Honestly, trying to wrap your head around the Tesla stock market cap right now feels a bit like trying to catch a lightning bolt in a mason jar. It’s fast, it’s flashy, and just when you think you’ve got it pegged, the jar shatters. As of mid-January 2026, we’re looking at a valuation hovering around $1.46 trillion.

That is a massive number. It’s also a weird one.

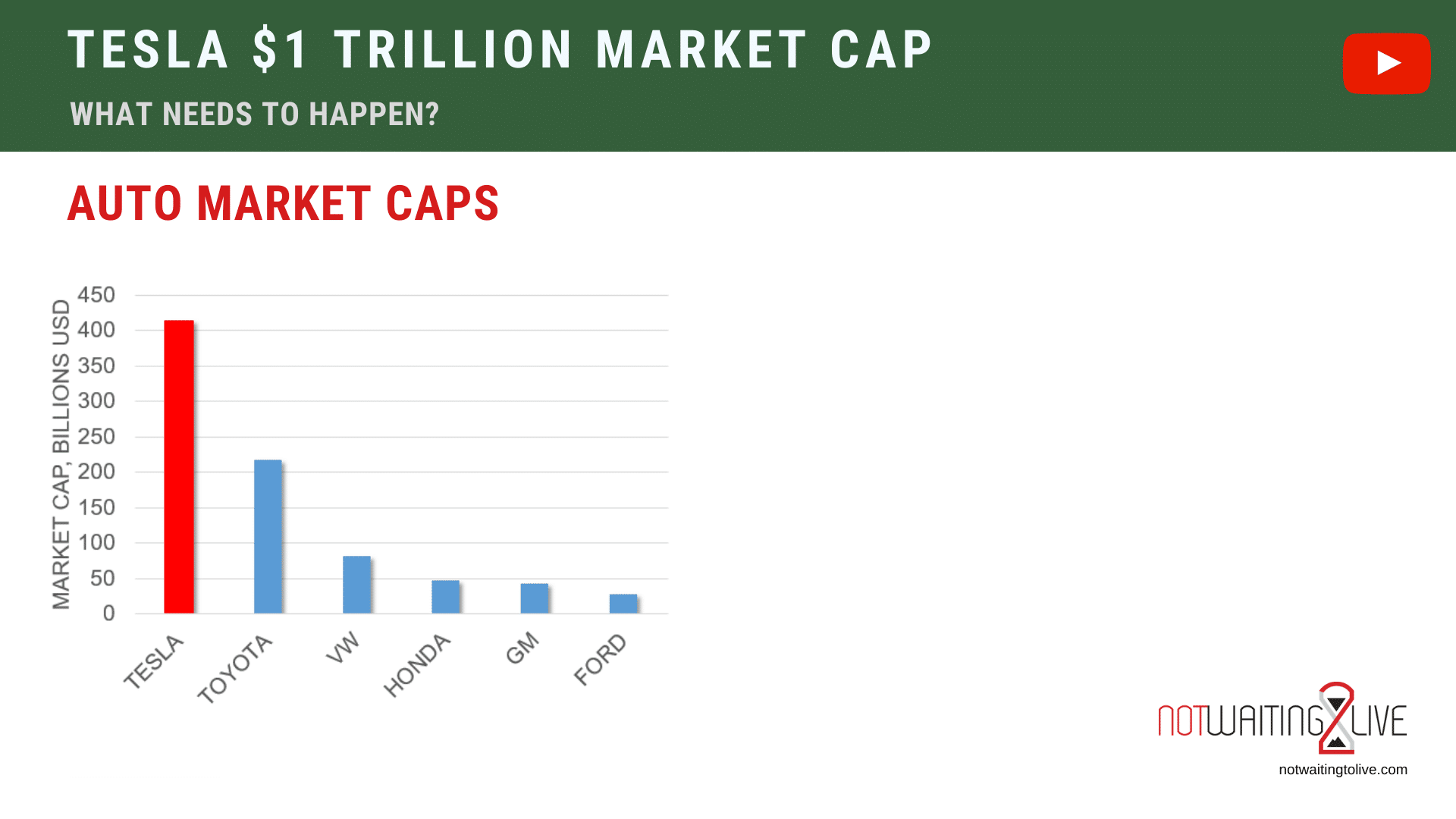

To put that in perspective, Tesla is worth more than most of the world's legacy automakers combined, yet its actual car deliveries—about 1.63 million in 2025—don't even come close to the volume of giants like Toyota or BYD. In fact, BYD actually pulled ahead in total battery-electric vehicle sales last year, moving 2.26 million units. So why is the market cap still sitting in the stratosphere?

Basically, the market isn't pricing Tesla as a car company anymore. It hasn’t for a while. If you look at the price-to-earnings (P/E) ratio, which is currently sitting at a staggering 300+, it’s clear that investors are betting on something much bigger than four wheels and a battery. They are betting on an AI and robotics revolution that is supposed to kick into high gear right about... now.

Why the Tesla Stock Market Cap Defies Traditional Logic

If you’ve spent any time looking at spreadsheets, you know that a $1.4 trillion valuation usually requires a mountain of net income. Tesla’s net income, however, actually dipped in recent quarters. In late 2025, GAAP net income fell nearly 37% year-over-year to roughly $1.4 billion.

💡 You might also like: History of Nike Timeline: How a Waffle Iron and a Handshake Built an Empire

Normally, that kind of performance would send a stock into a tailspin. But Tesla is different. The Tesla stock market cap is propped up by what analysts like Dan Ives from Wedbush call the "AI Chapter."

Ives has been vocal about a bull case where Tesla hits a $2 trillion or even $3 trillion market cap by the end of 2026. This isn't because he thinks they’ll sell ten times more Model Ys. It’s because of the Cybercab and the Optimus robot.

The Robotaxi Factor

Tesla is scheduled to start mass production of the Cybercab in April 2026. This is the vehicle with no steering wheel and no pedals. If Tesla can actually prove that "unsupervised" Full Self-Driving (FSD) works and get regulatory approval, the revenue model shifts from selling a car once to earning recurring fees from a global autonomous fleet.

Musk has even suggested that the realization of this tech could make Tesla worth "18 Nvidias." Whether you believe that or think it’s just classic Elon hype, that sentiment is the primary engine behind the current valuation.

The Brutal Reality of the 2026 Competitive Landscape

It's not all sunshine and robots, though. Tesla is facing a "three-front war" that is putting serious pressure on its margins.

✨ Don't miss: Gold and Silver Prices Today USD per Ounce: What Most People Get Wrong

- The China Squeeze: In China, the world’s biggest EV market, Tesla’s market share slipped to under 5% at the start of 2026. Companies like Geely and BYD aren't just cheaper; they are faster at releasing new models and smarter with their localized tech stacks.

- The Margin Meltdown: To keep volume up, Tesla has been slashing prices. Automotive gross margins hit 4.5-year lows recently. It turns out that when you treat your cars like commodities to win a price war, your stock eventually starts to look like a commodity stock, too.

- The FSD Pivot: Tesla recently announced it will stop offering FSD as a one-time purchase after February 14, 2026. Moving strictly to a monthly subscription model is a bold move to create "sticky" recurring revenue, but it also risks alienating buyers who don't want another monthly bill.

Breaking Down the Math

How do we actually get to that Tesla stock market cap? It’s a simple formula:

$$\text{Market Cap} = \text{Current Stock Price} \times \text{Total Outstanding Shares}$$

As of January 2026, the stock has been bouncing between $430 and $480. With billions of shares outstanding, every $10 move in the stock price adds or subtracts roughly $30 billion from the total valuation. That’s like losing or gaining an entire Ford Motor Company in a single afternoon.

The volatility is exhausting. In 2025 alone, the share price fell over 50% before rebounding. This is why valuation gurus like Aswath Damodaran often look at Tesla and scratch their heads. By traditional metrics, the stock is "outrageously expensive." But as long as the "physical-AI" narrative holds, the floor stays relatively high.

What to Watch for the Rest of 2026

If you're tracking the Tesla stock market cap, the next six months are make-or-break. Forget the delivery numbers for a second; they’re likely to stay "lackluster" according to Morningstar analysts. Instead, watch these three specific triggers:

- The Cybercab Production Ramp: If April 2026 comes and goes without real Cybercabs rolling off the line in Texas, expect the market cap to shed a few hundred billion real quick.

- Energy Storage Growth: One of the few bright spots has been Tesla’s energy business. They deployed 12.5 GWh of storage in Q3 2025, up 81%. This segment is growing way faster than the car business and could provide a much-needed valuation cushion.

- Optimus Milestones: Musk has targeted 2026 for the launch of the Optimus humanoid robot. Even a semi-functional demo in a real-world factory setting would be enough to ignite another bull run.

Insights for the Modern Investor

You can’t treat Tesla like a car company. If you do, the Tesla stock market cap will never make sense to you. You have to view it as a venture capital fund that happens to manufacture cars on the side to fund its robotics experiments.

For those looking at the numbers today, the consensus from Wall Street is a messy "Hold." Average price targets are sitting around $395, which implies the stock might actually be a bit overvalued at its current $440+ range. However, with "Master Plan IV" in full swing, betting against the narrative has historically been a painful exercise.

Actionable Next Steps:

- Analyze the Energy Segment: Check the upcoming Q1 2026 earnings specifically for "Energy Generation and Storage" revenue. If this is growing at 40%+ while automotive stays flat, the valuation shift is working.

- Monitor FSD Subscription Rates: Since the one-time purchase option expires in February 2026, the Q2 and Q3 reports will be the first time we see if customers are actually willing to pay for "Software as a Service" in their cars.

- Set "Narrative" Stop-Losses: Because Tesla’s market cap is driven by sentiment and AI promises, any regulatory setback for the Cybercab (like a DMV ban in California or Texas) is a signal to re-evaluate your position immediately.

The story of the Tesla stock market cap in 2026 isn't about how many Model 3s are in driveways. It’s about whether the "AI Chapter" is a bestseller or just a very expensive piece of science fiction.