You’ve seen the red hexagon everywhere. It sits atop skyscrapers in London, glows over the harbor in Hong Kong, and pops up in quiet suburban strip malls. Most people just call it HSBC, but the full name—the Hongkong and Shanghai Banking Corporation—carries a weight that most modern fintech apps could never replicate. It’s a bank that essentially birthed the concept of global trade as we know it today. But honestly, if you think it’s just another boring financial institution, you’re missing the weird, gritty, and occasionally controversial history that built the modern world.

Money talks. This bank shouts.

The Hongkong and Shanghai Banking Corporation wasn't founded by some dusty committee in a London basement. It was started by a Scotsman named Thomas Sutherland in 1865 because he was tired of waiting for mail to arrive from Europe. He realized that the merchants trading tea, silk, and—yes, let’s be real—opium, needed a local bank that understood the chaotic reality of the China coast. They needed a bank that could handle silver bullion and credit without asking permission from a headquarters six months away by ship. So, he got a bunch of traders together and just... started it.

The Lions at the Door

If you ever visit the headquarters at 1 Queen's Road Central in Hong Kong, you’ll see two bronze lions. Their names are Stephen and Stitt. They’ve been through a lot. During the Japanese occupation in World War II, these lions were actually shipped to Japan to be melted down for scrap metal. Luckily, they were rescued from a shipyard in Osaka after the war and brought back home. You can still see the shrapnel scars on them from the Battle of Hong Kong. Locals touch their paws for good luck. It’s a superstition, sure, but in a city built on the volatile swings of the stock market, you take every bit of luck you can get.

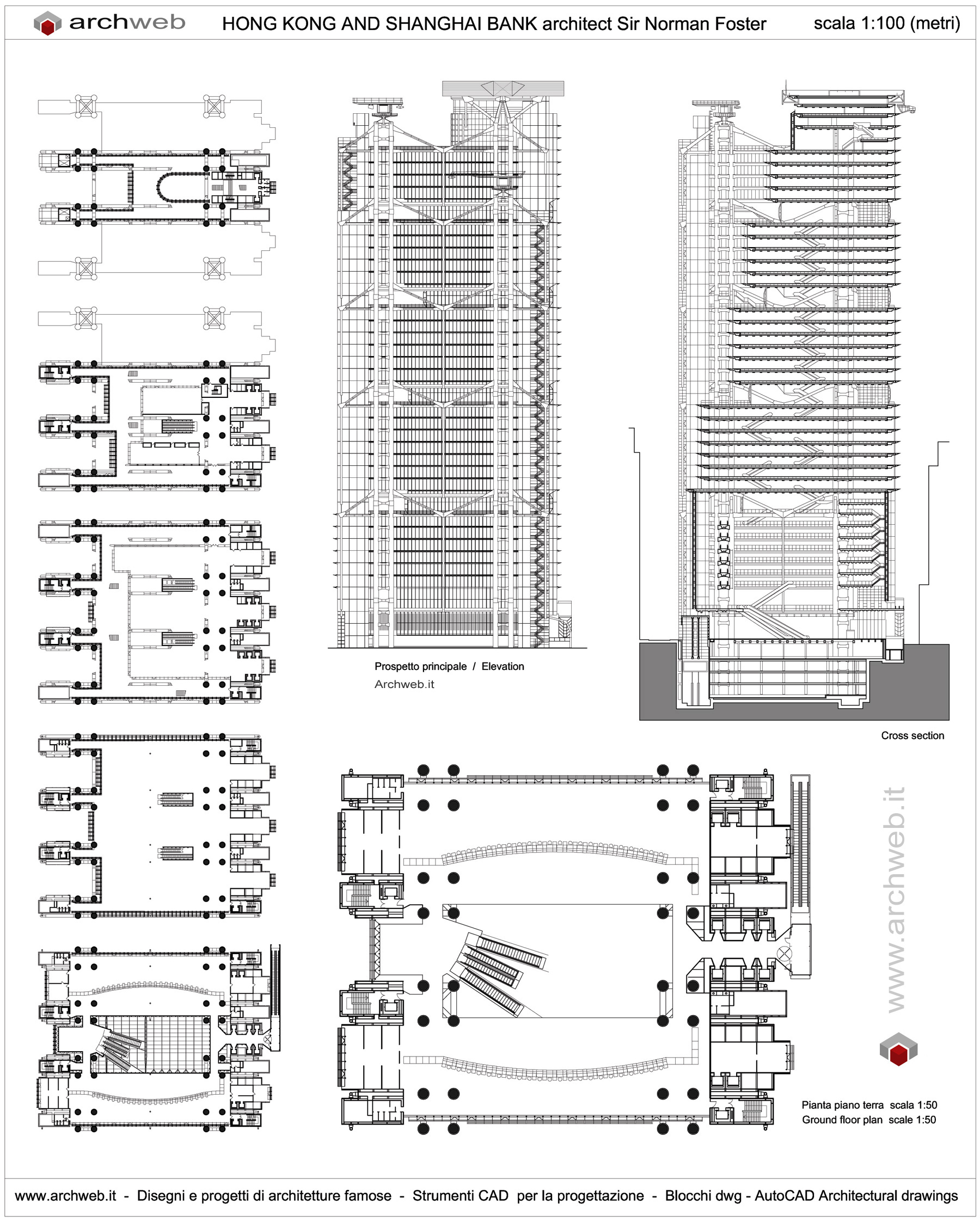

The building itself is a marvel of high-tech architecture. Designed by Lord Norman Foster, it was at one point the most expensive building in the world. Why? Because it’s modular. You can literally take it apart and move it. Back in the late 70s and early 80s, when the lease on the New Territories was coming to an end, there was a very real fear that the British might have to hand everything back to China. The bank wanted a headquarters that could be packed up and shipped away if things got too dicey. It’s basically a giant Lego set for billionaires.

Why the Name Still Matters (And Why It’s Confusing)

People often ask if HSBC is a Chinese bank or a British bank. The answer is "both and neither." It’s a bit of a mess, actually. In 1991, they created HSBC Holdings plc, a new parent company based in London, so they could buy Midland Bank. This was a massive shift. Suddenly, the Hongkong and Shanghai Banking Corporation was technically a subsidiary of a UK-domiciled firm. This move was strategic—it gave them a "lifeboat" in Europe before the 1997 handover of Hong Kong to China.

Yet, despite the London HQ, the heart of the profit engine remains in Asia. If you look at their annual reports, the vast majority of their adjusted profit comes from the Asian market. They are the "local" bank for millions in Hong Kong, issuing the majority of the city's banknotes. Think about that. A private company prints the money you use to buy a coffee. It’s a level of influence that most Westerners find hard to wrap their heads around.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The Regulatory Rollercoaster

It hasn't all been smooth sailing and fancy architecture. To understand the Hongkong and Shanghai Banking Corporation, you have to look at the 2012 deferred prosecution agreement with the U.S. Department of Justice. It was a dark period. They were caught up in some pretty heavy stuff regarding money laundering for Mexican drug cartels and dealings with sanctioned nations. They paid a $1.9 billion fine. It was a wake-up call that shifted the entire culture of the bank toward massive, sometimes stifling, compliance.

If you try to open a business account there today, you'll feel the ghost of 2012. The paperwork is endless. The "Know Your Customer" (KYC) rules are intense. They aren't doing it to be annoying; they're doing it because they almost lost their license to trade in US dollars. For a global bank, losing the ability to clear dollars is basically a death sentence.

The Pivot to Asia (Again)

Recently, there’s been this massive push called the "Pivot to Asia." It’s kind of funny because they never really left, but the strategy is now official. They are selling off "non-core" businesses in places like France, Canada, and the US to double down on the Greater Bay Area—that massive economic hub connecting Hong Kong, Shenzhen, and Guangzhou.

Wealth management is the new frontier. There is a staggering amount of new money in mainland China, and the Hongkong and Shanghai Banking Corporation wants to be the one to manage it. They’re betting the farm on the idea that the future of the global economy isn't in London or New York, but in the Pearl River Delta.

Common Misconceptions vs. Reality

Misconception: They are just another retail bank like Chase or Barclays.

Reality: They are a "bridge" bank. Their value isn't in your savings account; it's in their ability to help a factory owner in Vietnam sell goods to a retailer in Germany using a credit line managed in Hong Kong.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Misconception: The bank is owned by the Chinese government.

Reality: It is a publicly traded company on the London and Hong Kong stock exchanges. However, its largest shareholder has historically been Ping An Insurance, a Chinese giant, which has led to some very public disagreements about how the bank should be run. Ping An famously pushed for the bank to spin off its Asian business entirely to "unlock value." The board fought it off, but the tension remains.

How to Navigate HSBC Today

If you're looking to interact with the Hongkong and Shanghai Banking Corporation—whether as a customer, an investor, or a business owner—you need to understand their hierarchy.

For the average person, "HSBC Premier" is the sweet spot. It’s their mid-tier global service. If you have Premier status in one country, you get it in all of them. This is a lifesaver for expats. You can open a bank account in a new country before you even land. Most banks won't even talk to you until you have a local utility bill, but HSBC uses your global footprint to vouch for you. It's one of the few remaining perks of their "World's Local Bank" era.

On the business side, they are the kings of Trade Finance. If you are importing or exporting at scale, their Letters of Credit are basically the gold standard. But be warned: they are a huge bureaucracy. Things move slowly. You need a dedicated relationship manager who actually answers their phone, or you'll get lost in a sea of automated emails and compliance checks.

The Digital Shift

Let's talk about the app. For years, it was... not great. But they’ve poured billions into tech lately. They launched "Kinetic" for small businesses in the UK and have been trying to compete with "neobanks" like Monzo or Revolut. Honestly? They’re getting better, but they still feel like a big bank trying to wear sneakers. The real tech innovation is happening in their "Zing" app, which is a direct competitor to Wise for international transfers. It’s a sign that they finally realize that being big isn't enough anymore; you have to be fast.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Is It Still "The World’s Local Bank"?

They actually dropped that famous slogan a few years ago. It was too ambitious. You can't be "local" everywhere without becoming impossibly complex. Now, they focus on "Opening up a world of opportunity." It’s more vague, but probably more honest. They are a gateway.

The Hongkong and Shanghai Banking Corporation exists at the friction point between the West and the East. That’s a precarious place to be in 2026. As trade tensions fluctuate between Washington and Beijing, HSBC has to walk a tightrope. They have to follow Western sanctions while also complying with Hong Kong's National Security Law. It’s a geopolitical nightmare, but they’ve been navigating these waters since the days of steamships and telegraphs. They’re survivors.

Actionable Insights for the Modern User

If you're planning to use the Hongkong and Shanghai Banking Corporation for your financial needs, here is the "insider" way to do it:

- For Expats: Don't just open a basic account. Look into the "Global Money Account." It allows you to hold multiple currencies and transfer them instantly without the massive fees usually associated with big banks.

- For Business Owners: Use them for international trade, but keep a local neobank for your daily expenses. Use HSBC’s "Trade Pay" to manage your supply chain finance—it’s where their real power lies.

- For Investors: Watch the "Common Equity Tier 1" (CET1) ratio in their quarterly reports. It tells you how much "buffer" they have. In a volatile market, this is the most important number for a bank this size.

- The "Premier" Hack: If you’re moving countries, ask for a "Global Transfer." They can see your credit history in your home country and apply it to your new one, which is huge for getting a mortgage or a credit card in a place where you have no history.

The Hongkong and Shanghai Banking Corporation isn't just a place to park your money. It’s a 160-year-old experiment in globalism. It has survived wars, depressions, and digital revolutions. Whether you love them or find their bureaucracy maddening, there is no denying that they are the plumbing of global trade. If the plumbing stops working, the whole house starts to shake. Understanding how they operate is basically a lesson in how the world's money actually moves.

Check your statements, keep an eye on the exchange rates, and remember those lions. They’ve seen worse than a bad fiscal quarter.