If you’ve spent any time looking at a chart of Tesla stock price over time, you know it’s not exactly a "smooth ride." Honestly, it’s more like a multi-decade cardiac stress test. People love to argue about Tesla. Some see it as a world-saving AI powerhouse, while others insist it’s just an overpriced car company that happened to get lucky with a cult of personality.

But looking at the numbers from 2010 to today—January 14, 2026—the reality is way more nuanced.

✨ Don't miss: Valero Q1 2025 Earnings: Why the Big Loss Isn't What It Seems

Tesla isn't just a stock; it's a proxy for how people feel about the future. When the future looks bright, the price hits the moon. When interest rates rise or Elon Musk tweets something particularly "Elon," it drops like a stone. It’s a cycle of euphoria and panic that has turned early believers into millionaires and late-comers into very frustrated bag-holders.

The Early Years: Betting on the Impossible (2010–2019)

Tesla’s IPO back in June 2010 was almost cute by today's standards. They listed on the NASDAQ at $17.00 per share. If you adjust that for the splits we’ve seen since then, we’re talking about pennies. Back then, most of Detroit thought they’d be bankrupt in eighteen months. They weren't entirely wrong to be skeptical. Tesla was burning cash faster than a SpaceX rocket burns RP-1.

By 2013, things shifted. The Model S started winning "Car of the Year" awards, and suddenly the stock wasn't a joke anymore. It jumped from roughly $30 to $190 in a year. That was the first time "shorts"—investors betting the price would fall—really got burned.

Then came the "Production Hell" of 2017 and 2018.

The Model 3 was supposed to be the mass-market savior, but the assembly lines were a mess. Musk was sleeping on the factory floor. The stock stayed mostly flat, trapped between $250 and $380 (pre-split), as the world waited to see if Tesla could actually build cars at scale.

Basically, it was a coin flip. If they failed to ramp up, the company died. They didn't fail.

The 2020 Explosion and S&P 500 Entry

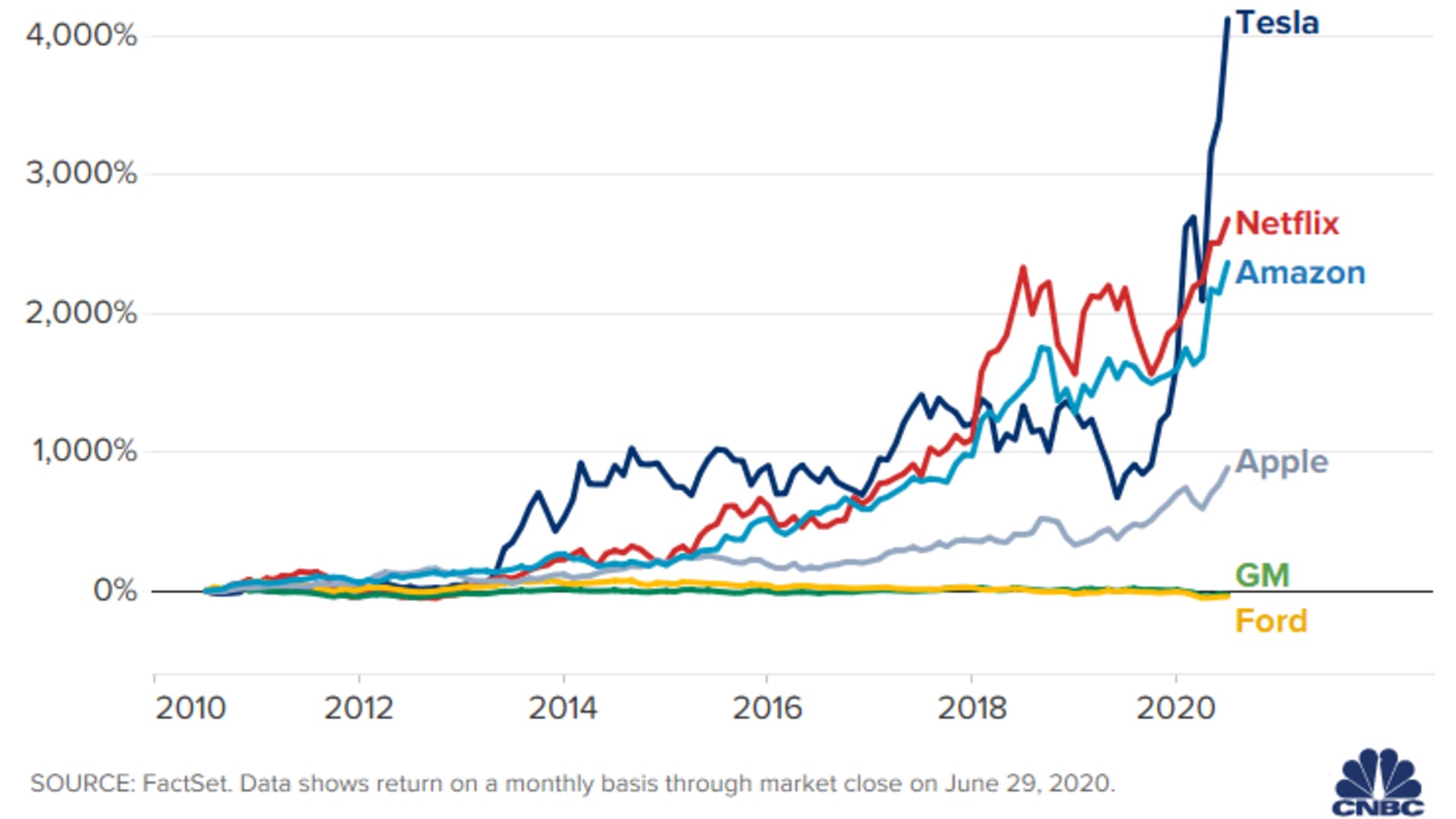

If you want to see the most dramatic part of the Tesla stock price over time, look at 2020. It was absolute insanity. At the start of the year, shares were trading around $90 (split-adjusted). By the end? Over $700.

A few things happened at once:

- The Shanghai Gigafactory started pumping out cars ahead of schedule.

- Tesla finally proved it could be consistently profitable.

- The company announced a 5-for-1 stock split in August 2020.

- They were finally added to the S&P 500 in December.

Being added to the S&P 500 is a huge deal. It means every index fund on the planet is forced to buy your stock. It created a massive "buy" wall that pushed the valuation into the stratosphere, eventually crossing the $1 trillion market cap mark in 2021. For a moment, Tesla was worth more than the next nine largest automakers combined. Think about that. They were making a fraction of the cars that Toyota or VW produced, but the market valued them like a software company.

Splits, Twitter, and the Great Correction

Tesla likes to split its stock. It makes the shares look "cheaper" to retail investors, even though the total value of the company doesn't change.

- August 2020: 5-for-1 split.

- August 2022: 3-for-1 split.

But the party didn't last forever. 2022 was a rough year for everything, but Tesla got hit double. Inflation surged, interest rates went up, and then there was the whole Twitter—now X—takeover. Investors hated it. They felt Musk was distracted and, more importantly, he was selling billions in Tesla stock to fund the purchase.

By early 2023, the stock had plummeted over 60% from its highs. People were calling it the "end of the Tesla era."

📖 Related: Air One Tech LLC: What Homeowners Usually Miss About HVAC Service

Of course, it wasn't. The stock bounced back in 2024 and 2025, driven by a new focus on AI and the Cybercab. But the "loyalty" has started to soften. According to recent data from LexisNexis Risk Solutions, Tesla’s brand loyalty slipped to about 55.9% in 2025. Still high, but no longer the untouchable leader as rivals like Hyundai and Rivian catch up.

Where We Stand Today: 2026 Reality Check

As of right now, January 14, 2026, Tesla is trading around $439.

It’s been a volatile start to the year. Just last week, it hit a 4-week low after some anxiety about 2026 delivery forecasts. Analysts are all over the place. UBS recently raised their target to $307, which is actually lower than the current price, while others like Rob Wertheimer at Melius Research are eyeing $525 based on the autonomous driving lead.

The bull case now isn't about cars. It's about:

- Robotaxis: The "Cybercab" is moving toward volume production.

- Energy: The Megapack 3 is becoming a massive revenue driver for the grid.

- AI5 Chips: Tesla is designing its own silicon for FSD (Full Self-Driving) and Optimus.

The bear case? It’s basically the same as it’s always been: valuation. With a P/E ratio still hovering near 200, Tesla is priced for perfection. If they miss a delivery target or if federal EV tax credits are slashed—which is a real risk in the current political climate—the stock could easily give back its 2025 gains.

👉 See also: The Definition of a Leader: Why Most People Get It Completely Wrong

Actionable Insights for the "TSLA" Investor

If you're looking at Tesla stock price over time to decide on a move, you've got to stop thinking like a car buyer and start thinking like a tech analyst.

- Ignore the Daily Noise: Tesla moves 4% to 10% in a single day all the time. If you can’t handle a 20% swing in a week, this isn't the stock for you.

- Watch the Margins, Not Just Deliveries: In 2023, Tesla’s net margins were a staggering 15.5%. Recently, they’ve dipped closer to 5.3% due to price wars. A recovery here is the "buy" signal many are waiting for.

- The "Elon" Discount/Premium: You have to accept that the CEO's personal brand is baked into the price. When he’s in favor, the stock flies. When he’s in a legal or political battle, the stock drags.

- Track Regulatory Credits: Tesla makes huge money selling emission credits to other car companies. In 2020, this was $1.2 billion in pure profit. Keep an eye on whether this "easy money" is drying up as other brands finally start making their own EVs.

Tesla is no longer the "only game in town" for EVs, but it's still the only one with the scale and the data. Whether that's worth a $1.5 trillion valuation is the trillion-dollar question.

Next Steps for You:

If you want to get serious about tracking this, set up a Google Alert for "Tesla Automotive Gross Margin" and "Tesla FSD Take Rate." Those two metrics will tell you more about the future stock price than any headline about a new car color or a CEO tweet. You should also check the latest SEC 10-K filings to see exactly how much of their profit is coming from those regulatory credits versus actual car sales.