You’re holding a cold drink. It feels light. It’s shiny. You probably didn't think twice about the thin silver cylinder in your hand until you noticed the price of a six-pack creeping up at the grocery store. Most people assume they’re paying for the liquid inside. Honestly? A massive chunk of that retail price is just the metal. The cost of an aluminum can isn't a static number you can find on a price tag at a wholesaler; it’s a vibrating, chaotic reflection of global energy markets, trade wars, and how many people decided to recycle their trash last month.

It's expensive. Well, relatively.

If you’re a craft brewer or a soda startup, the empty can is often your single biggest expense after labor. We're talking about a global industry that churns out over 180 billion cans a year. When the price of aluminum shifts by even a fraction of a cent per pound, it sends shockwaves through the entire supply chain.

What Drives the Price of a Single Can?

To understand the cost of an aluminum can, you have to look at the London Metal Exchange (LME). This is where the world’s "primary" aluminum—the stuff pulled from the ground as bauxite—is traded.

But here’s the kicker.

The raw metal is only the starting point. Usually, the "Midwest Premium" gets tacked on. This is a regional surcharge that covers the cost of physically moving the metal into the U.S. and through the clearinghouses. In the last few years, this premium has swung wildly. You might see the raw metal trading at $2,200 or $2,500 per metric ton, but by the time it’s rolled into a thin sheet and stamped into a "body," the math has changed.

A standard 12-ounce can weighs about 14.9 grams. Do the math on a ton of aluminum, and you’re looking at roughly 67,000 cans. If the raw material costs $2,500 a ton, the metal alone is roughly $0.037 per can.

That sounds cheap. It's not.

📖 Related: Forex Trading News Today: Why the Yen and Dollar are Tussling While Everyone Else Watches

Once you add the internal coating (to keep the acid in the soda from eating the metal), the printing, the "end" (the lid with the pull-tab), and the shipping, that price jumps. For a massive player like Coca-Cola, they might get cans for $0.10 to $0.12. For a small brewery buying only a few pallets at a time? You’re lucky to see $0.25 or $0.30 per can.

The Energy Factor: Frozen Electricity

They call aluminum "frozen electricity." That’s not a metaphor.

To turn bauxite ore into alumina and then into metal via the Hall-Héroult process, you need a staggering amount of power. Specifically, it takes about 13 to 15 megawatt-hours of electricity to produce one ton of aluminum. Because of this, the cost of an aluminum can is basically a proxy for the cost of energy. When natural gas prices spiked in Europe in 2022, smelters literally shut down because it was too expensive to keep the pots hot.

When energy is expensive, your beer gets expensive.

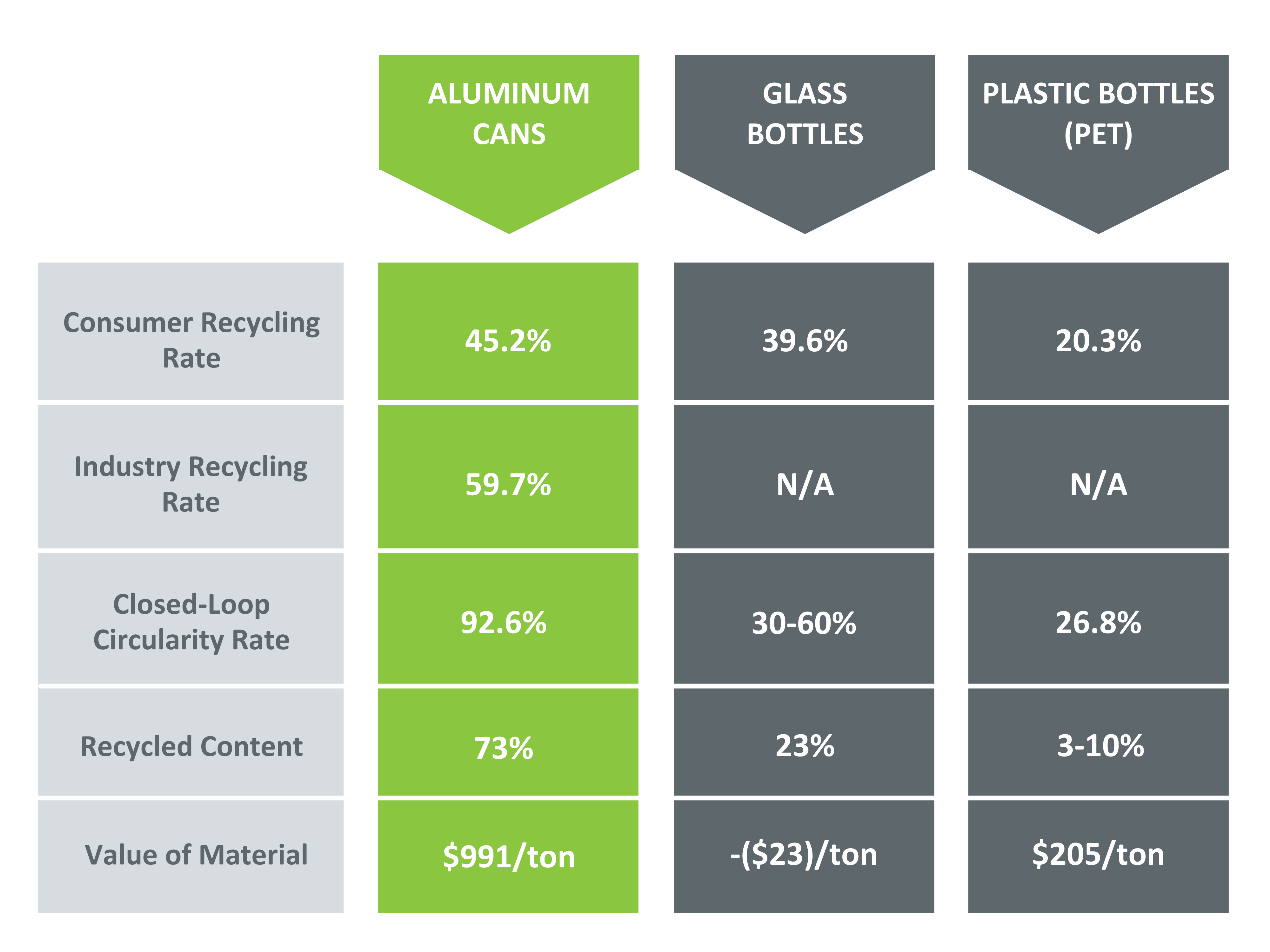

It’s also why brands are obsessed with recycled aluminum (Rusal, Alcoa, and Rio Tinto all talk about this constantly). Melting down an old can takes 95% less energy than making a new one from ore. That’s a massive margin. If the industry could get 100% of its cans back, the price would stabilize. But we don't. In the U.S., the recycling rate for aluminum cans hovers around 45% to 50%, which is actually pretty dismal compared to places like Brazil or Germany.

Tariffs and the Supply Chain Headache

Remember 2018? Section 232 tariffs on imported aluminum changed the game. Suddenly, domestic producers had a protective "wall," but beverage makers saw their input costs skyrocket. Even if you buy American aluminum, the price is pegged to the global market plus those local premiums.

Then came the "Can-demic."

During the COVID-19 lockdowns, everyone stopped drinking at bars (kegs) and started drinking at home (cans). Demand surged. Supply vanished. Ball Corporation, the world's largest can manufacturer, actually had to increase their minimum order requirements for printed cans. Small players were told they couldn't buy 60,000 cans anymore; they had to buy five times that or go through a middleman.

When you go through a distributor or a "sleeper" (who puts plastic labels on plain cans), the cost of an aluminum can can easily hit $0.45 or $0.50 before you’ve even put a drop of liquid in it.

The Complexity of the Can Lid

People forget the lid. The "end" is actually a different alloy than the "body." The body of the can needs to be malleable enough to be drawn and ironed into a cylinder, but the lid needs to be stiffer to handle the pressure and the mechanical action of the stay-tab.

Lids are often priced separately.

If you’re looking at a quote from a supplier like Crown Holdings or Ardagh Group, you’ll see the body price and the end price listed as distinct line items. Lately, the ends have been a bottleneck in the supply chain just as much as the cans themselves.

Why Plastic Isn't Winning

You’d think everyone would just switch to PET plastic if aluminum is so volatile.

✨ Don't miss: How Much Is Silver An Ounce Today: Why the $90 Breakout Changes Everything

Not quite.

Aluminum has better "barrier properties." It keeps CO2 in and oxygen out better than plastic, which means a longer shelf life. It also chills faster. More importantly, from a business perspective, the "infinite recyclability" of the metal is a massive PR win. Even if the cost of an aluminum can is higher upfront, the brand value of being "sustainable" often outweighs the pennies saved by switching to plastic.

The Shrinkflation Reality

Ever notice how some premium energy drinks or craft sodas come in those skinny 12-ounce "sleek" cans?

They look fancy. They’re also a way to manage costs. While the volume is the same as a standard "squat" can, the manufacturing lines for sleek cans are often newer and more efficient, and the perceived value allows brands to charge a premium. You’re paying more for the same amount of liquid, partly because the packaging looks like it costs more—even if the aluminum weight is nearly identical.

Actionable Insights for Navigating Metal Costs

If you are a business owner or just a curious consumer trying to understand why your grocery bill is climbing, here is the reality of the situation.

First, watch the Midwest Premium. If you see news reports about rising industrial energy costs in the Midwest or changes in aluminum tariffs, expect your beverage prices to follow in about three to six months. Most large companies hedge their aluminum costs, meaning they buy "futures" to lock in a price, but those hedges eventually expire.

Second, if you're a small-scale producer, "bright stock" (unprinted silver cans) is your safety net. Buying printed cans in bulk is cheaper per unit, but the inventory carrying cost is a killer. Use pressure-sensitive labels or shrink sleeves to stay agile, even though it adds about $0.10 to your cost of an aluminum can.

Lastly, support closed-loop recycling. The more metal stays in the system, the less we rely on expensive, energy-intensive primary smelting. It’s the only way to decoupled the price of a soda from the price of global Brent crude or natural gas.

The silver cylinder isn't just trash. It's a high-tech, energy-dense commodity that happens to hold your sparkling water. Treat it accordingly.