You know that feeling when you're flipping through a stack of junk mail—pizza coupons, a pre-approved credit card you don't want, a local handyman flyer—and then you see it. A plain, white, business-sized envelope. The return address says "Department of the Treasury, Internal Revenue Service." Your stomach drops. You haven't even opened it yet, but you're already sweating. Honestly, the irs audit letter envelope is probably one of the most stressful pieces of mail a human being can receive in the United States. It's the physical embodiment of "we need to talk."

But here is the thing: not every letter from the IRS is a full-blown audit. People freak out way too early. Sometimes it’s just a math error. Sometimes they just need a copy of a form you forgot to attach. Before you let your heart rate hit 120, you need to look at the envelope itself and the notice inside. There are specific markers that tell you exactly how worried you should be, and frankly, some of the "scary" stuff is actually pretty routine.

Decoding the Anatomy of the IRS Audit Letter Envelope

Let’s look at the exterior. A genuine IRS envelope is going to be austere. It’s not flashy. If you see "IMPORTANT TAX DOCUMENT" in bright red, bold letters with a picture of an eagle wrapped in a flag, it might actually be a scam or a private tax relief company trying to scare you into calling them. The real deal is boring. It usually features a return address from a specific IRS Service Center—think Austin, TX; Holtsville, NY; or Fresno, CA.

Look at the top left corner. You’ll see "Department of the Treasury" and "Internal Revenue Service" printed in a standard, no-nonsense serif or sans-serif font. If there is a window in the envelope, you’ll see your name and address, but more importantly, you’ll usually see a "Notice Number" or "Letter Number" peeking through or printed right at the top of the first page once you slide it out. This is your North Star. Everything the IRS does is categorized by these codes.

Why the Envelope Design Matters

Scammers have gotten incredibly good at mimicking the irs audit letter envelope. They use the same weight of paper. They use official-looking logos. However, the IRS rarely uses "pressure-sealed" mailers (the kind you have to tear the perforated edges off of) for initial audit notices. Those are more common for simple PIN deliveries or basic transcripts. If you get a thick envelope with a lot of heft, it’s more likely a formal inquiry. If it’s a thin, single sheet, it might just be an adjustment to your refund.

Also, check the postmark. The IRS sends official correspondence via the U.S. Postal Service. They don’t use FedEx or UPS for initial contact. If a guy in a brown shorts-suit knocks on your door and hands you a "tax audit" package, that’s a massive red flag. Real IRS audits start with a letter in a standard envelope delivered by your regular mail carrier. Period.

The Codes You’ll See Inside

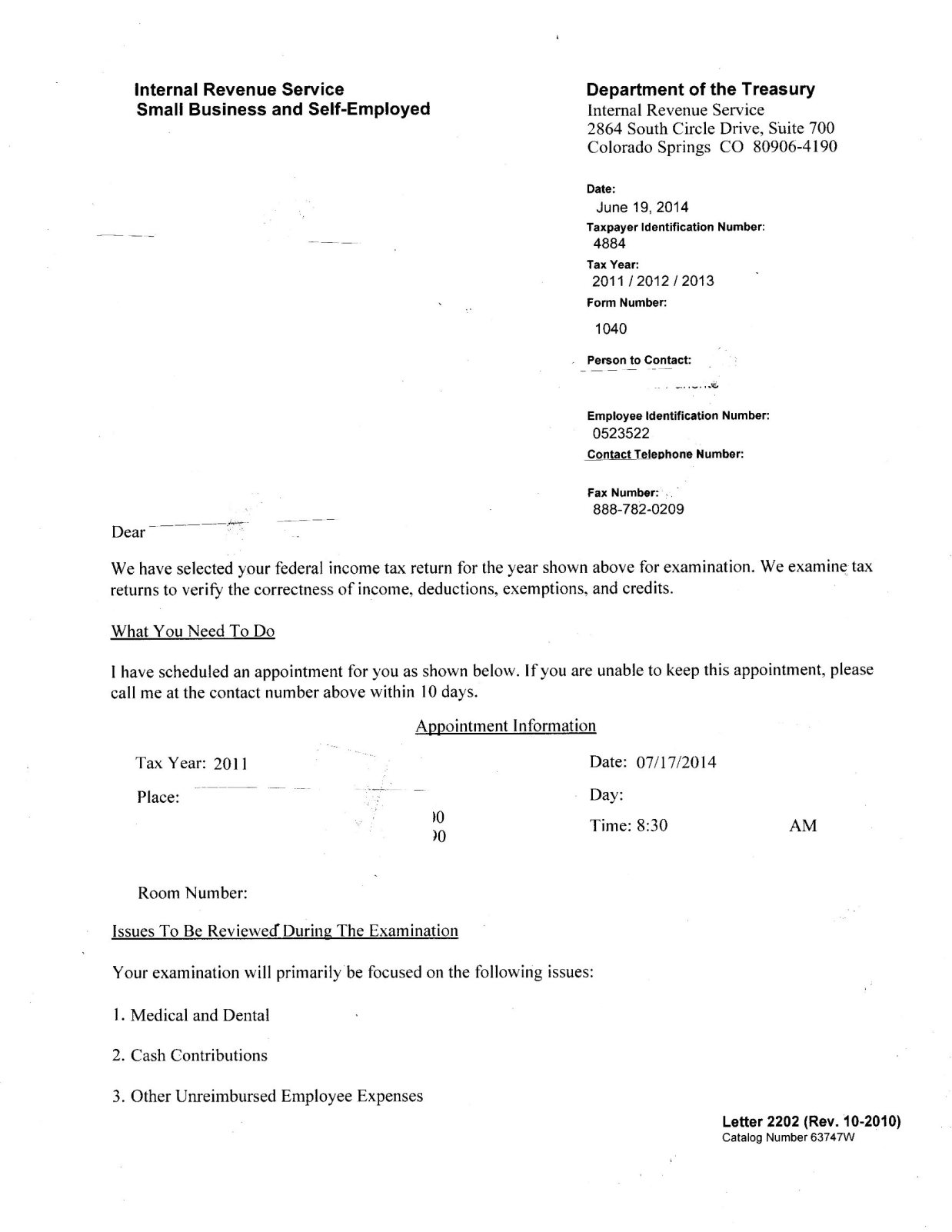

Once you stop staring at the envelope and actually rip it open (carefully, please), look at the top right corner. You are looking for a CP or LTR code. This is basically the IRS's shorthand for "how much do we want from you?"

- CP2000: This is the big one people mistake for a full audit. It’s an "Underreporter Inquiry." Basically, their computers saw that an employer or bank reported income (like a 1099 or W-2) that didn't show up on your return. It’s a mismatch. It’s automated. It’s not a human being digging through your trash... yet.

- Letter 2205-A: This is the "real" audit. If this comes out of your irs audit letter envelope, this is a focused examination. It means a human revenue agent has been assigned to your case. They want to see receipts. They want to see logs.

- CP501: This is just a reminder that you owe money. It’s a bill. It’s annoying, sure, but it’s not an investigation into your soul.

The IRS doesn't just "audit" people for fun. According to the IRS Data Book, the agency’s audit rate for individual taxpayers has actually hovered at historic lows—often less than 0.5% for most income brackets—though that’s starting to shift with new funding. They are looking for high-probability errors. If you claimed $40,000 in charitable contributions on a $50,000 salary, that envelope was inevitable.

Common Myths About IRS Mail

Everyone has a story about a "friend of a friend" who got hauled off to jail because of a letter. That doesn't happen. The IRS is a massive, slow-moving bureaucracy. They don't want to put you in jail; they want the money they think you owe them, plus interest.

One of the biggest misconceptions is that if you ignore the irs audit letter envelope, it will go away. It won't. If you don't respond to a CP2000 or a formal audit letter, the IRS simply "defaults" the decision. They will decide you owe the maximum amount possible, tack on penalties, and start the collection process. This can lead to tax liens or wage garnishments. Opening the envelope is the hardest part. Once it's open, you have a timeline. You usually have 30 days to respond. That’s your window of power. Use it.

Another myth? That you should immediately call the number on the letter and confess everything. Take a breath. You have the right to representation. You can hire a CPA or an Enrolled Agent (EA) to talk to them for you. In many cases, if you provide a Power of Attorney (Form 2848), you never even have to speak to the IRS yourself.

How to Tell if it's a Scam

Scams are rampant. Here is a quick checklist to run through if you're doubting the authenticity of the mail you just received:

✨ Don't miss: Claim Unemployment Benefits in Florida: What Most People Get Wrong

- Does it ask for a Credit Card over the phone? The IRS will never do this.

- Does it mention iTunes Gift Cards or Wire Transfers? Obviously a scam, but people fall for it when they're panicked.

- Is the tone aggressive or threatening? Real IRS letters are incredibly dry and formal. They don't use exclamation points. They don't threaten to send the local police to your house within the hour.

- Check the "From" address. If the return address is a P.O. Box in a city that doesn't host an IRS Service Center, be skeptical.

If you are truly unsure, don't call the number on the letter. Go to IRS.gov and call their verified 800-number. Ask them if a notice was recently issued for your Social Security number. They can see it in the system.

Dealing with the Paperwork

So, you’ve opened the irs audit letter envelope and it is, in fact, an audit. What now?

First, look at the "Items under examination" section. They usually aren't auditing your entire life. They might just be questioning your "Schedule C" business expenses or your "Schedule E" rental income. You need to organize your documents to match exactly what they are asking for. If they want receipts for travel, give them a folder labeled "Travel" with a summary sheet on top. Don't give them a shoebox of loose paper. If you make it hard for the auditor, they will make it hard for you.

Keep the original envelope, too. The postmark can be vital evidence if the IRS claims you didn't respond in time but the letter actually sat in a sorting facility for two weeks before reaching you. It happens more than you’d think.

The Reality of the Modern IRS

In 2026, the IRS is using more data analytics than ever. They are pulling data from third-party payment processors like Venmo, PayPal, and CashApp. If you’re running a side hustle and the numbers don't square with your tax return, that irs audit letter envelope is going to find its way to your mailbox. It's not personal; it's just an algorithm flagging a discrepancy.

However, the "human" side of the IRS is still struggling with backlogs. This means that if you do have to correspond with them, it might take months to get a reply. This is why certified mail is your best friend. Every time you send something to the IRS in response to that envelope, send it Certified Mail with a Return Receipt. It's the only way to prove you met their deadlines.

Actionable Steps to Take Right Now

If you are holding an unopened or recently opened IRS letter, do these three things immediately:

- Confirm the Deadline: Locate the date on the letter and add 30 days. Mark this on your calendar in red. This is your "drop-dead" date for a response.

- Make a Copy: Scan the letter and the envelope. Put the digital copy in a secure folder. Physical mail gets lost; digital files don't.

- Review the "Explanation of Changes": Most notices include a page showing "Information on Return" vs. "Information Proposed by IRS." Look at the numbers. If the IRS says you made $10,000 at a job you never worked at, you might be a victim of identity theft, which is a different process entirely.

Don't let the sight of a government envelope ruin your month. Most of the time, these things are fixable with a few phone calls or a well-organized stack of documents. The fear of the unknown is always worse than the reality of the process. Handle the mail, document the interaction, and if the numbers are big, get professional help. It's just paperwork.

Next Steps for Handling IRS Correspondence

- Verify the Notice: Go to the official IRS "Understanding Your Notice or Letter" page to see a sample of your specific CP or LTR code.

- Organize Your Records: Gather all receipts, 1099s, and W-2s for the tax year mentioned in the letter.

- Consult a Professional: If the amount the IRS claims you owe is more than you can comfortably pay or explain, contact a CPA or Tax Attorney to discuss your rights and potential for an "Offer in Compromise" or an installment agreement.