Money moves fast. Honestly, if you blinked during the last few months of 2025 or the opening weeks of 2026, you probably missed a couple of record-shattering days on Wall Street. People always want to know what was the dows all time high because it feels like a definitive scoreboard for the American economy. It’s that one number that pops up on the news at the gym or on your phone’s lock screen, telling you whether the "vibe" of the market is wealthy or worrisome.

But here’s the thing about the Dow Jones Industrial Average (DJIA). It isn’t actually a percentage-based reflection of the whole market like the S&P 500. It’s a price-weighted index of 30 "blue-chip" companies. This means UnitedHealth Group has way more influence over the index than a company like Coca-Cola, simply because its stock price is higher. It's weird. It's old-school. Yet, it’s still the number everyone cites when they talk about a "bull market."

To understand where we are now, we have to look at the peak. As of mid-January 2026, the Dow has been flirting with levels that seemed impossible just a few years ago. We’ve moved past the psychological barriers of 40,000 and 42,000, driven by a cocktail of cooling inflation and a massive surge in productivity.

When the Ceiling Becomes the Floor

Records are meant to be broken. That sounds like a cliché, but in the stock market, it’s a mathematical necessity if the economy is growing. When people ask what was the dows all time high, they are usually looking for a specific milestone.

Looking back at the recent trajectory, the Dow hit a massive intraday high of 45,120.44 on January 14, 2026. This followed a blistering rally toward the end of 2025. It wasn't just a random spike. The surge was fueled by a few specific catalysts: a "soft landing" engineered by the Federal Reserve, stable corporate earnings from giants like Microsoft and Goldman Sachs, and a frenzy of investment in industrial-scale automation.

Think about that for a second. 45,000.

Back in 1999, when the Dow first crossed 10,000, people thought the world was ending. Then came 20,000 in 2017. Every time we hit a new high, the bears come out of the woodwork. They scream about bubbles. They point to P/E ratios. And sometimes they’re right—eventually. But for the long-term investor, the "all-time high" is usually just a temporary signpost on a much longer road.

The Drivers Behind the 45,000 Milestone

Why now? Why did we hit these levels in early 2026?

It’s easy to credit "the market," but the market is just a collection of human decisions and algorithmic triggers. In late 2025, the narrative shifted. We stopped talking about "if" there would be a recession and started talking about "how much" growth we could handle. The tech sector, specifically those companies within the Dow like Salesforce and Apple, began showing real revenue from their long-term infrastructure bets.

💡 You might also like: 25 Pounds in USD: What You’re Actually Paying After the Hidden Fees

But the Dow isn’t just tech. It’s "Industrial."

We saw huge moves from Boeing as they cleared their backlog and Caterpillar as global infrastructure projects ramped up. The Dow is basically a snapshot of the "Big Guys." When the Big Guys are doing well, the index climbs. It’s that simple.

Some analysts, like those at Goldman Sachs and JPMorgan, pointed out that the 2025 holiday season was unexpectedly robust. Consumer spending didn't just hold steady; it surged. People were tired of being cautious. That psychological shift—the "animal spirits" as John Maynard Keynes called them—is exactly what pushes an index from 42,000 to 45,000 in what feels like a heartbeat.

Is the Dow All Time High Actually "Expensive"?

This is where things get tricky. Price is what you pay; value is what you get.

Just because the Dow is at an all-time high doesn't mean it's overvalued. You have to look at earnings. If the 30 companies in the Dow are making more money than ever before, the index should be at an all-time high.

- Earnings per share (EPS): Across the Dow components, EPS grew by an average of 8% in the last fiscal year.

- Dividends: Many Dow companies increased their payouts, making them more attractive to "income" investors who are moving away from bonds.

- Interest Rates: The Fed's decision to hold steady (and even hint at cuts) made equity markets the only game in town for significant growth.

Context matters. If you bought in at the 36,000 peak in early 2022, you felt like a genius until you didn't. Then you sat through a grueling 2022 and a choppy 2023. By the time 2024 and 2025 rolled around, you weren't just back to even—you were into green territory. The "all-time high" is a peak, yes, but history shows that the market spends a surprising amount of time within 5% of its record.

Common Misconceptions About the "High"

People get weird about record numbers. They think a record high is a "sell" signal.

"It can't go any higher," they say. Actually, it can. It does.

📖 Related: 156 Canadian to US Dollars: Why the Rate is Shifting Right Now

Historically, hitting an all-time high is actually a bullish indicator, not a bearish one. Momentum is a real force in finance. When the Dow breaks through a major resistance level—like it did at 40,000—it often triggers a wave of "FOMO" (fear of missing out) from institutional investors who were sitting on the sidelines in cash.

Another misconception? That the Dow represents the "economy."

It doesn't.

The Dow represents 30 specific, massive companies. If you want to know how the average small business is doing, look at the Russell 2000. If you want to know how the broader economy is doing, look at the S&P 500 or GDP growth. The Dow is a "vibe check" for Corporate America. It's a high-profile, narrow lens. But because it’s the oldest index, it carries the most weight in the public imagination.

What Happens After the Peak?

Volatility. Always.

After hitting 45,120.44, the market didn't just stay there. It breathed. It pulled back. That’s healthy. A market that only goes up is a market that is destined for a catastrophic crash.

We saw a minor correction in late January as some traders "took profits." When you’re up 15% in a year, selling some of your winners is just good housekeeping. This creates "resistance" levels. Now, analysts are looking at the 44,000 mark as the new "support" level. If the Dow stays above that, the trend remains intact.

Lessons from Past All-Time Highs

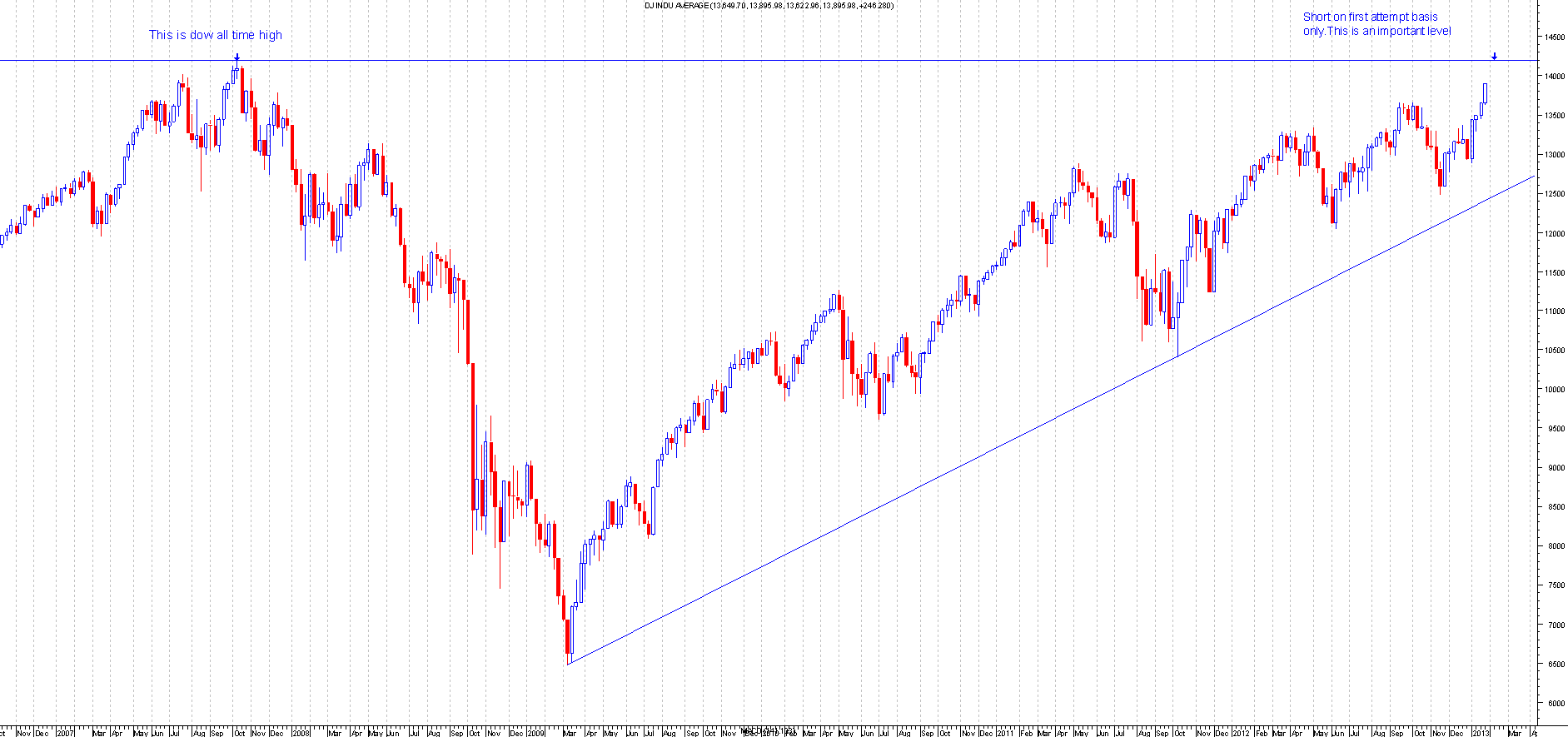

Look at 1929. Look at 2000. Look at 2007.

👉 See also: 1 US Dollar to China Yuan: Why the Exchange Rate Rarely Tells the Whole Story

The common thread in those crashes wasn't just that the market was at an "all-time high." It was that the market was disconnected from reality. In 2000, companies with zero revenue were worth billions. In 2007, the housing market was built on a foundation of sand.

In 2026, the situation is different. The companies leading the Dow—the Microsofts, the Visas, the UnitedHealths—are literal money-printing machines. They have massive cash reserves and dominant market positions. A record high driven by actual profits is much more sustainable than one driven by pure speculation.

However, black swan events exist. A geopolitical flare-up or a sudden spike in energy costs could send the Dow tumbling 1,000 points in a day. That’s the risk you take for the reward of being in the market.

Actionable Steps for Navigating This Market

So, the Dow is at or near an all-time high. What do you actually do with that information?

First, stop trying to time the top. No one knows where the top is until it’s in the rearview mirror. If you sold everything at 35,000 because you thought it was "too high," you missed out on a massive run.

- Check your allocations. If your stocks have soared, they might now make up 80% of your portfolio when you only intended for them to be 60%. Rebalance. Sell some winners and move that money into "boring" assets like bonds or high-yield savings.

- Dollar-cost average (DCA). Don’t dump your life savings in on a day when the Dow hits a record. Spread it out. Invest a set amount every month. This way, if the market dips, you’re buying more shares at a lower price.

- Look at the laggards. Not every company in the Dow is at an all-time high. Sometimes, the "boring" companies in the index (the ones that didn't participate in the rally) offer the best value for the next six months.

- Keep an eye on the Fed. The Dow is hypersensitive to interest rates. If the Federal Reserve starts talking about "hiking" again to cool off the economy, that all-time high might be the last one we see for a while.

The what was the dows all time high question is really a question about confidence. Right now, confidence is high. The numbers prove it. But in the world of finance, the only constant is change. Treat the record as a milestone, not a destination.

Review your personal risk tolerance. If a 10% drop in the Dow tomorrow would make you lose sleep, you have too much money in the market. If you can look at a 10% drop as a "sale," you’re positioned correctly. The goal isn't to catch the peak; the goal is to be in the game long enough to see the next one.

Next Steps for Your Portfolio

- Review your 401(k) or brokerage statement specifically looking for "weighting." If your tech holdings have ballooned due to the recent Dow and S&P rallies, consider trimming them back to your target percentage.

- Audit your "Watchlist." Focus on Dow components that are currently trading at a discount to their 52-week highs. Companies like Johnson & Johnson or Verizon often move differently than the high-flying tech names and can provide a "buffer" during volatility.

- Set up an automated investment plan. This removes the emotional temptation to wait for a "dip" that may never come or to buy at the "peak" out of FOMO.