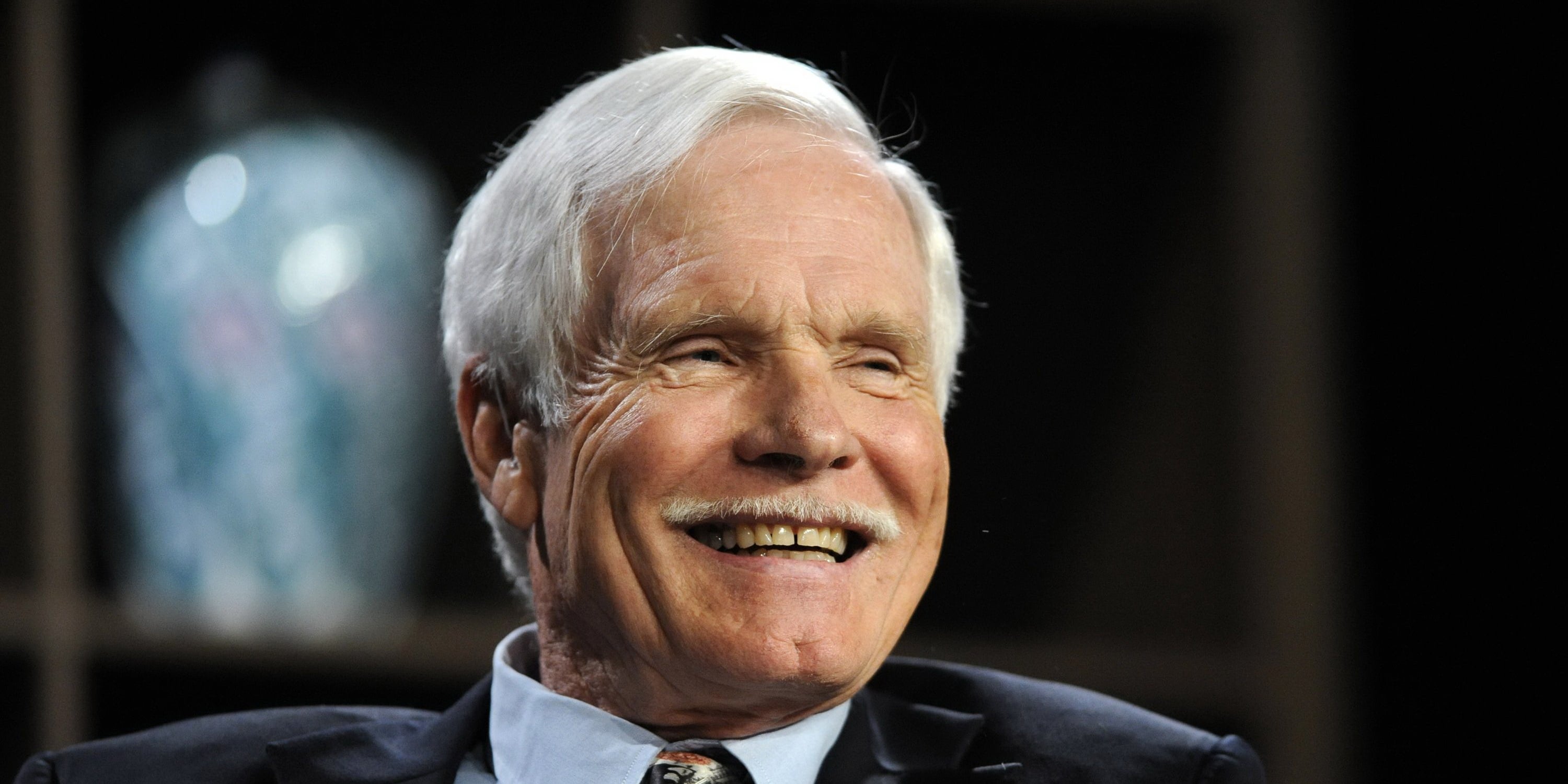

When you think about the net worth of Ted Turner, you probably picture the swashbuckling media mogul who founded CNN or the guy who once owned the Atlanta Braves. But the real story of his bank account is a wild ride of massive gains, an $8 billion vanishing act, and a second act as one of America’s biggest landlords. Honestly, it’s a lesson in why you shouldn't put all your eggs in one corporate basket.

As of early 2026, Ted Turner's net worth sits at approximately $2.8 billion.

That’s a huge number for anyone, but it’s a far cry from where he used to be. Back in the late 90s, Turner was one of the richest people on the planet. He was worth closer to $10 billion. Then, the AOL-Time Warner merger happened. It’s often called one of the worst business deals in history. Ted basically watched $8 billion of his personal fortune evaporate almost overnight as the stock price cratered.

He didn't just lose money; he lost his "baby," the empire he’d built from a struggling billboard business.

📖 Related: Sam Lee Prospect Medical: Why the Hospital Crisis Still Matters in 2026

The Rise of Captain Outrageous

Ted didn't start with billions, but he did start with a platform. After his father’s tragic death, he took over the family’s billboard company and turned it into a media powerhouse. He was the "Mouth of the South." He bought a small UHF station in Atlanta and turned it into the first "Superstation," WTBS.

Suddenly, people in Idaho were watching Braves games.

Then came CNN in 1980. Everyone thought he was crazy. "Who wants to watch news 24 hours a day?" they asked. Turns out, everyone did. By the time he sold Turner Broadcasting to Time Warner in 1996 for $7.3 billion, he was a legend. But that’s where the trouble started. When Time Warner merged with AOL in 2001, Ted was the largest individual shareholder.

The dot-com bubble burst. The stock went from $80 to $10.

Imagine losing $10 million a day for two and a half years straight. That’s what Ted lived through. He later told The Guardian that the merger was a "disaster" that destroyed his net worth.

💡 You might also like: Machias Savings Bank Presque Isle Maine: Why Local Banking Still Wins in the County

Where the Money Is Now: Land and Bison

You might wonder how he still has nearly $3 billion if he lost so much. Well, Ted stopped playing the "paper wealth" game and started buying things you can actually touch. Dirt. Specifically, 2 million acres of it.

He is currently the third-largest individual landowner in the United States.

- The Land: He owns massive ranches across New Mexico, Montana, Nebraska, and even Argentina. His Vermejo reserve in New Mexico alone is over 550,000 acres. That’s bigger than some small countries.

- The Bison: Ted owns about 45,000 bison. It’s the largest private herd in the world. He isn't just a fan of the animal; he turned them into a business with the Ted’s Montana Grill restaurant chain.

- Eco-Tourism: His "Ted Turner Reserves" allow people to pay for luxury stays on his properties. It’s a way to monetize conservation.

The Billion-Dollar Gift

It’s impossible to talk about the net worth of Ted Turner without mentioning his philanthropy. In 1997, he pledged $1 billion to the United Nations. At the time, that was roughly a third of his wealth. People thought he was showboating, but he followed through. He even had to borrow money at one point to keep the payments going after the AOL crash.

He's a signee of The Giving Pledge, meaning he’s committed to giving away at least half of his wealth before or upon his death.

Why His Net Worth Actually Matters Today

Today, Ted lives a quieter life, primarily in Atlanta or on his ranches. He went public with his Lewy body dementia diagnosis in 2018, which has naturally slowed his public appearances. But his financial legacy is more than just a number on a Forbes list.

He proved that you could build a fortune on a "crazy" idea like 24-hour news, and he showed the danger of corporate ego when he got sidelined by the AOL deal. Most billionaires today are obsessed with tech and AI. Ted? He’s obsessed with the soil and the species on it.

His wealth is no longer tied to the volatile swings of a media stock. It’s tied to the enduring value of the American West.

Actionable Insights for Investors:

- Diversify early: Ted’s biggest mistake was having his entire net worth tied up in Time Warner stock during a merger he couldn't control.

- Hard assets vs. Paper: There’s a reason billionaires like Turner and Bill Gates are buying up farmland. Stocks can go to zero; land rarely does.

- Legacy over Liquidity: Ted’s $1 billion UN gift defines him more than his $8 billion loss. Thinking about "social return" can be as important as financial return.

If you want to track how these massive land holdings affect the economy, look into the current trends in regenerative agriculture. Turner was ahead of the curve on this, and it's a sector that's only growing as climate concerns take center stage in the 2026 market.