Money makes the world go 'round. Honestly, we hear that all the time, but when you look at the newest gdp list by country, you start to see exactly how much certain "geopolitical heavyweights" are throwing their weight around.

The numbers are huge. Trillions.

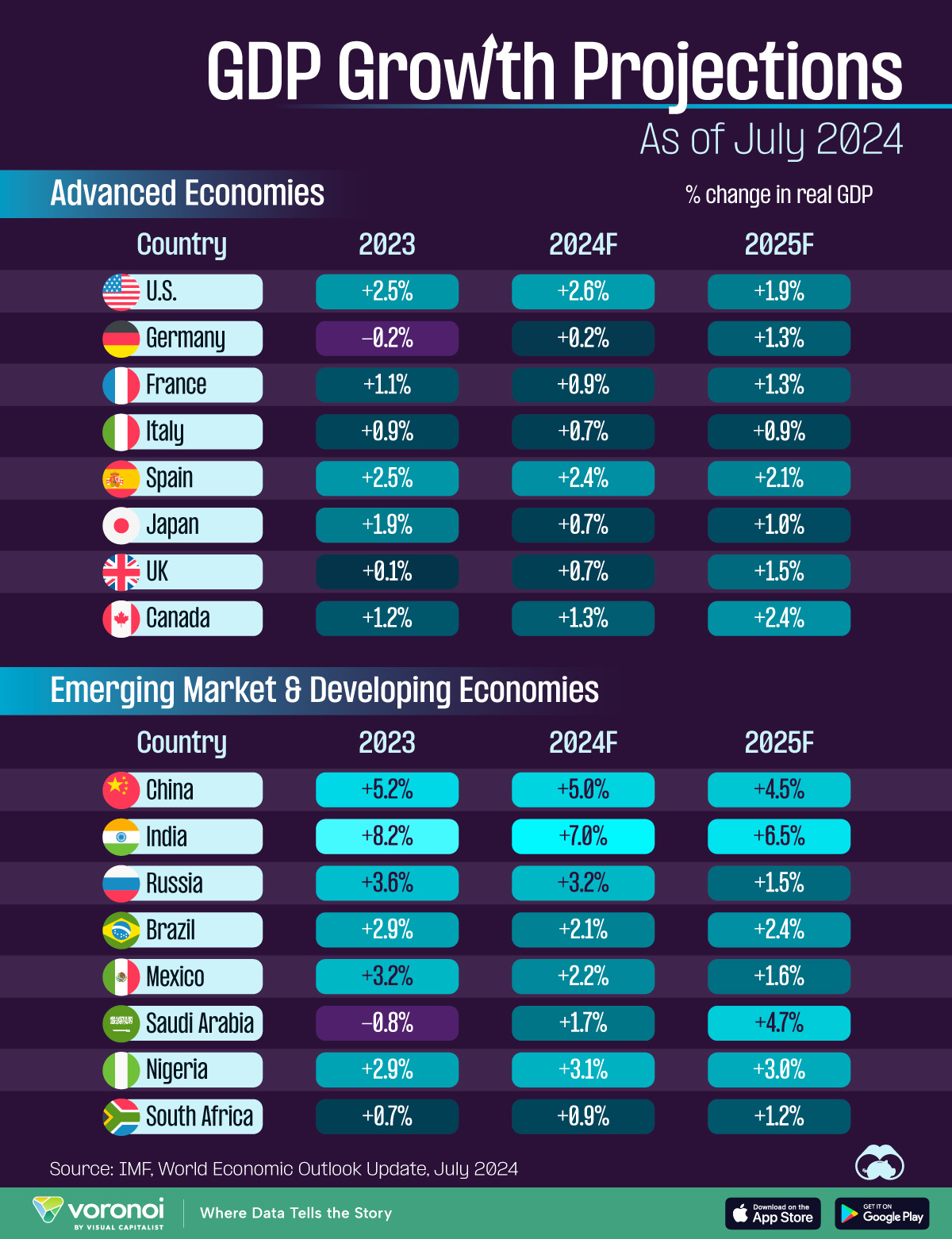

Basically, Gross Domestic Product (GDP) is just a fancy way of measuring everything a country produces—every car, every software subscription, every haircut. If you were looking at the 2024 or 2025 rankings, you might be in for a surprise. Things have moved. The International Monetary Fund (IMF) and the World Bank have been busy crunching the data, and the 2026 landscape shows a world where old-school powerhouses are feeling the heat from fast-moving upstarts.

Who Is Winning the Numbers Game?

The United States is still sitting at the top of the gdp list by country. It’s massive. With a projected GDP of roughly $31.82 trillion for 2026, the U.S. remains the undisputed heavyweight champion. Think about that for a second. That is nearly a quarter of the entire planet's economic output coming from one single nation.

Why? Because they've got their hands in everything. From the tech giants in Silicon Valley like Apple and Microsoft to the massive financial engines of Wall Street, the American economy is built on high-value services and innovation. Plus, the U.S. dollar is still the global reserve currency, which gives them a kind of "cheat code" in international trade.

Then there’s China.

China is holding the #2 spot with about $20.65 trillion. For a while, everyone thought China would just zoom past the U.S. by now. But things have gotten complicated. They’re dealing with a property market that’s a bit of a mess and a population that is getting older, fast. Still, being the "world's factory" means they aren't going anywhere.

💡 You might also like: Dealing With the IRS San Diego CA Office Without Losing Your Mind

The Big Shakeup: India and Japan

This is where it gets interesting. If you haven't checked the rankings lately, you might have missed that India has officially jumped into the #4 spot, overtaking Japan.

India's GDP has hit approximately $4.51 trillion.

They are growing at a rate of 6% to 8% while most of Europe is struggling to even stay above 1%. It's a demographic goldmine. While China and Japan are aging, India has a massive, young workforce. Japan, on the other hand, has slipped to #5. It’s a bit sad, really. They have incredible tech and cars, but a shrinking population and a weak Yen have pushed their nominal dollar value down to around $4.46 trillion.

Germany is still holding onto #3 at roughly $5.33 trillion, but they’re barely growing. Their energy costs have been a nightmare for their industrial sector. Honestly, many economists expect India to leapfrog Germany too, likely by 2027 or 2028.

Breaking Down the 2026 GDP List by Country (Top 15)

Forget those perfect, sterile tables you see in textbooks. Let's talk about where these nations actually stand in the real world as we enter 2026.

- United States: $31.82 Trillion. The giant. They are currently focusing on "re-shoring" manufacturing and AI.

- China: $20.65 Trillion. Growing slower than before, but still a manufacturing beast.

- Germany: $5.33 Trillion. Europe’s engine, though the engine is sounding a bit raspy lately.

- India: $4.51 Trillion. The world's fastest-growing major economy.

- Japan: $4.46 Trillion. Still a tech leader, but struggling with a "super-aged" society.

- United Kingdom: $4.23 Trillion. Heavily reliant on the City of London’s financial services.

- France: $3.56 Trillion. A mix of luxury goods (LVMH) and nuclear energy.

- Italy: $2.70 Trillion. High-end manufacturing and tourism keep them afloat.

- Russia: $2.51 Trillion. Heavily focused on energy and defense, though sanctions have made their long-term outlook murky.

- Canada: $2.42 Trillion. A resource-rich powerhouse with a strong banking sector.

- Brazil: $2.29 Trillion. Dominates in agriculture and mining in the Southern Hemisphere.

- Spain: $2.04 Trillion. Recovering well through a massive boost in services and green energy.

- Mexico: $2.03 Trillion. Benefiting massively from "near-shoring" as companies move out of China to be closer to the U.S.

- Australia: $1.95 Trillion. Essentially the world’s quarry—iron ore and gas are their bread and butter.

- South Korea: $1.94 Trillion. High-tech exports like semiconductors and ships define this nation.

Why Nominal GDP Can Be Kinda Misleading

Here’s a secret: the gdp list by country doesn't tell the whole story.

📖 Related: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

If you look at "Nominal GDP," you're looking at current exchange rates in U.S. dollars. But a dollar goes a lot further in New Delhi than it does in New York. That’s why economists use something called Purchasing Power Parity (PPP).

If we measured the world by PPP, China is actually already the largest economy, and India is #3.

It’s a bit of a head-scratcher, right? Nominal GDP is better for measuring a country's power in international trade—like their ability to buy oil or fighter jets. But PPP is often a better look at the actual standard of living for the people on the ground. For instance, according to recent IMF data, the U.S. GDP per capita is over $92,000. India’s? It’s only around $3,051.

That is a staggering gap. It means that while India as a country is rich and powerful, the average person there is still living in a developing nation.

The Surprise Winners of 2025 and 2026

We can’t talk about the gdp list by country without mentioning the "oil lottery" winners.

Guyana. Have you heard of them? It’s a small country in South America that has seen its GDP explode by 20% to 30% year-over-year because of massive offshore oil discoveries. It’s one of the fastest-growing economies in human history.

👉 See also: Is The Housing Market About To Crash? What Most People Get Wrong

Then you have Ireland. Their GDP often looks "fake" because so many big tech companies (Google, Meta) headquarter there for tax reasons. It makes their GDP per capita look like $135,000—higher than the U.S.

But if you ask a regular person in Dublin, they’ll tell you the rent is impossible and the "wealth" doesn't always feel real. This is what's known as "Leprechaun Economics," a term coined by economist Paul Krugman.

What Should You Actually Do With This Information?

Checking a gdp list by country isn't just for bored geography students. It actually helps you make better decisions in the real world.

If you’re an investor, you probably noticed that the U.S. and India are the places where the growth is actually happening. Europe is safe, but it’s stagnant. If you're looking for where the next big market for your business is, look at Indonesia (#17) or Vietnam (#35). They are climbing the ranks every single year.

Next Steps for Savvy Readers:

- Diversify your perspective: Don't just look at Nominal GDP; check the PPP rankings to see where real consumer demand is growing.

- Watch the demographics: Keep an eye on countries with "young" GDPs like India and Nigeria; they are the long-term bets.

- Track currency shifts: Remember that a weak local currency can make a strong economy look "small" on a dollar-denominated GDP list.

- Monitor "Near-shoring" trends: Countries like Mexico and Vietnam are currently stealing market share from China, making them vital nodes in the 2026 global supply chain.

By staying on top of these shifts, you aren't just reading a list of numbers—you're reading the map of where the world's power is heading next.