You probably think the minimum wage has always been a thing, but for most of American history, it wasn't. It didn't exist. Before 1938, if your boss wanted to pay you five cents an hour to work in a sweltering basement, that was basically between you and them. The history federal minimum wage is actually a story of massive legal battles, a desperate President, and a Supreme Court that kept saying "no" until it finally said "yes."

It’s kind of wild to think about now.

Most people assume the wage floor was created just to be nice to workers. Honestly, that’s only half the story. It was actually a survival tactic for a country that was literally falling apart during the Great Depression. When Franklin D. Roosevelt signed the Fair Labor Standards Act (FLSA), he called it the most important piece of legislation since the Civil War. He wasn't exaggerating. The economy was a mess, and people were working for "starvation wages" that kept them from buying the very products they were making.

The Messy Reality of the 25-Cent Starting Line

In 1938, the first federal minimum wage was set at exactly $0.25 per hour.

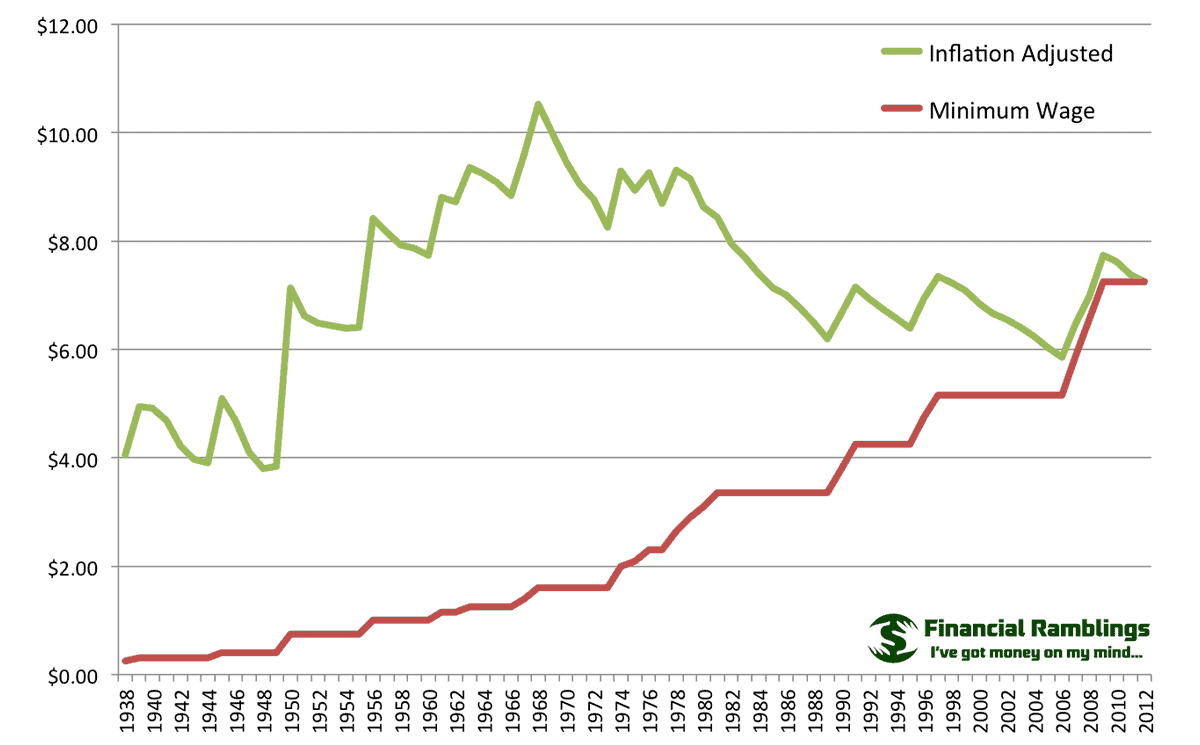

Sounds like a joke, right? But back then, it was a massive deal. That quarter is worth about $5.50 in today's money when you adjust for inflation, which is actually lower than the current federal rate of $7.25, but the impact was different. It initially only covered about 20% of the workforce. If you worked in a local grocery store or on a small farm, you were out of luck. The law mainly targeted industries involved in "interstate commerce," like manufacturing and transportation.

🔗 Read more: What Is Venezuela Currency Called? The Truth About the Bolivar

FDR had to fight like hell to get this through. The Supreme Court had a habit of striking down labor laws, arguing they interfered with the "freedom of contract." They basically said the government had no business telling a grown adult what they could or couldn't agree to be paid. It took a shift in the court’s makeup—and a lot of political pressure—to finally make the wage floor stick.

Why the 1960s Were the High-Water Mark

If you want to know when the minimum wage was actually "good," you have to look at 1968. That’s the peak.

In 1968, the minimum wage was $1.60. If you run that through an inflation calculator, that’s roughly $14 to $15 in today's buying power. Think about that for a second. A gas station attendant in the late sixties had more purchasing power than a retail worker today making the federal minimum. It’s a staggering gap. This was the era when the wage actually kept pace with how much stuff workers were producing.

But then, things started to stagnate.

The history federal minimum wage shows a pattern: Congress raises it, inflation eats it, and then everyone waits a decade to fix it. Unlike Social Security, the minimum wage isn't "indexed." It doesn't go up automatically when the price of eggs or rent goes up. It requires an actual Act of Congress. And as we've seen over the last twenty years, getting Congress to agree on the color of the sky is hard enough, let alone a pay raise for millions of people.

The Longest Gap in American History

We are currently living through a record-breaking drought. The federal minimum wage hasn't moved since July 24, 2009.

That’s over 16 years.

Back in 2009, $7.25 could buy a lot more than it can in 2026. The previous record for the longest stretch without an increase was between 1997 and 2007. We blew past that record years ago. What’s interesting is that while the federal government has stayed silent, the states have gone rogue. This has created a bizarre "patchwork" economy.

If you walk across the border from a state like Pennsylvania (which sticks to the $7.25 federal rate) into a state like Maryland or New York, the legal floor for your time can literally double.

- The West Coast Model: States like Washington and California have moved toward $16+ and often link their increases to the Consumer Price Index.

- The Southern/Midwest Stalemate: Many states in these regions have laws that explicitly prohibit cities from raising their own local minimum wages above the federal level.

- The "Fight for $15" Legacy: What started as a protest by fast-food workers in NYC in 2012 eventually became the benchmark for most state-level increases, even if the federal government never adopted it.

Does Raising It Actually Kill Jobs?

This is the big question economists have been screaming at each other about for eighty years.

The "Old School" view—led by folks like Milton Friedman—was that if you raise the price of labor, employers will buy less of it. Period. It's basic supply and demand, right? Well, it's not that simple. In 1994, economists David Card and Alan Krueger did a famous study comparing fast-food employment in New Jersey (which raised its wage) and Pennsylvania (which didn't).

They found that employment didn't drop in New Jersey. In some cases, it went up.

Why? Because when people have more money, they spend it. That retail worker who gets a $2 raise spends that money at the grocery store or the mechanic, which fuels more demand. However, there is a "tipping point." If you raised the minimum wage to $100 an hour tomorrow, the economy would collapse. The debate isn't about whether a floor should exist; it's about where that floor sits before it starts hurting more than it helps.

The Tipped Minimum Wage Loophole

We can't talk about the history federal minimum wage without mentioning the "sub-minimum" wage for tipped workers. This is a weird relic. Since 1991, the federal tipped minimum wage has been stuck at $2.13 per hour.

The idea is that tips make up the difference. If they don't, the employer is legally required to top you up to $7.25. But in reality? Wage theft is a massive issue here. Many workers don't know their rights, and many owners "forget" to do the math. Several states, including Alaska, California, and Minnesota, have actually abolished this two-tier system, requiring everyone to be paid the full state minimum before tips.

Specific Milestones You Should Know

It wasn't a straight line up. It was a series of jumps.

- 1949: The wage jumped from $0.40 to $0.75. This was a huge 87% increase, the largest single percentage jump in history.

- 1961: Retail and service workers were finally brought under the umbrella. Before this, "minimum wage" was mostly for factory workers.

- 1977: Jimmy Carter signed a series of hikes that brought the wage up to $3.35 by 1981.

- 2007-2009: The most recent series of hikes, moving the rate from $5.15 to $7.25 in three steps.

Looking at these dates, you see a trend. The raises usually happen in clusters when the economy is doing okay and the political will is there. When things get polarized, the wage just sits there, rotting against inflation.

Real-World Impact: Who is Actually on the Minimum Wage?

There's a myth that it's only teenagers flipping burgers.

According to the Bureau of Labor Statistics (BLS), the majority of people making the minimum wage (or less) are over age 25. Many are women, often single mothers, working in service or caregiving roles. In states that still use the $7.25 federal rate, these workers are effectively living in a different economic reality than those in high-wage states.

It also creates a "ripple effect." When the minimum wage goes up, it’s not just the people at the bottom who get a raise. Employers often have to bump up the pay of the supervisors and more experienced workers to maintain a "buffer." This is called "wage progression," and it’s why even people making $15 or $18 an hour often care deeply about what happens to the $7.25 rate.

The Problem with a "National" Rate

One of the smartest arguments against a high federal minimum wage is that $15 an hour goes a lot further in rural Mississippi than it does in downtown San Francisco.

A "one size fits all" approach is hard. If you set the federal rate too high, you might bankrupt small businesses in low-cost areas. If you set it too low, it’s useless in big cities. This is why the history federal minimum wage is moving toward a world where the federal rate acts as a "safety floor" for the poorest regions, while states and cities do the heavy lifting for their local economies.

What You Can Do Now

Understanding the history is one thing, but navigating the current landscape is another. If you are an employer or an employee, here is how you should handle the current stagnation:

- Check Your State, Not the Feds: If you are looking for a raise or checking compliance, the federal $7.25 is increasingly irrelevant. Check the Department of Labor’s state map for your local rate, which is almost certainly higher if you aren't in the Deep South or parts of the Midwest.

- Audit for Wage Theft: If you work for tips, ensure your "base + tips" always equals at least $7.25 per hour (or your state's minimum). If your employer isn't topping you off during slow shifts, they are breaking federal law.

- Watch for New Rules: Even without a "wage hike," the Department of Labor often changes "overtime" rules. In 2024 and 2025, new thresholds were set that make more salaried workers eligible for overtime pay if they earn below a certain yearly amount. This is a "backdoor" way the government raises pay without touching the minimum wage itself.

- Negotiate Based on "Market Rate": In 2026, the market rate for labor in most industries is far above $7.25. Use sites like Glassdoor or the BLS Occupational Outlook Handbook to find the actual median wage for your role in your specific zip code. Don't let a stagnant federal law dictate your value in a competitive market.

The federal minimum wage isn't just a number on a paycheck. It’s a reflection of what we think a person’s time is worth at a bare minimum. Whether it moves again soon or stays frozen for another decade, its history proves that it only changes when the public demand becomes louder than the economic fear.