You’re sitting in a Prometric testing center. The air is slightly too cold. You’ve got two scratch paper booklets, a lead pencil that feels like it’s from 1994, and your trusty HP-12C. But there’s one thing that feels like a security blanket: the cfp board formula sheet.

Honestly, most candidates treat this piece of paper like a holy relic. They think it’s going to do the heavy lifting for them. It won't. If you don't know how to navigate it, that sheet is basically just a list of Greek symbols designed to ruin your afternoon.

Why the CFP Board Formula Sheet Isn't a Cheat Sheet

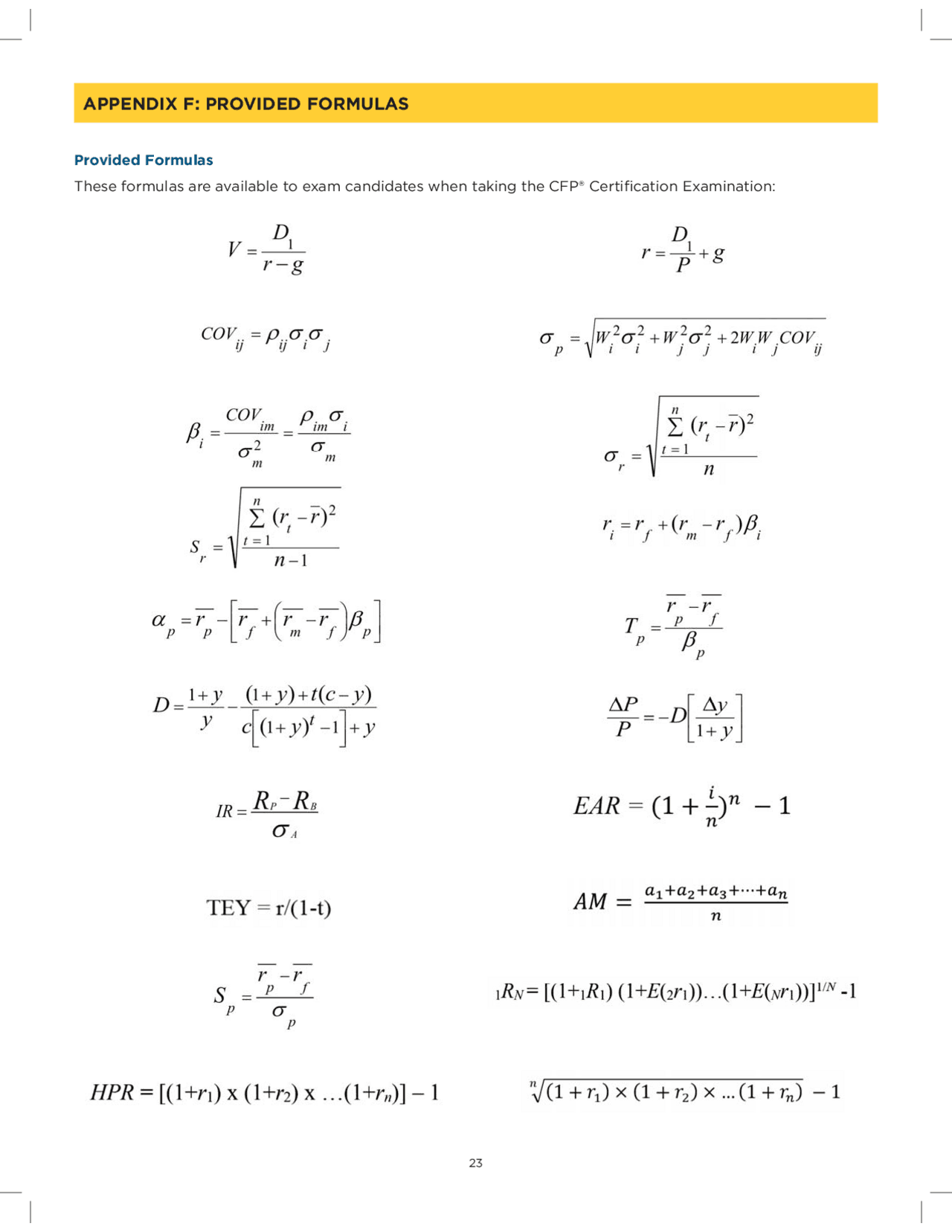

Let’s be real for a second. The CFP Board isn't handing out freebies. They provide a specific set of formulas, but they don't label them. You won't see "CAPM" or "Sharpe Ratio" neatly typed out. You just see the raw math.

Basically, if you can’t recognize the Capital Asset Pricing Model from its variables, you’re already in trouble. It’s a tool, not a tutor. You’ve got to know when to pull it out and, more importantly, when to ignore it entirely.

What's Actually on the Paper?

The provided document is divided into a few key areas, primarily focusing on investments and bond math. You'll find things like:

- The Gordon Growth Model (Intrinsic Value)

- Standard Deviation (Both population and sample)

- Sharpe, Treynor, and Jensen’s Alpha

- Duration and Bond Price Change

Wait, let’s stop there. Did you know the formula for Tax Equivalent Yield is on there? Most people forget it’s tucked away at the bottom. It’s a lifesaver for those "muni vs. corporate bond" questions that pop up when you're three hours into the exam and your brain is turning into mush.

The Danger of Over-Reliance

Here is the thing. The CFP Board formula sheet is notoriously "thin." It covers the complex investment stuff, but it leaves out some of the most common math you'll actually do on the exam.

📖 Related: Fidelity Personalized Planning and Advice: What Most People Get Wrong About the Costs and Value

I’ve seen students panic because they can't find the Margin Call Price formula. It’s not there. You have to memorize it: $Price = \frac{Loan}{1 - Maintenance \ Margin}$.

If you spend five minutes scrolling through the provided PDF looking for it, you’ve just flushed two questions worth of time down the toilet. Efficiency is everything.

The "Missing" Formulas You Need to Know

- Housing Ratios (28/36): You’ll be calculating PITI in your sleep, but don't expect the sheet to remind you what the "36" stands for.

- Current Yield: It's so simple people overthink it. Annual Coupon / Current Price. Not on the sheet.

- Real Rate of Return: The "inflation-adjusted" return. You need the $(1+r) / (1+i) - 1$ calculation burned into your retinas.

How to Use the Sheet Without Losing Your Mind

When you start your session, you’ll have a few minutes of "instructional time." Professional test-takers use this time to do a "brain dump."

Even though you have the cfp board formula sheet available as a digital pop-up, it’s often faster to write down the stuff that isn't on there. Write down the Alimony Recapture formula. Scribble the AMT exemptions if they aren't in your tax tables.

Sorta feels like cheating? It’s not. It’s strategy.

Navigating the Investment Formulas

Most of the sheet is dedicated to Investment Planning (which accounts for roughly 17% of your score).

The Portfolio Standard Deviation formula is on there, and it looks terrifying. It's that long string of $W$s and $\sigma$s and $COV$s. Honestly, the exam rarely asks you to do the full manual calculation for a two-asset portfolio from scratch. They usually want you to understand the relationship—how adding a negatively correlated asset drops the overall risk.

If you find yourself doing 10 minutes of math on one question, you’re probably doing it wrong. The formula is there to help you verify a result, not to be a substitute for understanding the concept of covariance.

The Tax Tables: The Unsung Hero

Along with the formulas, you get the tax tables. For 2026, these are vital. You'll have the income tax brackets, the gift tax limits, and the standard deductions.

But here is a trap: The Phase-outs. The Board might give you the 2026 tax brackets, but they won't always give you the phase-out range for a Roth IRA contribution or the Child Tax Credit. You’ve got to keep those numbers in your head.

The sheet tells you the "how," but the study prep tells you the "where" and "when."

Actionable Tips for Your Next Study Session

Don't wait until the week before the exam to look at the official PDF. It's available on the CFP Board website right now.

- Print the actual sheet. Put it on your desk. Every time you do a practice question, try to find the relevant formula on that specific piece of paper.

- Label it yourself. Take a highlighter and mark which formula is which. "This one is Treynor. This one is Jensen." Do this until you recognize the "face" of the formula without the name.

- Practice the "Missing" math. Spend one entire study block only on formulas that aren't on the sheet. If you can’t do a Bond Equivalent Yield or a Housing Ratio from memory, you're leaving points on the table.

- Use your calculator's memory. Learn how to store variables in your HP-12C or BA II Plus. If a formula has four steps, don't write down the intermediate numbers. Store them. It prevents rounding errors that the CFP Board loves to use as "distractor" answer choices.

The cfp board formula sheet is a tool for the prepared. For the unprepared, it’s just a distraction. Master the "missing" formulas, learn to recognize the provided ones by sight, and keep your pace steady. You've got 170 questions and 360 minutes. Don't let a math problem steal more than two of them.

Key Takeaways for 2026 Candidates

- Recognition is King: Since formulas aren't labeled, you must know what $D1 / (r - g)$ represents (Gordon Growth) before you open the PDF.

- Watch the Clock: Use the digital sheet for verification, but rely on your "brain dump" for the high-frequency, non-provided formulas.

- Focus on Investments: The majority of the sheet is dedicated to the Investment Planning domain; ensure you can distinguish between the Sharpe and Treynor denominators.

- Tax Tables are Separate: Remember that tax brackets and standard deductions are provided in a different section of the interface than the financial formulas.