If you’ve ever bought a $5 t-shirt from Temu or a pair of $12 earbuds from AliExpress and wondered how they got to your front door in Ohio for basically zero shipping cost, you’ve met the "de minimis" loophole. It’s a Latin term. It basically means "the law doesn't care about small things." For years, it was the secret sauce of the global e-commerce boom. But the party is ending. The end of de minimis as we know it is currently unfolding in Washington D.C., and honestly, it’s going to change how everyone shops online.

What's actually happening with the de minimis rule?

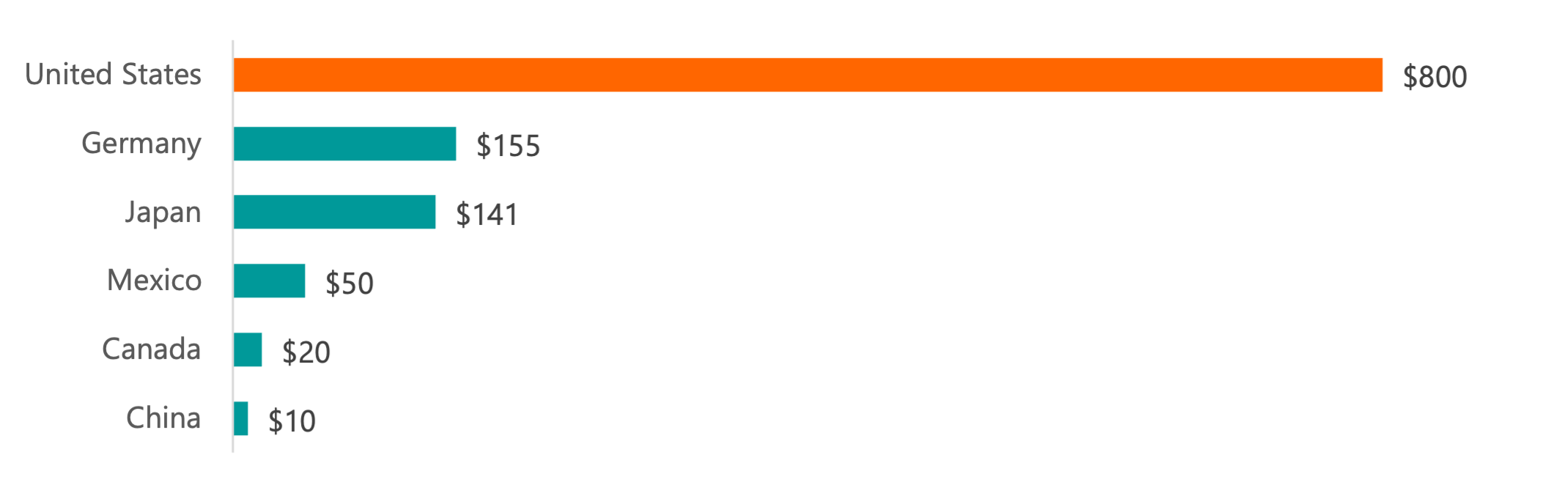

Right now, Section 321 of the Tariff Act of 1930 allows packages worth less than $800 to enter the United States duty-free. No taxes. No intensive inspections. Just a straight shot from a warehouse in Shenzhen to your mailbox.

In 2023 alone, over one billion—yes, billion with a B—packages entered the U.S. under this exemption. It's a massive volume. Most of these come from Shein and Temu. The Biden-Harris administration recently announced a major crackdown. They aren't just "looking into it." They are using executive rulemaking to strip de minimis eligibility from any products covered by Section 301, Section 201, or Section 232 trade enforcement actions.

Since about 70% of Chinese textile and apparel imports fall under those Section 301 tariffs, this move effectively marks the end of de minimis for the vast majority of budget fast fashion.

Why the sudden panic?

It’s not just about taxes. It's about safety. And politics. Custom and Border Protection (CBP) officers are overwhelmed. How do you check a billion packages for fentanyl or lead-tainted toys when they arrive in individual mailers? You can't.

Lawmakers like Senator Sherrod Brown and Representative Earl Blumenauer have been screaming about this for a while. They argue that American retailers like Target or Gap have to pay tariffs when they bring in shipping containers of clothes, while Shein gets a free pass by shipping directly to customers. It’s an un-level playing field. It's also why you might see a $15 hoodie suddenly jump to $22 once these rules are fully baked in.

The logistics nightmare no one is talking about

Think about the paperwork.

💡 You might also like: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

Imagine a single cargo plane landing in Los Angeles. If it’s carrying 50,000 individual packages, and suddenly 35,000 of those require formal entry because they no longer qualify for de minimis, the system grinds to a halt.

Logistics experts are sweating.

Brokers are going to be swamped. A formal entry requires a lot more data than a simple de minimis manifest. You need Harmonized Tariff Schedule (HTS) codes. You need precise valuations. You need to prove the origin of the fabric. If you're a small business owner who relies on importing cheap components from overseas, the end of de minimis means you’re going to need a customs broker. And customs brokers aren't cheap.

The Shein and Temu factor

These two giants are the primary targets. Shein alone accounted for a staggering percentage of de minimis entries in recent years. By shipping "direct-to-consumer," they bypassed the tariffs that traditional brands have been paying for decades.

It was a brilliant hack. Truly.

But it created a massive "dark" spot in the economy. The U.S. government doesn't like dark spots, especially when those spots represent billions in lost tariff revenue. By targeting "Section 301" goods, the government is essentially saying: "If it's made in China and it's on our list of tariffed items, you pay up, even if it's just one skirt."

📖 Related: Joann Fabrics New Hartford: What Most People Get Wrong

It's not just about clothes

While fashion gets the headlines, the end of de minimis hits the tech world too. Think about those tiny electronic components, replacement screens, or even niche hobbyist gear. If those items are hit with Section 232 (steel/aluminum) or Section 301 (Chinese electronics) duties, the price is going up.

There's also a serious conversation happening about "forced labor." The Uighur Forced Labor Prevention Act (UFLPA) is incredibly hard to enforce on a package-by-package basis.

When you ship 40,000 shirts in a container, CBP can audit the supply chain of the manufacturer. When you ship one shirt to a guy named Mike in Florida, it’s almost impossible to verify that the cotton wasn't sourced from a region using forced labor. Closing the de minimis loophole is the government's way of forcing these companies to provide better data or face seizure of the goods.

What this means for your wallet in 2026

Prices are going up. There’s no way around it.

If a company has to pay a 25% tariff plus a $15 processing fee for a formal entry, they aren't going to eat that cost. They'll pass it to you. Or, more likely, they will stop shipping low-value items altogether because the "landed cost" makes no sense anymore.

We might see the return of the "domestic warehouse" model. Instead of shipping from China, companies might start bulk-importing (and paying the tariffs) to warehouses in the U.S. This would speed up shipping but kill the "insanely cheap" pricing we've gotten used to.

👉 See also: Jamie Dimon Explained: Why the King of Wall Street Still Matters in 2026

How to prepare for the shift

If you run an e-commerce brand or just shop a lot online, the end of de minimis shouldn't catch you off guard. The "wild west" era of international shipping is closing.

- Audit your supply chain now. If you're a seller, you need to know exactly which HTS codes your products fall under. If they are on the Section 301 list, start calculating your new margins today.

- Diversify your sourcing. Looking at countries like Vietnam, Mexico, or India might become more attractive because they aren't subject to the same Section 301 "Trade War" tariffs that are triggering the de minimis crackdown on Chinese goods.

- Expect shipping delays. As CBP ramps up enforcement and new data requirements kick in, packages are going to sit in customs for longer. That "3-day shipping" from overseas is likely a thing of the past.

- Watch the Type 86 entries. Customs has already been cracking down on "Entry Type 86" (the digital way de minimis is processed). Several major customs brokers have had their licenses suspended recently for "non-compliance." This shows the government is serious.

The end of de minimis is basically the government's way of hitting the "reset" button on global trade. It’s messy, it’s going to be expensive, and it’s going to frustrate a lot of people who just want their cheap stuff. But from a policy perspective, the goal is clear: stop the flow of illicit goods and protect domestic businesses from what they see as an unfair advantage.

Whether it works or just makes everyone’s life harder remains to be seen. One thing is certain—the days of the $2 trinket arriving postage-free and tax-free are numbered. Get your orders in now, because the 2026 trade landscape looks a lot more restrictive than the one we've lived in for the last decade.

Immediate Action Steps for Businesses:

- Map your 10 most imported items to their 10-digit HTS codes.

- Consult with a Licensed Customs Broker to see if you qualify for "Duty Drawback" or other mitigation strategies.

- Evaluate the cost-benefit of moving to a Bonded Warehouse or a Foreign Trade Zone (FTZ) to manage cash flow on tariff payments.

- Prepare your customer service team for a 15-30% increase in "package held by customs" inquiries.

Immediate Action Steps for Consumers:

- Be wary of "too good to be true" prices on sites shipping from overseas; you might be hit with a surprise "bill for duties" from the courier.

- Look for domestic alternatives or brands that stock inventory within the U.S. to avoid shipping volatility.

- Check the "Shipping & Returns" policy specifically for who is responsible for import duties (the "Importer of Record").