If you’ve been hunting for a way to squeeze some consistent US-dollar cash flow out of your portfolio, you’ve probably bumped into the TD US Monthly Income Fund 2460 TDAM. It’s one of those "boring" workhorse funds that pops up in bank meetings and brokerage screens. But honestly, most people just see a ticker and a yield and think they’re done.

There is a lot more under the hood of TDB2460 than just a monthly check.

Basically, this is an "I" series fund. In the world of TD Asset Management (TDAM), that usually signals it's for institutional-style pricing or specific fee-based accounts, though the retail equivalent is everywhere. It’s designed to be a one-stop shop for US exposure. You get the stocks, you get the bonds, and you get the currency.

But is it actually doing what it says on the tin?

What TDB2460 Actually Owns (It’s Not Just a Dividend Fund)

When people hear "Monthly Income," they usually assume they’re buying a basket of utility stocks and slow-moving REITs. That’s a mistake. The TD US Monthly Income Fund 2460 TDAM is actually a "Global Neutral Balanced" fund, which is a fancy way of saying it’s a hybrid.

As of early 2026, the asset mix is roughly 57% equities and about 35% fixed income. The rest is a mix of cash and "other" bits.

Here is the part that surprises folks: the top holdings look like a Silicon Valley Christmas list. We are talking about heavy hitters like NVIDIA, Microsoft, Apple, and Alphabet.

💡 You might also like: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

Wait, Nvidia? For an income fund?

Yeah, exactly. The strategy here isn't just harvesting dividends from old-school companies. The portfolio managers, led by veterans like David Sykes and Damian Fernandes, are chasing total return. They want the growth of Big Tech to fuel the share price, while the heavy lifting for the "income" part comes from a massive 33% chunk sitting in the TD U.S. Corporate Bond Fund (O-Series).

It’s a barbell. One side is the "safety" of corporate debt; the other is the "gasoline" of high-growth tech.

The Reality of the 2.03% MER

Let’s talk about the elephant in the room: the fees. The Management Expense Ratio (MER) for the Investor series of this fund (which often maps to the TDB2460 structure) sits right around 2.03%.

In the age of 0.05% ETFs, that number makes some investors' eyes water.

You’ve got to ask yourself if the convenience is worth it. For that 2%, you are paying for:

📖 Related: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

- Active management (people like Benjamin Gossack and Anthony Imbesi making the calls).

- Automatic rebalancing between stocks and bonds.

- The "Monthly Income" service where the fund handles the math of your payouts.

If you’re a DIY investor who loves tinkering with spreadsheets, you could probably replicate 80% of this fund for a fraction of the cost. But if you’re someone who just wants to see USD land in your account every 30 days without thinking about it, that 2% is the "convenience tax" you pay.

Performance: Does It Beat the S&P 500?

Short answer: No.

Longer answer: It’s not trying to.

If you compare TD US Monthly Income Fund 2460 TDAM to the S&P 500, you’ll see it lagging during massive bull runs. For instance, while the S&P 500 might be up 18%, TDB2460 might only be up 10-11%.

But that is the design. It's a "Balanced" fund. Because 35% of the fund is in bonds, it’s supposed to have a smoother ride. When the market falls 20%, a balanced fund is theoretically supposed to only fall 12-14%.

Looking at the 10-year numbers, the fund has generally delivered a CAGR (Compound Annual Growth Rate) of around 7.6% to 8.8% depending on the specific series and timing. That’s solid. It’s not "retire on a yacht" money, but it’s "keep up with inflation and then some" money.

The "Monthly Income" Part is Kinda Tricky

Here is where people get confused. The fund pays out "distributions." These aren't just dividends from the stocks.

👉 See also: Manufacturing Companies CFO Challenges: Why the Old Playbook is Failing

The payout can include:

- Interest from the corporate bonds.

- Dividends from the tech stocks.

- Realized capital gains (selling a stock for a profit).

- Return of Capital (ROC).

That last one, Return of Capital, is basically the fund giving you your own money back to keep the payout level. It sounds bad, but in a non-registered account, it can be tax-efficient because it's not taxed as immediate income. It just lowers your adjusted cost base.

Just don't mistake a high monthly payout for a high "yield" in the traditional sense. It's a cash flow mechanism.

Who Should Actually Buy This?

I’ve seen a lot of people jump into this fund because they have a vacation home in Florida or they like shopping on US sites and want "free" US dollars every month.

It makes sense if:

- You need USD cash flow: If your life happens in US dollars but your main savings are in Canada, this avoids the constant currency conversion headache.

- You hate volatility: You want US tech exposure but you can't stomach the 3% daily swings of a pure Nasdaq fund.

- You want "Set it and Forget it": You don't want to manage a bond ladder and a stock portfolio separately.

It makes zero sense if you are 25 years old and have a 30-year time horizon. At that age, the 2.03% MER will eat a massive chunk of your potential wealth, and you don't actually need monthly income yet. You need growth.

Actionable Steps for Your Portfolio

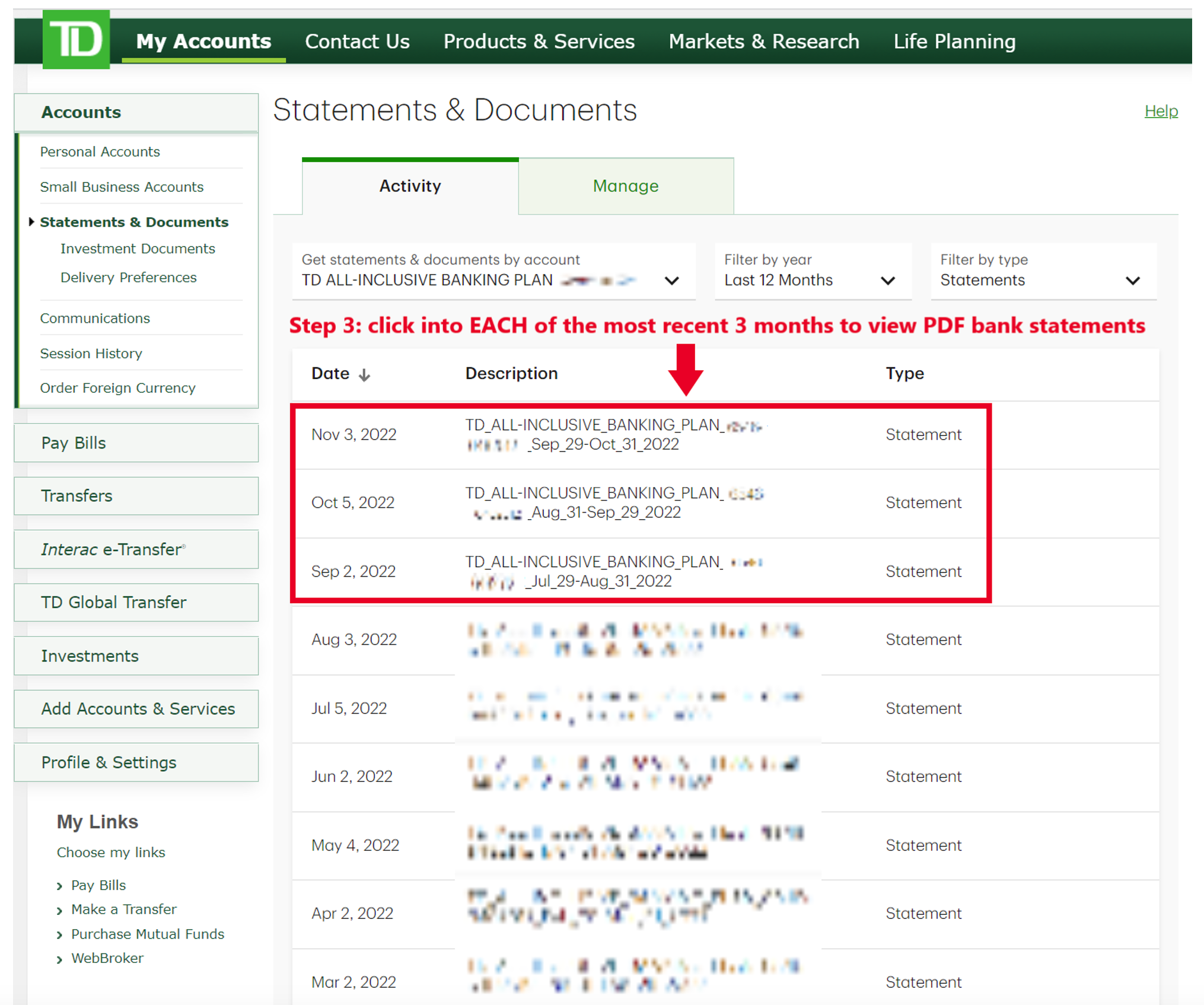

If you are looking at the TD US Monthly Income Fund 2460 TDAM, don't just click "buy" in your EasyTrade or WebBroker account. Do this first:

- Check the Series: If you have a fee-based advisor, ask for the F-series (TDB2465) instead. The MER is significantly lower (usually around 0.8% - 1%) because it doesn't include the "trailing commission" paid to the salesperson.

- Look at the Bond Exposure: Since over 30% of this fund is the TD U.S. Corporate Bond Fund, check if you already own a lot of bonds elsewhere. You might be more "conservative" than you realize if you’re doubling up.

- Verify the Currency: This fund is priced in USD. Ensure you are buying it with USD cash. If you buy it with CAD, your bank might charge you a 1.5% to 2% conversion fee on the way in AND the way out, which kills your first year of returns instantly.

- Compare to the ETF Version: TD now has a variety of actively managed ETFs. Check if there is a "TD Active U.S. Enhanced Dividend ETF" or similar that fits your needs with a lower management fee.

Ultimately, TDB2460 is a reliable, managed solution for people who value their time more than the last 1% of fees. It’s got the "Magnificent Seven" for growth and a massive slab of corporate debt for stability. Just know that you're paying for that balance, and the "monthly income" is a mix of earnings and your own capital being smoothed out for your convenience.