Money makes the world go 'round, but lately, it feels like the world is spinning on a totally different axis. Honestly, if you haven't checked the GDP charts in the last few months, you're looking at an old map. The global hierarchy is shifting. It’s not just about who has the most factories anymore; it’s about who controls the AI chips, who’s got the youngest workforce, and who can actually survive a trade war without imploding.

The biggest economies of the world aren't a static list of the "usual suspects" anymore. While the United States and China are still the heavyweights in the ring, the gap between them and the rest of the pack—and even between each other—is telling a brand-new story. We’re seeing a massive divergence. Some old-school powers are struggling to keep the lights on, while others are climbing the ladder so fast it’s giving economists whiplash.

The Trillion-Dollar Club: Breaking Down the Top Tier

Right now, the United States is sitting at the top with a projected GDP of roughly $31.8 trillion. That’s a massive number. It’s more than the next two countries combined. You’ve probably heard people say the U.S. is "falling behind," but the data says otherwise. Between Silicon Valley’s relentless AI push and a consumer base that seemingly refuses to stop spending despite high interest rates, the American engine is surprisingly loud.

Then there’s China. They’re at about $20.6 trillion. For a long time, the narrative was that China would overtake the U.S. by 2030, or maybe even sooner. But things got complicated. Real estate woes and a shrinking population have slowed things down. They’re still a manufacturing beast, no doubt, but the "overtaking" timeline keeps getting pushed back.

Why India is the One to Watch

If you want to talk about real momentum, you have to look at India. In 2026, India has firmly secured its spot as the 4th largest economy, sitting at around $4.5 trillion. They just nudged past Japan, which is a huge deal.

India’s growth rate is hovering around 6.2% to 6.7%, making it the fastest-growing major economy on the planet. They have what economists call a "demographic dividend"—basically, a ton of young people. While China and Japan are aging, India is building. It’s not just call centers anymore; they’re becoming a global hub for electronics and pharmaceutical manufacturing.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

The Biggest Economies of the World by the Numbers

Let's look at how the top ten stack up right now. These figures are based on the latest IMF and World Bank projections for 2026.

- United States: $31.8 trillion

- China: $20.6 trillion

- Germany: $5.3 trillion

- India: $4.5 trillion

- Japan: $4.4 trillion

- United Kingdom: $4.2 trillion

- France: $3.5 trillion

- Italy: $2.7 trillion

- Russia: $2.5 trillion

- Canada: $2.4 trillion

Wait, did you see Germany? They’re still in 3rd place at $5.3 trillion, but don't let the rank fool you. The growth there is sluggish—around 0.9%. They’re the "engine of Europe," but the engine is making some weird clanking noises due to high energy costs and a heavy reliance on old-school industrial exports that China is now competing with.

The Japan Dilemma

Japan is a fascinating case. They were the world's second-largest economy for decades. Now they’re 5th. It’s a "precision" economy—think robotics, cars, and high-end tech—but they’re battling a ghost: a shrinking workforce. There are simply more people retiring than entering the factories. Despite a weak Yen making their exports cheaper, the sheer lack of people is a hard ceiling on growth.

Beyond the Top Five: The Rising Stars and Steady Hands

The UK and France are basically neck-and-neck. The UK has managed to stay ahead at $4.2 trillion, largely thanks to London remaining a massive financial hub. Even after all the post-Brexit drama, capital still flows through the City of London. France, at $3.5 trillion, relies on a mix of luxury goods (think LVMH and Chanel) and aerospace.

But look further down the list at Indonesia. They’re currently the 17th largest economy, but they are climbing fast. They’ve got the nickel everyone needs for EV batteries and a massive, growing middle class. They’re basically where China was twenty years ago.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

What’s Actually Driving This Growth?

It isn't just "selling stuff" anymore. The drivers have changed.

- AI and Compute: If you don't have data centers, you're falling behind. The U.S. is winning here because they own the software and the high-end chips.

- Energy Transition: Countries like Brazil and Indonesia are becoming essential because they have the raw materials for the "green" shift.

- Nearshoring: Mexico is booming (now around $2 trillion) because American companies are moving factories from China to just across the border. It’s faster, cheaper, and avoids a lot of the geopolitical headaches.

The Risks Nobody Wants to Talk About

It’s not all sunshine and rising GDPs. The World Economic Forum’s latest reports highlight "geoeconomic confrontation" as the number one risk for 2026. Basically, that’s a fancy way of saying trade wars and sanctions.

If the U.S. and China decide to stop talking, the whole world feels it. Inflation is also "sticky." It’s not going away as fast as people hoped. In the U.S., things like healthcare and housing costs are still rising way faster than general inflation. This creates a "K-shaped" recovery where the big companies and wealthy individuals do great, but the average person feels like they’re treadmill-running just to stay in the same place.

Actionable Insights for 2026

So, what do you do with this info? If you're looking at the biggest economies of the world from an investment or career perspective, here’s the play:

Diversify into India. Whether it’s through ETFs or business partnerships, you can’t ignore a country growing at 6% with a billion people. The infrastructure gap is closing fast.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Watch the "Nearshore" winners. Mexico and Vietnam are the new manufacturing hubs for the West. They are less about "innovation" and more about "execution," and they are winning big time.

Follow the Chips. The U.S. lead in GDP is currently tied to its dominance in AI. If that bubble pops, the U.S. lead shrinks. If it holds, the gap between #1 and #2 might actually widen for the first time in years.

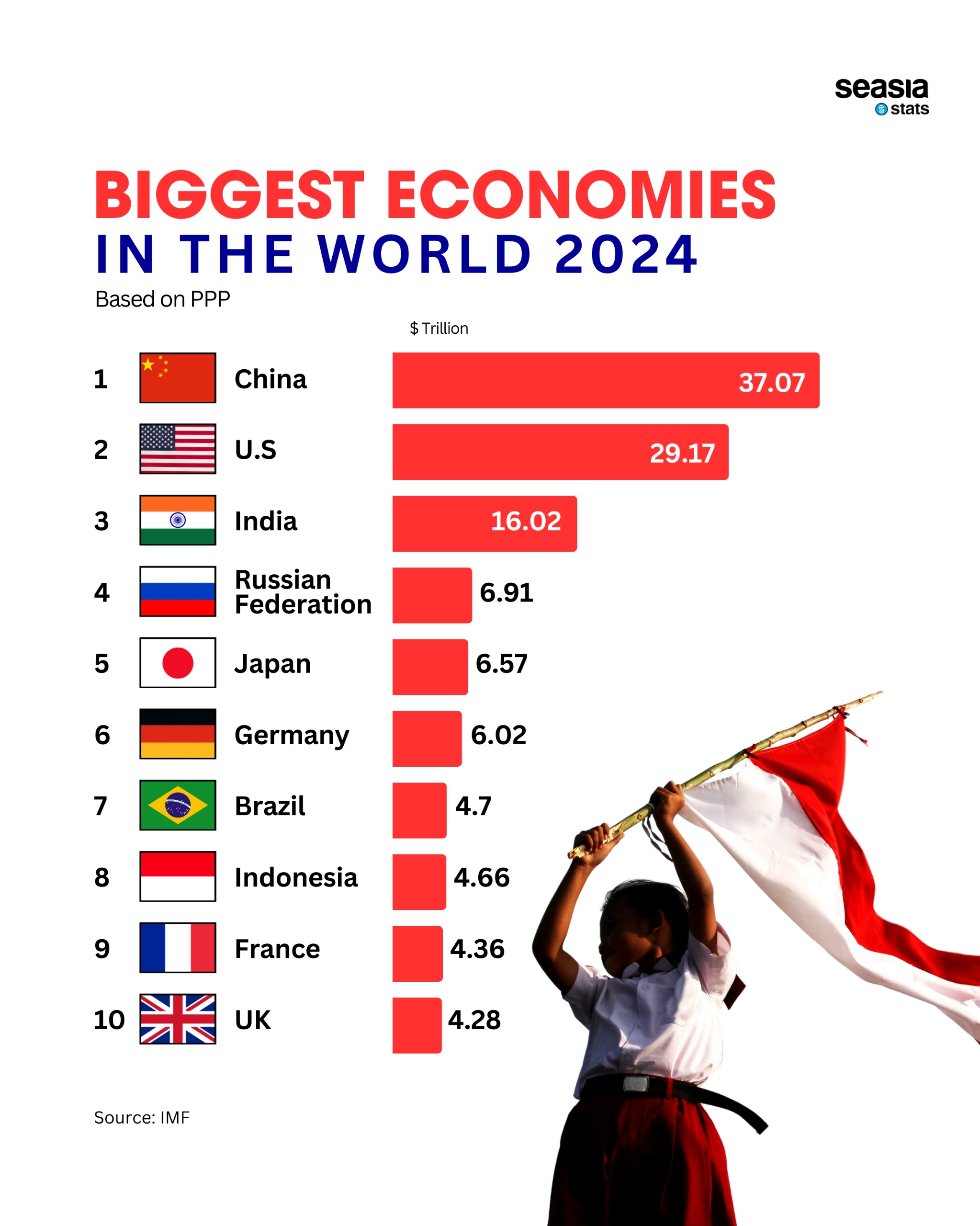

Pay attention to "Real" GDP. Nominal GDP (the numbers above) can be inflated by high prices. Look at "Purchasing Power Parity" (PPP) if you want to know how much a country can actually do with its money. In PPP terms, China is already bigger than the U.S., which tells you they have a massive internal capacity that the dollar-value doesn't always show.

The global economy in 2026 is a game of resilience. The winners aren't just the ones with the biggest numbers today; they’re the ones building the most flexible systems for tomorrow. Keep your eye on the middle of the list—that’s where the real surprises are brewing.