You’re sitting at your kitchen table, staring at a pay stub that feels lighter than it should. Or maybe you’re looking at a bank balance and realizing April 15th is looming like a debt collector with a grudge. We’ve all been there. You start wondering about a how much federal tax should i pay calculator because the math just isn’t mathing. Honestly, most people treat their taxes like a "set it and forget it" slow cooker, but the IRS is more like a high-maintenance garden. If you don't prune it, the weeds take over.

The U.S. tax system is basically a "pay-as-you-go" deal. The government doesn't want to wait until next year to get its hands on your money. They want it now. Every time you get paid, a chunk of change vanishes before it even hits your account. But the problem is that the standard withholding tables used by payroll departments are often just... guesses. They’re educated guesses, sure, but they don't know about your side hustle, your new mortgage, or the fact that your kid just turned 17 and suddenly you lost that sweet, sweet Child Tax Credit.

The Math Behind the How Much Federal Tax Should I Pay Calculator

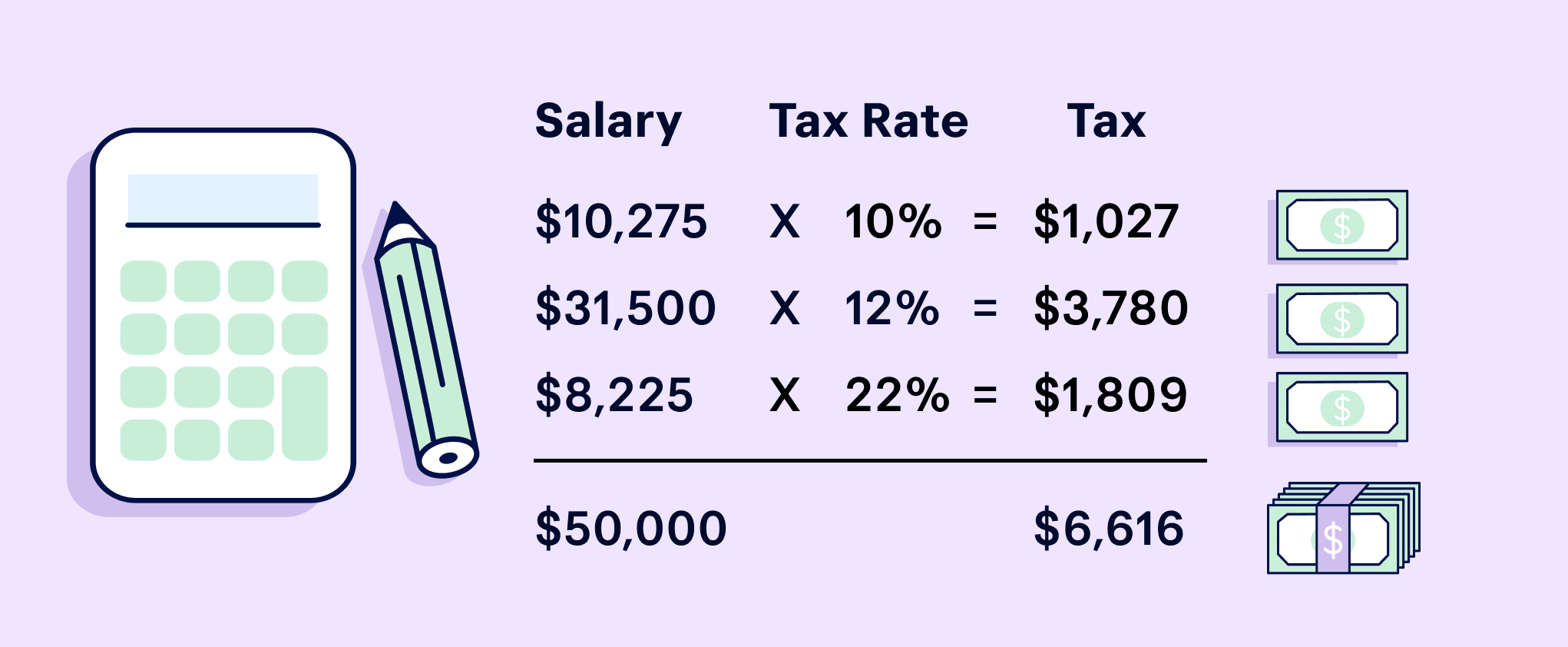

Let's get real about how the IRS actually looks at your wallet. For 2025 and 2026, we are still operating under the remnants of the Tax Cuts and Jobs Act (TCJA). This means we have seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

But here’s the kicker: being in the 22% bracket doesn’t mean you pay 22% on every dollar. That’s a massive myth that keeps people from taking raises because they’re "afraid of the next bracket." It’s progressive. You pay 10% on the first chunk, 12% on the next, and so on. If you use a how much federal tax should i pay calculator, it’s essentially trying to solve a puzzle where the pieces are constantly moving.

Your "taxable income" isn't your salary. It's your salary minus the Standard Deduction. For the 2025 tax year (the ones you file in early 2026), the standard deduction for single filers jumped to $15,000. For married couples filing jointly, it’s $30,000. If you make $60,000 as a single person, the IRS only cares about $45,000 of it. That’s the starting line.

Why Online Tools Often Give You Bad Advice

Most calculators you find on a random financial blog are too simple. They ask for your gross pay and your state, then spit out a number. That number is almost always wrong. Why? Because they ignore the "above-the-line" deductions.

Are you contributing to a 401(k)? That lowers your taxable income. Traditional IRA? Lower. Health Savings Account (HSA)? Lower again. If you’re self-employed, you’re also dealing with the Self-Employment Tax (15.3%), which is a whole different beast. A basic how much federal tax should i pay calculator might tell you that you owe $8,000, but it doesn't know you spent $3,000 on home office equipment or that you're paying off student loan interest.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

The IRS actually has its own tool called the Tax Withholding Estimator. It’s clunky. It looks like it was designed in 2004. But it’s the most accurate because it forces you to look at your most recent pay stub and account for every cent already withheld.

The W-4 Trap and How to Escape It

Remember that form you signed when you got hired? The W-4. You probably scribbled some numbers, checked "Single" or "Married," and handed it back to HR without a second thought. That piece of paper is the steering wheel for your taxes.

If you're wondering "how much federal tax should I pay," the answer is usually "just enough to avoid a penalty, but not so much that you're giving the government an interest-free loan." If you get a $5,000 refund every year, you're doing it wrong. That’s $400 a month you could have used for groceries, gas, or investing. You’re essentially letting Uncle Sam hold your money for a year and give it back with zero interest.

On the flip side, if you owe $3,000 at the end of the year, the IRS might hit you with an underpayment penalty. They want you to have paid at least 90% of your current year's tax or 100% of last year's tax (whichever is smaller) through withholding or quarterly payments.

Life Changes That Break the Calculator

- Getting Married: If both spouses work and earn similar high salaries, the "Marriage Penalty" can sneak up on you.

- The Side Gig: Uber, Etsy, Freelancing. None of these withhold taxes. You have to do it yourself.

- Capital Gains: If you sold some Bitcoin or stocks at a profit, that's taxable income, but it's not on your W-2.

- Kids: The Child Tax Credit is huge, but it phases out. And as mentioned, once they hit 17, the credit drops from $2,000 to a mere $500 Credit for Other Dependents.

Real World Example: The $75,000 Single Filer

Let's look at a hypothetical person, Sarah. She makes $75,000 a year in a mid-sized city.

Sarah's 2025 Standard Deduction is $15,000.

$75,000 - $15,000 = $60,000 taxable income.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

The first $11,925 is taxed at 10% ($1,192.50).

The income from $11,926 to $48,475 is taxed at 12% ($4,386).

The remaining $11,525 (the part over $48,475) is taxed at 22% ($2,535.50).

Total federal tax: $8,114.

If Sarah’s payroll department is only withholding $500 a month ($6,000 a year), she’s going to have a very bad April. She’ll owe over $2,000. This is exactly why using a how much federal tax should i pay calculator mid-year is so vital. You can catch these gaps before they become disasters.

How to Fix Your Withholding Right Now

You don't need a degree in accounting. You just need a little bit of time and your last two pay stubs.

First, go to the IRS website and search for the "Tax Withholding Estimator." Don't use the shady third-party ones that ask for your Social Security number—those are just lead-gen tools for high-interest loans.

Enter your total expected income for the year. Be honest. If you expect a bonus in December, include it. If you have a side job where you make $500 a month, include it. The tool will tell you exactly what your total tax liability is. Then, it compares that to what you’ve already paid.

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

If you’re behind, you need to file a new W-4 with your employer. There’s a specific line—Line 4(c)—for "extra withholding." If the calculator says you're going to be $1,200 short and there are 6 months left in the year, put $200 on that line. Boom. Problem solved.

Nuance: The Self-Employed Struggle

If you're a 1099 contractor, no one is withholding for you. You are the HR department. You are the payroll department.

A common rule of thumb is to set aside 25-30% of every check for taxes. That sounds high, but remember you’re paying both the employer and employee portions of Social Security and Medicare. Plus federal income tax. Plus state tax. It adds up fast. Using a how much federal tax should i pay calculator specifically designed for freelancers is better here because it factors in the QBI (Qualified Business Income) deduction, which can knock 20% off your taxable business income.

Actionable Steps for Your Tax Strategy

Don't wait for tax season to find out you're broke. Taxes are a year-round management task.

- Check your withholding every June and October. These are the "pivot points." In June, you have enough time to fix a small error. In October, you can still make a "hail mary" contribution to your 401(k) or HSA to lower your tax bill before the year ends.

- Adjust for Life Events. If you bought a house, your mortgage interest might allow you to itemize deductions instead of taking the standard one. If you had a baby, you’ve got a new credit.

- Use the "Safe Harbor" Rule. If you’re worried about penalties, just make sure you’ve paid 100% of what you owed last year. Even if you owe more this year, the IRS won't penalize you for the underpayment as long as you hit that mark.

- Max Out Tax-Advantaged Accounts. Every dollar you put into a traditional 401(k) is a dollar the IRS can't touch. If you’re in the 24% bracket, putting $10,000 into your 401(k) effectively "saves" you $2,400 in taxes.

- Keep Records of Everything. If you're using a calculator to estimate deductions, make sure you actually have the receipts. The IRS doesn't care what an online tool told you; they care what you can prove.

The goal isn't just to fill out a form. The goal is to keep more of your money. By staying on top of your federal tax liability, you avoid the stress of a surprise bill and keep your financial life on track. Check your stubs, run the numbers, and adjust that W-4 today.