If you’d told a casual investor back in 2023 that we’d be looking at a world where gold sits comfortably near $4,600 an ounce, they probably would have laughed. Yet, here we are. It’s Saturday, January 17, 2026, and the gold market is doing something truly strange. It’s staying high. Usually, after a massive run-up like the one we saw throughout 2025, you’d expect a "pop" or a massive correction. Instead, we’re seeing a market that has fundamentally shifted its floor.

Honestly, the cost of gold right now is hovering right around $4,596.62 per ounce.

That’s the spot price as of the weekend close. It’s down slightly from a mid-week peak where it actually tickled the $4,620 mark. Some people are calling this a "pullback," but when you’re talking about a $20 drop on a $4,600 asset, it’s basically noise. What’s more interesting is that even with a firming U.S. dollar, gold isn't budging much. People are scared, or maybe just cautious, and that’s keeping the floor incredibly high.

Breaking Down the Cost of Gold Right Now

To understand why your local coin shop is quoting such high numbers, you have to look at the global board. It’s not just about one thing. It’s a messy mix of central bank hoarding, a weird crisis at the Federal Reserve, and the simple fact that nobody knows what the next tariff is going to be.

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Earlier this week, specifically on January 12th, gold hit an all-time record of $4,568. Then it kept going. By the 15th, it was clearing $4,614 in New York. If you’re looking at the domestic markets—say, if you’re in Vietnam checking SJC prices—you’re seeing gold bars listed around 162.8 million VND. The gap between international spot prices and local physical prices is widening in some spots, which usually tells you that regular people are rushing to buy the physical stuff, not just trading paper contracts on a screen.

Why the Price Refuses to Drop

- The Powell Factor: There’s a lot of chatter about the criminal investigation into Fed Chair Jerome Powell. Regardless of the legal outcome, the mere hint of an independence crisis at the Federal Reserve makes investors run to gold. It’s the ultimate "I don't trust the system" trade.

- Central Bank Appetite: In 2024, central banks bought over 1,100 tonnes. In 2025, they kept up the pace. Even though some analysts, like those at JP Morgan, think central bank buying might dip to around 755 tonnes this year, that’s still a massive amount of gold being pulled off the market and tucked into vaults.

- The $5,000 Target: Goldman Sachs and Bank of America aren't just being bullish for the sake of it. They’ve moved their targets. BofA is looking at a $5,000 average for 2026. When the big banks tell their institutional clients that $5,000 is the goal, it creates a self-fulfilling prophecy where every "dip" to $4,550 gets bought up instantly.

The Reality of Buying Physical Gold Today

Buying gold right now isn't like it was five years ago. You can't just walk in and expect a tiny premium over spot. If the cost of gold right now is $4,596, expect to pay significantly more for a one-ounce American Eagle or a Canadian Maple Leaf. Premiums are staying stubborn because the supply of newly minted coins can’t always keep up with the "safe-haven" demand.

I was talking to a dealer recently who mentioned that people aren't even looking at the price anymore; they're looking at the availability. That’s a dangerous mindset for a bubble, but gold has a way of proving the doubters wrong.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

Comparisons You Should Care About

If you think gold is expensive, look at silver. Silver has been the "crazy cousin" of the precious metals world lately. While gold gained significantly, silver has had runs of 120% to 150% in the last year alone. The gold-to-silver ratio, which used to hang out near 80:1 or even 100:1, has collapsed down toward 55:1 or 60:1.

What does that mean for you? It means gold is actually the "stable" one. Silver is behaving like a tech stock on steroids, but gold is acting like the anchor. If you're looking for a place to park wealth without the heart-attack-inducing volatility of silver, the current gold price starts to look a bit more reasonable, even at these historic highs.

What Most People Get Wrong About High Prices

The biggest mistake is thinking, "I missed the boat."

👉 See also: ROST Stock Price History: What Most People Get Wrong

Sure, buying at $2,000 would have been better. But the macro environment in 2026 is fundamentally different from 2024. We have massive government debt-to-GDP ratios that are starting to look unsustainable. We have a "de-dollarization" trend that has moved from a conspiracy theory to a line item in central bank reports.

Some experts, like Todd “Bubba” Horwitz, are even floating the idea of $8,000 gold. Is that realistic? Maybe not by next week. But if the U.S. dollar continues to lose its grip as the sole reserve currency, the "cost" of gold is really just a reflection of the "devaluation" of the paper in your wallet. Gold isn't necessarily getting more valuable; the dollar is just buying less of it.

Practical Steps for the Current Market

- Stop looking for the "Perfect" Entry: If you're waiting for gold to go back to $3,000, you might be waiting forever. Most analysts see $4,300 as a "hard floor" now. If it hits that, it’s a massive buying opportunity, not a sign of a crash.

- Watch the 50-Day Moving Average: Right now, that’s sitting around $4,255. As long as the price stays above that line, the bull market is healthy. If we break below it, then—and only then—should you worry about a deeper correction.

- Check Local Premiums: Don't just look at the Kitco chart. Call three different dealers. The "spread" (the difference between what they sell for and what they buy back for) is a better indicator of market health than the spot price itself.

- Diversify Your Storage: If you're buying at these prices, don't keep it all in one place. Systematic risk is the whole reason people buy gold; don't create your own risk by keeping a fortune in a home safe that isn't bolted down.

The cost of gold right now tells a story of a world in transition. It’s a story of shifting power, nervous investors, and a metal that has been the ultimate store of value for 5,000 years. Whether it hits $5,000 by June or takes a breather at $4,400, the trend for 2026 is clearly skewed to the upside.

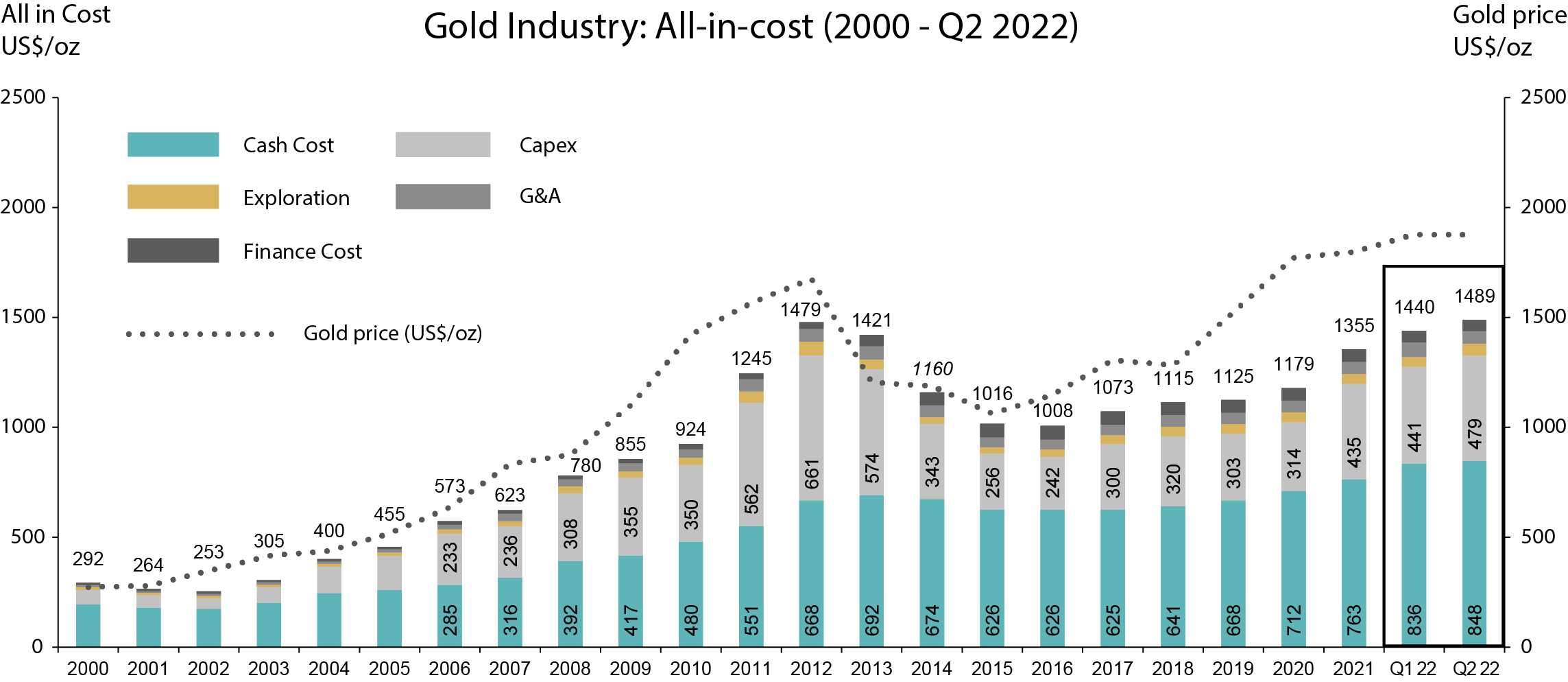

To get the most out of this market, you should start by calculating your current portfolio's exposure to precious metals. Most financial advisors are now suggesting a move from the traditional 5% allocation up to 10% or even 15% given the current geopolitical climate. Once you have your percentage, compare the "all-in" cost from at least three physical bullion dealers versus the convenience of a gold ETF like GLD to see which fits your storage capabilities.