Tax season is usually a headache, but for anyone over 65, the IRS tries to make things a little easier. Sorta. You’ve probably seen the 1040 SR form 2024 popping up in your tax software or at the local library, and if you're like most people, you're wondering if it's actually any different from the regular 1040.

It is. But also, it isn't.

Let's get the weird part out of the way first: the math is exactly the same. You aren't getting a secret "senior discount" just by switching forms. However, the 1040 SR form 2024 is designed specifically with "old school" readability in mind. It has a much larger font. The lines are spaced out. It’s easier on the eyes if you’re still filing on paper. But the real value isn't just the big print; it’s how the form highlights the specific tax benefits that kick in once you hit that magic age of 65.

💡 You might also like: Las Vegas Market: Why This Furniture Show Actually Matters More Than You Think

What’s the Big Deal with the 1040 SR Form 2024?

Honestly, the IRS introduced this back in 2019 because the AARP and other advocacy groups pushed for it. They realized that as we get older, our income sources change. You aren't just dealing with a W-2 from a 9-to-5 anymore. Now, you’ve got Social Security benefits, RMDs (Required Minimum Distributions) from your IRA, maybe some pension income, and definitely more interest from those high-yield savings accounts or CDs you’ve been sitting on.

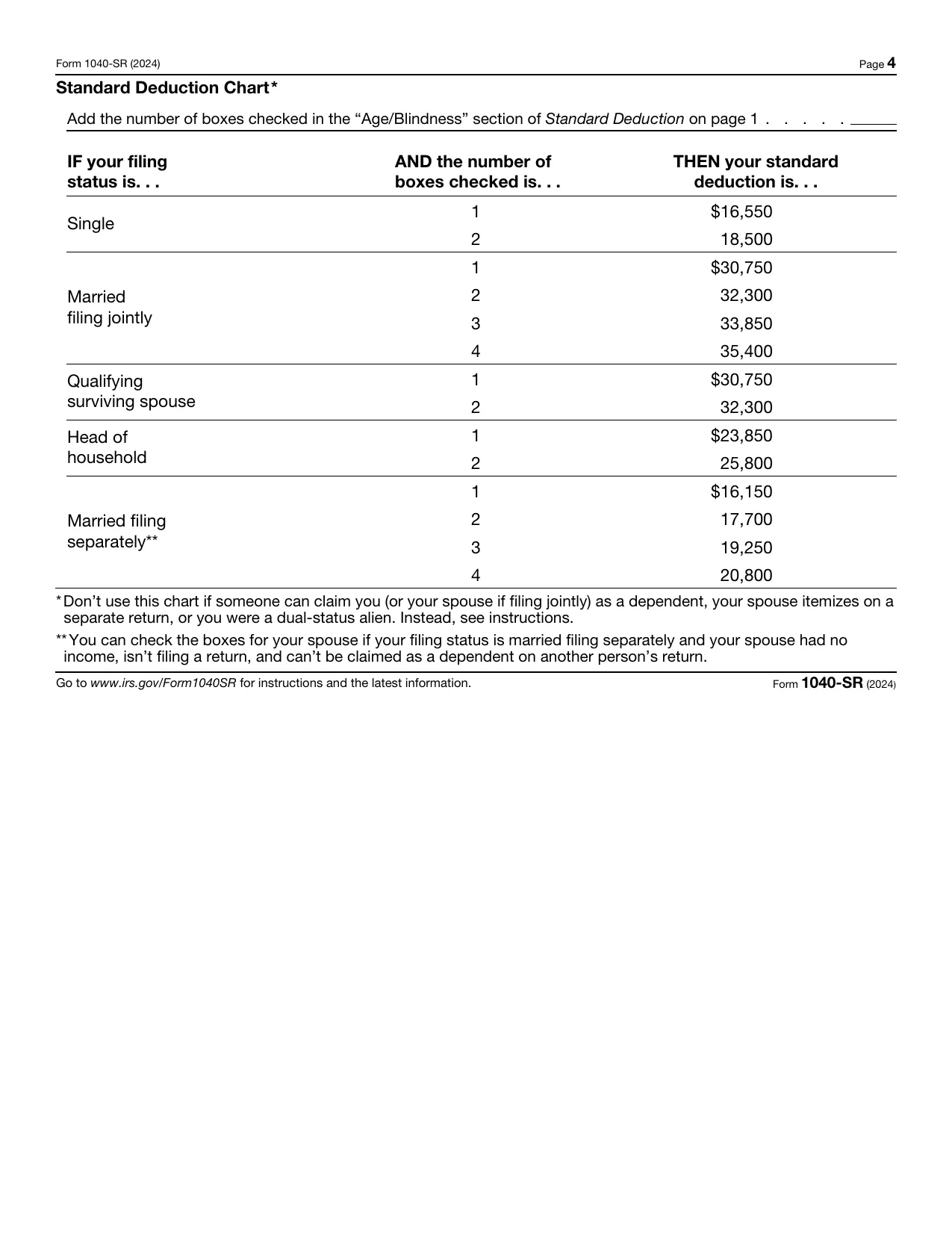

The 1040 SR form 2024 acts like a giant cheat sheet. For example, right on the form, there’s a printed chart for the standard deduction. For most people, the standard deduction is just a flat number. But for seniors? It’s higher.

If you or your spouse were born before January 2, 1960, you get an extra "bump" to your deduction. For the 2024 tax year (the ones you file in early 2025), that extra amount is $1,950 if you’re single or head of household. If you’re married and both of you are 65 or older, that’s an extra $3,100 ($1,550 each) wiped off your taxable income. The 1040-SR makes sure you don't miss that. It’s right there in your face.

Income Reporting That Actually Makes Sense

Most people get confused about how to report Social Security. It’s not all taxable, which is a common misconception that drives people crazy every year. Depending on your "combined income," you might pay taxes on 0%, 50%, or 85% of your benefits.

The 1040 SR form 2024 has specific lines (Lines 6a and 6b) that walk you through this. You put the total amount you got from the SSA in 6a, and only the taxable part goes in 6b. If you’re doing this by hand, it saves you from flipping through a 100-page instruction booklet every five minutes.

We also have to talk about the "Qualified Business Income" (QBI) deduction. Just because you’re retired doesn't mean you stopped working. Maybe you’re consulting or you’ve got a side hustle on Etsy. The 1040-SR still allows you to take that 20% QBI deduction. It doesn't strip away any of the "complex" tax breaks just because it’s a "senior" form. It’s a full-powered 1040, just wearing more comfortable shoes.

The Standard Deduction Breakdown for 2024

Let’s look at the actual numbers because they changed for the 2024 tax year due to inflation adjustments.

If you are filing as Single and you are 65 or older, your total standard deduction is $16,550. That’s the base $14,600 plus the $1,950 senior kicker.

If you are Married Filing Jointly and both of you are over 65, your deduction is $32,300. That is a massive chunk of income that the government can’t touch. If only one of you is over 65, the amount drops to $30,750.

These numbers matter. A lot. If you’re living on a fixed income, every thousand dollars deducted from your taxable total is money that stays in your pocket for groceries, healthcare, or the grandkids.

✨ Don't miss: How Much Is a 1000g Gold Bar Worth: What Most People Get Wrong

Common Mistakes Seniors Make on the 1040-SR

One thing people get wrong is thinking they must use this form. You don't. If you’re 66 and you want to use the standard 1040, go for it. The IRS doesn't care. Also, if you’re using software like TurboTax or H&R Block, you might not even realize which form the computer is generating in the background. Most tax software will default to the 1040 SR form 2024 if you enter a birthdate that qualifies you.

Another mistake? Forgetting about the "blindness" deduction. If you are legally blind and over 65, your standard deduction goes even higher. The 1040-SR has a checkbox for this. Don't skip it. It’s another $1,950 (for single filers) that you’re entitled to.

Then there’s the Credit for the Elderly or the Disabled. This one is tricky. It’s a non-refundable credit, but the income limits are honestly pretty low. Most people who have a decent pension or Social Security find themselves "earned out" of this credit, but it’s still worth checking Schedule R if your income is on the lower side (generally under $17,500 for a single person).

Why Paper Filers Love the 1040-SR

Even though the world has gone digital, a huge percentage of seniors still prefer to mail in a paper return. There's a sense of security in it. The 1040 SR form 2024 was literally built for this.

The IRS uses a specific type of paper and ink for these forms to ensure they are high-contrast. If you have cataracts or general age-related vision decline, the difference between the tiny 7-point font on a standard 1040 and the 10- or 12-point font on the 1040-SR is night and day.

What About Schedules?

Don't be fooled. Just because the main form is simplified doesn't mean you escape the "Schedules."

- If you have more than $1,500 in interest, you still need Schedule B.

- If you have capital gains from selling stock, you still need Schedule D.

- If you're itemizing (which is rare now because the standard deduction is so high), you still need Schedule A.

The 1040 SR form 2024 is just the "face" of your tax return. It’s the summary. All the heavy lifting still happens in the attachments.

Real-World Example: The "Gap Year" Retiree

Consider "Larry." Larry retired at 64, but in 2024 he turned 65. He’s got a small pension, he’s taking some money from his 401(k), and he hasn't started Social Security yet because he wants to wait until 70 to maximize the benefit.

For Larry, the 1040 SR form 2024 is perfect. Why? Because his tax situation is in flux. By using the SR, he can clearly see that his standard deduction increased significantly from the previous year. He can see where his 401(k) distributions (which are fully taxable) go on Line 5b. He can clearly see the "Taxable Amount" box, which helps him estimate his quarterly estimated tax payments for 2025.

If Larry were still using the standard 1040, he might miss that extra $1,950 deduction. It sounds small, but in a 12% or 22% tax bracket, that’s a few hundred dollars. That's a car payment. That's a nice dinner out.

Tax Planning and the 1040-SR

If you’re looking at the 1040 SR form 2024 and realizing you’re going to owe money, it might be time to look at your withholding. Most people don't realize you can have taxes withheld from your Social Security checks. You use Form W-4V.

📖 Related: How Much Gold Is at Fort Knox: Why the Real Number Matters

If you’re staring at Line 24 (Total Tax) and Line 33 (Total Payments) and the math isn't in your favor, don't panic. The SR form makes it very easy to see the "Amount You Owe" in big, bold letters. If that number is over $1,000, the IRS might hit you with an underpayment penalty.

To avoid this next year, you can increase the withholding on your RMDs or your pension. It’s way easier than writing a big check in April.

Key Takeaways for the 2024 Tax Year

The 1040 SR form 2024 isn't a magic wand, but it’s a better tool for the job if you’re a senior. It prioritizes what matters to you: readability and the age-based deduction.

- Check your age. If you were born before Jan 2, 1960, you qualify for the 2024 tax year.

- Look at the chart. Use the built-in standard deduction chart on the form to make sure you're claiming the right amount.

- Don't ignore the Schedules. You still have to report interest, dividends, and capital gains on the same secondary forms as everyone else.

- Social Security nuance. Remember that only a portion of your benefits is likely taxable. Use the worksheet!

- Electronic vs. Paper. You can use the 1040-SR even if you file electronically; the software just handles the formatting for you.

Actionable Next Steps

To get the most out of the 1040 SR form 2024, start by gathering your 1099-R forms (for pensions and IRAs) and your SSA-1099. Compare your total income to the new, higher standard deduction amounts ($16,550 for singles or $32,300 for couples both over 65). If your total income is below these amounts, you might not even be required to file, though you should still file if you had any taxes withheld so you can get that money back as a refund.

If you prefer paper, you can order the 1040-SR directly from the IRS website or pick one up at a participating post office or library starting in January 2025. For those who find the math intimidating, look into the VITA (Volunteer Income Tax Assistance) or TCE (Tax Counseling for the Elderly) programs. These are IRS-certified volunteers who provide free tax prep for seniors, and they are experts at navigating the nuances of the 1040-SR.

Finally, double-check your "Taxable Interest" on Line 2b. With interest rates being higher recently, many seniors are seeing a jump in their 1099-INT forms from banks. Ensuring these are recorded correctly on your 1040 SR form 2024 is the best way to avoid an automated "CP2000" notice from the IRS later in the year.