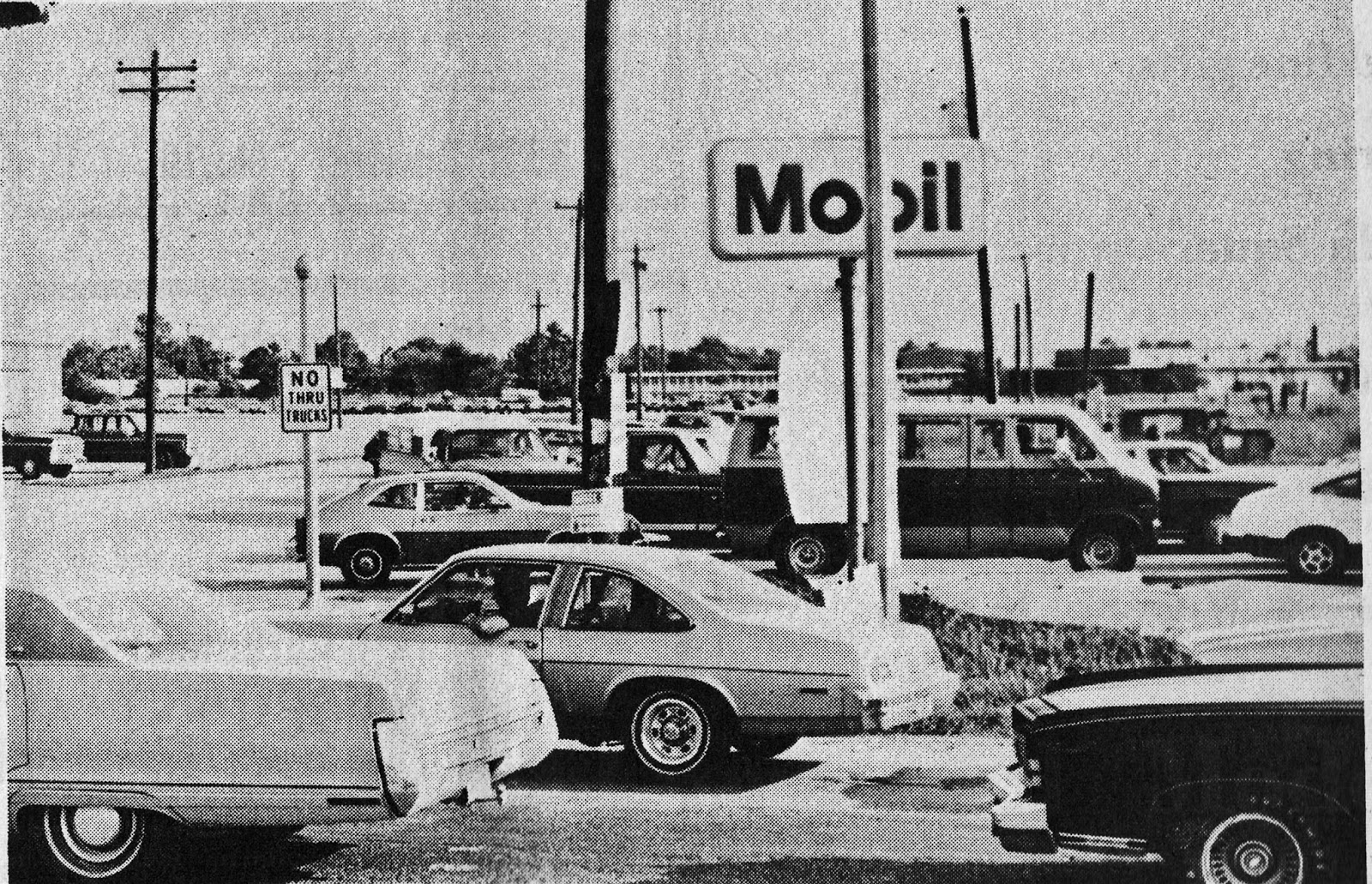

You’ve probably seen the old grainy photos of cars backed up for blocks. People leaning against their sedans, looking frustrated, waiting for a chance to pump a few gallons of leaded gasoline. It looks like a scene from a movie, but for anyone living through the 1979 oil crisis, it was a daily, grinding reality. Prices didn't just go up; the fuel simply wasn't there.

It was chaos.

Honestly, we talk about inflation a lot these days, but the late seventies were a different beast entirely. It wasn't just about the money in your wallet losing value. It was about the literal gears of society grinding to a halt because of events happening thousands of miles away in the Middle East. If you want to understand why the global economy looks the way it does now, you have to look at 1979.

What Actually Triggered the 1979 Oil Crisis?

Most people think "OPEC" and stop there. While the Organization of the Petroleum Exporting Countries definitely played a role, the spark was the Iranian Revolution. It started in late 1978. Protests against the Shah led to massive strikes in Iran's oil fields. By the time the Shah fled and Ayatollah Khomeini took power in early 1979, Iran's oil production had basically fallen off a cliff.

The world lost about 4% of its total production.

That sounds small. You might think, "4%? That’s nothing." But in a global market where supply and demand are balanced on a razor's edge, 4% is a catastrophe. It triggered a panic. People started hoarding. Companies started panic-buying. The price of crude oil more than doubled in twelve months, jumping from around $13 a barrel to over $30.

The Psychology of the Pump

It's weird how humans react to scarcity. When the news started reporting that Iranian exports had stopped, everyone in the United States and Europe rushed to the gas station at the same time. This "precautionary demand" actually did more damage than the actual shortage.

If everyone keeps their tank topped off instead of waiting until they’re empty, the system breaks.

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

Panic.

President Jimmy Carter didn't have many good options. He tried to manage the situation through federal regulations, but many economists argue today that those very regulations made the 1979 oil crisis much worse. The government tried to control prices and allocate where gas went. The result? Huge surpluses in some rural areas and massive, soul-crushing lines in cities like New York and Los Angeles.

The Odd-Even Rationing Nightmare

Do you remember hearing about "Odd-Even" days? If your license plate ended in an odd number, you could only buy gas on odd-numbered days of the month. Even numbers got the even days. It sounds like something out of a dystopian novel, but it was the law in several states.

People were getting up at 4:00 AM just to sit in line. Tempers flared. There were reports of "gasoline fever" where drivers would pull guns on each other over a spot in line. It was a visceral realization that the "American Dream" of the open road was incredibly fragile.

- State governments were desperate.

- The Department of Energy was a brand-new agency struggling to find its footing.

- Gas stations started using colored flags: Green meant they had gas, yellow meant limited rations, and red meant they were bone dry.

The Economic Aftermath: A World Changed

The 1979 oil crisis didn't just affect cars. It killed the "Muscle Car" era. Suddenly, those massive V8 engines that got eight miles to the gallon weren't cool anymore; they were liabilities. This was the moment Japanese automakers like Honda and Toyota really took a bite out of Detroit. They had the small, fuel-efficient cars that Americans suddenly craved.

But it went deeper than cars.

Inflation went nuts. Because oil is used for everything—transporting food, making plastics, heating homes—the price of literally everything went up. This led to "Stagflation," a nasty mix of stagnant economic growth and high inflation. Paul Volcker, the Fed Chair at the time, eventually had to jack interest rates up to nearly 20% to break inflation's back.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

Imagine trying to buy a house today with a 20% interest rate.

It was a brutal solution to a brutal problem. Many historians believe the economic misery caused by the energy shortage was the final nail in the coffin for Jimmy Carter’s presidency, paving the way for Ronald Reagan’s landslide victory in 1980.

Misconceptions: Was it a "Fake" Crisis?

You’ll still hear people at bars or on internet forums claim the oil companies staged the whole thing. They point to tankers sitting offshore waiting for prices to rise. While oil companies certainly didn't mind the higher profits, the "conspiracy" theory doesn't hold much water when you look at the global data.

The Iranian shortfall was real. The Saudi refusal to immediately flood the market was real.

The crisis also highlighted how vulnerable the West was. We had become addicted to cheap energy without a backup plan. In 1979, the United States was importing record amounts of oil. We were essentially at the mercy of geopolitical shifts in a region we didn't fully understand.

What We Learned (And What We Forgot)

The 1979 oil crisis sparked a massive push for energy independence. This is when the U.S. started looking seriously at the Strategic Petroleum Reserve. It's also when we started talking about solar power and wind—Carter even put solar panels on the White House roof (Reagan later took them down).

We learned that:

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

- Diversity of supply is everything.

- Market-based pricing usually works better than government rationing.

- Energy security is national security.

However, as prices dropped in the 1990s, we got lazy again. We started buying SUVs. We forgot the anxiety of the gas line. But the ghosts of 1979 are still there, hiding in the background every time there’s a conflict in the Middle East or a spike at the pump.

Actionable Steps for Today's Volatile Market

History isn't just for textbooks; it's a blueprint for not getting caught off guard again. If 1979 taught us anything, it’s that the status quo can change in a weekend. Here is how you can apply those lessons to your own life and business:

Audit your energy dependency. Look at your home and your commute. If gas prices doubled tomorrow—which they did in '79—could you survive it? Investing in efficiency isn't just about "being green"; it's about insulating yourself from geopolitical shocks.

Diversify your investments. During the 1979 crisis, traditional stocks got hammered, but commodities and gold skyrocketed. If you're heavily weighted in one sector, you're vulnerable. Ensure your portfolio includes energy-hedged assets or companies that thrive on efficiency.

Watch the "shocks," not just the trends. The 1979 crisis wasn't a slow build; it was a sudden break. Keep an eye on major geopolitical shifts in energy-producing regions. Don't wait for the "Red Flag" at the gas station to start planning for higher costs.

Understand the "Odd-Even" mindset. In a crisis, people act irrationally. If you run a business, have a plan for supply chain disruptions before they happen. The time to find an alternative supplier is when things are calm, not when everyone else is fighting for the last shipment.

The 1979 oil crisis was a painful wake-up call that the world is interconnected in ways we can't always control. By staying informed and remaining flexible, you can ensure that the next time the "gears of society" start to grind, you aren't the one stuck in the four-block-long line.