You’re sitting there at 11:00 PM with a lukewarm coffee, staring at a 64% on your latest CPA exam practice test. Your heart sinks. You’ve been studying for weeks, but the simulation just kicked your teeth in on a lease accounting question that felt like it was written in ancient Greek.

It sucks. I know.

But here’s the thing—that 64% might actually be a 75% in the eyes of the AICPA. Or it might be a total fluke. Most candidates treat practice exams like a crystal ball, but they’re actually more like a messy, slightly inaccurate weather forecast. If you don’t know how to read the "clouds," you’re going to panic for no reason or, worse, walk into the Prometric center with a false sense of security that gets shattered by the first testlet.

The "Becker Bump" and Other Practice Test Myths

People talk about the "Becker Bump" like it’s some kind of mystical religious experience. If you aren't familiar, it's the phenomenon where candidates score significantly higher on the actual CPA exam than they did on their final CPA exam practice test from providers like Becker, UWorld (formerly Roger), or Gleim.

Is it real? Yeah, mostly.

Statistics gathered by the CPA candidate community on platforms like Reddit’s r/CPA suggest that for the FAR (Financial Accounting and Reporting) section, the "bump" can be anywhere from 10 to 15 points. For disciplines like ISC or TCP, it’s a bit more unpredictable because the content is newer. But why does this happen? It’s not because the AICPA is "easier." It’s because prep providers deliberately tune their questions to be more "granular." They want to over-prepare you. They’d rather you cry over a practice test in your living room than fail the real thing and demand a refund.

However, relying on the bump is a dangerous game. Some people don't get a bump at all. If you’re scoring a 50% and hoping for a 25-point miracle, you’re basically gambling with your $350+ NTS fee.

Stop Doing 100 MCQs in a Row

I see this all the time. Candidates think they’re "studying" by slamming through 100 Multiple Choice Questions (MCQs) in one sitting.

Stop.

Your brain turns into mush after question 40. You start recognizing the pattern of the question rather than the concept. If you see a question about a "non-monetary exchange with commercial substance" for the fifth time, you aren't calculating the gain anymore; you’re just remembering that the answer is $12,000 because it was $12,000 last time.

The most effective way to use a CPA exam practice test is to break it into "bite-sized" sets of 10 or 20 questions. Do them "tutor mode" style first, where you see the answer immediately. Then, and only then, do a full-length, timed simulation.

Why the SIMs are actually where the war is won

The MCQs are the appetizer. The Task-Based Simulations (TBS) are the 16-ounce steak that usually gives people indigestion.

Most people skip the SIMs during practice because they’re "too hard" or "take too long." That is a massive mistake. The 2024 CPA Evolution changes made the exam even more focused on "application" and "analysis." You can't just memorize your way through a simulation that requires you to reconcile a bank statement across four different PDF exhibits while your timer is ticking down.

When you take a CPA exam practice test, you need to treat the SIMs as the priority. Learn how to use the "Search" function in the Authorized Literature (the IRC for tax or the FASB Codification for FAR). Honestly, being fast with the literature search is basically a cheat code. It can give you the exact wording you need for a research question or help you clarify a rule for a journal entry simulation.

The Psychology of the 4-Hour Grind

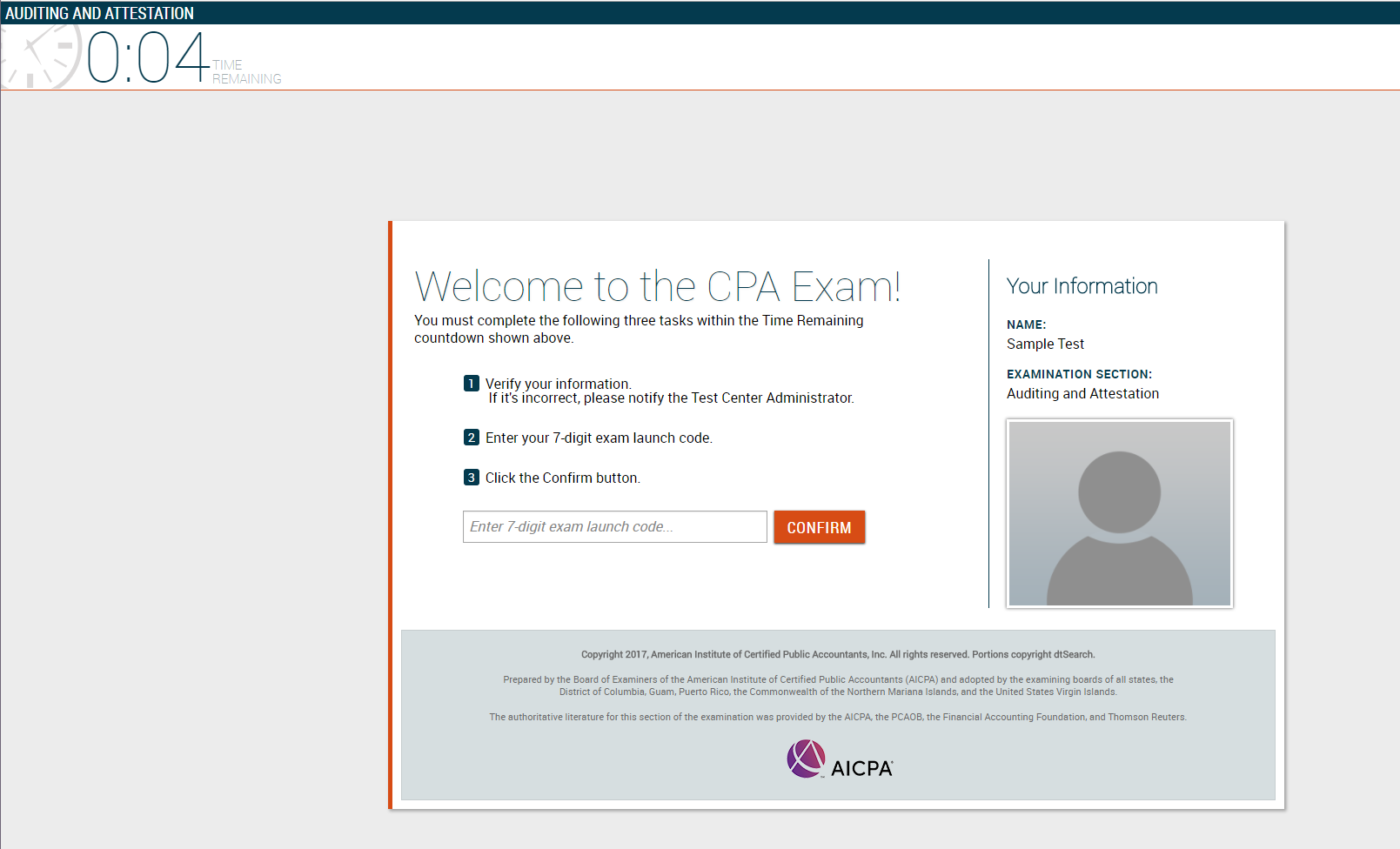

The CPA exam is as much an endurance sport as it is an accounting test. You’re in a quiet, sterile room. The person next to you is banging on their keyboard like it’s a drum set. The "security" check-in feels like you’re entering a high-security prison.

If you haven’t taken at least two full-length CPA exam practice tests under these exact conditions, you’re going to struggle with the "mental wall" at hour three.

- Turn off your phone. Not just face down. In another room.

- Use a crappy calculator. The one in the exam center isn't a fancy TI-84. It’s a basic four-function piece of plastic or an on-screen calculator.

- Time your breaks. You get one 15-minute break that doesn't stop the clock. Learn exactly when to take it. Usually, after the third testlet is the sweet spot.

Real Talk: Which Practice Test Should You Trust?

Not all practice exams are created equal.

Becker is the "gold standard" mostly because of its legacy, but their questions can be wordy to the point of annoyance. UWorld has, in my opinion, the best explanations. If you’re a visual learner, their diagrams of how a trust works or how a consolidation entry flows are lifesavers.

Gleim is known for having a massive test bank. If you’re the type who needs to see 2,000 questions to feel safe, Gleim is your best bet. Ninja CPA is fantastic as a "supplemental" tool. Many people use Ninja's "Sparring" sessions and their CPA exam practice test bank to get a fresh perspective when they start memorizing the questions in their main software.

Don't get married to one provider's "score." If you’re hitting 70% across two different platforms, you’re probably ready. If you’re hitting 90% on one but 50% on another, you’ve likely just memorized the first one's question style.

💡 You might also like: Motown Sports Group Holdings Explained (Simply): The $1.9 Billion Bet on Romulus

The Strategy for the Week Before the Exam

In those final seven days, your CPA exam practice test results should dictate your "weak spot" list.

Don't just keep doing everything. If you’re a pro at Government Accounting but you keep missing questions on Pensions, stop doing Gov questions. It feels good to get things right, but it's a waste of time. Focus on the pain.

Take one final practice exam four days before the real thing. Spend the next two days reviewing every single question you got wrong and the ones you guessed right on. Then, 24 hours before the exam, stop. Completely.

If you don't know it by then, you aren't going to learn it in a midnight panic session. Go see a movie. Eat a carb-heavy dinner. Sleep. The "exam day brain" is worth more than five extra hours of frantic skimming.

Actionable Steps for Your Next Practice Session

To actually move the needle on your scores, try this specific workflow:

- The "Why" Review: For every question you miss on a CPA exam practice test, write down—by hand—the specific reason why. Not "I forgot." Write "I forgot that salvage value is ignored in Double Declining Balance depreciation."

- Cumulative Sets: Every Friday, do a 30-question MCQ set covering every chapter you’ve studied so far. This prevents "forgetting the beginning" syndrome.

- Exhibit Management: Practice opening multiple windows on your screen. The real exam has a "split screen" feel. If you aren't used to toggling between a memo, an Excel sheet, and an invoice image, you'll lose 10 minutes just to "UI friction."

- The 75-Point Mindset: You don't need a 100. You need a 75. If a practice test question is taking you more than three minutes, guess and move on. Learning when to give up on a question is a skill that saves your score in the later testlets.

The CPA exam is a beast, but it’s a predictable one. The practice test isn't just a score—it's a diagnostic tool. Use it to find where your armor is thin, patch it up, and get that three-letter designation behind your name. You've got this. Barely. But "barely" still counts as a pass.