Money matters. But if you’ve ever looked at a government pay chart, your head probably started spinning faster than a centrifuge at NASA. Most people think they understand the federal employee pay schedule, but the reality involves a messy, bureaucratic overlap of base pay, locality adjustments, and "step" increases that can change depending on whether you're sitting in an office in D.C. or a field site in rural Wyoming.

It’s not just one big list of numbers.

Federal pay is a massive, living architecture managed primarily by the U.S. Office of Personnel Management (OPM). For the vast majority of the white-collar workforce, we are talking about the General Schedule, or GS system. This system covers about 1.5 million workers globally. If you’re trying to budget for a new car or just wondering if that promotion is worth the extra stress, you need to look past the "base" numbers.

The General Schedule: It’s All About the Grades

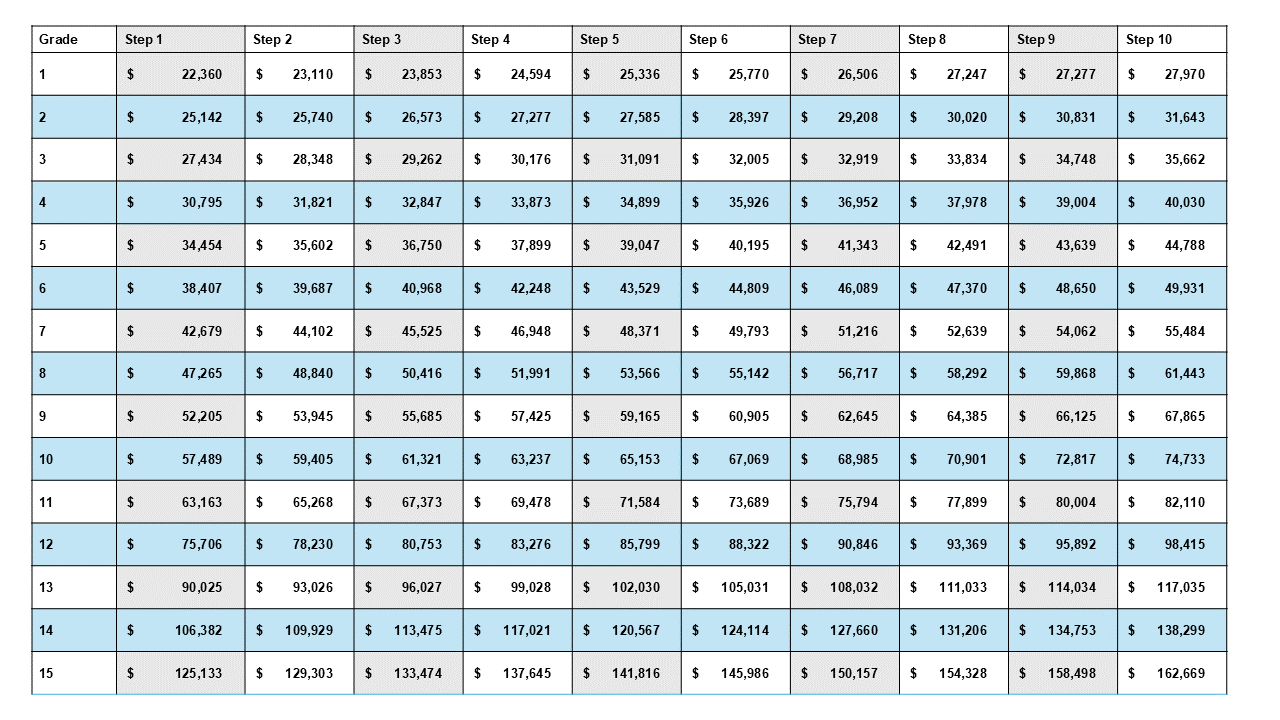

Think of the GS system as a ladder with 15 rungs. These rungs are called "grades." A GS-1 is basically entry-level, often reserved for student trainees or very high-volume clerical work, while a GS-15 is the top tier, reserved for senior technical experts and high-level managers.

But wait. There’s a catch.

Within every single grade, there are 10 "steps." You don’t just jump from GS-12 to GS-13 because you had a good year. You usually move horizontally across the steps first. Steps 1 through 3 usually happen every year. Then the wait gets longer. Moving from step 4 to 5 takes two years of "acceptable" performance. Once you hit the high end, like moving from step 9 to 10, you’re looking at a three-year wait. It’s a marathon, not a sprint.

Honestly, the federal employee pay schedule rewards longevity more than almost any other system in the modern world. You can be the smartest person in the room, but if you're a GS-13 Step 1, you're making significantly less than the "lifelong" employee at Step 10 who has been doing the same job since the 90s.

Locality Pay: The Great Geographic Equalizer

Here is where it gets spicy.

✨ Don't miss: Walmart Distribution Red Bluff CA: What It’s Actually Like Working There Right Now

If you live in San Francisco, your rent is astronomical. If you live in Mobile, Alabama, it’s… not. The government knows this. To keep federal jobs competitive with the private sector, they add "Locality Pay" on top of the base GS scale.

The "Rest of U.S." (RUS) rate is the baseline for everywhere that doesn't have its own specific pay area. But if you’re in a high-cost area like New York City, Houston, or Los Angeles, your paycheck gets a percentage-based bump. For 2025 and 2026, these adjustments have been a major point of contention in Congress.

Take the Washington-Baltimore-Arlington area. It consistently has one of the highest locality adjustments in the nation. Someone at a GS-12 level in D.C. might make $15,000 to $20,000 more per year than someone with the exact same job title in a rural part of the Midwest. It sounds fair until you realize that even with that extra $20k, the D.C. employee is still struggling to buy a townhouse within an hour's commute of the Pentagon.

Why the 2026 Pay Raise Actually Matters

Every year, the President and Congress haggle over the annual pay adjustment. Usually, it’s a split between a general "across-the-board" increase and a locality-specific increase.

For 2026, the discussions have centered on keeping up with the lingering effects of inflation. When the private sector raises wages to attract talent, the federal government has to follow suit or risk a "brain drain" to contractors like Lockheed Martin or Deloitte.

We saw a significant push for a 2.0% to 3.5% increase recently. While that sounds small, when you apply it across millions of employees, it represents billions in taxpayer dollars. It’s a balancing act. The government wants to be a "model employer," but they also have to answer to a public that is often skeptical of "bureaucrats" getting raises.

Special Rates and The "Technical" Exception

Not everyone is on the standard GS scale. If you're a cyber security expert or a specialized medical professional, the standard federal employee pay schedule might look like a joke compared to what Google or a private hospital would pay you.

🔗 Read more: Do You Have to Have Receipts for Tax Deductions: What Most People Get Wrong

To fix this, OPM uses "Special Rates."

These are authorized under Title 5 of the U.S. Code. They allow agencies to pay certain positions way above the standard scale to prevent people from quitting for 40% raises elsewhere. For example, the VA (Department of Veterans Affairs) frequently uses special salary rates for nurses and physicians. If they didn't, the hospitals simply wouldn't have staff.

There are also entirely different systems like:

- The Wage Grade (WG) system: For "blue-collar" trades and labor.

- The Senior Executive Service (SES): For the big bosses who don't have "steps" but have performance-based pay.

- AcqDemo or Title 38: Specialized systems for defense acquisition and healthcare.

The "Salary Cap" Problem

There is a ceiling. It’s called the Level IV of the Executive Schedule.

Basically, the law says that most federal employees cannot make more than certain high-level political appointees. In high-cost areas like San Francisco, senior GS-15 employees often hit this "pay cap." This means that even if the President gives everyone a 5% raise, the people at the very top of the scale get $0 of it because they are already bumped up against the legal limit.

This creates a weird phenomenon called "pay compression." You end up with supervisors making the exact same amount as the people they manage. It’s a huge morale killer. Why take on the stress of a director-level role if you aren't getting a dime more than the guy sitting in the cubicle outside your office?

Cracking the Code on Your Own Paychecks

If you're looking at a job offer or a promotion, don't just look at the Grade. Look at the Step. Look at the Locality. And look at the benefits.

💡 You might also like: ¿Quién es el hombre más rico del mundo hoy? Lo que el ranking de Forbes no siempre te cuenta

The federal employee pay schedule is only half the story. You have to factor in the FERS (Federal Employees Retirement System) pension, the TSP (Thrift Savings Plan) match, and the fact that federal health insurance (FEHB) is generally much more stable than private-sector plans.

Real Steps to Maximize Your Federal Salary

Don't just wait for the annual January raise. You have to be proactive.

Request a Recruitment Incentive. If you are being hired from the private sector into a hard-to-fill role, you can often negotiate a "step increase" before you even start. Instead of starting at Step 1, ask for Step 4 or 5 based on your "superior qualifications." Once you're in the system, this is almost impossible to do, so do it during the hiring process.

Track Your WGI (Within-Grade Increase). Check your SF-50 (Notification of Personnel Action). Make sure your HR department is actually processing your step increases on time. Mistakes happen, and in a system this big, things slip through the cracks.

Look for "Ladder" Positions. If you can, apply for jobs listed as "GS-7/9/11/12." These are "target" positions where you can be promoted to the next grade every year without having to compete with other applicants, provided you're doing a good job. It’s the fastest way to climb the schedule.

Understand the "Two-Step Rule." When you get promoted from one grade to another (say, GS-11 to GS-12), the government uses a specific formula. They take your current pay, find what it would be if you were two steps higher, and then find the lowest step in the new grade that exceeds that amount. It’s a weird bit of math that ensures a promotion always results in a decent pay jump.

The system is rigid. It’s slow. It can be incredibly frustrating. But it’s also transparent. You know exactly what your boss makes, and you know exactly what you’ll be making in five years if you stay in your seat. In an economy that feels increasingly volatile, there’s a certain comfort in that predictability.

Check the current OPM website for the most recent locality tables, as they are updated every January. Look specifically for the "Salary Table 2026" (or the current year) to see the exact breakdown for your specific city. Compare the "Base" table with your "Locality" table to see exactly how much of your "COLA" (Cost of Living Adjustment) is actually being funded.