emails. Eventually, they’ll revoke your "telematics discount." In some cases, if the device was a requirement for your specific policy type, they might even cancel your coverage or refuse to renew it. They need the data stream to keep the contract valid. It’s a two-way street: they provide the low rate, you provide the data.

👉 See also: Tax Deeds Miami Dade: Why Most Investors Get Burned (And How to Actually Win)

Is it right for you?

This isn't for everyone.

If you have a lead foot, stay away. If you live in a city with terrible drivers where you're constantly slamming on your brakes to avoid accidents, the device might misinterpret your defensive driving as "aggressive."

But if you’re a "boring" driver—someone who goes the speed limit, avoids the roads at 3 a.m., and works from home—you are leaving money on the table by not using a telematics-based system. The lemonade car insurance device is just the tool that proves to the underwriters that you aren't a risk.

Actionable Next Steps

- Check your port: Before signing up, look under your dash to ensure your OBD-II port is accessible and not damaged. Some older cars (pre-1996) won't have one, making the device useless.

- Audit your habits: For one week, try to drive without "hard braking." If you find it impossible, telematics insurance will likely frustrate you.

- Battery Check: Ensure your car battery is in good health. While these devices draw very little power, if your car sits for three weeks without moving, a plug-in device can contribute to a parasitic drain on an already weak battery.

- Permissions: If you pull the trigger, go into your phone settings immediately and set the Lemonade app to "Always Allow" for location. If you don't, you'll be paying full price for a discount you aren't receiving.