Look at a map of the Gulf of Mexico. It’s basically a massive, underwater factory. Most people think about the 2010 Deepwater Horizon disaster when they hear "Gulf of Mexico and oil," or maybe they picture those rusty rigs you see from the beach in Galveston. But there is a much weirder, more complex reality happening a hundred miles offshore. We are talking about some of the most sophisticated engineering on the planet, sitting in thousands of feet of water, pumping millions of barrels a day. It’s not just a legacy patch; it’s the backbone of U.S. energy security, and honestly, it’s arguably more important now than it was twenty years ago.

Despite all the talk about the energy transition, the Gulf keeps breaking records. Why? Because the oil there is "low carbon intensity" compared to, say, the oil sands in Canada. It’s relatively easy to refine. It's close to the massive refinery complexes in Louisiana and Texas. So, while activists want to shut it down and investors are looking at wind, the actual business of sucking crude out of the seafloor is hitting a fever pitch.

The Gulf of Mexico and Oil: A Deepwater Chess Match

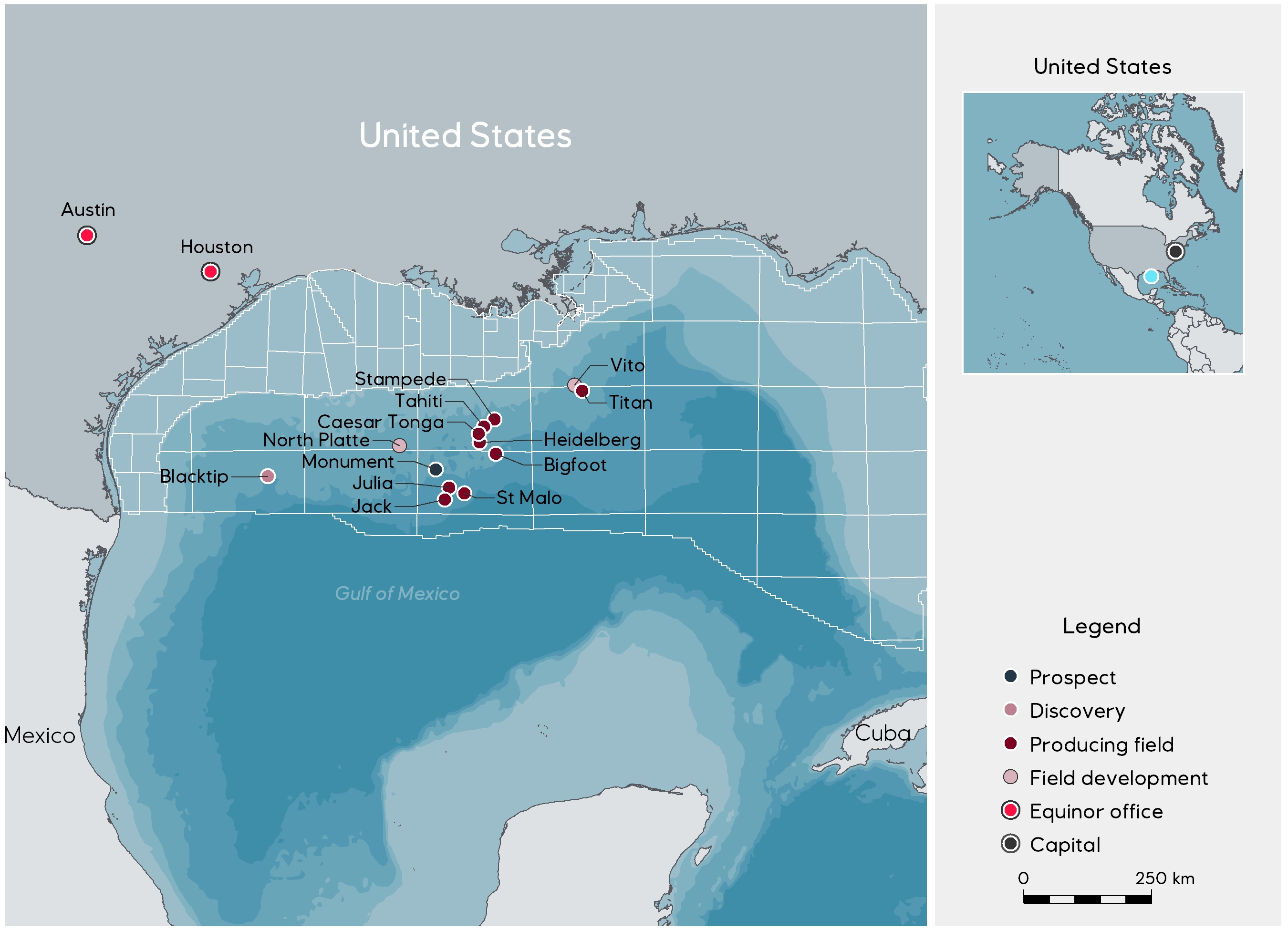

It isn't like drilling on land. You can't just poke a hole in the dirt. In the deepwater Gulf, specifically the Mississippi Canyon or the Keathley Canyon blocks, you’re dealing with "ultra-deep" depths. We are talking about the Thunder Horse platform or Shell’s Appomattox. These are essentially floating cities.

The geology here is a nightmare. There’s a massive layer of salt—the Louann Salt—that shifted millions of years ago. It acts like a giant, blurry curtain. For decades, seismic technology wasn't good enough to see under it. Engineers knew there was oil there, but they were basically "drilling blind" into the salt. Now, with supercomputing and 4D seismic imaging, companies like BP and Chevron can see exactly where the pockets are. It’s the difference between trying to find a needle in a haystack in the dark and using a high-powered flashlight.

Technically, the Gulf is divided into "Shelf" and "Deepwater." The shelf is the shallow stuff you see near the coast. That’s mostly tapped out. The real action—the stuff that keeps the lights on—is in the deepwater. According to the U.S. Energy Information Administration (EIA), deepwater wells account for about 80% of the total Gulf production. It’s a high-stakes game. A single well can cost $100 million. If you hit a "dry hole," you just burned a hundred million dollars. No big deal, right? That’s why only the "supermajors" play in the deep end.

The Miocene and Paleogene Play

Geologists get excited about "vintages" of rock. In the Gulf of Mexico and oil circles, the big talk for a long time was the Miocene. These were the reliable, high-pressure reservoirs that built the industry. But lately, everyone is obsessed with the Paleogene (or the Lower Tertiary).

👉 See also: Disney Stock: What the Numbers Really Mean for Your Portfolio

This stuff is deep. Like, 30,000 feet deep. The pressures are insane—upwards of 20,000 psi. For a long time, we didn't have the metal alloys or the gaskets that could handle that kind of heat and pressure without melting or snapping. Then came projects like Anchor by Chevron. They had to develop "20K" technology specifically to survive those conditions. It’s basically the equivalent of building a spaceship, but for the bottom of the ocean. If Anchor succeeds long-term, it opens up a massive new frontier that was previously "un-drillable."

Why the Economics Defy Logic

You’d think with the rise of EVs and solar, the Gulf would be a ghost town. It’s actually the opposite.

The Gulf of Mexico and oil production is incredibly "sticky." Once you spend $5 billion to build a platform, the incremental cost to get one more barrel out is tiny. These platforms are designed to run for 30 or 40 years. Unlike a fracking well in West Texas that drops off in production after 18 months, a deepwater Gulf well is a steady, roaring fire. It’s a cash flow machine.

- Infrastructure Advantage: There is a literal web of pipelines on the seafloor. If you find a small pocket of oil, you don't need a new platform. You just "tie back" to an existing one.

- Carbon Footprint: This is the part that surprises people. Because these wells produce so much volume from a single point, the methane leakage and energy used per barrel is often lower than land-based drilling.

- The Hub Model: Look at the Mars Corridor. Shell has a cluster of platforms there that share resources. It’s efficiency at a scale that’s hard to wrap your head around.

Honestly, the "death of the Gulf" has been predicted every decade since the 1970s. People called it the "Dead Sea" in the late 80s because they thought it was empty. Then they found the deepwater. Then they thought the 2010 spill would kill the industry through regulation. Instead, it just made the companies more disciplined.

The Regulatory Tug-of-War

Politics and the Gulf of Mexico and oil are inseparable. You have the Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement (BSEE). Every time there’s a new administration in D.C., the rules for lease sales change.

✨ Don't miss: 1 US Dollar to 1 Canadian: Why Parity is a Rare Beast in the Currency Markets

One year, lease sales are canceled. The next year, a court order says they have to happen. It creates a weird "stop-and-go" vibe for investment. But the industry plays the long game. They buy leases that last ten years. They don't care who is in the White House today; they care about who will be there in 2032 when the first oil from a new field finally hits the pipe.

There's also the Inflation Reduction Act (IRA). Interestingly, the IRA actually tied offshore wind development to oil and gas leasing. You want to build a wind farm in the Atlantic? You have to offer oil leases in the Gulf. It was a compromise that basically guaranteed the Gulf’s relevance for the next decade. It's a weird marriage of old and new energy.

Environmental Realities and the "Dead Zone"

We can't talk about the Gulf without the environmental cost. It's not just about spills. The "Dead Zone"—an area of low oxygen where marine life can't survive—is a huge issue. While people blame the oil industry, most of that actually comes from fertilizer runoff from the Midwest coming down the Mississippi River.

But the oil industry has its own baggage. Abandoned wells are a ticking time bomb. There are thousands of "orphan wells" in the shallow waters that no one wants to pay to plug. Small companies go bankrupt and leave the mess for the taxpayer. It’s a massive point of friction between the state governments of Louisiana and Alabama and the federal government.

What Happens Next?

The future of the Gulf of Mexico and oil isn't just about oil anymore. It’s about Carbon Capture and Storage (CCS).

🔗 Read more: Will the US ever pay off its debt? The blunt reality of a 34 trillion dollar problem

The same geology that holds oil—porous sandstone capped by impermeable salt—is perfect for sucking CO2 out of the atmosphere and shoving it back underground. Companies like ExxonMobil are planning huge CCS hubs along the Gulf Coast. They want to take the emissions from the refineries in Houston and Beaumont and pipe them into the old, empty oil reservoirs.

It’s a bit ironic. The industry that "caused" the carbon problem is now using the same holes in the ground to "solve" it. But from a business perspective, it makes total sense. They already have the pipes, the ships, and the geologists who know the seafloor better than anyone.

Actionable Insights for Following the Industry

If you're trying to track where this is going, stop looking at the price of oil today. It doesn't matter for the Gulf. Look at these three things instead:

- Rig Counts in Deepwater: Watch the utilization rates of high-spec "drillships." If the daily rental rate for a drillship hits $500,000, the industry is in a massive boom.

- Tie-back Announcements: Small discoveries that connect to old platforms are the "secret sauce" of profitability right now. They are low-risk and high-reward.

- The 20K Limit: Keep an eye on the Beacon Offshore Energy Shenandoah project. If they can successfully manage 20,000 psi environments, a whole new layer of the Gulf becomes a gold mine.

The Gulf isn't going anywhere. It’s a high-tech, high-pressure, high-stakes world that basically ignores the headlines. Whether you love the industry or hate it, the engineering required to pull oil from five miles under the sea floor is, quite frankly, insane. It’s a feat of human will that continues to defy the odds, even as the world tries to move on.

Mapping the Future

To really understand the landscape, you have to look at the transition. The Gulf is becoming an "energy province" rather than just an oil field. This includes the massive expansion of LNG (Liquefied Natural Gas) export terminals along the coast. The gas comes from the Permian Basin, but it leaves through the Gulf.

- Follow the lease sales: The maps provided by BOEM show exactly where companies are betting their billions.

- Watch the "Jones Act" vessels: These are the specialized U.S. ships that service the rigs. Their availability often dictates how fast projects move.

- Seismic Technology: Keep an ear out for "Ocean Bottom Nodes" (OBN). This is the tech that is finally letting us see the oil through the salt curtains.

The Gulf of Mexico and oil story is far from over. It's just entering a new, more technical, and much more expensive chapter. The easy oil is gone, but the "hard" oil is still there in quantities that keep global markets stable. It's a brutal environment, but for the companies that can survive it, the rewards are still too big to walk away from.