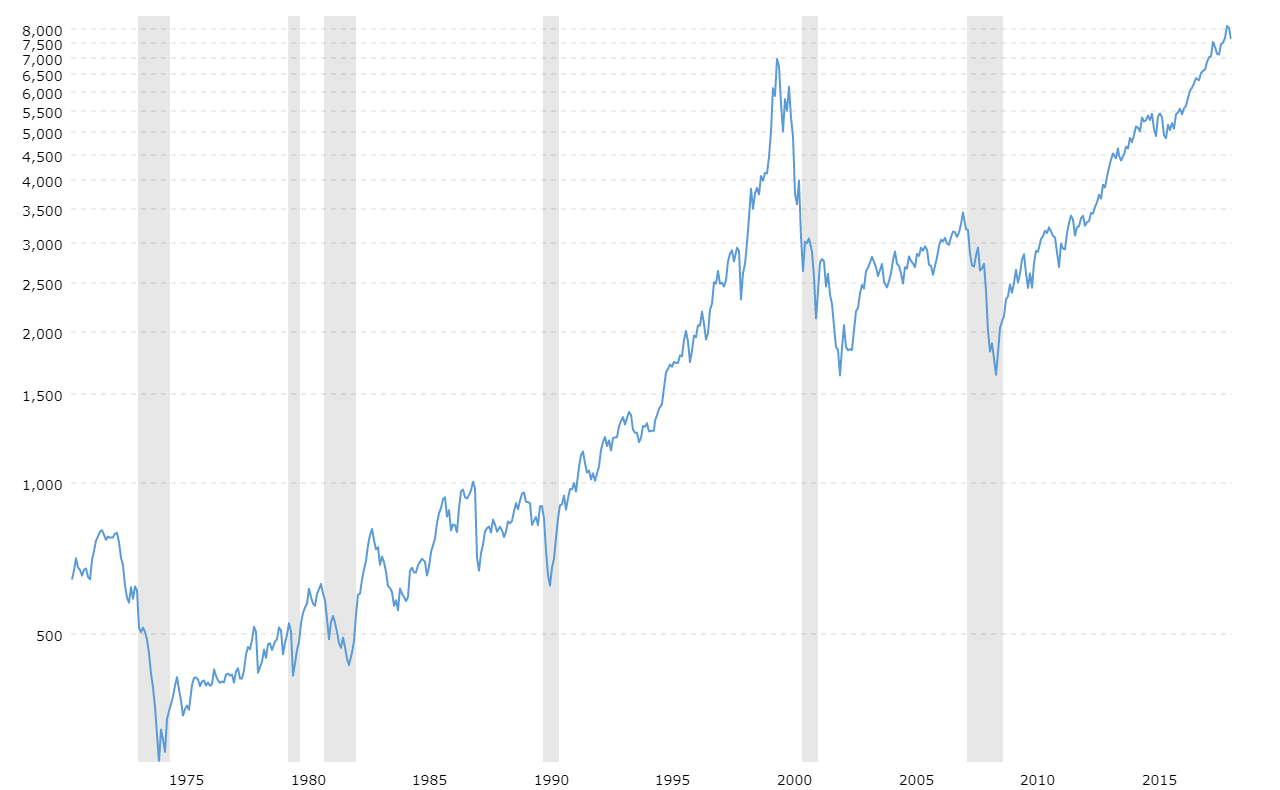

Look at a Dow all time chart and you’ll see it. That massive, sweeping curve that looks like a mountain climber finally hitting their stride after decades of stumbling. It’s breathtaking. Honestly, it’s also a bit deceptive if you don't know what you're looking at. Most people see that line going from the bottom left to the top right and think, "Easy money." If only.

The Dow Jones Industrial Average (DJIA) isn't just a bunch of numbers. It is a 130-year-old diary of human progress, greed, panic, and stubborn resilience. It started in 1896 with just 12 companies. Names like American Cotton Oil and Distilling & Cattle Feeding Company. None of those original 12 are in the index today. Not one. General Electric was the last holdout, and even they got booted in 2018.

That’s the first thing you have to understand about the Dow. It’s a "survivor" index. When a company fails or shrinks, it gets replaced by a winner. This survivorship bias is why the long-term chart looks so incredibly smooth over decades, despite the fact that individual companies—and individual investors—get absolutely wrecked along the way.

📖 Related: Why Milan Center Feed & Grain Inc Still Matters to the Indiana Farm Scene

Why the Dow All Time Chart is Logarithmic (And Why That Matters)

If you look at a standard "linear" chart of the Dow, it looks like nothing happened for 80 years and then suddenly, in the 1990s, the world exploded. That’s because on a linear scale, a move from 100 to 200 (a 100% gain) looks tiny, while a move from 30,000 to 31,000 (a 3% gain) looks huge. It’s a visual lie.

Smart traders use logarithmic scales.

In a log chart, the vertical distance represents percentage change, not dollar points. This is the only way to see that the 1920s boom was actually just as wild—if not wilder—than the tech boom of the 1990s. Without this perspective, you’re basically flying blind. You’re seeing the "noise" of big numbers rather than the "signal" of actual growth.

The Great Depression: A Scar That Lasted 25 Years

We talk about the 1929 crash like it was a bad weekend. It wasn't. It was a generation-defining catastrophe. The Dow peaked near 381 in September 1929. It didn't get back to that level until 1954.

Think about that.

If you bought at the top, you waited a quarter of a century just to get your principal back. This is the part of the Dow all time chart that scares the hell out of institutional historians. It proves that "buy and hold" is a great strategy, but "buy and hold at the absolute peak of a speculative bubble" can be a life sentence.

During that slide, the Dow lost 89% of its value. Imagine checking your 401k and seeing that your $100,000 is now $11,000. Most people didn't hold. They couldn't. They sold at the bottom because they needed to buy bread. This is why the chart doesn't tell the whole story—it shows price, but it doesn't show the "blood in the streets" that Baron Rothschild famously talked about.

👉 See also: Mondelez Q1 2025 Earnings Date: Why Cocoa Prices Are Changing Your Snacks

The "Sideways" Decades Nobody Talks About

Everyone loves talking about the 1980s and 90s. The "Great Moderation." But look closer at the 1960s and 70s. From roughly 1966 to 1982, the Dow basically went nowhere. It hit 1,000, fell, hit 1,000 again, fell.

It was a 16-year emotional meat grinder.

Inflation was eating everyone's lunch. Even though the Dow was "flat," in real terms (adjusted for inflation), investors were losing money hand over fist. This is the "hidden" bear market. If you only look at the nominal Dow all time chart, you miss the fact that the 1970s were a lost decade for wealth creation. It wasn't until Paul Volcker broke the back of inflation in the early 80s that the "Super Bull" was born.

The Modern Era: 1982 to 2026

Since 1982, the trajectory has been almost vertical, interrupted by some very violent hiccups.

- The 1987 Crash: A 22% drop in a single day. Black Monday. The chart shows it as a sharp needle prick.

- The Dot-Com Bust: A slow grind down from 2000 to 2002.

- The 2008 Financial Crisis: The moment the world almost ended. The Dow fell from 14,000 to 6,500.

- The 2020 Pandemic: The fastest 30% drop in history, followed by the fastest recovery.

What’s crazy is how these events look on the long-term chart now. The 1987 crash, which felt like the end of the world to people living through it, is now just a tiny blip. A "buying opportunity" in retrospect. This is the power of time. It heals all wounds on the Dow, provided the underlying economy continues to innovate.

Is the Dow a Good Representation of the Economy?

Kinda. But also, not really.

The Dow is price-weighted. This is a weird, old-school way of doing things. It means that a company with a high stock price has more influence on the index than a company with a low stock price, regardless of how big the company actually is. Goldman Sachs has more "pull" on the Dow than Apple does, simply because its share price is higher.

👉 See also: Bristol Myers Squibb Ticker Symbol: What Most People Get Wrong

It’s a bit of a quirk. Most professionals prefer the S&P 500 because it’s market-cap weighted (size matters), but the Dow persists because it’s the "people’s index." When your uncle asks "How's the market doing?" he’s asking about the Dow.

The Psychological Trap of All-Time Highs

We see "Dow hits all-time high" in the news and we get nervous. We think, "It’s too high, I should wait for a pull-back."

Statistically? That's usually a mistake.

An index that trends upward over time should be at or near all-time highs most of the time. If it wasn't, it wouldn't be an upward-trending index. Looking at the Dow all time chart, you'll notice that all-time highs often come in clusters. One high leads to another, and another, for years. Waiting for a "crash" often means missing out on a 50% gain while waiting for a 10% dip.

Realities of the 2020s Volatility

Lately, the chart has looked like a heart monitor for someone running a marathon. We’ve seen 1,000-point swings become "normal." Why? High-frequency trading, massive liquidity from central banks, and the fact that 30,000 is a much bigger base than 3,000.

A 1,000-point drop at Dow 30,000 is only 3.3%. Back in the 1970s, a 1,000-point drop would have meant the entire index went to zero. Context is everything. Don't let the big numbers freak you out. Percentages are the only truth in finance.

How to Actually Use This Information

Stop looking at the daily zig-zags. They are literally designed to make you make bad decisions. The Dow all time chart is a tool for perspective, not for timing your entry next Tuesday.

Actionable Steps for the Long-Term Investor:

- Zoom out. If you're feeling panicked because the Dow is down 2% today, look at the 10-year chart. Then look at the 30-year chart. The "catastrophe" of today usually vanishes into the background noise of history.

- Check the "Real" Value. Occasionally look at the Dow adjusted for inflation. It will give you a much humbler view of how much wealth is actually being created versus how much is just currency devaluation.

- Ignore the "Point" Drops. Start translating every news headline from points to percentages. "Dow drops 600 points!" sounds scary. "Dow drops 1.5%" sounds like a boring Tuesday.

- Rebalance, don't retreat. History shows that the Dow eventually recovers from every single crash it has ever had. The only way to "lose" is to sell when the chart is at a local bottom.

The Dow is a reflection of the 30 most powerful companies in the US. As long as you believe that American capitalism will continue to churn out profits and replace dying industries with new ones, that long-term chart is likely to keep heading in one general direction. Just be prepared for the decades where it decides to go sideways and test your patience.

History isn't a straight line. It's a series of crises that we eventually figured out how to solve. The chart is just the scoreboard for that process.

Next Steps:

Go look at a logarithmic version of the Dow chart for the last 100 years. Compare the visual "size" of the 1929 crash to the 2008 crash. You’ll see that while 2008 felt massive, 1929 was a fundamentally different beast. Understanding that difference will make you a much calmer investor when the next "unprecedented" event hits the headlines.