You’ve probably seen it. That grainy, black-and-white footage of men in newsboy caps and oversized wool coats swarming the steps of the New York Stock Exchange. It’s the quintessential 1929 stock market crash video that pops up in every high school history class and every "are we in a bubble?" YouTube essay. People look panicked. Cops are pushing back crowds. It feels like the world is ending in real-time.

But honestly, that video only tells about 10% of the story.

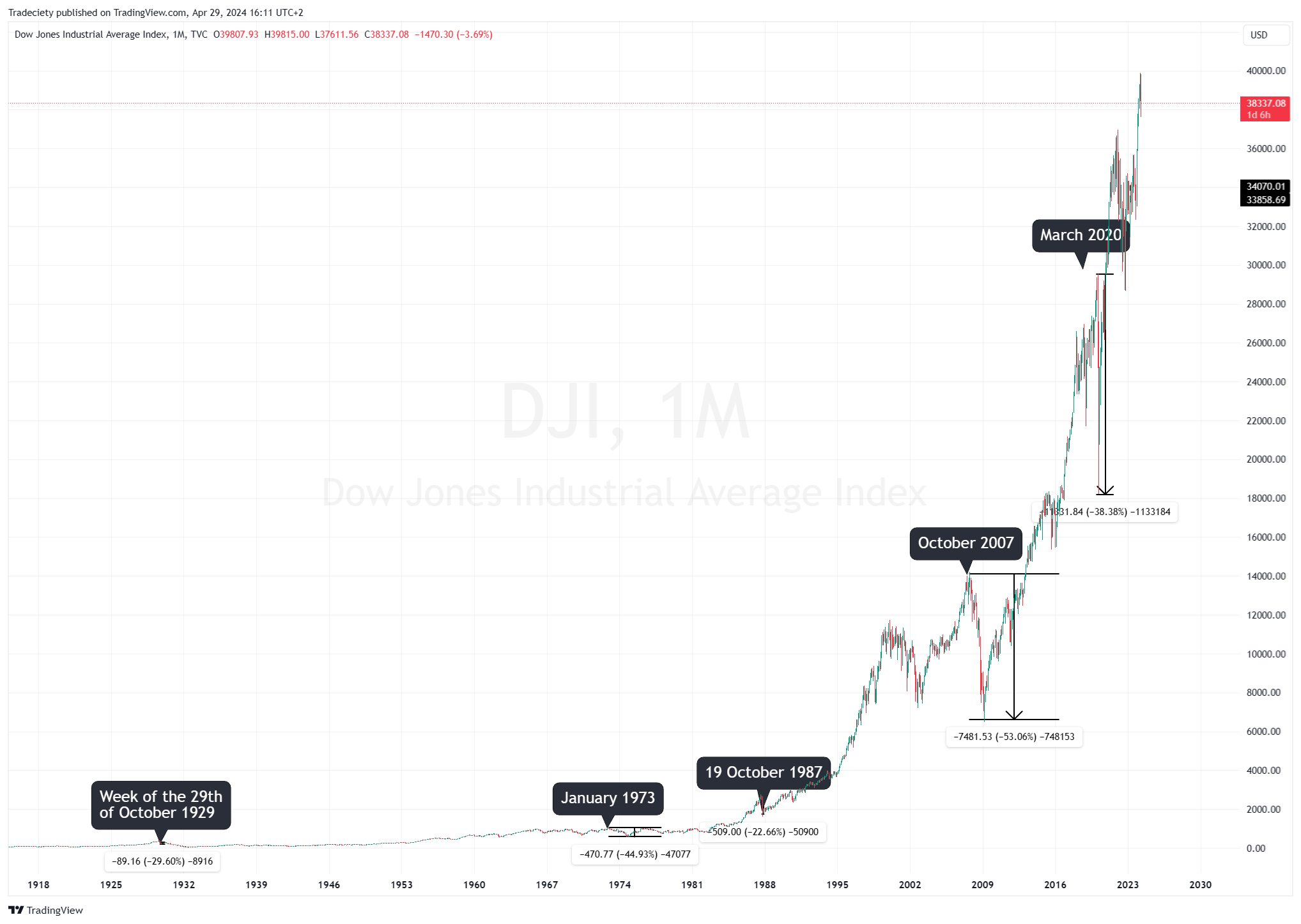

Most of those famous clips aren’t even from "Black Tuesday" (October 29, 1929). They are a collage of the entire week of chaos. If you want to actually understand why your portfolio feels shaky in 2026, you have to look past the grainy film and see the mechanics of how a "sure thing" turned into a generational disaster.

Why this footage still goes viral

It’s the drama. Humans love watching a train wreck, especially one involving billions of dollars.

In the 1920s, the stock market was the new toy. Before then, regular people didn't really "invest." It was for the suits, the tycoons, the Rockefellers. But by 1928, everyone from your barber to your grandmother was buying shares. They were "buying on margin," which is basically a fancy way of saying they were gambling with borrowed money. You could put down just 10% of a stock's price, and the broker would lend you the rest.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Imagine buying a house with a 90% loan where the bank can demand the whole thing back the second the value drops $1. That’s what happened.

The real "Villains" in the 1929 stock market crash video

When you watch that 1929 stock market crash video, you see the "throng." What you don't see are the guys inside the building who actually pulled the trigger.

- Charles Mitchell: The head of National City Bank (now Citibank). He was the one who really pushed the idea of selling stocks to the "little guy."

- Michael Meehan: A legendary stock specialist who manipulated the price of "glamour stocks" like RCA. He’d create "trading pools" to pump a stock up, lure in the public, and then dump it. Sound familiar? It’s basically the 1920s version of a crypto rug pull.

- William Durant: The founder of General Motors. He tried to single-handedly save the market by buying millions of dollars in shares as it fell. He died broke.

It wasn't just one day

People think the market crashed on Tuesday and everyone was poor on Wednesday. It doesn't work like that. The market actually started wobbling in September. By October 24 (Black Thursday), the panic was real.

There's a famous story—partially captured in some documentaries—where a group of bankers led by Thomas Lamont (representing J.P. Morgan) met on the floor of the NYSE. They started buying massive blocks of U.S. Steel to show confidence. It worked for about two days. Then, the weekend happened. People had time to think. They realized their "margin calls" were due.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

By Monday and Tuesday, the dam broke. $30 billion vanished in two days. To put that in perspective, that was more than the U.S. spent on the entirety of World War I.

What the documentaries get wrong

Most 1929 stock market crash video segments suggest the crash caused the Great Depression.

Most economists today, like the ones you'll hear on PBS American Experience or Crash Course, argue that the crash was just a symptom. The real "killer" was the banking collapse that followed. People ran to the banks to get their cash, the banks didn't have it, and the whole system seized up.

Also, the "jumpers" story is mostly a myth. While a few high-profile people did take their lives, the image of hundreds of brokers leaping from windows was largely an exaggeration by the press. The real tragedy was much slower—years of bread lines and 25% unemployment.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Why we’re watching this in 2026

We are currently obsessed with these videos because the "AI boom" of the last couple of years feels eerily similar to the "Radio boom" of the 20s.

In 1929, the "tech" was Radio (RCA). It was going to change the world. And it did! But that didn't mean the stock was worth 500 times its earnings. Today, we see the same "delirious optimism" around AI and automation. We see the "democratization of finance" through apps that make trading feel like a video game.

Actionable insights for the modern investor

Watching a 1929 stock market crash video shouldn't make you hide your money under a mattress. It should make you smarter. Here is how you actually protect yourself:

- Check your leverage: If you are trading on margin or using "options" you don't fully understand, you are the guy in the newsboy cap. When the market turns, you won't have time to react.

- The "Barber" Test: In 1929, Joseph Kennedy (JFK's dad) famously sold all his stocks because a shoe-shine boy gave him stock tips. If people who have no interest in finance are suddenly telling you which AI stock is "going to the moon," it’s time to look for the exit.

- Liquidity is King: The crash became a depression because nobody had cash. Keep an emergency fund that is not tied to the S&P 500.

- Watch the "Specialists": Keep an eye on institutional selling. Big banks usually start unloading their positions weeks before the "big" crash video happens.

If you want to see the best version of this history, look for the PBS American Experience: The Crash of 1929. It uses real diaries from people who lived through it—including Groucho Marx, who lost every penny he had.

Don't just watch the footage for the drama. Look at the faces of the people in the crowd. They weren't stupid; they were just caught up in a cycle of greed and easy credit that eventually ran out of gas. History doesn't always repeat, but as the saying goes, it definitely rhymes.

Next Steps:

Go to your brokerage account right now and look at your "Buying Power." If you see a large amount of margin being used, calculate what happens to your account if your biggest holding drops by 30% tomorrow. If that calculation makes you feel sick, it's time to deleverage. Move a portion of your "speculative" gains into a high-yield money market fund to ensure you have dry powder if a real correction hits.