Ever get into a heated debate at a backyard BBQ about which president actually "fixed" the economy? We’ve all been there. Someone pulls out a phone, shows a jagged line on a screen, and suddenly, that specific graph of economy by president becomes the ultimate truth. But here is the thing. Data is messy. It’s loud, it’s often biased by whoever is presenting it, and it rarely tells the whole story in a single snapshot.

Economic success isn't just one thing. It's a chaotic mix of GDP growth, unemployment rates, the S&P 500, and inflation. You can't just look at a line going up or down and say, "Yep, that was all because of the guy in the Oval Office." Presidents aren't kings. They share power with Congress, and they’re at the mercy of the Federal Reserve—an entity that arguably has more influence over your wallet than the White House does.

Why that graph of economy by president isn't as simple as it looks

If you look at a chart of the Dow Jones Industrial Average over the last fifty years, it looks like a mountain range that mostly goes up. People love to point at the steep climbs under Clinton or Trump or Obama and claim victory. But markets are forward-looking. They often react to what they think will happen, not just what is happening.

Take the post-2020 recovery. If you look at the graph of economy by president for the transition between Trump and Biden, you see a massive spike in GDP followed by terrifying inflation. Is that because of Biden’s American Rescue Plan? Or was it the lingering supply chain ghost of the pandemic? Most serious economists, like those at the Bureau of Economic Analysis, will tell you it's a bit of both, mixed with a healthy dose of global energy price shocks.

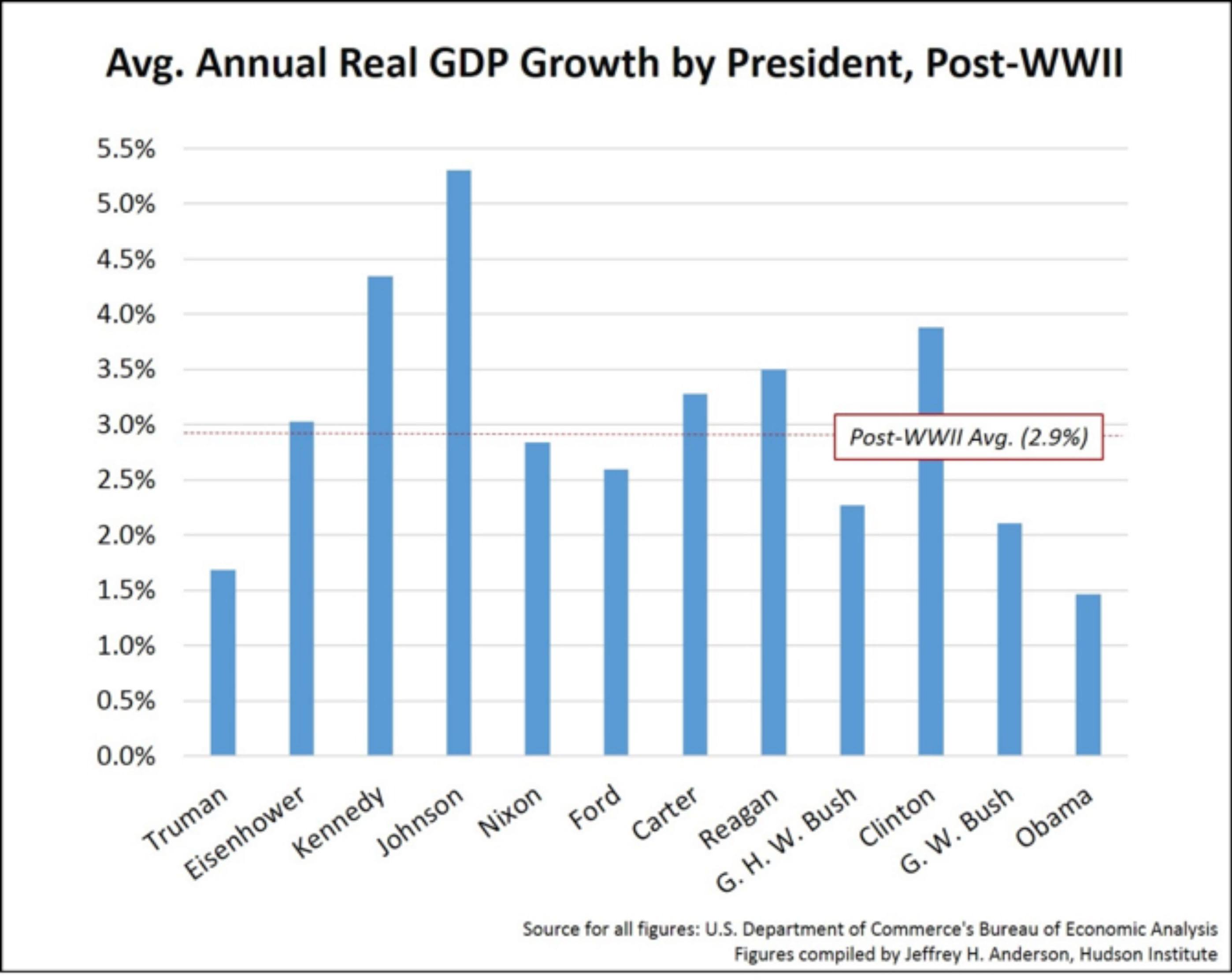

Context matters. A president inheriting a recession, like Obama in 2009, is going to have a graph that looks very different from someone inheriting a booming tech era like Bill Clinton did in the 90s. When Reagan took office in 1981, he was staring down "stagflation"—a nasty cocktail of stagnant growth and high prices. His graph starts in a hole. You have to account for the starting line.

The GDP factor and the "Lags"

GDP growth is the big one. It’s the total value of everything we make and do. Historically, Democrats often point to higher average GDP growth since World War II. According to data from the National Bureau of Economic Research, the economy has technically grown faster on average under Democratic administrations.

Why? It’s a point of massive debate. Some say it's consumer-focused spending. Others argue it’s just luck—the timing of the business cycle.

📖 Related: The Natascha Kampusch Case: What Really Happened in the Girl in the Cellar True Story

There is also the "lag effect." A law signed today might not actually impact the "graph of economy by president" for two or three years. The tax cuts passed under Trump in 2017 didn't fully permeate the corporate landscape until 2018 and 2019. Similarly, the infrastructure bills signed by Biden are long-term plays. They are meant to move the needle over a decade, not a fiscal quarter.

Jobs, Jobs, and More Jobs

Unemployment is the metric people feel in their bones. When the line on the graph goes down, people feel secure. When it spikes, like it did in 2008 or 2020, panic sets in.

- The Reagan Era: Saw a massive drop in unemployment after the early 80s recession, falling from nearly 11% to under 6%.

- The Clinton Years: Often cited as a "golden era," where the graph shows a steady, almost rhythmic decline in joblessness, ending his term around 4%.

- The Modern Seesaw: Trump saw record-low unemployment for minorities before the COVID-19 cliff. Biden then saw a rapid return to those lows, with the graph showing a "V-shaped" recovery that surpassed most projections.

But here is a nuance most people miss: the labor force participation rate. If people stop looking for work, the unemployment rate looks better, but the economy isn't actually healthier. A truly honest graph of economy by president should probably overlay unemployment with participation rates to show who is actually "winning."

The Inflation Monster

Honestly, nobody cared about inflation graphs for about thirty years. Then 2021 happened.

Inflation is the great equalizer—or the great destroyer. You can have 5% wage growth, but if the inflation line on your graph is at 8%, you’re actually getting poorer. This is where the Biden-era charts get tricky. While job growth was historic, the cost of eggs and gas became the primary political metric.

Presidents get blamed for gas prices. It's a tradition. But look at a global chart. When oil prices spiked in 2022, they spiked in London, Tokyo, and Berlin too. A president can release oil from the Strategic Petroleum Reserve, which Biden did, but they don't control the OPEC+ spigot.

👉 See also: The Lawrence Mancuso Brighton NY Tragedy: What Really Happened

The National Debt: The line that only goes up

If you want to see a graph that is truly bipartisan, look at the National Debt. It doesn't matter who is in charge. Since the early 2000s, the line has gone vertical.

Bush had the wars in Iraq and Afghanistan. Obama had the Great Recession stimulus. Trump had the 2017 tax cuts and COVID relief. Biden had the Inflation Reduction Act and more COVID era spending.

We are currently hovering around $34 trillion. When you see this graph of economy by president, you realize that both parties have essentially agreed to fund the present by borrowing from the future. It’s the one area where the "who is better" argument usually falls apart because everyone is spending money we don't have.

Real-world impact vs. Abstract lines

We talk about these graphs like they are sports scores. "My guy had 3% growth, yours had 2%!"

But the "economy" isn't a monolith. In the 1950s, a graph of the economy showed a rising tide lifting almost all boats. Manufacturing was king. Today, the graph is "K-shaped." That means the tech sector and high-earners see their line go to the moon, while service workers see their line stay flat or even dip when adjusted for the cost of housing.

A president might boast about a record-breaking S&P 500. And they do. Frequently. But if 50% of the country doesn't own stocks, that graph is meaningless to them. When looking at any graph of economy by president, always ask: "Who is this line representing?"

✨ Don't miss: The Fatal Accident on I-90 Yesterday: What We Know and Why This Stretch Stays Dangerous

The Federal Reserve: The invisible hand

You can't talk about these graphs without mentioning Jerome Powell or Alan Greenspan. The Fed sets interest rates. If the Fed raises rates to fight inflation, the economy slows down. The president can scream all they want, but the Fed is technically independent.

Much of the "economic boom" of the 2010s was fueled by "easy money"—interest rates near zero. That wasn't an Obama policy or a Trump policy; it was a central bank policy. When the Fed finally started hiking rates in 2022 and 2023 to kill inflation, the "graph of economy by president" for Biden’s term showed a housing market that basically froze.

How to actually read these charts without the bias

So, how do you look at a graph of economy by president without getting fooled?

First, look at the Y-axis. Is it starting at zero? If it starts at, say, 3.5% and goes to 4%, a small change can look like a massive cliff. It's a classic trick used in political ads.

Second, check the dates. Does the "Trump economy" start the day he was inaugurated, or do you give it six months for his policies to kick in? Does the "Obama recovery" include the tail end of the 2008 crash that he didn't cause?

Third, look for "Real" numbers. "Real GDP" or "Real Wages" means the data has been adjusted for inflation. If a graph isn't "Real," it’s basically garbage for long-term comparison because a dollar in 1990 isn't a dollar in 2024.

Actionable Insights for the Savvy Data Consumer

Don't let a single chart dictate your entire political worldview. The economy is a massive, $27 trillion engine with millions of moving parts. To be a more informed observer, follow these steps:

- Cross-reference sources: If you see a chart on social media, go to the source. Use the St. Louis Fed (FRED). It is the gold standard for economic data and allows you to overlay different presidencies yourself.

- Focus on the "Why" not just the "What": If unemployment dropped, was it because of a new trade deal, or because 2 million Baby Boomers retired? Retirement isn't a "policy win," it's just demographics.

- Watch the Debt-to-GDP ratio: Total debt is scary, but the ratio of debt to how much we actually produce is the number that economists worry about. If that ratio is climbing regardless of who is president, the underlying structure of the economy has a problem that tax cuts or stimulus checks won't fix.

- Ignore the "First 100 Days" graphs: They are functionally useless. No economic policy can fundamentally change the trajectory of a global economy in three months. Look at the "Second Two Years" of a term to see the actual impact of an administration's legislative agenda.

- Look at Global context: If the US is growing at 2% and the rest of the G7 is at 0%, the president is doing something right. If the US is at 2% and everyone else is at 5%, we’re falling behind.

Understanding the graph of economy by president requires a bit of skepticism and a lot of context. It’s rarely as simple as "Red good, Blue bad" or vice versa. The real story is usually found in the overlaps, the global trends, and the quiet decisions made by the Federal Reserve.