If you’ve spent any time watching the ticker lately, you know that Tesla motors stock value is basically a high-stakes psychological thriller. It’s January 2026, and the vibe is... complicated. One day the stock is hovering near $437, and the next, it’s swinging 4% because of a tweet or a new regulatory filing in China.

Tesla isn't just a car company anymore. It hasn't been for a long time. But the market is finally being forced to price it as something else: an AI and robotics house that happens to sell wheels.

Honestly, the "car company" narrative is what's tripping people up. In 2025, revenue actually dipped for the first time in the company's public history. That hurt. Margins got squeezed because of those aggressive price cuts intended to keep BYD at bay. Yet, here we are in early 2026, and the market cap is still sitting pretty at roughly $1.5 trillion. Why? Because investors are betting on the "AI Chapter" finally sticking.

The Reality of Tesla Motors Stock Value Right Now

Let's look at the hard numbers from this week. As of January 16, 2026, TSLA closed at $437.50. It’s been a choppy start to the year. We saw it hit a high of $481 back in December, but the New Year hangover brought a bit of a pullback.

The bulls, led by folks like Dan Ives at Wedbush, are pounding the table for a $600 price target. They see 2026 as the "monster year" where FSD (Full Self-Driving) and the Optimus robot move from science fiction to line items on the balance sheet. On the flip side, you’ve got the bears. GLJ Research and others are still looking at the fundamentals—like the $99 monthly FSD subscription—and arguing that the "appreciating asset" dream is dead.

What’s driving the price today?

- The FSD Pivot: Tesla just shifted to a subscription-only model for Full Self-Driving. No more $8,000 or $12,000 upfront. It’s $99 a month, take it or leave it. This is a massive play for recurring revenue.

- The Robotaxi Hype: Testing is officially underway in Austin with no one in the driver's seat. If you've seen the "Cybercab" prototypes, you know they don't even have pedals.

- Energy Storage: This is the sleeper hit. Tesla Energy is growing at double-digit rates, often outperforming the automotive side in terms of percentage growth.

- The Musk Factor: Elon's $56 billion pay package was recently restored by the Delaware Supreme Court. For some, this is a sign of stability; for others, it's a massive dilution risk.

Why 2026 is a "Make or Break" Year

The consensus for 2026 revenue is somewhere around $107.5 billion. That would be a 14% jump from last year. If they hit it, the stock probably flies. If they miss? Well, we've seen how fast the floor can fall out.

Earnings are coming up on January 28. That's the big one. Analysts are expecting an EPS (Earnings Per Share) of about $2.17 for the full year 2026. Right now, the price-to-earnings (P/E) ratio is still sky-high—we’re talking over 290. That is an "expensive" stock by any traditional metric. You aren't buying a company that makes Model Ys; you're buying a company that you hope will eventually run a global fleet of autonomous taxis.

The Competition is Getting Real

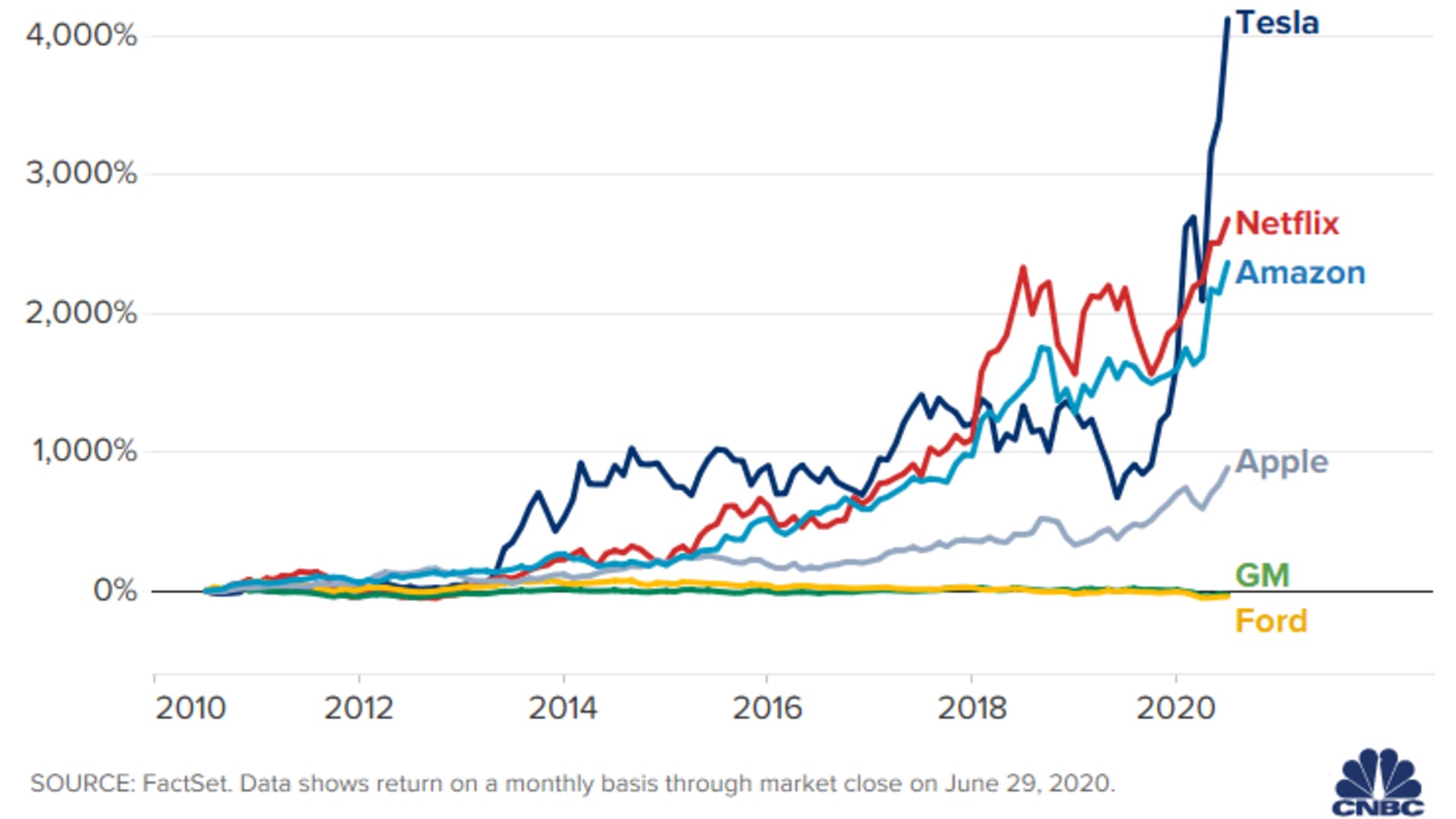

It’s not just about Ford or GM anymore. BYD actually overtook Tesla in unit sales recently. In China, the pressure is relentless. Tesla's market share is shrinking, and that’s a big reason why the tesla motors stock value has been so volatile.

Then you have the tax credits. The $7,500 federal EV tax credit in the U.S. expired in late 2025. That was a gut punch for demand. Without that "discount," the Model 3 and Model Y have to stand on their own merits against a sea of new hybrids and cheaper EVs.

The Bull Case vs. The Bear Case

It's sorta like a tug-of-war.

The Bulls say: "Look at the data!" Cathie Wood from Ark Invest is still out there claiming that 90% of Tesla’s value will eventually come from autonomous systems. They see the Cybercab production ramp-up in April 2026 as the moment everything changes.

The Bears say: "Look at the margins!" They see declining profits and a CEO who is spread thin across X, SpaceX, and xAI. They point to the fact that FSD has been "one year away" for about six years now.

👉 See also: Major Companies in Europe: What Most People Get Wrong

Actionable Insights for Investors

If you're holding or looking to buy, you've gotta decide which camp you're in. This isn't a "set it and forget it" index fund. It’s a battleground.

- Watch the Jan 28 Earnings: Don't just look at the top-line revenue. Look at the Automotive Gross Margin. If it stays below 17%, the stock might struggle to maintain this $400+ level.

- Monitor FSD Adoption: The shift to a $99 subscription is designed to get more people using it. High adoption means high-margin software money.

- The $420 Support Level: Technically, the stock has a lot of support around the $420 mark (the 100-day moving average). If it breaks below that, the next stop could be the mid-$300s.

Tesla remains the most debated ticker on the planet. Whether it hits a $2 trillion market cap by the end of the year or slides back to reality depends almost entirely on whether those "driverless" cars actually start picking up passengers for money.

Your next move: Set a price alert for $415 and $455. These are the current "breakout" or "breakdown" points. If the stock clears $455 on high volume after the Jan 28 earnings call, the path to $500 is wide open. If it fails to hold $415, it might be time to look for a better entry point later in the spring.