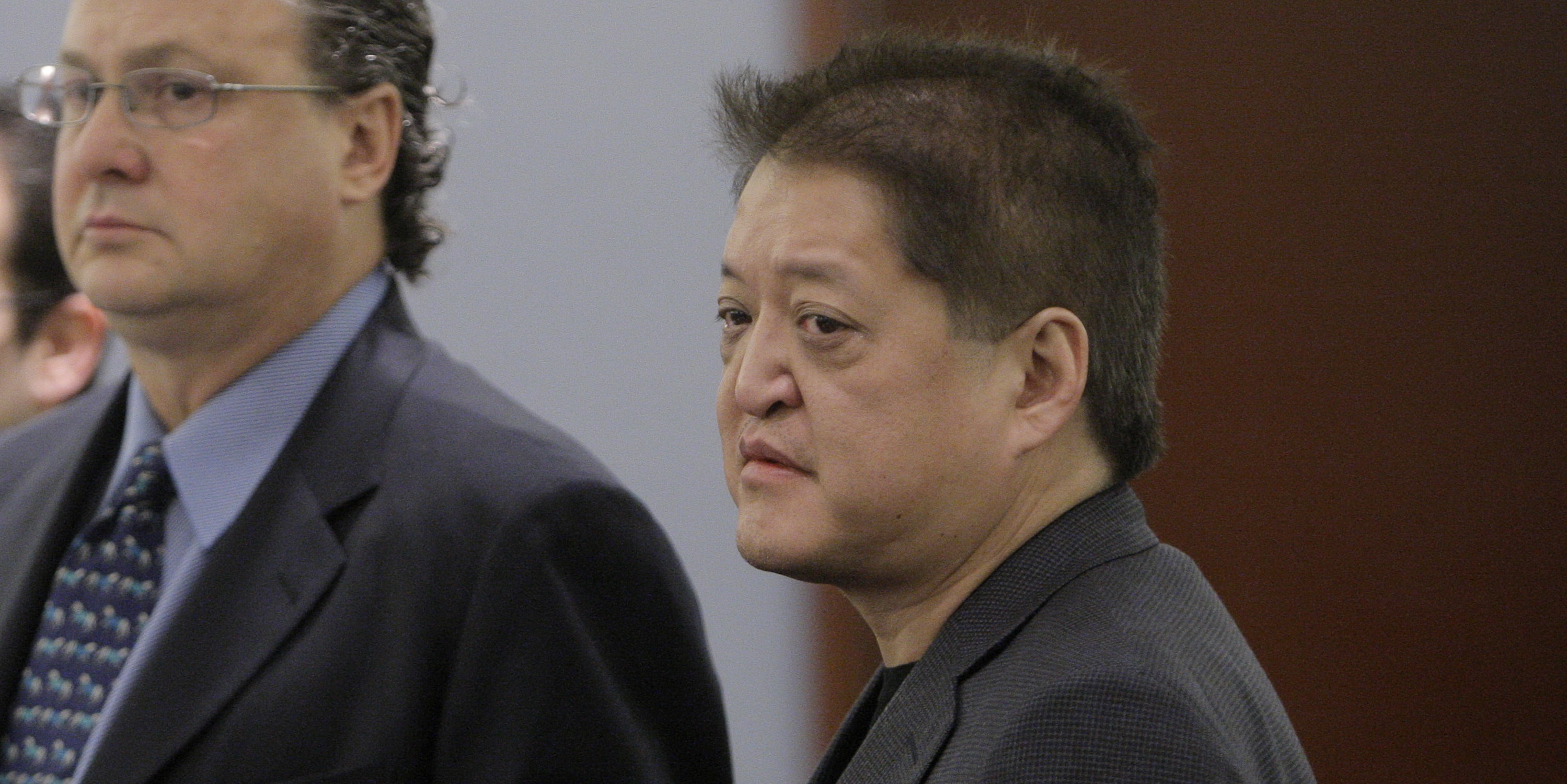

You’ve probably heard the rumors about the man who lost it all in Las Vegas. Usually, these stories are urban legends or exaggerated tales of a weekend gone wrong. But with Terrance Watanabe, the reality is actually more staggering than the myth.

Terrance Watanabe net worth was once estimated at over $500 million. He wasn't just wealthy; he was the king of the "party favor" world, the man who turned plastic trinkets into a massive business empire. Then, in a single year, he managed to lose more money than most successful CEOs earn in a lifetime.

Today? Honestly, the numbers are sobering. While once a fixture in the highest-stakes rooms in the world, the 2026 reality for Watanabe is a far cry from the private jets and the 1-of-1 "Chairman" status he once held at Caesars.

The Trinket King: Building a $500 Million Fortune

Before the neon lights of the Strip, there was Omaha. Terrance’s father, Harry Watanabe, started the Oriental Trading Company in 1932. It was a modest gift shop. When Terrance took the reins in 1977, he didn't just maintain it—he exploded it.

He shifted the focus. He realized that schools, churches, and carnivals needed a steady supply of cheap, fun stuff. Basically, if you ever went to a birthday party in the 80s or 90s and got a plastic dinosaur in a goody bag, you probably have Terrance Watanabe to thank.

By the time he sold his entire stake in the company to Brentwood Associates in 2000, Oriental Trading was a $300 million-a-year powerhouse. Reports suggest the sale netted him somewhere north of **$400 million**.

At that moment, his net worth was untouchable. He was a philanthropist. He gave millions to AIDS research and local Omaha charities. He was the guy who had everything.

The 2007 Binge: Losing $204 Million in 12 Months

The decline didn't happen slowly. It was a high-speed collision with the Las Vegas gambling industry. In 2007, Watanabe went on what is widely considered the biggest losing streak in the history of the city.

He gambled $825 million that year. Read that again. Not $8 million. $825 million in total turnover.

- He lost $204 million in a single calendar year.

- At one point, he was responsible for 5.6% of Harrah’s entire gambling revenue in Las Vegas.

- He sometimes played three hands of blackjack simultaneously with a $50,000 limit per hand.

- Reports surfaced of him playing for 24 hours straight without sleep.

The casinos treated him like royalty because, quite frankly, he was their best customer. They gave him a three-bedroom suite, $500,000 in credit at the gift shop, and personal attendants. But behind the scenes, things were dark. Watanabe later sued, claiming the casinos kept him intoxicated with alcohol and prescription painkillers to keep him at the tables.

The legal battles were messy. He was facing felony charges over $14.7 million in unpaid markers. Eventually, he settled with the casinos, and the criminal charges were dropped, but the damage to his bank account was permanent.

✨ Don't miss: Northrop Stock Price Today: Why This Defense Giant Just Hit Record Highs

What is Terrance Watanabe Net Worth in 2026?

If you're looking for a comeback story with a massive bank account at the end, this isn't it. After the dust settled from the lawsuits and the debt repayments—he reportedly paid back $112 million of his losses before the legal fight even started—there wasn't much left.

By the late 2010s, news broke that Watanabe was struggling with health issues, specifically prostate cancer. He even had to resort to a GoFundMe campaign to raise $100,000 for his surgery. It’s a jarring image: the man who once tipped casino staff with $100 coins asking for help to pay medical bills.

Current estimates for Terrance Watanabe net worth sit at effectively $50,000 or less. In recent interviews, including a rare public appearance in late 2025, it was revealed that he largely lives on Social Security.

It’s a total wipeout.

Why This Matters for Investors and Entrepreneurs

Watanabe's story is the ultimate cautionary tale about "liquidity." When he sold his company, he moved from an illiquid asset (a business) to a highly liquid one (cash). Without the structure of a daily job or the guardrails of a board of directors, that liquidity became a liability.

Key Takeaways from the Watanabe Saga:

- Asset Protection is Real: Many high-net-worth individuals use trusts to prevent "impulse" spending of the principal. Watanabe had total control, which proved fatal to his fortune.

- The House Always Wins: Even at the highest level of "whale" status, the math of the casino remains undefeated.

- Health is the True Wealth: Seeing a multi-millionaire struggle for surgery costs is a reminder that cash flow can vanish, but the need for healthcare doesn't.

If you are managing your own portfolio or looking at the wealth of major CEOs, the lesson is clear: diversification and professional oversight aren't just for people who don't know what they're doing. They are for people who want to keep what they've built.

To avoid the pitfalls that led to Watanabe's financial collapse, focus on building a resilient financial plan that separates your "lifestyle" capital from your "legacy" capital. Setting up a structured trust or an irrevocable life insurance trust (ILIT) can ensure that even in a worst-case scenario, your basic needs and your family's future are never at the mercy of a bad run at the tables.