You’re sitting at your kitchen table, scrolling through a mountain of digital clutter, when you see it. An alert from Capital One. The subject line screams something about "unauthorized activity" or a "restricted account." Your heart skips. It’s a natural reaction because nobody wants their money messed with. But here is the thing: that fake Capital One email is likely a psychological trap designed by someone sitting halfway across the world who has never even seen your face.

Scammers are getting scary good. They don't just send misspelled messes anymore. They use high-resolution logos, the exact same font pairings the bank uses, and even "Security Notice" footers that look completely legitimate. Honestly, even tech-savvy people get tripped up because these emails tap into our panic response. When you're scared, you stop looking for the tiny red flags. You just want the problem to go away, so you click.

The Anatomy of a Modern Phishing Attempt

Let’s get into the weeds of how these guys actually operate. Most people think a fake Capital One email is just a link to a virus. It’s usually much more calculated than that. The goal is "harvesting." They want your username, your password, and those precious security questions like your mother's maiden name or the name of your first pet.

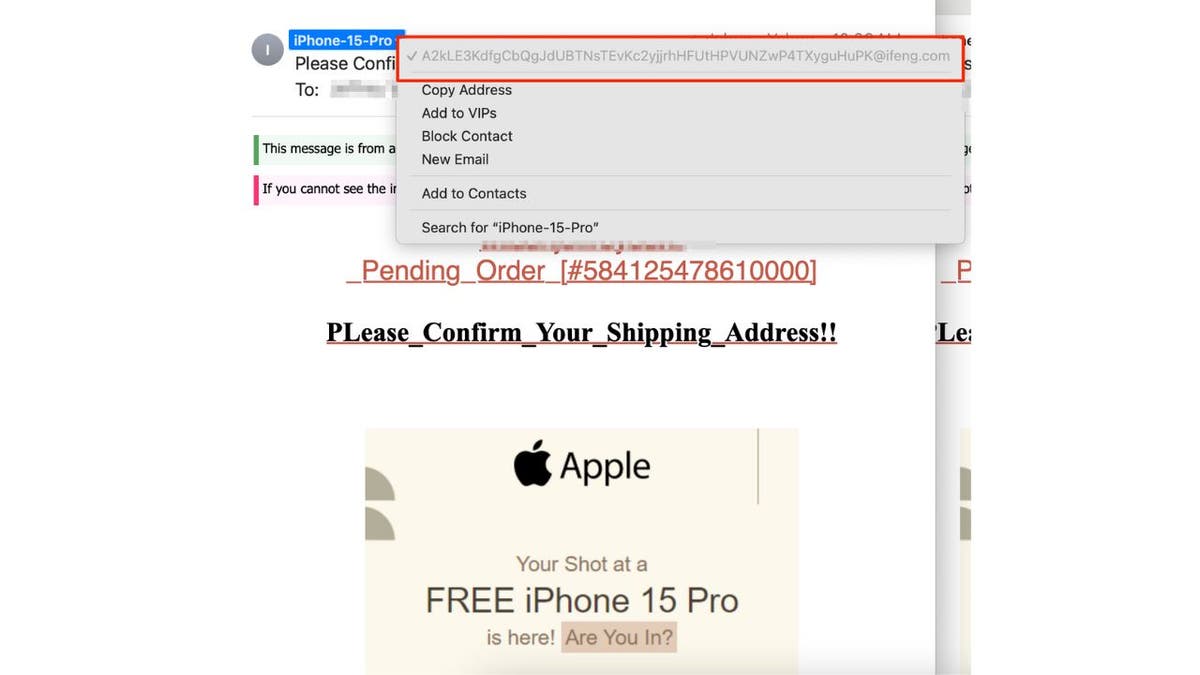

The "From" field is the first place they try to trick you. At a glance, it might say "Capital One Security." But if you actually hover your mouse over that name—or tap the sender's name on a smartphone—the real email address reveals itself. You’ll see something ridiculous like support-security-dept-9921@global-verify-check.net. A real email from the bank is going to come from a capitalone.com domain. Period. No dashes, no weird numbers, no .net or .org variations.

Why the "Urgency" is a Huge Red Flag

Psychology plays a massive role here. If a scammer tells you that you have 24 hours to "verify your identity" or your account will be permanently closed, they are trying to bypass your critical thinking. Real banks don't work like that. If Capital One suspects fraud, they might freeze a transaction or lock your card, but they aren't going to send an ultimatum via email that requires you to click a mysterious link to save your life savings.

Think about the tone. Is it pushy? Does it sound like a threat? Genuine corporate communication is usually pretty dry and professional. If it sounds like a ransom note for your checking account, it’s a scam.

👉 See also: Lateral Area Formula Cylinder: Why You’re Probably Overcomplicating It

Real Examples of What These Scams Look Like

Let's look at a few specific "templates" that have been circulating recently. One common version claims your "3D Secure" enrollment is incomplete. It looks official because it uses technical jargon that sounds plausible. Another popular one is the "New Device Login" alert. It tells you someone just logged into your account from a city you’ve never been to.

"We detected a login to your account from a New Device in Moscow, Russia. If this was not you, please click here to secure your account immediately."

This is the classic hook. You see "Russia" or some far-off location, you panic, and you click. The link takes you to a "spoofed" website. This site is a mirror image of the real Capital One login page. You enter your credentials, the site says "Thank you, your account is secure," and meanwhile, the scammer now has your password and is currently draining your actual account.

Technical Tricks They Use to Hide the Truth

The sophistication of the fake Capital One email often lies in the hidden code. Scammers use "URL shorteners" or redirects to hide where the link is actually going. If you see a link that looks like bit.ly or t.co in an email that is supposed to be from a multi-billion dollar financial institution, run the other way.

Another sneaky tactic is using "Cyrillic characters" that look identical to Latin letters. In the world of tech, this is called a "homograph attack." An "a" in the URL might actually be a character from a different alphabet that looks exactly the same to the human eye but leads to a completely different server.

✨ Don't miss: Why the Pen and Paper Emoji is Actually the Most Important Tool in Your Digital Toolbox

Checking the Footer and Fine Print

Look at the very bottom of the email. Real Capital One emails include specific legal disclosures, your partial account number (usually just the last four digits), and a physical address. Scammers often copy-paste this, but they mess up the formatting. Sometimes the copyright year is out of date—like seeing "© 2022 Capital One" when we are well into 2026. It's a small detail, but these guys are often lazy with the fine print.

What to Do if You Actually Clicked

Okay, let’s say you were distracted, you were holding a crying toddler, and you clicked the link. Maybe you even entered your password. Don’t spiral. You need to move fast.

- Change your password immediately. But don't do it through the link in the email. Go directly to

capitalone.comby typing it into your browser yourself. - Call the real Capital One. Use the number on the back of your physical credit or debit card. Tell them you think you’ve been phished. They can put a fraud alert on your profile.

- Check your "Sent" folder. Sometimes these scams install a script that sends the same phishing email to everyone in your contact list.

- Enable Two-Factor Authentication (2FA). If you don't have this on, do it now. Even if a scammer has your password, they can't get in without that secondary code sent to your phone.

Honestly, 2FA is the single biggest deterrent for these criminals. It makes your stolen password basically useless unless they also have your physical phone in their hand.

How to Report the Scam

You aren't just a victim; you can be part of the solution. Capital One actually wants you to send these fake emails to them. You should forward the suspicious email to abuse@capitalone.com. Don't just delete it. By reporting it, you help their security team take down the fraudulent websites the scammers are using.

You can also report it to the Federal Trade Commission (FTC) at reportfraud.ftc.gov. This helps law enforcement track patterns in how these groups are targeting Americans. It feels like a small thing, but it adds up when thousands of people do it.

🔗 Read more: robinhood swe intern interview process: What Most People Get Wrong

The "Smishing" Evolution

We can't talk about a fake Capital One email without mentioning its annoying cousin: the fake text message, or "smishing." These are arguably more dangerous because we tend to trust our text messages more than our email. You get a text saying "Cap1 Alert: Your card has been suspended. Verify here: [link]."

The same rules apply. Capital One will never ask you for your PIN, your full Social Security number, or your password via a text message. If the message asks you to "reactivate" something by clicking a link, delete it.

Why Your Data is Out There

You might wonder how they even knew you have a Capital One account. Sometimes, it’s just a numbers game. Capital One has tens of millions of customers. If a scammer blasts out a million emails, they are going to hit a few hundred thousand actual customers by pure luck.

Other times, your email address was part of a data breach from a different site—like a clothing store or a fitness app. Scammers buy these lists on the dark web and then "cross-reference" them. They try different bank templates until they find one that sticks. It's not personal; it's just a very dark version of digital marketing.

Staying Safe Moving Forward

The best defense is a healthy dose of skepticism. Treat every unsolicited email from a financial institution as guilty until proven innocent. It sounds cynical, but it’s the only way to navigate the internet safely today.

If you get an email that looks like a fake Capital One email, or even if you're only 10% sure it’s fake, just close your email app. Open your browser. Type the address yourself. Or better yet, use the official Capital One mobile app. If there is a real problem with your account, the app will tell you the moment you log in. There is absolutely no reason to ever click a link inside an email to "fix" an account issue.

Immediate Action Steps

- Verify the sender. Tap the "From" name to see the actual underlying email address. If it isn't @capitalone.com, it’s garbage.

- Hover before you click. On a computer, hover your mouse over any button to see the destination URL in the bottom corner of your screen.

- Ignore the threats. Real banks don't use "account deletion" as a threat to get you to verify information.

- Set up biometrics. Use FaceID or fingerprint login on your banking app. It's much harder for a remote scammer to bypass than a simple typed password.

- Audit your accounts. Take five minutes once a week to just scroll through your transactions. If you see something weird, call the number on your card immediately.

Scammers rely on you being in a hurry. They rely on the "blink" response—that split second where you act before you think. By slowing down and looking for these specific markers, you've already won. They can't steal what you don't give them. Keep your guard up, keep your software updated, and never, ever let an email bully you into giving away your digital keys.