Ever had a bad night at the blackjack table? Maybe you dropped a few hundred bucks and felt that pit in your stomach during the drive home. Well, whatever you're feeling, it's nothing compared to the story of Terrance Watanabe. This isn't just a story about a guy who liked to bet; it’s a legendary cautionary tale about wealth, addiction, and how a massive fortune can vanish in the bright lights of the Vegas Strip.

When people search for Terrance Watanabe net worth today, they’re usually looking for a number that no longer exists. At one point, Watanabe was sitting on a mountain of cash—hundreds of millions of dollars. He was the king of party favors. If you ever bought a plastic dinosaur or a bulk bag of glitter for a kid's birthday party, you probably contributed to his bank account. But by the time he left Las Vegas in 2007, that mountain had basically turned into a molehill.

The Fortune Behind the Man: Oriental Trading Company

To understand how much he lost, you have to know how much he had. Terrance "Terry" Watanabe didn't just stumble into money. He inherited a very successful business called the Oriental Trading Company from his father, Harry Watanabe, in 1977.

Under Terry's leadership, the company didn't just grow; it exploded. He turned a small gift shop into a massive direct-marketing powerhouse. We’re talking about a $300 million-a-year enterprise. Honestly, the guy was a brilliant businessman. He knew exactly what schools, churches, and carnival organizers wanted.

In 2000, Terry decided he’d had enough of the corporate grind. He sold his entire stake in the company to Brentwood Associates, a private equity firm. The sale price? Estimates put it at over $400 million. Imagine having $400 million in your bank account at age 43. You’d think he was set for life, right? Most people would buy an island or a sports team. Terry went to Vegas.

The $204 Million Binge: A Breakdown of the Losses

The numbers involved in Watanabe's downfall are so big they almost don't feel real. Between 2007 and 2009, Watanabe went on what is arguably the most disastrous gambling run in history. He wasn't just a "whale"—the term Vegas uses for high rollers—he was more like the entire ocean.

According to court documents and various reports, Watanabe lost roughly $127 million in 2007 alone.

👉 See also: Exchange rate of dollar to uganda shillings: What Most People Get Wrong

Think about that for a second. That is $347,000 every single day for a year.

He was primarily playing blackjack and slots at Caesars Palace and the Rio, both owned at the time by Harrah’s Entertainment. The casinos absolutely loved him. They even created a special "Chairman" tier of their loyalty program just for him. It was a 1-of-1 level. No one else in the world had it.

The perks were insane:

- A three-bedroom suite at Caesars Palace.

- $12,500 a month for airfare.

- $500,000 in credit at the casino gift shops (that’s a lot of Rolexes).

- Tickets to see the Rolling Stones whenever he wanted.

But the house always wins. By the time the dust settled, his total losses across a couple of years were estimated to be north of $204 million. Some newer interviews and reports, like his 2024/2025 appearances on podcasts like WiseKracks, suggest the total "lifetime" loss might even be closer to $350 million when you factor in everything.

What Most People Get Wrong About the Legal Battle

A lot of people think Watanabe just gambled the money away and then tried to sue to get it back because he was a "sore loser." It’s actually way more complicated and kinda dark.

Watanabe’s legal team, led by high-profile lawyer Pierce O'Donnell, argued that the casinos basically kept him in a "constant state of intoxication." They alleged that staff would bring him a never-ending supply of alcohol and even prescription painkillers (specifically Lortab) to keep him at the tables.

✨ Don't miss: Enterprise Products Partners Stock Price: Why High Yield Seekers Are Bracing for 2026

Nevada law actually says a casino is supposed to kick out anyone who is "visibly intoxicated." But according to some former employees who gave depositions, managers told them to ignore the rules because Watanabe was responsible for about 5.6% of Harrah's total Las Vegas gambling revenue that year. He was literally keeping their stock price up.

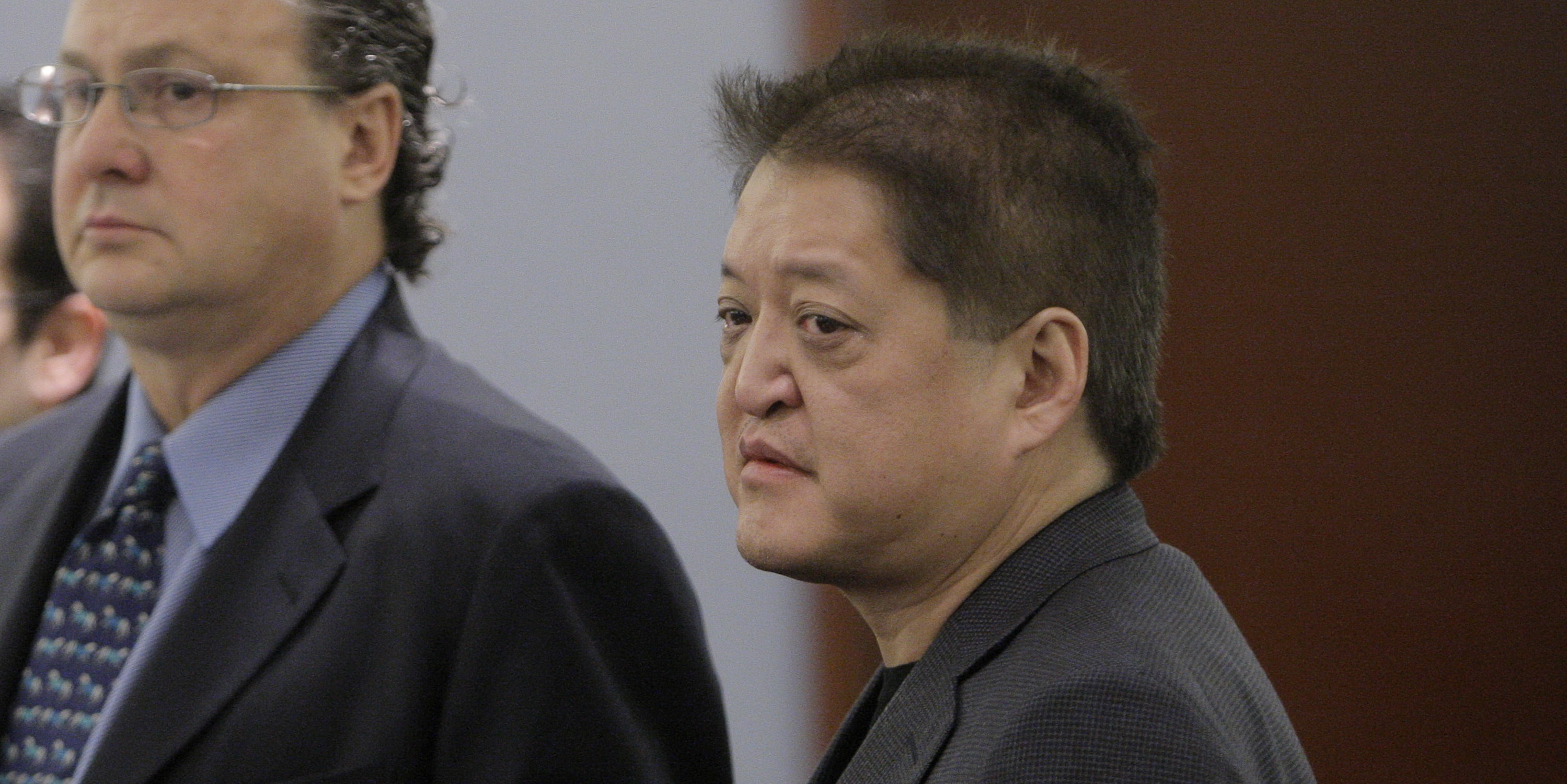

There was a criminal side to this, too. In 2009, the Clark County District Attorney charged Watanabe with four felony counts of theft and intent to defraud. Why? Because he had $14.7 million in "markers" (casino credit) that he hadn't paid back. He faced up to 28 years in prison.

In 2010, right before the trial was supposed to start, both sides reached a confidential settlement. The criminal charges were dropped, and the civil lawsuit was dismissed. We don’t know the exact terms, but it’s safe to say it wasn't a "win" for Terry's net worth.

Terrance Watanabe Net Worth in 2026: Where is He Now?

If you’re looking for a specific number for Terrance Watanabe net worth today, it’s basically impossible to pin down, but it is a fraction of what it used to be. After the settlement and the massive losses, he moved back to Nebraska and then eventually to the San Francisco area.

By 2017, the situation had grown quite grim. Watanabe launched a GoFundMe campaign seeking $100,000 to help pay for a prostate cancer surgery. It was a shocking turn of events for a man who used to drop $5 million in a single weekend.

Honestly, it's one of the most sobering examples of how quickly a legacy can disappear. He went from being a respected philanthropist and business leader to needing public help for medical bills. While some sources might list a "net worth" based on old data or remaining assets, the reality is that the $400 million fortune is effectively gone.

🔗 Read more: Dollar Against Saudi Riyal: Why the 3.75 Peg Refuses to Break

Why This Story Still Matters

Watanabe’s story isn't just about a guy losing money. It changed how people look at casino responsibility. After his case, the Nevada Gaming Control Board ended up fining Caesars Entertainment $225,000 for allowing him to gamble while intoxicated. It was a slap on the wrist compared to the millions they made off him, but it was a rare public admission that something went wrong.

He wasn't a "bad" guy. People who knew him in Omaha described him as incredibly generous. He donated millions to AIDS research and local charities before his life spiraled. His sister, Pam, eventually had to step in and basically stage an intervention to get him out of Vegas.

Practical Lessons from the Watanabe Case

If there's anything to take away from this, it's about the thin line between a hobby and a life-destroying addiction. Even with $400 million, you aren't "safe" from the psychological traps of a casino floor.

- Understand the "Whale" Dynamic: Casinos aren't your friends. If they're giving you a "Chairman" tier, it’s because they’ve calculated exactly how much they expect to take from you.

- Credit is a Trap: Much of Watanabe's legal trouble came from "markers." Using a casino's money is essentially taking out a high-interest loan that can lead to criminal charges in Nevada if you can't pay it back.

- The House Edge Never Changes: No matter how many hands you play or how much you bet, the math stays the same. Watanabe would play three hands of blackjack at once with $50,000 limits. He was just losing three times faster.

For those interested in the intersection of business and personal finance, Watanabe serves as the ultimate "black swan" event. You can do everything right for 20 years, build a massive company, sell it for a fortune, and lose it all in 12 months if you don't have the right guardrails in place.

Next Steps for Research:

If you want to understand the legal mechanics of how this happened, look into the Nevada "Bad Check" law, which allows casinos to prosecute unpaid gambling debts as criminal felonies. You might also want to look up the 2024 interviews with Watanabe on platforms like YouTube (search for WiseKracks or VSiN), where he speaks for the first time in years about the mental state he was in during that 2007 run.