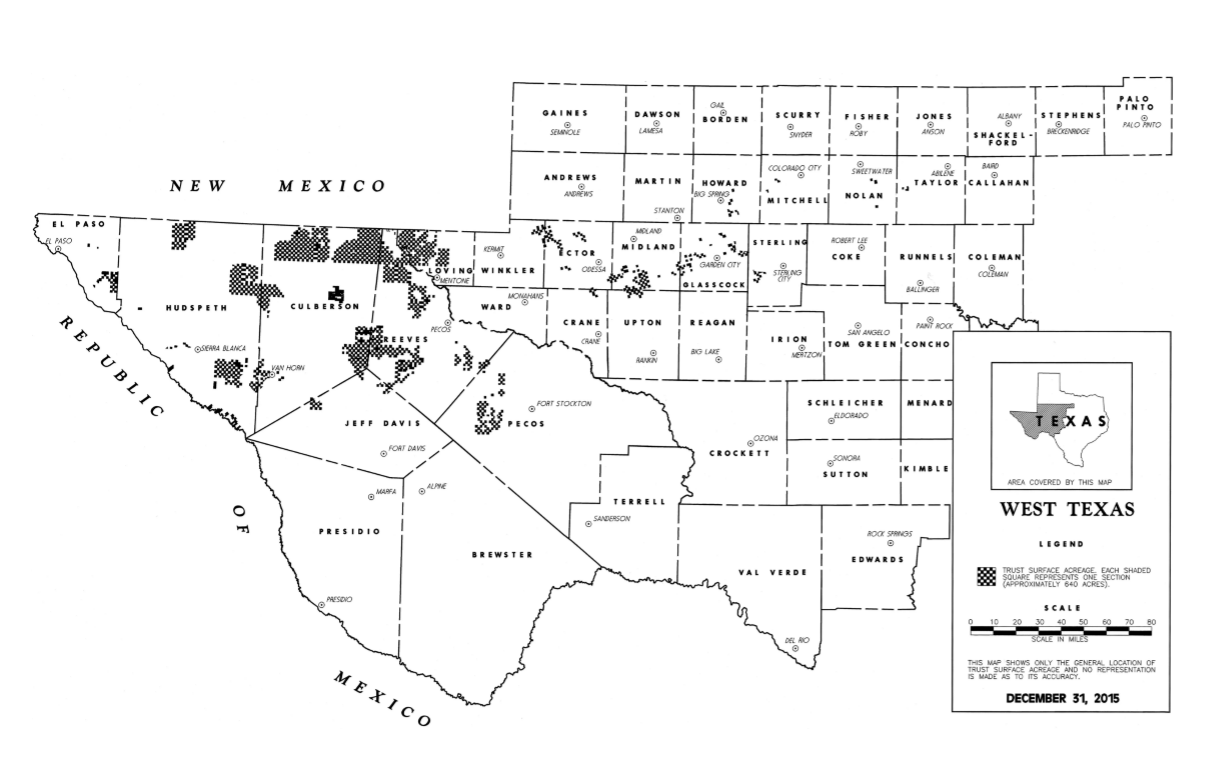

Owning a piece of Texas Pacific Land Corporation (TPL) used to be the ultimate "boring" investment. You basically owned a slice of a company that did nothing but collect checks from oil companies because it happened to own a massive amount of dirt in West Texas. It’s a legacy that stretches back to 1888, born out of a railroad bankruptcy. For over a century, the strategy was simple: sit on the land, let people drill, and take a cut.

Then 2025 happened.

If you’ve been watching texas pacific land stock lately, you know the vibe has shifted. It’s no longer just a proxy for Permian Basin oil production. In the last year, TPL has aggressively pivoted into the "Energy-Water-Data Nexus," a fancy way of saying they are using their 880,000 acres to fuel the AI revolution.

Honestly, it’s a bit surreal. A company founded in the 19th century is now a key partner for high-tech data centers.

The Data Center Pivot Everyone is Talking About

The big news that sent shockwaves through the market in late 2025 was TPL’s partnership with Bolt Data & Energy. This isn't some small-time land lease. We’re talking about large-scale data center campuses. Bolt was co-founded by Eric Schmidt—yeah, the former Google CEO—and they raised $150 million to make this happen. TPL didn't just hand over the keys; they actually invested $50 million of their own cash into the venture.

📖 Related: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Why West Texas for AI? It’s not just about the space. Data centers are incredibly "thirsty" for power and water. TPL has both in spades. They own the surface, the water rights, and the ability to facilitate massive solar and wind farms to power these server racks.

Breaking Down the Numbers

Financially, TPL is a beast. There’s really no other way to put it. While most energy companies have to spend billions on rigs and labor, TPL just collects royalties. This gives them margins that look like a typo.

For the trailing twelve months ending in late 2025, their gross margin was over 94%. Think about that. For every dollar that comes in, almost all of it is pure profit because they don't have to "produce" anything. Their operating margin hovered around 76%, while the rest of the industry struggles to stay in double digits.

- Cash on hand: Roughly $532 million as of the end of Q3 2025.

- Debt: Zero. Zip. Nada. They recently opened a $500 million credit facility, but that’s for acquisitions, not because they’re hurting.

- Dividend: They recently paid out a $1.60 quarterly dividend in December 2025.

The stock also underwent a massive 3-for-1 split on December 22, 2025. If you look at the chart and see a huge "drop" in price around that time, don't panic. It was a planned move to make the shares more accessible to retail investors who didn't want to shell out four figures for a single share.

👉 See also: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

The Water Business: The Secret Sauce

Most people ignore the water. That’s a mistake. TPL’s "Water Services and Operations" (WSO) segment is growing faster than a mesquite tree after a rainstorm. In Q3 2025 alone, they saw record water sales of $45 million.

Fracking requires millions of gallons of water. TPL provides it. But they are also solving the "produced water" problem—the dirty water that comes back up with the oil. They are finishing the Orla Desalination Facility, which treats this waste water for industrial reuse. It’s a brilliant circular economy move that turns an environmental headache into a recurring revenue stream.

Is it Overvalued?

You’ll hear some analysts grumble about the P/E ratio. Trading at over 40x earnings, it’s definitely not "cheap" by traditional energy standards. Some folks at Simply Wall St have suggested the fair value might be closer to $280, while the stock has been trading well above $330 in early 2026.

The disagreement usually comes down to how you categorize them. Are they an oil stock? If so, they’re expensive. Are they a tech-infrastructure and land-scarcity play? In that case, you’re paying for the moat.

✨ Don't miss: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

The "governance overhang" that used to plague the stock is also mostly gone. For years, there was a nasty legal battle between the board and some major shareholders like Horizon Kinetics. That’s settled now. The company converted to a C-Corp, and the board is now fully declassified, meaning shareholders get to vote on all directors every year. That modernization has made big institutional investors much more comfortable holding the bag.

What to Watch in 2026

If you’re holding texas pacific land stock or thinking about it, keep your eyes on the next earnings report scheduled for February 18, 2026. Analysts are looking for an EPS of about $1.82.

The real story, though, won't be in the oil royalties—those are steady but dependent on commodity prices. The real story will be the progress updates on the Bolt Data & Energy partnership. If TPL can prove they can break ground on these data centers and secure long-term power contracts, the "Landlord of the Permian" might just become the "Landlord of the Cloud."

Actionable Insights for Investors:

- Monitor the "Line of Sight" Inventory: TPL recently bought 17,300 net royalty acres in the Midland Basin. Watch for how quickly operators like Chevron or Occidental start drilling on that specific land.

- Watch the Water Margins: As the Orla Desalination Facility comes online, check if it improves the WSO segment's bottom line or if the CapEx eats into the cash flow.

- Data Center Milestones: Look for specific announcements regarding power hookups or tenant signings for the Bolt campuses. This is the catalyst for a valuation re-rating.

- Tax Considerations: Since TPL is now a C-Corp, its dividends are taxed differently than the old trust structure. Consult your tax pro to see how those quarterly $1.60 payments affect your specific situation.

The Permian Basin is maturing, but TPL is just starting its second act. It’s a rare combination of old-world land wealth and new-world tech utility. Just remember that it’s a volatile ride; the stock has a history of wild swings regardless of how much cash is in the bank.